The U.S.’s War on Coal Is Purported to Be Over—What About the Rest of the World?

The Trump administration unabashedly supports coal, and regulations designed to phase out its use in U.S. power production are being reviewed. But while other nations continue to rely on coal for much of their power, they also are increasing their use of natural gas and renewables, including heavyweight coal users such as China and India.

King Coal appeared to be on the ropes at the end of the Obama era, both in the U.S. and worldwide. Indeed, when it comes to coal, one can accurately say as China goes, so goes the rest of the world.

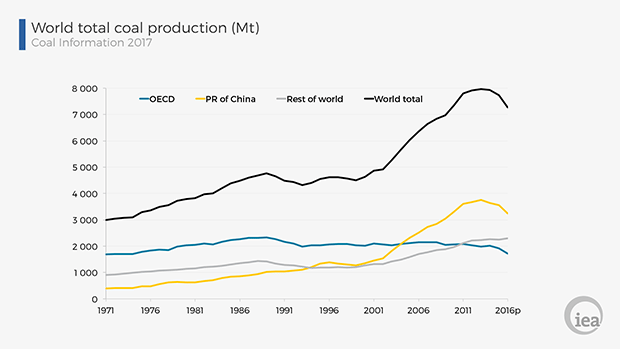

According to new data from the International Energy Agency (IEA), overall coal production fell sharply in China in 2016 by about 320 million metric tons, or 9%. Production also fell steeply in the U.S., where coal seems to have bottomed out at about the same burn rate as in 1978. In total in 2016, global output dropped by another 458 million metric tons, according to an IEA report (Figure 1).

There’s no doubt the Obama administration and the leaders of other nations kept their fingers on the scale against coal. But coal’s stagger into the ropes was more a result of the U.S. being inundated with cheap fracked natural gas, and increased gas volumes being unlocked in many areas, with new pipelines and liquefied natural gas (LNG) terminals coming online to serve growing markets.

Natural gas prices have kept dropping worldwide even as more gas-fired power plants have come online. In the run-up to the Paris Agreement, with emission laws worldwide coming into effect, coal’s days were seemingly numbered, especially in the U.S. The expected election of Hillary Clinton as U.S. president seemed to all but guarantee that fracked natural gas, along with ever-tightening international environmental regulations, would wrap around King Coal’s throat, just like Princess Leia strangling Jabba the Hut.

But then a funny thing happened. Clinton lost the election. And the old king, a bit weary and punch drunk perhaps, has since hauled his battered old self off the ropes to live and fight another day.

The man in the White House is an unabashed friend of coal. Donald Trump’s administration has taken strong and immediate steps to put its thumb on the other side of that proverbial scale, hoping to jumpstart a flagging industry at home while using American soft power to increase export markets for U.S. coal abroad, with new boatloads sailing to the Ukraine even now.

Indeed, at the end of August, just as the stormwaters of Hurricane Harvey started to recede in Houston, Vice President Mike Pence, a strong supporter of coal while governor of Indiana, spoke at the ballyhooed Greenbrier Resort in White Sulphur Springs, West Virginia. Long the preferred gathering place for America’s coal barons (and much of Washington’s power elite), Pence addressed the West Virginia Chamber of Commerce’s 81st Annual Meeting and Business Summit and proudly declared, “The war on coal is over.”

Are Boom Times Back Again?

During the nine months he has been in office, according to Pence, “President Trump has signed more laws to cut through federal red tape than any president in American history. He ordered every federal agency to find two regulations to get rid of before passing any new regulations. To fuel the great revival of American industry, President Trump has been unleashing American energy. We are already seeing results. Coal [production] is up 19% over last year” in Appalachia, he said to a huge round of applause.

Smiling and nodding in agreement was Jim Justice, himself a wealthy coal baron, owner of the Greenbrier Resort and the newly turned Republican governor of West Virginia. Elected as a Democrat just last year, he recently switched parties as the state moves forward to unlock even more premium coal. The other gathered coal executives were equally pleased, especially as they read fresh reports from the Energy Information Administration (EIA) that annual coal production was up 9.6% from the same week a year ago (Figure 2). Indeed, based on the most recent EIA estimates available at the end of August, U.S. coal production through 2017 would, on an annualized basis, total 786.8 million short tons, up 8% from 2016.

But the best news was that natural gas prices were still inching upward, now hovering near $3/MMBtu while utility coal stockpiles continue to decline. In fact, gas prices have risen so much that merchant power generators worldwide are switching back to coal. And as long as gas remains in demand and prices climb, the King knows he’ll still be able to hold court for many years to come.

Over the summer, Fortune magazine and other outlets, citing new data from the EIA, reported that U.S. coal producers were planning for a sustained increase in production and jobs throughout the year and into 2018, as the industry recovers from perhaps its steepest drop since the 1950s—a descent that now looks to have bottomed-out early last year.

But the blood and fear is still in the water after a steep fall that began in 2014. Coal production fell sharply from 1 billion tons in the U.S. to just 739 million tons in 2016, according to the U.S. Mine Safety and Health Administration. During that time, the average number of coal miners employed by the industry also plummeted from 110,000 to just 78,000 (Figure 3).

But the bottom seems to have been plumbed as production started to climb by almost 35 million tons in the third quarter of 2016, and it has continued to increase along with demand in 2017.

It’s the Economy, Stupid

Coal’s fight isn’t political; it’s economic. As gas production increased, it was still cheaper than coal between November 2015 and June 2016. And as gas prices fell, power plants just kept switching away from coal. According to Fortune, “the average coal-fired power plant was running around 61 percent of the time in 2014 but that declined to 55 percent in 2015 and 53 percent in 2016. By contrast, the average gas-fired power plant was generating just 48 percent of the time in 2014 but that increased to 56 percent in both 2015 and 2016.”

Of course, as coal burns fell drastically, what rose? Piles of unwanted coal that producers kept stubbornly sending to power plants (Figure 4). As stockpiles mounted to record heights, power plants found ways to stop shipments, and coal miners had no choice but to close or curtail production. Lost production led to lost revenues and the negative spiral seemed as if it was going to take the industry off the proverbial cliff.

In May 2016, gas production finally started to fall and prices began to rise. As Fortune reported, the delivered cost of gas finally moved above coal in July 2016, and by January 2017 gas was almost twice as expensive. Unsurprisingly, almost as fast as before, electricity producers started fuel-switching again, back to now-cheaper coal. The trend has continued through this year.

Indeed, during the Obama administration, for many coal investors it simply made more sense to park their money elsewhere. But there can be no question that Trump is pro-coal, and he seems to be doing all he can to make good on his promises to help revive the industry. The only real question is will investors agree that coal’s future is long. While certainly the power industry is happy to start making money again with their recently mothballed or sidelined coal-burning power plants, it remains to be seen whether banks or investors that previously backed the construction of new coal plants will do so again. After Mississippi Power’s debacle with clean coal at its Kemper plant, will investors return to back clean coal initiatives even with a friend in the White House? That remains to be seen.

Be that as it may, investors are certainly returning to coal-mining companies. Late last year, Arch Coal, once the second-largest U.S. coal producer, returned from restructuring after another bankruptcy and resumed trading on the New York Stock Exchange. Similarly, U.S. leader Peabody Energy also began trading again in April of last year. In some ways, now shorn of a variety of debts and long-term environmental obligations after restructuring, many of the previously bankrupt U.S. miners—which constituted a large swath of the industry—may be in the strongest financial position in a decade or more.

Hurricane Harvey Stokes Coal’s Fire

No matter what, as per a recent report from EIA, U.S. coal production can only go up. 2016 was essentially the bottom as production reached its lowest point since 1978, when there was a major revival of coal-fired power plant construction. EIA now expects that, given the gradual revival in demand and export of coal, coal production will rise by 4.7% and 1.5% year-over-year in 2017 and 2018, respectively.

EIA even is forecasting an increase in coal exports, which will lead to another 5% rise in coal production in 2017 (though some of the coal that is exported is actually used for steel production and not to generate electricity). And EIA predicts a revival in coal-fired electricity generation should lead to an additional 1% increase in production next year, perhaps 8 million or more tons.

However, one should note that even if 2016 really was the bottom for the industry, then coal still provided nearly 30% of the total fuel-required U.S. electrical generation. Not too shabby for a “failing” industry. Going forward, as natural gas prices continue to rise and more of it is exported, coal will remain cheap and therefore attractive.

Remember that even before Hurricane Harvey, the U.S. EIA predicted in its most recent Short-Term Energy Outlook that the total share of gas-fired utility-scale generation in 2017 would average 31%, down from more than a third last year. In this period, coal’s share would likely climb slightly from 30% last year to 32% this year. Now the EIA predicts in 2018 that coal will again become America’s top energy source. Earlier the EIA predicted those numbers would stay about the same, but short-term gas prices are already rising after Harvey—fueling even more fuel-switching back to coal.

“U.S. coal production is getting a boost in 2017 from higher coal exports and more coal-fired electricity generation,” said Howard Gruenspecht, the EIA’s former acting administrator (he resigned at the end of August) as he released the agency’s latest short-term energy outlook. “Coal-fired power plants are expected to be the leading source of U.S. electricity for the next two years, as the cost of coal is expected to rise by less than the cost of natural gas and renewable generation continues to grow.”

China, Rest of World Weigh In on Coal’s Future

Globally, coal consumption leader China continues to invest huge resources into both natural gas and renewables, resulting in a huge decline in its coal usage in 2016, a trend that will likely continue. Though China uses almost half the world’s coal, it is increasingly diversifying away from it. According to BMI Research, China’s natural gas consumption is on a path to increase at an average 10% over the next five years as the nation embraces more clean energy.

Moreover, during the summer coal imports to China have continued to rise as the country cracks down on illegal mining and increases regulations within its own borders. Beginning July 1, China imposed and began enforcing a ban on coal shipments to small ports while officials began to inspect even more cargoes. Driving demand down further, a cooler summer is reducing overall power plant burn, and the latest figures show internal coal production falling. Indeed, China seems to be curtailing coal production internally while instead turning in ever-increasing numbers of imports to fill the gap, even as it rapidly embraces renewable energy and more natural gas.

Indeed, as the IEA’s August World Energy Balances report states, coal and natural gas are becoming equally important and equally used to make electricity globally, meaning coal usage will continue to retract in many markets. While looking for a bright spot, India has become one of the few long-term growth markets for coal going forward. Now the second-largest coal consumer in the world, analysts see it as one of the few places where coal consumption is likely to climb in large numbers in 2018 and beyond. However, according to the IEA, despite an increase from India, overall global coal consumption in 2016 fell by around 2% in energy terms. And despite Trump and Harvey, these are trends that are likely to continue.

—Lee Buchsbaum (www.lmbphotography.com), a former editor and contributor to Coal Age, Mining, and EnergyBiz, has covered coal and other industrial subjects for nearly 20 years and is a seasoned industrial photographer.