The State of Solar: New Tech, Outdated Rate Designs

As installed capacity in the U.S. continues its breakneck growth, the solar photovoltaic sector is poised for another leap forward with a variety of new technologies—if increasingly ill-suited regulations and rate designs can be updated to keep pace.

The global solar market has moved beyond its early, uncertain days. The luxury of behaving like start-ups has passed, and major firms in solar need to “grow up.” That, at least, was the message from top executives at Solar Power International (SPI), the industry’s largest trade show, held September 12 to 15 in Las Vegas.

David Crane of Pegasus Capital, who left his position as CEO of NRG Energy late last year, told attendees at the opening session that too many solar firms were still behaving like Silicon Valley start-ups, going public much too soon and trying to grow too fast. That’s not the sign of a mature industry planning for the future—something investors want to see to have long-term confidence in solar.

“Public markets don’t like lurches in strategy,” noted Crane. “They don’t even like exponential growth.”

C.J. Colavito, director of engineering for Standard Solar, told POWER that the high-profile failures that have hit the industry recently were often the result of companies straying too far outside their core competencies in pursuit of new business. That stemmed in part from a failure to recognize that the utility-scale, commercial and industrial, and residential solar markets have very different business models.

“Look at SolarCity. They’ve dominated residential. They’re really good at it,” he noted. “But now they’ve gone very aggressively into the commercial [distributed generation] space. They’ve had a really hard time picking up on it, and they’ve lost a lot of money on a lot of earnings.”

Much of succeeding in solar, he said, “is doing what you’re good at and not trying to do what you’re not good at and don’t understand.”

Yet the news and views were far from universally negative. Steve Malnight, vice president of regulatory affairs for Pacific Gas & Electric, who spoke at the same session as Crane, praised the industry’s growing sophistication. He noted that buyers large and small are increasingly looking for integrated, plug-and-play packages of solar, storage, and smart controls, and vendors are lining up to supply them.

“Solar may not be the iPhone,” he said, “but it can enable customers to do more without having an environmental impact and do it guilt free.”

That mix of views—optimistic about the industry’s potential but concerned about looming roadblocks—characterized much of the discussion during the four days of SPI.

Big Data Comes to Solar

Almost no one would argue against the idea that solar is booming. The Solar Energy Industries Association (SEIA), one of the two organizing groups behind SPI, reported as the conference opened that the U.S. added 2 GW of solar photovoltaic (PV) capacity in the second quarter of 2016 alone, with another 7.8 GW expected in the second half of the year—both new records, the SEIA noted.

One sign of maturation in the PV industry is growth in the breadth and sophistication of support services available to generators to help them increase efficiency and profitability. Just as fossil generators are beginning to turn to advanced data analytics to help keep their plants competitive, solar project owners are no longer at the complete mercy of the sun: While generation still depends on solar irradiance, predicting and working with it is no longer the guesswork it once was.

Adam Adkins, a meteorologist with environmental data firm Vaisala, explained to POWER how the company has developed a decades-long data set of solar irradiance trends as well as real-time monitoring and forecasting to help solar plants have a much clearer view of what their output will be over the short and long term.

“Pre-construction developers typically use it to understand what the average output of their project will be,” he said. “In an operational sense, it’s more of a reconciliation tool. Developers can look at what the sun is doing, what the clouds are doing, and compare that to the actual output of their plant.”

In addition, owners can use past trends and forecasts to schedule maintenance outages during periods when overcast skies are likely and avoid missing periods of peak irradiance. That makes for much more predictable output, which makes it more attractive to investors and utilities.

“Having additional data sets only reduces your risk,” he said. “The closer you are to actual output, the closer your revenues are going to be to your projections. Even a 1% deviation can be a substantial hit.”

One point that is often missed, Adkins noted, is that solar irradiance is more than just sun and clouds. Other factors such as atmospheric dust, and environmental events such as wildfires and volcanic eruptions, can affect irradiance, sometimes substantially.

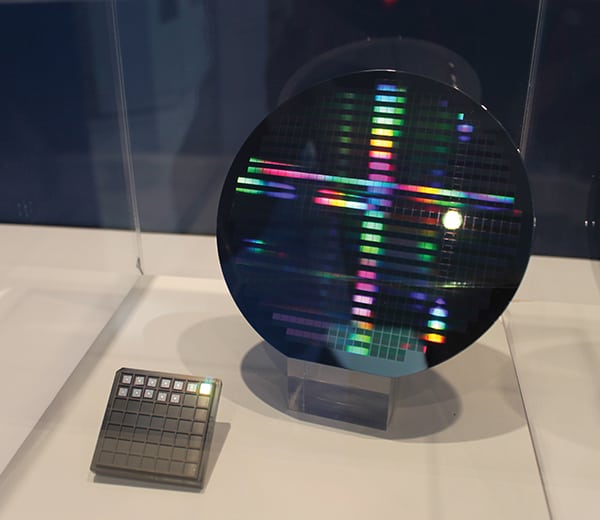

Data Vaisala released in early September showed that solar irradiance fell measurably in California during a series of recent wildfires. A major fire in Kern County in inland Southern California was likely responsible for a 1% to 4% drop in solar irradiance in different areas of the county in June (Figure 1).

|

|

1. Hazy skies. A major wildfire in inland Southern California in June contributed to lower solar irradiance that month compared to July and August. Courtesy: Vaisala |

Regulatory Reform Lags

As solar evolves, sector observers have noted repeatedly that regulatory models and rate design have often lagged behind. Those need to catch up, but what will replace them may be anyone’s guess.

The Smart Electric Power Alliance (SEPA), the other group behind SPI, released a report during the show calling for greater collaboration between utilities, solar stakeholders, and other groups to better promote efficiencies, define roles, identify principles of ratemaking, and foster customer choice (see www.51st.report). SEPA’s Chief Strategy Officer Tanuj Deora lamented that the report was necessary because the discussion has become so politicized.

“[E]fforts in many states to discuss electricity rate reform and net energy metering have, in some cases, devolved from reasonable policy debate to intractable conflict characterized by polarized, all-or-nothing rhetoric,” he noted in the report forward. “But such a zero-sum mentality runs counter to the reality that [distributed energy resources (DERs)] provide optimal value when deployed for both individual consumer value and system benefits.”

Scott Wiater, Standard Solar’s CEO, noted that while some utilities have embraced DERs—and in particular the smart grid technologies and data that are necessary to integrate them—others have resisted taking that step and don’t, he said, “want to be that smart.”

The data, rather than being a tool, can be viewed as a threat.

“I think some utilities don’t like having that much scrutiny in how they operate,” he noted, “because they’re inefficient and the data serves to expose those inefficiencies.”

Standard Solar’s Colavito noted that many of the challenges stem from difficulties in valuing the things solar adds to the grid and talking about them in a way various stakeholders can relate to.

“Solar does provide real value to the grid as a distributed resource, but it doesn’t always provide that same value at all times and at all locations. Because of that, the utilities say, ‘Distributed renewables and especially variable resources like solar and wind will never do anything,’ and the solar and wind guys say, ‘Yes, we do, we always do.’”

That disconnect frustrates the communication that’s necessary to effectively reform regulatory and rate designs.

“The truth is that [valuing DERs is] very situational and time-based, and it really is a pretty complex system,” he said. “Decoupling that requires a sophisticated regulatory framework where the different resources are properly rewarded.”

As a sign of how politicized and fraught with uncertainty the policy debate around solar has become, Republican leaders in the House Ways and Means Committee and the Senate Finance Committee announced on September 15 as SPI closed that they were opening an investigation into how solar companies have calculated expenses under the 30% Investment Tax Credit and whether overvalued projects have resulted in unwarranted subsidies—a development that many SPI attendees lamented on Twitter on their way home.

New Tech Promises Gains in Efficiency and Output

But the technology is not waiting for the rules to catch up. After years of incremental advances, a variety of innovations both simple and exotic are promising to boost the output of solar PV systems as much as 30% over current technologies.

The Dawn of SiC. For decades, silicon has been the go-to material for semiconductor substrates. It’s difficult to manufacture in the purity required and comes with a variety of limitations, but so far nothing else can match it for economics. That may finally be changing if GE has its way.

At SPI, GE announced that it was introducing a solar inverter that uses a silicon carbide–based converter chip. Silicon carbide (SiC) is a ceramic compound composed of silicon and carbon. After diamond, it is one of the hardest man-made substances in existence. It’s been manufactured for industrial use for more than 100 years but is only just beginning to see use in electronics.

SiC has significant advantages over crystalline silicon. SiC-based chips can operate at much higher temperatures and frequencies and are far more rugged—they can operate at twice the power density of a Si-based chip. This makes them ideal for high-power devices like inverters, Keith Longtin, product breakout lab director for GE Global Research told POWER, because they can convert power at higher efficiencies and lower losses.

“This allows us to switch up to 10 times faster, which gives us a much cleaner signal,” he said.

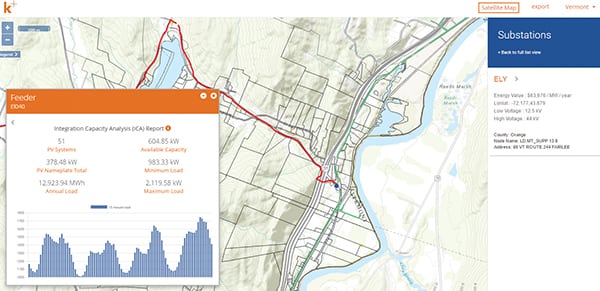

The SiC chips (Figure 2) form the core of GE’s LV5+ Solar Inverter, also announced at SPI, which it estimates can deliver around $2.5 million more revenue over the life of a typical 100-MW solar plant (Figure 3).

|

|

3. Solar skid. GE’s LV5+ transformer and inverter system incorporates silicon carbide–based processors that allow it to extract greater efficiencies from linked solar systems. Courtesy: GE |

GE has been working with the State University of New York College of Nanoscale Science and Engineering in Albany to build a fabrication line for manufacturing SiC power devices. To scale up the technology and reduce fabrication costs, the company says manufacturing must move from the current industry standard of 4-inch wafer production to 6-inch wafers. The Albany facility will be set up for 6-inch wafer production (an example is at right in Figure 2).

Particle Beams. Giant global firms like GE aren’t the only ones working on next-generation methods for extracting greater efficiency from PV.

Solar cell manufacturers have long struggled with a dilemma surrounding the silicon used to create PV cells: Electronics-grade silicon offers the best performance but is expensive to manufacture; metallurgical grade is much less expensive, but its lower purity degrades performance. Although some firms such as Silicor Materials have worked to develop solar-specific manufacturing processes (see “Weighing the Environmental Impacts of Wind and Solar” in the July 2016 issue), Los Angeles–based start-up firm Rayton Solar has gone a different route, developing what it says is an economical method for using float-zone silicon, the highest purity version, for PV.

Up to now, float-zone manufacturing has been prohibitively expensive for solar cells; it’s only used for certain high-performance electronic applications. Conventional PV cell wafers are mechanically sliced from silicon ingots, and this approach limits their minimum thickness, in addition to wasting some of the silicon through the cutting process. Rayton’s method, in contrast, uses a particle accelerator to implant silicon ingots with a layer of ions and exfoliate thin strata of silicon directly off the ingot, resulting in no wasted material (Figure 4). Compared to conventional wafers that are around 200 microns thick, Rayton’s method produces 3-micron-thick slices that are then backed up with a substrate.

Because so little silicon is used for each slice, float-zone silicon is an economic material for this method. Rayton says it has the potential to produce PV cells with conversion efficiencies up to 24%, a substantial jump from the current ~19% performance, which would lead to an approximate 25% reduction in system costs per kilowatt-hour.

Rayton has developed a prototype of its manufacturing process and is currently seeking financing for future development, CEO Andrew Yakub told POWER via email.

Dual-Axis Tracking Comes to Rooftops. Dual-axis tracking has been recognized for some time as a reliable method to boost PV capacity factors, especially in areas with less-than-optimal insolation. Tracking systems also have much flatter output profiles because they collect sunlight more efficiently when the sun is lower in the sky at the beginning and end of the day.

But the mechanical supports necessary to implement dual-axis tracking have thus far restricted these systems to ground mounting, because they’re too heavy for rooftop use. Among other problems, this greatly reduces opportunities for deployment in urban areas.

A remarkably simple design called the PV Booster from Pasadena, Calif.–based Edisun Microgrids may change all that, however.

The PV Booster mounts a standard PV panel on a lightweight pivoting frame that keeps the panel pointed directly at the sun. Because the mounting is so light, it’s able to use a direct-drive design and brushless motor rather than needing a gearbox (Figure 5). That makes it light enough to mount on a roof and substantially reduces maintenance issues. The panels move individually so each maintains its own optimal orientation toward the sun rather than being centrally controlled.

Designed for commercial and industrial rooftop use, the PV Booster can deliver as much as 30% more power for only a slight increase in cost, Edisun CEO Bill Gross told POWER. Consequently, system returns using the PV Booster are estimated to be 20% higher than conventional mountings.

The system can also be installed on carports using specially designed mountings that employ truss supports rather than conventional carport mounts. Because the design uses substantially less steel, it’s cheap enough that the efficiency boost provided by dual-axis tracking can pay for the carport installation.

“We make carports cheaper than rooftop solar,” he said.

Gross said Edisun has a test installation operating at its headquarters in Pasadena and is in discussions with customers for the first commercial installations.

More Funding on the Way

If the Department of Energy (DOE) has anything to say about it, there will be more such developments over the next few years. The DOE’s SunShot Initiative, which is intended to drive down the levelized cost of PV generation, announced another round of funding during SPI.

Operating under the DOE’s Office of Energy Efficiency and Renewable Energy, the latest round will fund 40 projects with a total of $42 million to improve PV performance, reliability, and manufacturability and enable greater market penetration for solar technologies. In addition, the DOE said it hopes to provide $65 million in additional funding (subject to appropriation) for upcoming solar research and development projects to continue driving down the cost of solar energy and accelerating widespread national deployment.

The 40 projects include 19 that will receive a total of $17 million to “advance next generation solar technology.” Most of them are in academia, and 21 will receive a total of $25 million for “development of new tools, technologies and services for the solar industry.” Those latter awards support several advanced analytical tools for locating optimal sites for solar and solar-plus-storage projects.

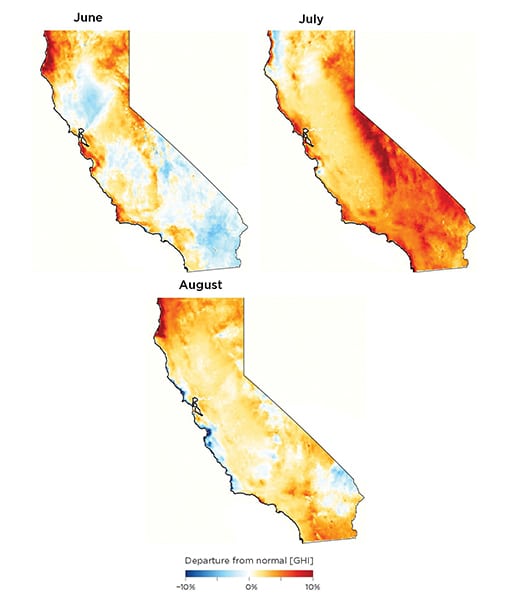

One of these tools, created by San Francisco firm Kevala Analytics, maps locations of wholesale price nodes and substation locations together with historical data for insolation, weather, and price fluctuations (Figure 6). Kevala CEO Aram Shumavon said in a statement announcing the award, “Instead of searching an entire territory or region, we can help developers find the best locations in a few clicks.”

SunShot Initiative Director Charlie Gay told POWER in an interview that tools like this offer enormous potential for advancing the role of PV on the grid, not just for developers but for utilities as well. Advances in cloud computing and data storage capabilities, he said, mean “being able to leverage a massively parallel network of servers to address problems in mapping the distribution network in a given area” and anticipating changes and challenges before they occur.

“The utility can anticipate that they need to make adjustments in this load center or this substation to handle the change in that area,” he noted, and that kind of interaction “can create opportunities to greatly improve long-range planning” and maximize the value of existing assets. ■

—Thomas W. Overton, JD is a POWER associate editor.