7 Strategies To Make Microgrids A Fit For Utility Grid Modernization

Executive Summary

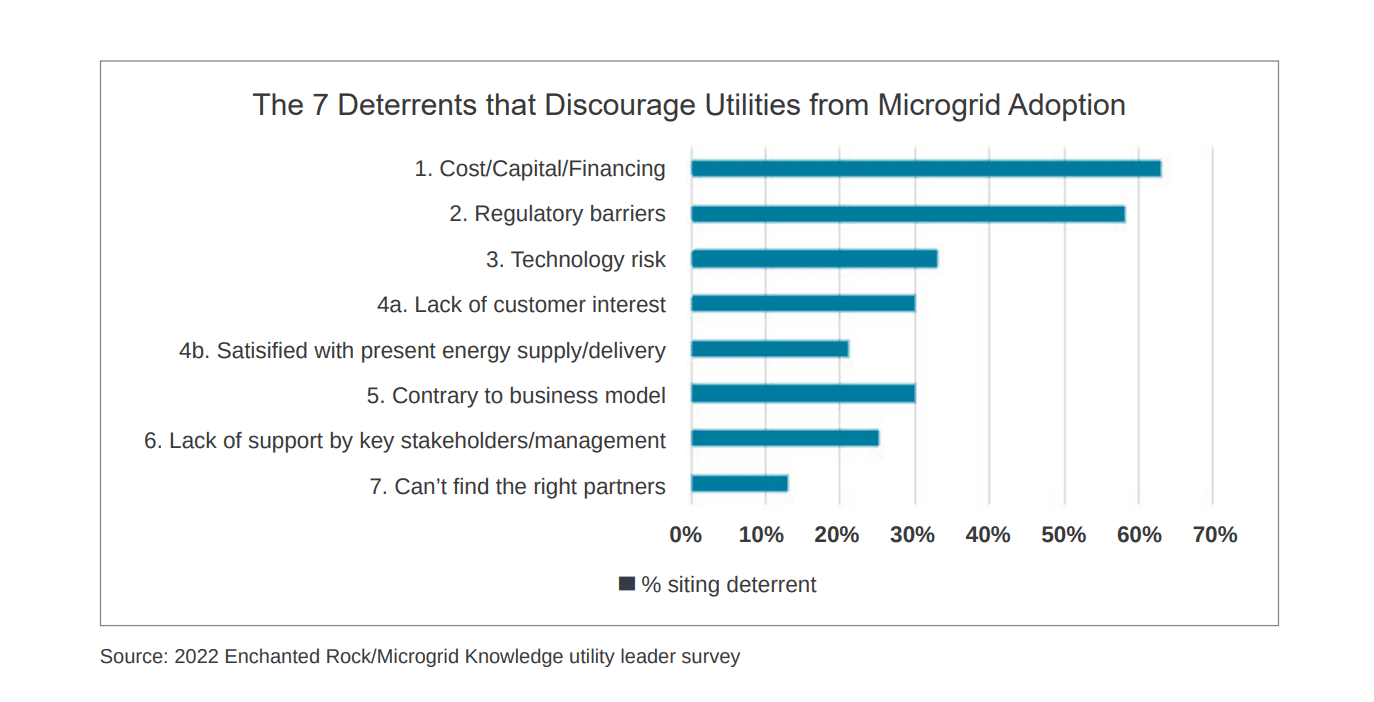

Most utility leaders believe their companies have a broad role to play with microgrids, yet say they face deterrents that prevent them from playing their rightful role. Core concerns include:

- Costs, capital and financing

- Regulatory barriers

- Technology risks

- Customer interest

- Fit with the utility business model

- Support from key stakeholders and management

- Finding the right partners

When utilities are deterred from making microgrids a part of their grid modernization roadmap, they miss opportunities to serve strategically important customers seeking increased resilience. In this report, Enchanted Rock shares what the leaders of large utilities said were the top deterrents to microgrid adoption and strategies to overcome them so that microgrids become the right fit to benefit utilities, their customers and the grid.

Contents

Executive Summary. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

What Discourages Utilities from Adopting Microgrids to

Advance Grid Modernization?. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

What We Mean When We Say Microgrid. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

Costs, Capital and Financing. . . . . . . . . . . . . .. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

Regulatory Barriers. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

Technology Risks. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

Customer Interest and Satisfaction with Present Energy Supply and Delivery. . . . . 5

Fit with the Utility Business Model. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

Support from Key Stakeholders and Management. . . . . . . . . . . . . . . . . . . . . . . . . . 6

Finding the Right Partners. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

About Enchanted Rock. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

What Discourages Utilities from Adopting Microgrids to Advance Grid Modernization?

Enchanted Rock and Microgrid Knowledge conducted a survey in 2022 of leaders at large U.S. electric utilities to take the pulse on their actions and attitudes on microgrid development. The results revealed a fascinating landscape, one in which most executives believe their utilities have a broad role to play with microgrids, from supporting interconnections to investing in and incentivizing developments. Yet most also saw deterrents that prevented their utilities from playing this role. In many cases, those deterrents result in missed opportunities to serve customers seeking 100% electric reliability and increased operational resilience.

As extreme weather events increase, resilience is becoming a strategic imperative for more and more businesses, and utilities need every tool available to deliver it to their customers. This report from Enchanted Rock explores the top seven deterrents utility leaders say discourage their organizations from incorporating microgrids onto their operational roadmaps. It offers strategic approaches to overcome those hurdles so that utilities can reap the benefits of microgrids as assets that modernize the grid, boost resilience, and increase customer satisfaction.

What We Mean When We Say Microgrid

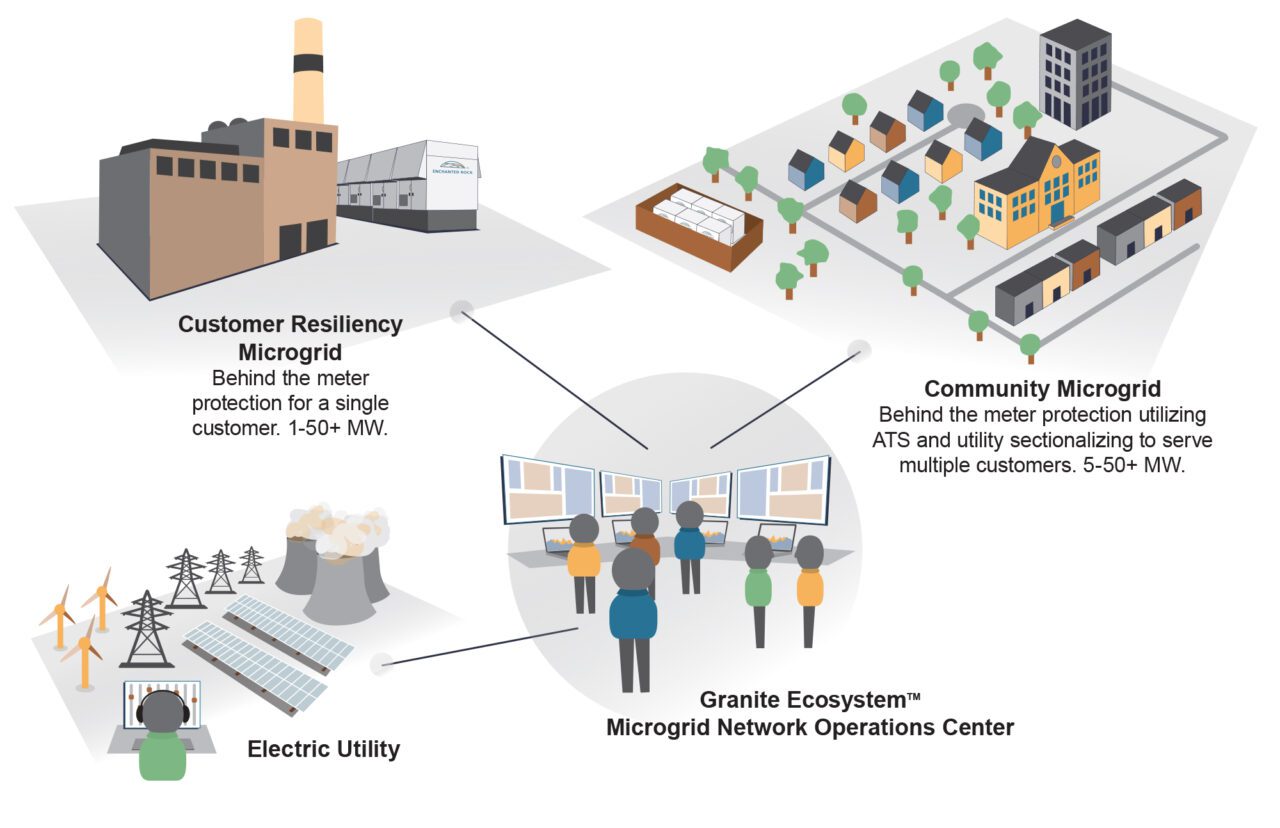

The term “microgrid” can mean different things to different people. Utilities often refer to microgrids as a portion of the utility grid — perhaps a single neighborhood or commercial campus — they can isolate from the main grid when needed and continue uninterrupted operation. Most energy consumers think of them as distributed energy resources (DER) with smart controls located at their home or business that can keep their power on, even when the grid is out.

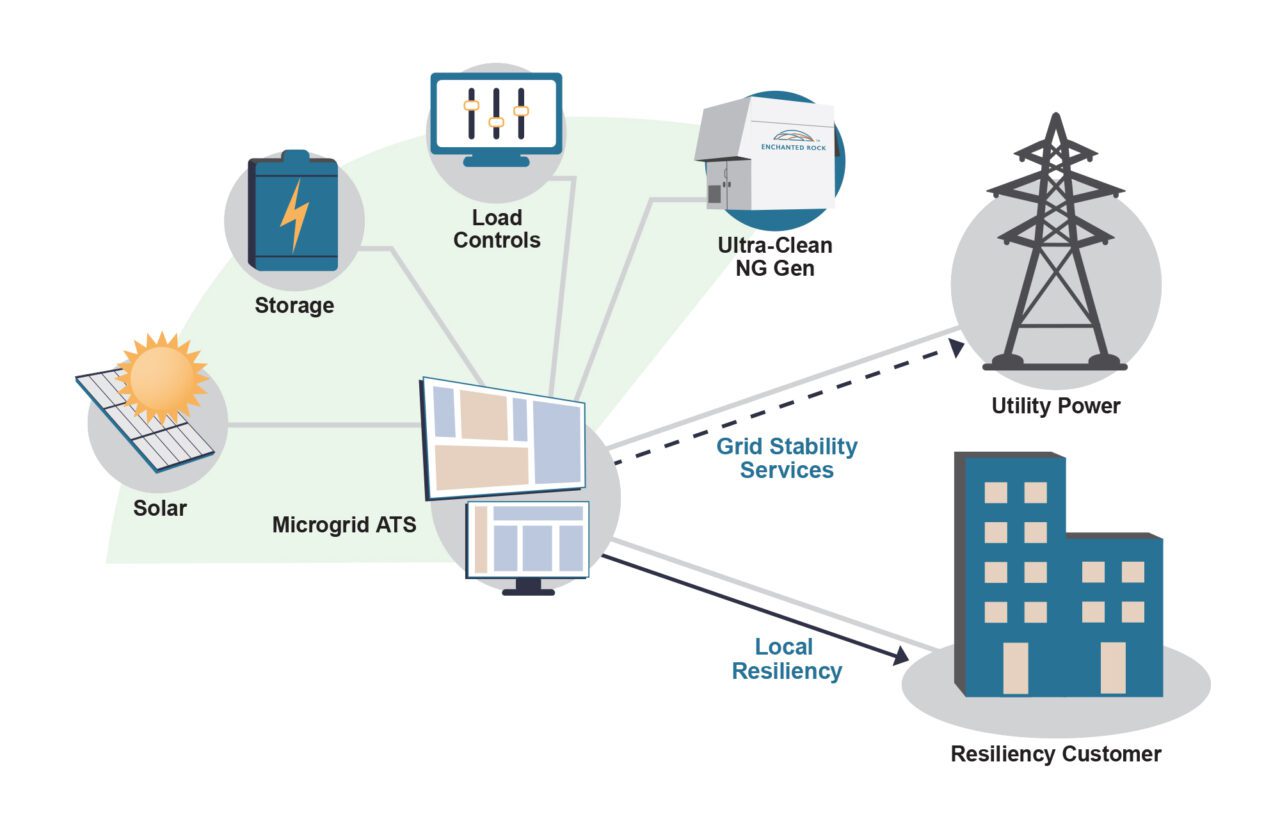

The microgrids we refer to in this paper can be either — a customer-sited, behind-the-meter asset or an in-front-of-the-meter asset that could allow an entire neighborhood or campus to operate independently from the main grid, while also providing valuable grid services when called.

Costs, Capital and Financing

More than 60% of utility leaders surveyed cited high costs or a lack of capital and financing for projects as a deterrent to microgrid adoption. There are many reasons a utility might not be able to deploy enough of its own capital to support microgrid developments, but that doesn’t mean microgrid adoption is off the table. Some utilities earn a return on rate base for microgrids that provide grid services, which can allow them to invest in microgrids on the same footing as other grid investments. It’s important for utilities to remember they don’t have to do it all on their own.

The robust market for backup diesel generation in markets around the United States proves that utility customers will pay more for resilience when it is critical for them. Combining these two investment streams, utilities can develop programs in which customers cover some or all of the costs in exchange for a microgrid solution that is better than third-party alternatives like diesel gensets and that support the grid too. Rocky Mountain Power in Utah and Sacramento Municipal Utility District in California provide incentives through demand-side management programs to help customers pay for battery storage systems, if the customers agree to allow the utilities to dispatch energy from the systems for purposes such as frequency support, demand response and peak load management.

In effect, the utilities are aggregating assets to build grid resilience through microgrids for a fraction of the full cost. If a utility can’t deploy its own capital on microgrids, it can sign a long-term offtake agreement in which a microgrid developer finances, builds and operates a system in exchange for compensation for the energy and grid services the project will provide. In addition, customers could help cover the cost of the contract through a resiliency fee. On the financing side, utilities can leverage ample third-party financing for microgrids.

Its availability may depend on the rules governing DERs and how they are compensated for the energy and services they provide to the grid. When a dispatchable microgrid is allowed to earn economic benefits for the services it provides to the grid, it creates the revenue certainty required for third parties to offer financing support. While the market awaits final rules and guidance related to the Inflation Reduction Act, the landmark law is expected to provide tax credits and other incentives for microgrids that will increase financing and capital available and reduce costs. That makes now a smart time for utilities to get in position.

Regulatory Barriers

Nearly 60% of utility leaders cited regulatory barriers as a deterrent that discourages their company from microgrid adoption. Utilities are often unsure if they can get regulatory approval to offer services behind the meter or use ratepayer funds for nontraditional investments, and microgrids are relatively unfamiliar for many regulatory commissions. Because of the extra effort required for any regulatory proceeding, it is tempting for utilities to play it safe.

The key to making the case for microgrid investment with regulators is education and outreach, so that the unfamiliar becomes familiar. Show regulators success stories from microgrid-related efforts by other utilities in other jurisdictions so they can feel assured that microgrids are a good investment for ratepayers and the utility role is appropriate.

Case in Point: Entergy’s Power Through Resilience-as-a-Service Program

Through its resiliency-as-a-service program called Power Through, Entergy has developed a model to fairly share the costs and benefits of microgrids that it is now using in several service territories. Under Power Through, Entergy pays for the upfront costs of industrial and commercial customer-sited microgrids. Entergy calculates the value of a microgrid’s benefits for all of its customers, such as the offset need for infrastructure ratepayers would have otherwise paid for, and adds that amount to its utility rate base. It charges the microgrid host the net amount remaining between the total cost of the system and the amount paid by all customers through on-bill charges.

Imagine a microgrid cost $10 million. If the microgrid helps ratepayers avoid paying $6 million in alternative new infrastructure like peaking generation, then a utility could fairly share that $6 million cost among all ratepayers, while the customer that reaps resilience benefits from hosting the microgrid covers the rest. Entergy’s model is one example U.S. utilities can use when educating regulators about the benefits of microgrids. Remember: Education is key.

Technology Risks

One-third of utility leaders said technology risk is a deterrent to their organizations pursuing microgrids. Because the primary value microgrids provide to utilities and customers is resilience, technology risk is unacceptable. Resiliency has to meet the highest standard of expected performance. To quote NASA mission control, failure is not an option. A resiliency asset must be available all the time, every time, without fail.

Fortunately, microgrid technologies are diverse and there are options to minimize risk. While a battery and solar panel-based microgrid might provide enough certainty for one operation, another seeking zero risk might want the tried-and-true technology of a microgrid that includes engine-based generation.

Enchanted Rock microgrids leverage natural gas reciprocating engines because they minimize technology risk, meet the performance standard of backup diesel generators while producing less greenhouse gas and local emissions, and cost much less than renewable plus battery storage systems for protection from outages exceeding a few hours. Sourcing renewable natural gas or blending gas with green hydrogen offers the opportunity to further decrease emissions from these systems, helping companies make progress toward net-zero carbon goals.

Customer Interest and Satisfaction with Present Energy Supply and Delivery

Nearly a third of utility leaders said there was a lack of customer interest in microgrids, while 21% said their utility was satisfied with its present energy supply and delivery. These two responses are interlinked and reflect the sentiment that if there is no demand for the utility to adopt microgrids, why should it go through the effort to develop them. It is true that not all customers want a microgrid. In fact, most probably never will because resilience is not important enough to justify the cost.

However, critical infrastructure, medical services, manufacturing, data centers and other energy users whose electric reliability has a disproportionate effect on their communities or own bottom line would benefit from resiliency microgrids. More importantly, those customers in any given utility service territory that want the resilience benefits of a microgrid are willing to pay for it.

Again, the robust U.S. market for backup diesel gensets and other resiliency solutions is proof of customer interest, yet utilities lose energy wallet share from these customers when they don’t provide a solution. To ensure the effort is worth it and that microgrid focused utility programs and pilots succeed, utilities must focus on market segmentation and targeting. Through efforts such as account-based marketing and improved customer data organization and analytics, utilities can get to know which customers would benefit most from a microgrid and are most likely to partner on developing one. serves a territory with a strong military presence.

The utility works closely with its military customers, who have made clear they want resiliency, energy efficiency and cleaner energy. Through that learning, JEA realized microgrids could be a part of the solution for its military customers’ energy goals. A customer might not express specific interest in microgrids, but if a utility helps the right customers understand how a microgrid could serve their goals, their interest is piqued.

Fit with the Utility Business Model

Nearly a third of utility leaders said microgrid development runs contrary to their business model. There are many potential reasons for this answer. Perhaps the utility is not allowed to own generation assets. Perhaps utility leaders consider microgrids as only behind-the-meter solar and battery storage systems that result in decreased sales for the utility.

Regardless of the rationale, there are microgrid development and ownership options that allow the utility to reap the benefits within the framework of their business model. For example, if a utility is not allowed to own generation, it can sign a long-term offtake agreement with a third-party developer that will own and operate the asset as a turnkey solution, accessing the dispatchable capacity from microgrids located near load centers. For utilities that believe microgrid development runs afoul of their business model, a first step is to discuss their constraints with a trusted partner and work with that partner to navigate the challenges.

In all likelihood, doing so will result in a solution that allows the utility to provide resiliency to large, key customers — the type of customers utilities most want to develop close relationships with to ensure the success of future programs.

Support from Key Stakeholders and Management

A quarter of utility leaders cited lack of support from key stakeholders or management as a reason their company is deterred from microgrid adoption. The C-suite may not be in favor of the utility’s involvement with microgrids for many of the reasons already discussed, leaving internal microgrid champions feeling that their hands are tied. Utilities may face pushback from outside stakeholders.

For example, in certain states utilities may face opposition from environmental groups or policymakers for use of natural gas-fired microgrids instead of zero-emission technology. As with regulatory barriers, lack of support from key stakeholders and management is a people challenge. To win over hearts and minds, education is still the best weapon. To overcome resistance from the C-suite, paint a clear picture of how microgrid adoption fits into utility grid modernization strategies. After all, microgrids are an energy resilience solution, and no one knows more about power outages than utilities. The value of a microgrid aligns perfectly with the service utilities strive to provide.

When deterrents such as the ones explored in this paper are cited, be ready with a pitch for how they are overcome. Come armed with data on past and projected customer satisfaction and loss of wallet share due to customers selecting third parties to install resiliency solutions such as diesel generators. Painting a picture of lost revenue related to energy resilience is sure to get attention. Highlight proven technologies and mature third party solutions. For lack of stakeholder support, treat the process similarly to regulator education. For example, the environmental group opposed to natural gas-fueled microgrids may not be aware of the availability of renewable natural gas or hydrogen blending to reduce emissions below their assumptions.

They may not have factored in that, if the utility doesn’t build grid resilience with gas-based technology, customers may adopt significantly higher-emitting backup diesel generators. Helping a stakeholder see the full landscape and the costs of inaction can be a powerful tool to build support for a utility’s microgrid vision.

Finding the Right Partners

Some utility leaders feel it’s hard to find good help when it comes to microgrid development: 13% of them say they can’t find the right partners to move forward. With so many new DER technologies, the microgrid industry can feel like a new one full of unknown players. But utility veterans know that microgrids have been around for decades, from combined heat and power systems on college campuses to small gas turbines at factories.

There are microgrid developers with long track records of success, who have built trust with major commercial and industrial businesses. For utilities, the first step is to start asking peers who those trusted developers are and then reach out to them. Founded in 2006, Enchanted Rock is an industry leader in resiliency-as-a-service. We provide all the capabilities needed to help utilities make microgrids a fit for their operational roadmaps:

- Regulatory support

- Stakeholder education

- Financial modeling

- Program planning, design and development

- Go-to-market support, including sales training

and lead generation.

Utilities can tailor a partnership with Enchanted Rock through our Power On Partner Program. Through the program, utilities can offer proven Enchanted Rock microgrids directly to their customers.

About Enchanted Rock

Founded in 2006, Enchanted Rock is the national leader in electrical Resiliency-as-a-Service, powering companies, critical infrastructure, and communities to ensure business continuity during unexpected power outages from extreme weather, infrastructure failures, cyberattacks and other grid disruptions.

Enchanted Rock’s electrical microgrids use natural gas and renewable natural gas (RNG) to produce significantly lower carbon emissions and air pollutants than diesel generators, capable of achieving resiliency with net-zero emissions. Additionally, the company’s end-to-end microgrid software platform, GraniteOS™, provides real-time 24/7/365 system monitoring and optimization, including forecasting of electricity market conditions to ensure worry-free reliable power to customers.

For more information:

www.Enchantedrock.com

[email protected]

713-429-4091