In-Depth: Meta’s suite of three landmark agreements is poised to provide the financial certainty to extend aging plants, accelerate first-of-a-kind advanced reactor deployments, and relieve PJM’s tightening capacity constraints while establishing the hyperscaler as an anchor customer for a 6.6-GW corporate-backed nuclear fleet.

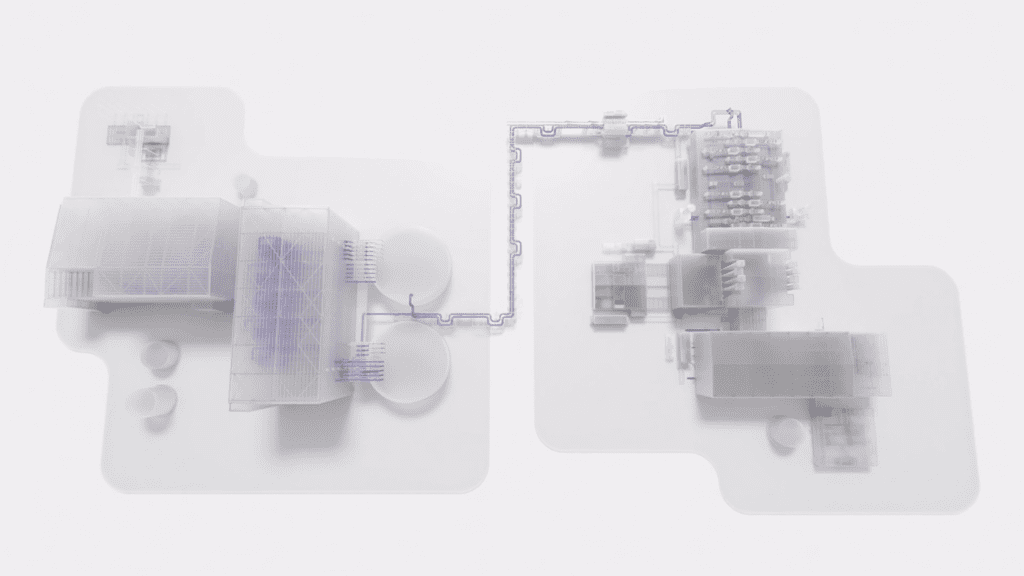

In a stunning move that reinforces Big Tech’s growing role in underwriting firm, carbon-free generation for artificial intelligence infrastructure, hyperscaler Meta unveiled partnerships with three major players—Oklo, Vistra, and TerraPower—that seek to secure up to 6.6 GW of nuclear power capacity by 2035. The agreements, finalized through Meta’s nuclear request-for-proposals (RFP) process launched in December 2024, mark one of the largest corporate nuclear procurement efforts in U.S. history.

The hyperscaler on Jan. 9 outlined the three separate deals, which span the full nuclear value chain, including long-term power purchase agreements (PPAs) and uprates at existing reactors, pairing them with early commercial backing for first-of-a-kind advanced nuclear deployments.

Under the deals, competitive generator Vistra will support 20-year PPAs covering more than 2.6 GW of nuclear capacity from its Perry and Davis-Besse plants in Ohio and the Beaver Valley plant in Pennsylvania, including 433 MW of uprates—the largest nuclear uprates ever backed by a corporate customer—while providing the financial certainty needed to pursue subsequent license renewals and extend plant operations for decades.

Advanced nuclear technology firm Oklo will advance development of an up to 1.2-GW Aurora fast-reactor campus in Pike County, Ohio, leveraging Meta-backed prepayments to secure fuel, initiate site work, and enable phased deployment beginning as early as 2030 directly into the PJM market. Separately, nuclear innovation firm TerraPower will accelerate deployment of up to eight Natrium reactors—a combined 2.8 GW of baseload capacity paired with 1.2 GW of integrated energy storage—that will be capable of boosting output to as much as 4 GW. Initial units are targeted for delivery in the early 2030s, TerraPower said.

The projects are expected to preserve and expand existing nuclear capacity, add new firm generation to constrained regional grids, and shift a significant portion of nuclear project risk and early-stage capital requirements onto a single large-load customer—Meta Platforms—at a scale never seen outside utility or federal sponsorship. They build on Meta’s June 2025–announced 20-year deal with Constellation for the 1,121-MW Clinton Clean Energy Center in Illinois, which, as POWER has reported, will keep the nuclear plant operating beyond 2027 and support a 30-MW uprate and potential advanced reactor deployment at the site.

“Our agreements with Vistra, TerraPower, Oklo, and Constellation make Meta one of the most significant corporate purchasers of nuclear energy in American history,” said Joel Kaplan, Meta’s chief global affairs officer on Friday.

“State-of-the-art data centers and AI infrastructure are essential to securing America’s position as a global leader in AI. Nuclear energy will help power our AI future, strengthen our country’s energy infrastructure, and provide clean, reliable electricity for everyone. These projects are going to create thousands of skilled jobs in Ohio and Pennsylvania, add new energy to the grid, extend the life of three existing nuclear plants, and accelerate new reactor technologies.”

Meta’s Extraordinary Nuclear RFP: A Structured Push for Clean Firm Power

The deals on Friday stem from a thorough Request for Proposals (RFP) process announced on Dec. 3, 2024, seeking 1 GW to 4 GW of new nuclear generation capacity that it envisioned would be delivered starting in the early 2030s from “developers that can help accelerate the availability of new nuclear generators and create sufficient scale to achieve material cost reductions by deploying multiple units, both to provide for Meta’s future energy needs and to advance broader industry decarbonization.” Meta explicitly sought partners “who will ultimately permit, design, engineer, finance, construct, and operate these power plants will ensure the long-term thinking necessary to accelerate nuclear technology.”

“Compared to renewable energy projects that we continue to invest in, such as solar and wind, nuclear energy projects are more capital intensive, take longer to develop, are subject to more regulatory requirements, and have a longer expected operational life,” Meta said in its December 2024 blog post announcing the RFP. “These differences mean we need to engage nuclear energy projects earlier in their development lifecycle and consider their operational requirements when designing a contract.” Meta added that because “scaling deployments of nuclear technology offers the best chance of rapidly reducing cost,” it views multi-project, multi-location partnerships as essential to deploying nuclear power strategically through its structured RFP process.

So far, Meta has backed nearly 28 GW of clean energy projects across 27 U.S. states and has contracted more than 12 GW of renewable energy worldwide, efforts it said have “matched” its global operations, which have used 100% clean and renewable electricity since 2020. But in its September 2025 Sustainability Report, the company pointed to accelerating AI deployment, which it said is reshaping data center infrastructure needs, noting that next-generation facilities are being designed specifically to support “future generations of AI growth.”

Future data centers will require larger, more persistent, and higher-density electrical loads than earlier generations, driving Meta to seek clean firm resources capable of delivering round-the-clock power to complement variable renewables, it suggested. However, the company’s recent firm-energy procurements have been of a smaller scale and include, for example, an August 2024 agreement with Sage Geosystems to supply up to 150 MW of geothermal power beginning in 2027.

On Friday, as it unveiled the three new deals—existing fleet operations and uprates (Vistra), first-mover advanced reactors under construction (TerraPower), and early-stage fast reactor technology (Oklo)—the company outlined its overriding priorities: “These projects are expected to provide thousands of construction jobs and hundreds of long-term operational jobs, supporting up to 6.6 GW of new and existing clean energy by 2035,” it said. “Importantly, these projects add reliable and firm power to the grid, reinforce America’s nuclear supply chain, and support new and existing jobs to build and operate American power plants.”

As significantly, Meta also noted that the work builds on its “ongoing collaboration with electric utility companies and power providers to plan for and meet our energy needs years in advance of our data centers becoming operational.” It underscored: “We pay the full costs for energy used by our data centers so consumers don’t bear these expenses, and we support the broader grid through our energy agreements.”

Effectively, it said, the agreements will mean “that Oklo and TerraPower have greater business certainty, can raise capital to move forward with these projects, and ultimately add more energy capacity to the grid.” Over time, “this will be an important tool in ensuring that grids maintain reliability for all customers and ensure stable wholesale electricity prices.”

Vistra Secures Record Nuclear 2.6-GW of Uprates Through 20-Year Meta Partnership

Adding to Meta’s support of Constellation’s Clinton plant, the company’s deal with Vistra will support 20-year PPAs with three Vistra nuclear plants. Specifically, Meta will buy 2,176 MW of nuclear energy and capacity from Vistra’s Perry and Davis-Besse plants in Ohio, while also backing 433 MW of incremental capacity from uprates at Perry, Davis-Besse, and Beaver Valley in Pennsylvania.

According to Vistra, Meta’s purchases under the agreements will begin in late 2026, with additional capacity added to the grid through 2034, when the full 2,609 MW of power will be online. “More than 15% of the contracted capacity announced today will be new capacity added to the PJM region,” Vistra noted on Friday. “The electricity generated at the plants will continue to go to the grid for all electricity users.”

Perry, a single-unit boiling water reactor (BWR) located on Lake Erie about 40 miles northeast of Cleveland, has a capacity of 1,268 MW and supports more than 600 full-time jobs in the North Perry area. Davis-Besse, a single-unit pressurized water reactor (PWR) in Oak Harbor, Ohio, approximately 35 miles east of Toledo, provides 908 MW of capacity and employs more than 600 workers. Beaver Valley, a two-unit PWR facility about 30 miles northwest of Pittsburgh, contributes 1,872 MW of capacity and supports more than 750 full-time jobs in western Pennsylvania.

Vistra acquired all three plants as part of its $3.4 billion Energy Harbor transaction in March 2024. All three facilities operate within the PJM Interconnection, which—despite being the nation’s largest regional transmission organization—has been signaling severe supply constraints through consecutive, record-setting capacity auctions.

System stress has become increasingly evident in recent market outcomes in the organized wholesale market. PJM’s 2025/2026 Base Residual Auction cleared at $269.92/MW-day—nearly ten times the prior year’s price—followed by the 2026/2027 and 2027/2028 auctions, both of which hit the Federal Energy Regulatory Commission (FERC)–approved price cap above $329/MW-day. The outcomes essentially point to tightening reserve margins and growing scarcity of firm capacity across the region.

The grid operator’s long-term outlook underscores the stakes of preserving—and expanding—its nuclear capacity. PJM’s 2025 load forecast projects that summer peak demand will rise by roughly 70 GW over the next 15 years. Data center load alone is expected to grow by up to 30 GW between 2025 and 2030. At the same time, PJM faces potential generation retirements approaching 40 GW by 2030, an interconnection queue exceeding 150 GW of proposed projects—many of which have withdrawn after receiving multi-billion-dollar network upgrade cost estimates—and transmission constraints that the U.S. Department of Energy estimates will require a 61% expansion of within-region transmission capacity.

“As recently as 2020, before Vistra owned Perry, Davis-Besse, and Beaver Valley, these plants were on a path to retirement,” said Stacey Doré, Chief Strategy & Sustainability Officer of Vistra. “When we signed a deal to acquire these plants in 2023, Vistra saw their tremendous contribution—to the reliability of the grid, to the stability of the region, to their local communities, and to the people who work there. Fast-forward to today, and we’re investing in expanding these same plants, and thanks to our dedicated employees and a committed partner like Meta, this fleet will continue to provide reliable, carbon-free energy to power the grid of the future.”

The deals quickly drew industry endorsement. The Electric Power Supply Association (EPSA), which represents competitive generators—including Vistra—framed the Meta agreements as a market-driven alternative to state-backed intervention. “These investments add new megawatts to the system, strengthen reliability, and do so without burdening captive customers with additional non-bypassable charges that only drive up electric bills,” said Todd Snitchler, EPSA’s president and CEO. “Made with private capital rather than guaranteed cost recovery, this investment shows that even amid market uncertainty, competitive markets shield consumers from risk.” EPSA’s comment, notably, reflects its broader pushback against recent calls—particularly from some PJM-state officials—for greater political intervention in capacity markets amid surging prices.

The Meta-backed uprates will still require regulatory clearance. While each of the three plants has received initial license renewal from the Nuclear Regulatory Commission (NRC), the PPAs “provide certainty for Vistra to pursue subsequent license renewal for each of the reactors, which would extend each license an additional 20 years,” Vistra noted. Currently, Beaver Valley Unit 1 is licensed through 2036; Davis-Besse is licensed through 2037; Perry is licensed through 2046; and Beaver Valley Unit 2 is licensed through 2047.

Oklo to Develop 1.2‑GW Advanced Nuclear Campus in Southern Ohio as Early as 2030

Meta’s deal with Oklo, meanwhile, will underpin the development of a 1.2‑GW Aurora powerhouse campus in Pike County, Ohio, to support Meta’s regional data centers, including its Prometheus AI supercluster, which Meta is building in the Columbus area in New Albany, about 100 miles away.

“This advanced nuclear technology campus—which may come online as early as 2030—is poised to add up to 1.2 GW of clean baseload power directly into the PJM market and support our operations in the region,” Meta noted on Friday.

For Oklo, the Meta agreement marks a dramatic scaling up of a Southern Ohio strategy it has pursued with the Southern Ohio Diversification Initiative (SODI) since at least 2023, evolving from the two 15‑MWe Aurora powerhouses it first slated for underutilized parcels at the former Portsmouth Gaseous Diffusion Plant (PORTS).

As POWER previously reported in 2023, DOE‑sponsored analyses identified the Portsmouth site—now a DOE cleanup and reuse project (and potentially a nuclear hub)—as one of the most suitable U.S. locations for industrial advanced reactor deployment, citing its existing nuclear infrastructure, experienced enrichment and decommissioning workforce, and formal community reuse organization. SODI has since used successive DOE land transfers and a DOE‑funded early‑site‑permit (ESP) template effort launched in 2020 to advance a “clean energy park” concept that Oklo is now apparently anchoring, with Meta as its first large‑load customer.

As Oklo explained on Friday, the Meta agreement is effectively a funding commitment that “provides a mechanism for Meta to prepay for power and provide funding to advance project certainty for Oklo’s Aurora powerhouse deployment.” Oklo plans to use the funds to “secure nuclear fuel and advance Phase 1 of the project—supporting the development of clean, reliable power in Pike County that can scale up to 1.2 GW.”

Ultimately, Oklo expects the agreement will lead to the build-out of “multiple Oklo Aurora powerhouses.” For now, “pre-construction and site characterization are slated to begin in 2026, with the first phase targeted to come online as early as 2030,” it noted. “The plans for the scalable powerhouse facility are expected to expand incrementally to deliver up to the full target of 1.2 GW by 2034.”

“Two years ago, Oklo shared its vision to build a new generation of advanced reactors in Ohio. Today, that vision is becoming a reality. We have finalized the purchase of over 200 acres in Pike County and are excited to announce this agreement in support of a multi-year effort with Meta to deliver clean energy and create long-term, high-quality jobs in Ohio,” said Jacob DeWitte, Oklo’s co-founder and CEO.

While the Southern Ohio project has long been a strong prospect for Oklo, the company’s much-watched first project—Aurora-INL—is advancing at an Idaho National Laboratory (INL) site, where it broke ground in September 2025. That 75‑MWe sodium‑cooled fast-reactor demonstration, which directly leverages EBR‑II experience, is one of three awarded to the company under DOE’s Reactor Pilot Program, and Oklo is targeting operations start between late 2027 and early 2028, contingent on regulatory approvals and construction progress.

The Aurora design uses metallic fuel, a fast-neutron spectrum, and liquid-sodium coolant to enable inherent and passive safety features that allow a much leaner set of safety‑grade systems than a conventional LWR—and, critically for data center loads, a high-capacity-factor, dispatchable profile.

The company has laid out a three‑pronged strategy built around high-assay, low-enriched uranium (HALEU) supply, downblended government stocks of uranium and plutonium‑bearing materials that do not require further enrichment, and, longer term, recycled fuel from its own and today’s LWR fleet. At INL, Oklo is already progressing its Aurora Fuel Fabrication Facility under DOE authorization to fabricate metallic HALEU fuel. The DOE in December 2025 approved the facility’s Preliminary Documented Safety Analysis, and its assembly is now underway.

Structurally, Aurora plants are packaged as standardized, shippable modules—reactor vessel, steam generators, and power conversion system—with Oklo indicating that roughly 70% of powerhouse components are sourced from established non‑nuclear supply chains in the industrial, energy, and chemicals sectors, a strategy DeWitte has highlighted in earnings calls and in interviews with POWER as central to cost and schedule control.

In tandem, Oklo has paired that supply‑chain approach with a master services agreement under which Kiewit provides full‑scope engineering, procurement, and construction (EPC) services for the Aurora‑INL project and follow‑on Aurora deployments, giving the company a repeatable EPC partner from early design through on‑site assembly.

In November 2025, Oklo and Siemens Energy went a step further by signing a binding contract for the design and delivery of the Aurora powerhouse power conversion system—covering a condensing SST‑600 steam turbine, SGen‑100A generator, and auxiliaries—which authorizes Siemens Energy to begin detailed engineering, lock in long‑lead turbine‑generator components, and initiate manufacturing for the first Aurora‑INL unit. Oklo has suggested it may leverage a standardized package across subsequent Aurora projects, including the planned Southern Ohio campus, to de‑risk the supply chain and support parallel builds.

Oklo has also pushed for early regulatory progress. Oklo was the first advanced reactor developer to submit a custom combined license application (COL) to the NRC for a non‑LWR, and while that initial COL submission was denied “without prejudice” in 2022, the company has since relaunched its NRC pre‑application engagement and in July 2025 completed Phase 1 of the NRC’s formal readiness assessment for a revised Aurora‑INL COL under Part 52.

In parallel, DOE’s selection of Aurora‑INL under the Reactor Pilot Program allows the first unit to proceed under DOE authorization—sidestepping the traditional NRC construction/operating license dual-track sequence—using DOE’s exemption authority under the Atomic Energy Act. Oklo, however, continues to develop its Part 52 COL as a reusable reference design for follow‑on commercial sites such as Southern Ohio and for future advanced-reactor-fleet scaling.

TerraPower: Up to 2.8 GW from Eight Natrium Reactor Plants

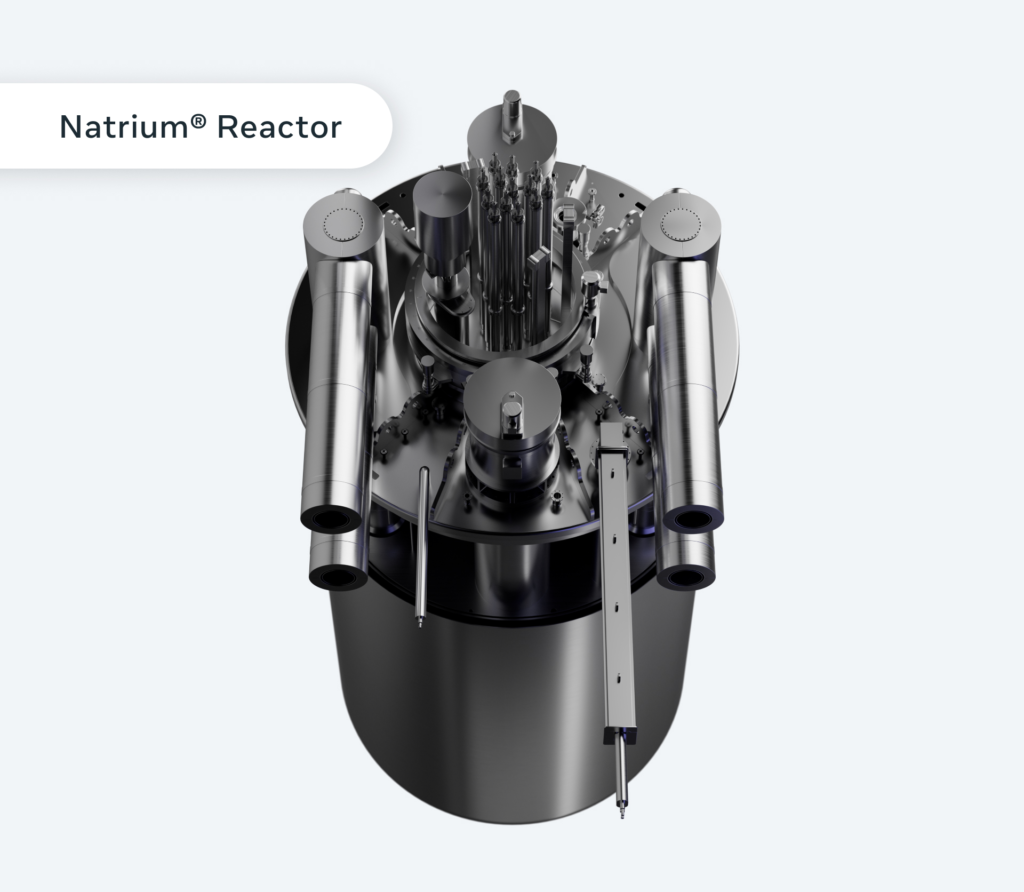

Finally, under Meta’s new agreement, TerraPower could deploy up to eight Natrium reactor and energy storage system plants in the U.S., which could furnish Meta with as much as 2.8 GW of a flexible additional carbon-free baseload capacity resource. Given that the system integrates a molten salt storage system, the deal could boost total output to as much as 4 GW when dispatched at peak. That could make it Meta’s largest single commitment to advanced nuclear technology to date.

Specifically, as Meta said on Friday, its agreement with TerraPower is for “funding” to support the development of two new Natrium units—a combined 690 MWe of firm power—whose delivery is targeted as early as 2032. But as notably, the Meta–TerraPower agreement will also provide Meta “with rights for energy from up to six other Natrium units capable of producing 2.1 GW and targeted for delivery by 2035.”

“To successfully address growing energy demand, we must deploy gigawatts of advanced nuclear energy in the 2030s. This agreement with Meta is designed to support the rapid deployment of our Natrium technology that provides the reliable, flexible, and carbon-free power our country needs,” noted Chris Levesque, TerraPower president and CEO, on Friday. “With our first Natrium plant under development, we have completed our design, established our supply chain, and cleared key regulatory milestones. These successes mean our TerraPower team is well-positioned to deliver on this historic multi-unit delivery agreement.”

For POWER readers who have followed Natrium’s trajectory, the Meta deal effectively scales up the commercial model that TerraPower is already demonstrating at Kemmerer 1 in Wyoming—a 345-MWe sodium-cooled fast reactor (SFR) coupled to a large nitrate molten-salt storage system now under construction next to a retiring coal plant. As POWER has reported, Kemmerer 1 is being built as a fully commercial plant under the DOE’s Advanced Reactor Demonstration Program. TerraPower has indicated it is targeting fuel loading around 2030 and will seek commercial operation in 2031.

Technically, the Natrium concept separates the nuclear island—a pool-type SFR operating at atmospheric pressure and cooled by liquid sodium—from the energy island, where sodium transfers heat to a non-radioactive molten salt loop that serves as a high-temperature thermal battery. That architecture eliminates the need for large, high-pressure containment typical of light water reactors and allows the reactor to run at essentially constant thermal power while the storage system flexes electrical output to match grid conditions. In practice, stored heat in the molten salt can be drawn down to drive a conventional steam cycle, boosting plant output by about 150 MW above its baseload rating for more than five hours, which allows the facility to become a dispatchable resource that can follow net load swings and firm up high renewable penetrations, while still providing the high-capacity-factor baseload profile prized by AI data centers.

Meanwhile, on the regulatory front, Natrium remains the most advanced non–light water commercial project in the U.S. The NRC accepted TerraPower’s construction permit application for the Kemmerer Natrium demonstration in March 2024, following several years of pre-application engagement and DOE Advanced Reactor Demonstration Program scoping. In October 2025, the project became the first commercial advanced reactor to receive an NRC‑issued final environmental impact statement for a commercial advanced nuclear power plant, and in December 2025, the NRC completed its final safety evaluation of TerraPower’s construction permit application for Kemmerer Power Station Unit 1, clearing the way for issuance of the construction permit once remaining administrative steps are finalized.

As POWER has detailed, TerraPower has already mobilized substantial non-nuclear construction at Kemmerer—test-and-fill facilities for sodium systems, a training center, and early energy-island works—under EPC contracts led by Bechtel and a reactor supply partnership with GE Hitachi.

However, TerraPower’s Meta deal effectively plugs into a Natrium pipeline that is already much broader than the Wyoming demonstration. Beyond Kemmerer 1, TerraPower is advancing multiple utility-facing siting efforts (including MOUs in Utah and Kansas and exploratory work with Sabey Data Centers and other load-serving partners) while seeding a global vendor base through repeated Natrium equipment awards and pushing the design into overseas licensing processes in the UK.

Who Bears the Risk?

As details emerge about the structure of Meta’s advanced nuclear agreements, attention is also shifting to how first-of-a-kind cost and schedule risks are allocated, particularly where corporate prepayment replaces traditional utility-backed contracting models. Asked how Meta’s Oklo and TerraPower arrangements compare with its more conventional power purchase agreements—and who ultimately bears the risk if advanced reactor projects exceed budgets or miss delivery timelines—Eric Chung, partner of energy and utilities at West Monroe, told POWER that limited public disclosure constrains definitive conclusions, but that the risk allocation may be different across the deals.

“On the face of it, and without knowing the terms of the deals, the risks of cost and schedule overruns in these deals are borne by the contracting parties,” Chung said. “While Meta’s arrangement with Vistra appears to be more of a traditional Power Purchase Agreement, it seems Meta is absorbing cost and schedule risk in the case Oklo and TerraPower.”

Chung said the agreements reflect a notable, “innovative and decarbonization-friendly” private-sector response to the accelerating power demands of data centers, and they remain substantial given that utilities and grid operators are struggling to keep pace with load growth. “However, in any of these situations, I have questions about what happens where such overruns are so significant that the parties seek relief from the state legislatures in Ohio and Pennsylvania,” he said.

Drawing on prior nuclear cost-recovery precedents, Chung warned that the boundary between private capital risk and public exposure has historically proven fragile. “State legislation in New Hampshire and Connecticut requires electricity customers in those states to subsidize the Seabrook and Millstone nuclear plants, for example,” he said. “I would like to see an open dialogue about how such situations would be handled without harming electricity customers, and that may require Meta and its counterparties to open up certain terms of their agreements to the public.”

—Sonal Patel is a national award-winning multimedia journalist and senior editor at POWER magazine with nearly two decades of experience delivering technically rigorous reporting across power generation, transmission, distribution, policy, and infrastructure worldwide (@sonalcpatel, @POWERmagazine).

Editor’s Note (Jan. 15): This article has been updated to include additional industry perspective from West Monroe regarding risk allocation and cost exposure in Meta’s advanced nuclear agreements.

- Generation IV reactors

- advanced nuclear

- Thorium fuel cycle

- Fuel conversion

- molten salt reactor

- Experimental reactors

- Shanghai Institute of Applied Physics (SINAP)

- Idaho National Laboratory

- Chinese Academy of Sciences (CAS)

- nuclear innovation

- Clean Core Thorium Energy

- Thorizon

- ThorCon International

- Copenhagen Atomics

- nuclear research