How to Position Your Power Company for the Future

Faced with the challenge of making the right moves to accommodate a swiftly changing energy ecosystem, one question draws into sharp focus for generators and the entire power and utilities industry: What will their role become in the years ahead, considering evolving portfolio mixes and changing industry dynamics?

Leaders know there’s a very real possibility that if they don’t fortify that answer quickly, they’ll continue to lose ground to new entrants eager to step in and take their place. It doesn’t have to be that way. We believe that power and utilities can avoid this fate by shifting toward a new role—what we’re calling a Utility Platform Player.

Evolving Frontier for Generation

The days of highly centralized generation, with business decisions largely focused on pursuing economies of scale, continue to transform into a world that is becoming far more decentralized. This is happening as more and more customers invest in their own sources of generation—from rooftop or commercial-scale solar facilities to microturbines or other technologies that produce power on a non-centralized basis. The trend further necessitates a new value proposition for utilities in the future, one of a platform that provides the interconnection between disparate and increasingly numerous energy players as opposed to purely a commodity pipeline. With this in mind, we see the following key focus areas continuing to rise in importance for generators and others within the utilities industry.

Reimaging Business Models. Naturally, there’s no one-size-fits-all path toward the future. Growing as a Utility Platform Player could mean many things, including making even more advances toward a customer-centric and innovative mindset; embracing new partnerships; enabling new entrants to join the energy ecosystem; becoming more digitally connected across all aspects of the generation, transmission, and distribution value chain; and more.

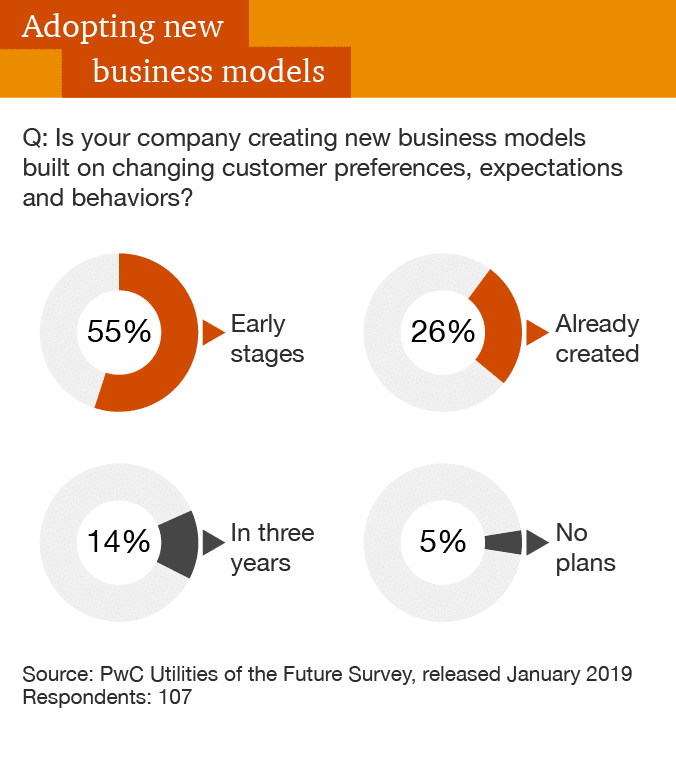

Companies are acutely aware that previous business models are not built for the needs of tomorrow. As PwC found in a survey of more than 130 senior power and utility professionals throughout the U.S., most are taking steps to adapt. In fact, the vast majority surveyed said they have already created or are beginning to build new business models to reflect these changing customer preferences, expectations, and behaviors (Figure 1).

|

| 1. Many companies have taken steps to adopt new business models, but nearly one in five have not. Courtesy: PwC |

Power and utilities must choose where they want to play, so to speak. Where do they want to be the provider and where do they want to be the enabler? Neither choice is wrong, as different decisions may be driven by external factors such as regulator preferences, stakeholder investment, regional needs, or strategic decisions.

Shifting and Shedding. To face the realities of tomorrow and changing market dynamics, utilities are taking a hard look in the mirror to evaluate asset portfolios and determine if they are “fit-for-purpose.” Most companies lack the resources in terms of bandwidth and capital (people and financial) to be all things to all customers. So, they need to choose how to get there.

Key strategies employed continue to be strategic mergers, acquisitions, or other business combinations to fill certain asset or capability gaps. At the same time, companies may consider shedding certain elements of historical portfolios to be more nimble for the future. For some, spinning off legacy assets could also mean ramping up asset portfolios they are focusing on—resulting in holding fewer but larger portfolios—in a big bet on their future business sustainability. Utilities are increasingly aware of the potential of mergers, acquisitions, or partnerships to help add the capabilities they will need to find new revenue streams, evolve their business model, and ultimately fill the future role as the connective tissue in an evolving power ecosystem.

Taking a Platform Position for Customers. A new way of doing business means working with (and not against) other energy providers and being at the center (not the sidelines) of newly emerging products and services. This can be through partnering with these entrants or facilitating greater access and choice for customers. It could mean facilitating access to distributed energy resources, energy storage, or electric vehicle charging stations. With sweeping changes in the industry often occurring closer to the customer edge of the grid, nearly half of power and utilities surveyed said they have a partnership strategy and work with third-parties to improve the customer-facing side of the business. Another 27% are actively building a strategy and pursuing partnerships (Figure 2).

|

| 2. Most utilities are partnering with third-parties to improve customer experiences. Courtesy: PwC |

As utilities grow on this front, customers’ perception of utilities will likewise evolve, thinking of them as a “one-stop-shop” for all things energy, just as the most-successful platform players in other industries—such as online retail and travel platforms—have already become. This also requires streamlining every touchpoint with the customer, including those they have with fieldworkers, a key contributor to the broader experience.

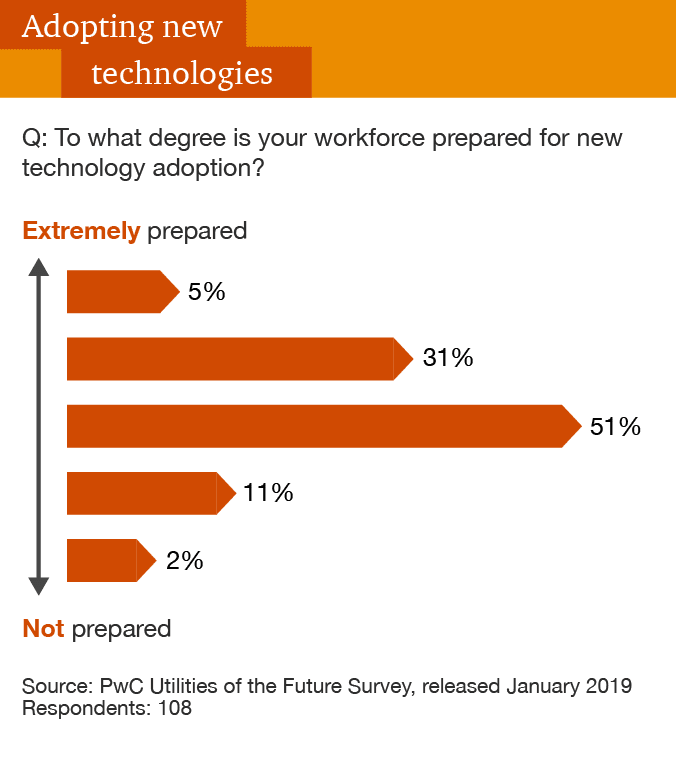

Building a Digital Workforce. As power and utilities seek to broaden their roles, they look inward, recognizing the need to adopt technology and develop a workforce with the talent and skills to embrace what the future brings. Strikingly, just under 5% put themselves in the highest level of preparedness with their teams (Figure 3). Many others know they still have a long way to go, with 64% saying their workforces were not at all, or only moderately, prepared for new technology adoption. They’re making progress and clear-eyed about the need for digital workforce transformation. More than two-thirds said they’re recruiting new digitally capable workers and retraining existing ones, or have a plan to do so.

|

| 3. Few power companies are well-prepared to adopt new technology. Courtesy: PwC |

In terms of most-sought-after skills needed to lead the future of their organizations, data science and analytics to the list according to those surveyed.

Competitive recruiting strategies are essential. This includes actively promoting values that may appeal to in-demand workers, such as a commitment to the community or support of “green” technologies like wind, solar, and electric vehicles. Also, companies interested in attracting digitally savvy talent may need to contemplate a cultural shift. The move toward becoming a Utility Platform Player will necessitate levels of innovation and flexibility (such as mobility, collaborative technology, etc.) that might have seemed unthinkable just a few years ago.

Navigating the Path Forward

Undertaking any transformation requires support of shareholders, customers, employees, lawmakers, and regulators. With the pace of change accelerating, power and utilities report that regulatory and governmental decision-making isn’t keeping up with emerging technology and the expanding customer needs of tomorrow. Most survey respondents said they fear the industry could potentially lose opportunities to other entrants offering new products and services such as access to distributed power, energy storage, or other services.

Future-proofing the industry will require utilities and regulators working together to redefine what tomorrow will look like. Coming to grips with the challenges that emerge when new technology and existing regulatory structures collide should be a top priority. Resisting the change is a risky strategy, as the competitive terrain is already shifting.

—Casey Herman is US Power & Utilities Leader with PwC. To learn more about the power and utilities survey referenced in this piece, or to further explore this topic, visit pwc.com/us/platform.