History of Power Plant Renovation and Modernization in India

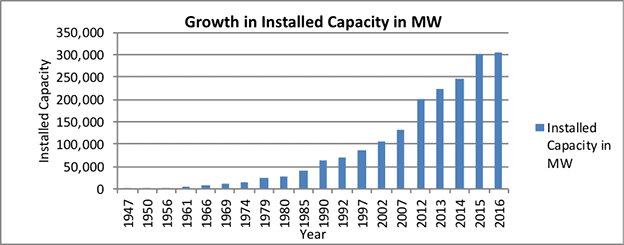

Good infrastructure is an essential component for the economic growth of a country, and power plays a crucial role in infrastructure development. India is home to 18% of the world’s total population, and it uses about 6% of the world’s primary energy. The total power generating capacity from all sources of power in India has increased from a meager 1,362 MW in 1947 to 267,000 MW at the end of March 2016, as shown in Figure 1.

|

| 1. Addition in total installed capacity from India’s independence to 2016. Source: Purnima Bajpai |

The per capita electricity consumption in India, which was a mere 16.3 kWh in 1947, has increased to 1,510 kWh in 2015–2016, according to the Ministry of Power (MOP). However, the growth of electricity demand has surpassed the power supply, and the country has been facing power shortages during periods of peak electricity demand in spite of the manifold growth over the years.

Even though the generation growth has resulted in economic development and has lifted millions of people out of extreme poverty, the per capita energy consumption still remains around one-third of the global average, and almost 240 million people have no access to electricity. Therefore, India’s power industry needs to almost quadruple in size by 2040 to catch up and keep pace with the increasing electricity demand, which is expected to increase at almost 5% per year.

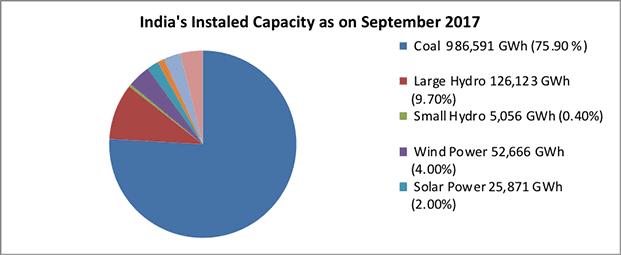

India’s electricity sector is dominated by fossil fuels, and in particular coal, which accounted for about three-fourth of the total electricity produced in the country in 2017–2018. Out of the total installed capacity in India, 75% is attributable to coal-based thermal power plants (Figure 2), of which more than 60% are subcritical in nature. Coal is expected to continue as a dominant fuel for power generation in the country, as the growth rate in alternate energy sectors is comparatively slower.

|

| 2. India’s installed capacity on Sept. 30, 2017. Source: Purnima Bajpai |

Since 2005, the World Bank Group (WBG) has adopted a two-tiered approach, favoring clean energy and energy efficiency projects on one hand and considering other higher emission-based projects only in limited circumstances on the other. To implement this, WBG has consistently increased lending for new renewable energy and energy efficiency projects. WBG committed almost $3.7 billion to renewable energy and energy efficiency projects between 2005 and 2008. Concurrent to clean energy promotion, WBG also supports higher carbon-based generation where it is a pressing development imperative.

Evolution of Renovation and Modernization Projects in India

The majority of thermal power plants in India were set up during the late 1990s and have been facing the problems of declining efficiency. A power plant is said to be inefficient if the existing inputs are not utilized in an optimum manner, and as a result, its generation becomes lower than its maximum possible generation.

Even though the Government of India (GoI) has been trying to focus equally on both the demand and supply side of power, major emphasis has been on capacity addition only. In the course of this action, one important area which did not receive much attention was the upkeep of the coal-based thermal power plants. As a result, the efficiency of these plants gradually deteriorated and plant load factors (PLFs) of many units dropped to alarmingly low levels. Despite the enormous capacity addition, the average PLF of coal-based plants reduced from 79% in 2008 to 73% in 2012. The various reasons identified for this reduction were the inability of the utilities to introduce modern technology and mining practices, various environmental and forest clearances, land acquisition problems, rehabilitation and resettlement challenges, and more.

The GoI initiated a new build program, and a renovation and modernization (R&M) program for existing thermal power plants during the Seventh Plan period (1985–1990) to address the problem of power shortages by increasing the efficiency of the existing thermal power plants. The main objective of an R&M program for generating units is to equip them with the latest technology, equipment, and systems to improve their efficiency, reliability, availability, and output, while reducing operation and maintenance (O&M) requirements.

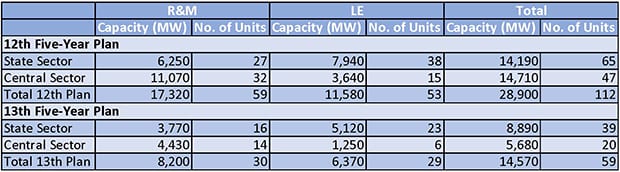

Based on the R&M program of the GoI, the Central Electricity Authority of India (CEA) in 2013 recommended closure/retirement of units older than 25 years, totaling almost 36,000 MW of capacity. In the National Perspective Plan of the CEA under the 12th Five-Year Plan (2012–2017), 65 units having installed capacity of 17,000 MW were identified for R&M.

However, there were many challenges faced by the investors and utilities during the planning, management, and implementation of these R&M projects that derailed the objectives, and only 37% of the 65 planned units were actually completed on time. Delay in supply of critical equipment, contractual issues, delays in obtaining shutdowns for units, and financial constraints were some of the major factors highlighted by the CEA. However, no detailed study was carried out to actually document reasons for such delays.

It was also emphasized by the R&M policy of the GoI in 1995 that R&M projects are a much cheaper and quicker way to add capacity, and, therefore, deserve the highest priority. The policy also highlighted that greenfield projects involve long gestation periods, while R&M projects offer a quick remedy to power shortages to a considerable extent. Keeping in mind the high cost of greenfield projects, deteriorating financial health of the utilities, and increasing fuel constraints, it has become imperative to maximize the generation from existing power units by renovating the rated capacity and also by improving the efficiency of the units through R&M programs.

Under the 12th Plan, life extension works have been identified on 72 thermal units with total capacity of 16,532 MW. This includes 30 units (5,860 MW) from the state sector and 42 units (10,672 MW) from the central sector. R&M works have been identified on 23 units (4,971 MW) during the 12th Plan. Out of those, 11 units (4,050 MW) are from NTPC, 9 units (291 MW) are from NEEPCO, and the rest are from the state sector.

Background of Thermal Power Plants in India

This section presents an overview of the power sector as a whole in India and identifies various challenges faced by the sector. It also examines the trend in plant efficiency over the past few years. In addition, the section presents the history of R&M projects proposed for the thermal power plants in India and how these projects have developed over the years.

Power Sector and Its Challenges. The power sector in India is one of the most diversified in the world, where the sources of power generation range from conventional sources, such as coal, lignite, natural gas, oil, hydro, and nuclear power, to non-conventional sources, such as wind, solar, and agricultural and domestic waste. There are three major pillars of the power sector in India, which are mainly governed by the MOP. The pillars are generation, transmission, and distribution.

The government’s focus on attaining “Power for All” has accelerated capacity addition in India. At the same time, the competitive intensity is increasing on both the market side as well as the supply side (fuel, logistics, finances, and manpower). Even though the GoI has taken many steps to encourage investment in the power sector, more emphasis is required toward formulation of an effective risk management framework, an essential requirement to attract bankable projects, and that is currently lacking in developing countries such as India.

An analysis of the power sector in India was carried out by Sharma et al. in 2011. It revealed that the market potential, rapidly increasing consumer class, and open economy are the biggest strengths of this sector. Further, the quality of power supplied, low capacity, and supply deficits are the biggest weaknesses. Various threats identified were operational risks like site selection, construction risk, fuel supply risk, political risks, policy risk, market risks, demand risk, foreign exchange risk, convertibility risk, lack of government support, bureaucracy, non-statutory approvals, law enforcements, tax reforms, and judicial systems, among others.

Trend in Thermal Power Plant Efficiency. Shanmugam and Kulshreshtha presented a stochastic frontier production model through their study, which measured the efficiency of 56 coal-based power plants for the period 1994–2001. Using the method of panel data, they tested the trend in plant efficiency during the period of their analysis. Their results suggested that even though the efficiency values did not vary during the study period, there were considerable variations in efficiency across plants (from 96% to 46%).

Linear programming methods were used by Singh, who carried out a study to estimate the efficiency of state-owned coal-fired power plants. The range of efficiency across plants was wide, varying from 40% to 100%. Further, the study also found that when these plants were grouped by region, plants in southern India were, on average, more efficient than plants in other regions.

Khanna and Zilberman analyzed 63 coal-fired power plants to understand the contributions of regulatory and technical factors on plant efficiency for two time periods: 1987–1988 and 1990–1991. They measured the efficiency in terms of the heat input required to produce a net kilowatt-hour of electricity and by auxiliary power consumption. They found that energy efficiency increases with the use of coal with higher heat content and is lower for plants operated by state electricity boards (SEBs) than for those operated by the private sector. They also found that improving management practices by SEBs to match those in the private sector could raise average thermal efficiency from 25% to 26%.

The only econometric study that attempts to estimate ex-post generation efficiency gains is Sen and Jamasb.

History of Renovation and Modernization of Power Plants in India. In India, the addition of one megawatt of new generating capacity requires a capital expenditure of around $1 million, according to the CEA. However, an equivalent capacity can be achieved by investing around one-third of this amount on R&M activities.

The latest study by the MOP and CEA in 2012 highlighted that there are many thermal power plants in India that are not operating at their full capacity and have become significantly old or have outlived their economical design life. The objective of R&M is not just to help the plant regain the lost efficiency, but also to improve environmental performance and output reliability of the plant.

Renovation of old thermal power plants is an economical and cost-effective technique to extend the life of the existing plants, and at the same time, aim at increasing the efficiency of the plants, which in turn reduces fuel requirements. This is also being viewed as an alternative to the construction of new power plants, which usually have a much longer gestation period.

R&M is an efficiency improvement tool and can improve power generation by about 30% and the efficiency by 23%. A well-designed R&M project of the plants could help in improving the operational efficiency and also provide reliable and competitively priced electricity in a comparatively shorter span of time. R&M has an additional advantage that the major issue of land acquisition and resettlement can be waived off. R&M of old power plants can also help in delivering clean power at a cheaper and faster rate.

Even though the MOP, CEA, and other governmental organizations have taken various steps for promoting R&M projects, the rate at which these projects are being implemented is very slow. The main reason for this was cited as the scarcity of funds with the SEBs or utilities, which are not willing to invest in R&M projects. The budgetary constraints and technical performance problems, such as blackouts, transmission and distribution losses, and low access rates, were other common problems identified. Further, low debt cover ratios, low rate of return (ROR), low creditworthiness, low self-financing ratios, improper planning functions, delay in decision-making, inadequate procurement, and contracting capacity, which hampers the timely and efficient private investments, were the most significant factors contributing to low investment in the R&M projects in India (Table 1).

|

| Table 1. Renovation and modernization (R&M) and life extension (LE) potential in India’s 12th and 13th Plan under the High Case category. Source: Purnima Bajpai |

R&M is not a substitute for regular annual maintenance activities and there must be a mid-life R&M study that is generally carried out after 100,000 hours of plant operation because equipment is subjected to various stresses due to high temperatures. The work taken up under routine O&M generally doesn’t fall under the scope of R&M project work. All activities having a frequency of once in five years or less are covered under O&M work.

A systematic study called the residual life assessment (RLA), involving destructive and non-destructive tests, should be carried out to reveal the remaining life of critical plant components and equipment, so that appropriate steps can be taken in order to extend the life of the plant by a period of about 15 to 20 years through R&M activities. In case CEA recommends a plant be retired, it can be prioritized according to performance. Generally, plants having a heat rate deviating more than 20% are recommended to be retired first, and subsequently, those units having a deviation of 15% and 10% from their design heat rate.

A detailed SWOT (strengths, weakness, opportunities, and threats) analysis carried out by Sharma et al. summarizes the strengths, weaknesses, opportunities and threats of R&M projects.

Strengths:

- Cost-effective technique as compared to greenfield projects.

- Short gestation/construction period as compared to greenfield projects.

- Less issues of approvals and clearances.

- Large domestic equipment manufacturing capacity.

Weaknesses:

- Lack of incentives for utilities to undertake R&M project.

- Limited competition.

- Limited market size.

- Limited skilled workforce.

- Delay in completion of R&M works.

- Lack of support from utilities during implementation of R&M projects.

Opportunities:

- Huge R&M potential, as 60% of coal-based thermal power plants in India are more than 20 years old.

- Major slowdown in greenfield projects due to approval and clearance issues.

- Shortage of fuel and increasing costs has also led to movement toward more efficient use of existing resources.

- Incentives and enforcement mechanisms to be designed to ensure implementation of R&M projects on a timely basis.

Threats:

- Lack of well-defined scope of work.

- Skewed risk-benefit analysis.

- Lack of well-structured contractual conditions.

- Limited success stories with respect to benefits of R&M works.

- Poor financial condition of utilities to take up R&M works.

- Poor O&M practices impacting the sustainability of R&M projects.

R&M Provides Numerous Benefits

The background research discussed in the preceding sections provide strong evidence, proving R&M programs undertaken in different power plants can improve power generation capacity, reduce the environmental impact, and most importantly, increase the efficiency of functional thermal power plants. High capital expenditure related to new capacity augmentation, poor financial health of utilities, and emerging fuel constraints necessitate efficiency improvement of existing power stations in India.

R&M of thermal power plants plays a critical role in restoring lost power plant capacity and reducing coal consumption, and is one of the most cost-effective options to achieve additional generation in a very short period. Despite numerous benefits, the pace of implementation of R&M in the country has been slow.

The purpose of this study is to communicate the R&M potential in India. The assessment of the R&M market clearly indicates that there are several players genuinely interested in R&M, but they are not able to commit due to low market visibility. The R&M market continues to witness a variety of challenges and issues that have impeded growth and scale-up plans, but a positive action plan could strengthen interest of R&M stakeholders.

—Purnima Bajpai is a research scholar at the Indian Institute of Technology Delhi, and project coordinator with Rajdarbar Realty Pvt. Ltd.