The U.S. Department of Energy (DOE) has issued its first production-scale task orders under a $2.7-billion uranium enrichment program launched in 2024, awarding $900 million each to Centrus Energy Corp., General Matter, and Orano Federal Services to expand domestic capacity for conventional low-enriched uranium (LEU) and high-assay low-enriched uranium (HALEU) over the next decade.

The fixed-price orders mark a significant milestone in implementing a competitive contracting framework that the DOE established in 2024 to rebuild U.S. uranium enrichment capacity.

The move—part of a concerted federal effort spanning the Biden administration and both the first and second Trump administrations—seeks to establish a stable, nationally rooted uranium supply. The effort is bolstered in part by a statutory ban on Russian enriched uranium imports enacted in May 2024 (which will begin in full in 2028 and end in December 2040), but it also reflects broader concern over fuel-security risks for the existing and advanced nuclear reactor fleet and the need to revive a long-dormant U.S. nuclear fuel supply chain.

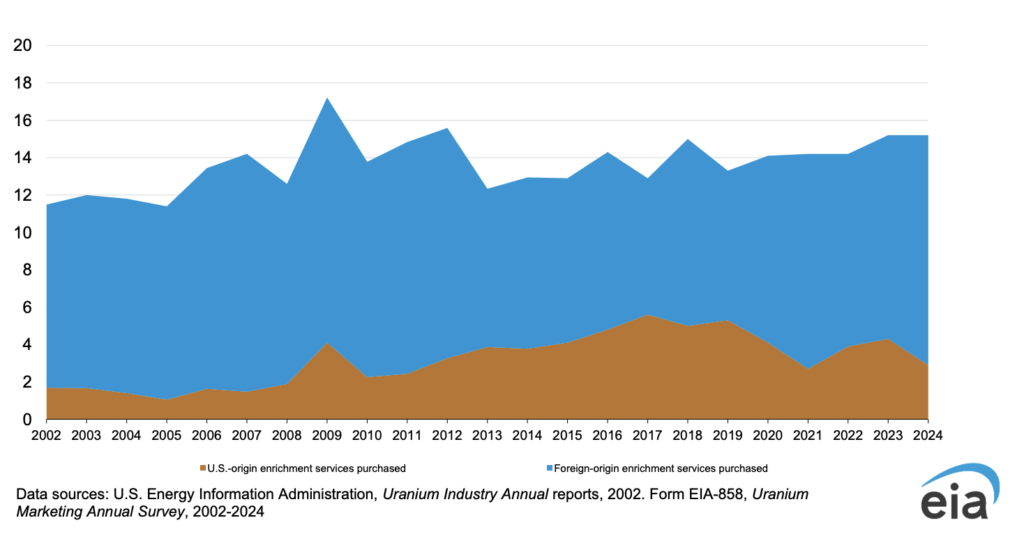

Current U.S. Uranium Enrichment CapacityMost commercial light-water reactors operate today using fuel fabricated with uranium enriched from natural uranium’s 0.7% U-235 content to about 3%–5% U-235 (LEU). LEU+—generally referring to enrichment between about 5% and 10% U-235—is an emerging commercial enrichment product intended to enable higher-burnup and certain advanced LWR fuel designs, while many non-LWR advanced reactors will require high-assay low-enriched uranium (HALEU), defined as enrichment between 5% and 19.75% U-235. According to the U.S. Energy Information Administration’s (EIA’s) September 2025–released 2024 Uranium Marketing Annual Report, U.S. utilities purchased about 15.2 million separative work units (SWU) of enrichment services in 2024, but roughly 80% was supplied by foreign providers, primarily from Russia and Western Europe, including state-owned supplier Rosatom and multinational firms such as Urenco and Orano. Still, the only large commercial domestic enrichment facility in the U.S. today is Urenco USA’s gas-centrifuge plant in Eunice, New Mexico, operated by Louisiana Energy Services, which has a capacity of about 4.9–5 million SWU per year—roughly one-third of current U.S. fleet requirements, EIA data shows. Urenco USA is expanding its capacity by about 700,000 separative work units (SWU) between 2025 and 2027 by adding new gas-centrifuge cascades at its National Enrichment Facility in Eunice. The expansion follows Nuclear Regulatory Commission authorization granted in September 2025 to allow the plant to enrich uranium up to 10% U-235 (which will make Urenco USA the first commercial enricher licensed to produce LEU+ in the U.S). Urenco, which has kicked off initial LEU+ production, anticipates first deliveries to fuel fabricators in 2026. For HALEU, no commercial domestic enrichment capacity yet exists. The sole U.S. source is a DOE-owned, demonstration-scale centrifuge cascade operated by Centrus Energy at Piketon, Ohio, which has produced about 900 kilograms of HALEU under federal contracts. Today, the U.S. imports roughly two-thirds of its enrichment services, while Russia controls an estimated 40%–45% of global enrichment capacity.

|

Task Order 2: Executing the Enrichment Buildout

The task orders announced on Jan. 5 stem from a competitive vendor pool the DOE established under Task Order 1 of its domestic enrichment program, which it designed to pre-qualify suppliers and fund proposal development.

Following a request for proposals in mid-2024, the DOE in December 2024 selected six companies to compete for LEU enrichment (of up to 10%) work, including 10-year contracts: Centrus Energy subsidiary American Centrifuge Operating, General Matter, Global Laser Enrichment, Louisiana Energy Services, Laser Isotope Separation Technologies, and Orano Federal Services.

In January 2025, the agency selected four companies—American Centrifuge Operating, General Matter, Louisiana Energy Services, and Orano Federal Services—to compete for HALEU enrichment work (defined as enrichment levels of between 5% and 19.75% U-235). Each selected vendor under these selections—which the DOE is calling “Task Order 1”—received $2 million to prepare bids for future production-scale task orders.

On Monday, the DOE unveiled its Task Order 2 selections, issuing task orders totaling $2.7 billion under its domestic uranium enrichment program. The agency finalized a $900 million task order with Orano Federal Services “to expand LEU capacity in the U.S. over the next 10 years,” while noting that all six companies previously selected for LEU enrichment remain eligible to bid on future task orders, pending appropriations.

For HALEU enrichment, the DOE finalized two $900 million task orders, awarding one to American Centrifuge Operating and one to General Matter, tasking the companies to “expand HALEU enrichment capacity in the U.S.” over the same time horizon. As with the LEU awards, the DOE said all four previously selected HALEU vendors remain eligible to compete for future task orders, pending appropriations.

Separately, the DOE awarded $28 million to Global Laser Enrichment under its HALEU Technologies program to advance next-generation uranium enrichment technology for the nuclear fuel cycle. Unlike the Task Order 2 awards, which are intended to establish commercial enrichment capacity through long-term service contracts, the HALEU Technologies program focuses on addressing technical gaps and de-risking new enrichment approaches that could improve efficiency, reduce costs, or expand production options for HALEU.

The DOE said the funding will support demonstration-scale projects at the engineering or pilot level, as well as earlier-stage applied research and development. Global Laser Enrichment is the exclusive licensee of the SILEX (Separation of Isotopes by Laser EXcitation) laser-based uranium enrichment process, developed in partnership with Silex Systems, an Australia-based company, and backed by strategic investor Cameco. The DOE also noted that applications for the program closed in February 2025 and that remaining funds will be reserved for other priorities within the initiative.

Orano Will Pursue Project IKE Centrifuge Plant in Tennessee

According to the DOE, the awards will be distributed under a “strict milestone approach,” though the agency did not disclose delivery timelines or expected production volumes.

Orano, in a statement sent to POWER, said its $900 million task order from the DOE will accelerate development of Project IKE, a multi-structure commercial uranium enrichment facility in Oak Ridge, Tennessee, on greenfield property owned by DOE.

The award underpins a roughly $5 billion investment in a large U.S. centrifuge plant designed to supply LEU to the existing reactor fleet and, with sufficient federal support and customer demand, potentially LEU+ and HALEU for advanced reactor designs. The facility is intended to expand U.S.-based enrichment and reduce reliance on imported services, which today provide roughly two-thirds of the fuel used by the U.S. nuclear fleet.

Project IKE will use commercially proven centrifuge technology and modular construction to scale output over time. The company has described the initial concept as a roughly 750,000–square-foot complex with an annual full production capacity of “several million SWU,” with room to add cascades if market demand warrants. “We anticipate writing another chapter of Orano’s decades-long history on American soil with the new Project IKE industrial enrichment facility,” said Nicolas Maes, CEO of Orano. “For this multibillion-dollar investment, we look forward to finalizing and completing the next milestones and then delivering production at the beginning of the next decade.”

Regulatory and site-development work is already underway. Orano has submitted a letter of intent to the Nuclear Regulatory Commission (NRC) and completed an initial pre-licensing meeting. For now, a full license application is expected in early 2026, with the company targeting initial LEU production in 2031, subject to NRC approval and finalization of contractual arrangements.

In parallel, DOE is completing the transfer of the Self Sufficiency Parcel 2 site to Oak Ridge’s Industrial Development Board, after which Orano can acquire the land and proceed with detailed design, board approval, and construction. Project IKE is designed to rely on an extensive U.S. supply chain and is expected to create more than 1,000 construction jobs and roughly 300 permanent positions once operational, the company said.

“Orano is the only Western company in the last 15 years that has successfully built and operated a new, modern, commercial-scale gas centrifuge uranium enrichment facility with our completion of the Georges Besse II facility in 2011. Plus, we are currently performing a 30% capacity expansion of this facility,” said François Lurin, executive vice president of Orano’s Chemistry and Enrichment business. “Our objective is to apply the best practices from that construction and expansion to the benefit of the Project IKE uranium enrichment facility in Tennessee.”

Centrus Moves From HALEU Demonstration to Scaled Production

Centrus, through its American Centrifuge Operating subsidiary, is set to expand its ongoing HALEU production at the American Centrifuge Plant in Piketon, Ohio, under the newly awarded $900 million task order. “Centrus intends to leverage the competitively-awarded federal funding to support its previously announced multi-billion dollar expansion in Piketon—which will also include additional Low-Enriched Uranium (LEU) production to serve commercial utilities and the existing reactor fleet,” the company said in a Jan. 6 statement.

“The fixed-price base task order amount for the award is $900 million to bring new enrichment capacity online,” it noted. “The award also includes options, at the Department’s discretion, for up to $170 million to produce and deliver HALEU to the Department, so that the total task order contract value with all options included is $1.07 billion.”

To date, from its cascade of AC-100M advanced centrifuges built at Piketon, the company has produced and delivered just over 920 kilograms (kg) of HALEU uranium hexafluoride (UF₆) to the DOE—comprising an initial 20 kg under Phase I of its HALEU demonstration contract and 900 kg under Phase II, which was completed in June 2025. Centrus continues to perform under the DOE’s HALEU Operation Contract awarded in 2022, which is structured to include Phase III production following the completion of Phase II and provides for at least one additional year of HALEU output, subject to DOE option exercise and appropriations.

In a series of announcements over the past year, the company has outlined a multi‑billion‑dollar expansion of enrichment capacity in southern Ohio, supported by the restart of domestic centrifuge manufacturing and new site infrastructure. In December 2025, notably, Centrus said it had begun manufacturing centrifuges to support commercial LEU enrichment activities at its centrifuge manufacturing factory in Oak Ridge, Tennessee, to support Piketon. Additional enrichment capacity expected to come online in 2029.

“Centrus has secured $2.3 billion in contracts and commitments from U.S. and international customers aimed at supporting new, U.S. uranium enrichment capacity,” the company noted. “These agreements are contingent upon Centrus realizing certain milestones towards building the new capacity. Centrus continues to pursue additional LEU and HALEU sales opportunities.”

So far, to prepare for sustained growth, Centrus has initiated design of a 150,000‑square‑foot Training, Operations & Maintenance facility at Piketon and detailed plans to add at least 300 new jobs in southern Ohio as part of its expansion. The company has also moved to line up private capital alongside federal support, signing a 2025 memorandum of understanding with Korea Hydro & Nuclear Power and POSCO International to explore potential investment in its American enrichment plant.

Startup General Matter Set to Rebuild Paducah

General Matter, a privately funded American enrichment startup, will use its $900 million HALEU task order to establish domestic high‑assay low‑enriched uranium capacity at the former Paducah Gaseous Diffusion Plant in western Kentucky. The DOE’s Office of Environmental Management in August 2025 noted that it had signed a lease with General Matter for about 100 acres of federal land at the Paducah site and granted the company access to at least 7,600 cylinders of existing U.S.-origin UF6, which will serve as feedstock for future re-enrichment operations. The DOE estimates that reusing the UF₆ inventory could avoid roughly $800 million in disposal costs while providing a consistent feed source for the new facility.

Kentucky officials have described the Paducah project as a nearly $1.5 billion investment—the largest economic development project in western Kentucky’s history. Governor Andy Beshear’s office and DOE both indicate that construction is expected to begin in 2026, and uranium enrichment operations are planned to start “by the end of the decade.” A state release, meanwhile, notes that General Matter “plans to enrich uranium at the Paducah site by 2030.”

Publicly available official documents, however, provide little detail about the company’s underlying technology. In a December 2024 affidavit to the NRC supporting a request to withhold portions of its licensing correspondence, General Matter CEO Scott Nolan described the company’s approach as a “novel technology” and said the redacted material covers its HALEU design basis and commercialization strategy. He argued that public disclosure “would create substantial harm” by revealing licensing strategy and timeline information that competitors could use, and noted that the work reflects “years of cumulative effort” that “cannot be acquired elsewhere.”

Last year, General Matter launched to restore U.S. leadership in nuclear enrichment and power America’s ambitions. Today, the Department of Energy awarded us a $900M contract to build and operate HALEU enrichment capacity for the nation’s nuclear energy needs.

Under this… https://t.co/8PyRcN7dDe pic.twitter.com/Hh7iJxjWqs

— General Matter (@generalmatter) January 5, 2026

—Sonal Patel is a POWER senior editor (@sonalcpatel, @POWERmagazine).

Updated (Jan. 7): Adds details about Centrus Energy’s efforts to expand HALEU production.

- domestic uranium enrichment

- nuclear fuel policy

- HALEU

- General Matter

- uranium enrichment

- Global Laser Enrichment

- nuclear fuel cycle

- Louisiana Energy Services

- Laser Isotope Separation Technologies

- DOE

- nuclear fuel supply chain

- NRC

- Centrus Energy

- energy security

- LEU+

- advanced nuclear reactors

- American Centrifuge Operating

- Orano