A New Frontier for Nuclear Fuels

Though much attention has been focused on the exciting realm of nuclear reactor technology innovation, major efforts to improve nuclear fuels—and boost power generation safety and economics—are underway. Part 1 of this two-part series focuses on ongoing nuclear fuel developments that could have an impact on the existing fleet. Part 2, which will be published in the April 2020 issue of POWER, surveys global nuclear fuel developments that support the emerging fleet of advanced nuclear reactors, including small modular reactors and micro-reactors.

Ask Dr. Tatiana Ivanova, a long-time nuclear engineer and head of the Nuclear Science division at Paris-based intergovernmental organization Nuclear Energy Agency (NEA), why so much activity is ongoing to transform nuclear fuel—and her answer is simple: “It is the principal part of nuclear power plants.” Fuel design optimization is “a cornerstone for the industry to deploy new, modern fuel for light-water reactors [LWRs], advanced reactors, and small modular reactors,” she said. “Also, it is a very important part in storing, recycling, and disposing of used nuclear fuel. That is why a study of performance and reliability of nuclear fuel have remained a high priority in the research portfolios of all nuclear countries.”

What’s notable, she explained to POWER in February, is that all LWRs around the world currently use fuel systems comprising uranium oxide (UO2) encased within a zirconium-based alloy cladding (and to a much smaller degree, some reactors use uranium-plutonium oxide, or mixed-oxide [MOX] fuels). Over many decades, this oxide fuel-zircaloy system has been optimized, it has matured, and it has generally met all performance and safety requirements. But over the last 10 years, a rapidly changing sector has required a transformation—an urgent revival that starts at that core, with safety and economics as key priorities, she said.

Urgency for Accident Tolerant Fuels

Safety, perhaps, has been the foremost driver of rapid fuel design optimization. As Fukushima showed, “because of the highly exothermic nature of zirconium-steam reactions, under some low-frequency accidents [when core cooling is temporarily lost and part of the core is uncovered], low-probability accidents may lead to an excess generation of heat and hydrogen, resulting in undesirable core damage,” Ivanova said. That’s why in 2014, the NEA, a specialized agency within the Organisation for Economic Co-operation and Development (OECD), jumped into action to gauge the interest of its of its 33 member countries in the exploration of enhanced accident-tolerant fuels (ATF) for LWRs, she said.

Barely eight years later, boosted by national programs, the progress it has achieved is remarkable. Activity is especially notable in the U.S., where the Department of Energy (DOE) aggressively implemented plans under its Congressionally mandated Enhanced Accident Tolerant Fuel program. As the DOE notes, the urgency is underscored by nine recent reactor retirements, many for economic reasons. Much of the U.S. nuclear fleet, in particular, already have 60-year operating licenses that will expire in the 2030s, and getting these new fuels to market before then would increase the performance of these reactors and ultimately improve their chances of applying for extended operation with the Nuclear Regulatory Commission (NRC), it said.

Under the DOE’s program that today casts a wide net of collaboration that includes several U.S. utilities, universities, and the Electric Power Research Institute (EPRI), the DOE is funding and technically backing several industry-led ATF fuel concepts, including fuel pellet and cladding materials developed by GE-Hitachi joint venture Global Nuclear Fuel (GNF), Westinghouse, General Atomics, and Framatome. The vendors must ensure an initial lead test assembly has been installed in a U.S. commercial power plant, and that prototypic pin segments have been installed in the Idaho National Laboratory’s (INL’s) Advanced Test Reactor’s (ATR’s) water loop by 2023, and have full cores licensed for higher burns by 2026.

Among notable projects are tests of GNF’s iron-chromium-aluminum fuel cladding material known as “IronClad” and coated zirconium fuel cladding known as “ARMOR” at Southern Nuclear’s Edwin I. Hatch Nuclear Plant in Georgia, which are slated to end in March 2020. In January, the company also installed IronClad and ARMOR materials at Exelon’s Clinton plant in Illinois. In April 2019, Exelon’s Byron Unit 2 in Illinois completed installation of Westinghouse’s EnCore Fuel, which encapsulates chromium-coated zirconium cladding for enhanced oxidation and corrosion resistance; higher-density ADOPT pellets—which are chromia (Cr2O3) and alumina (Al2O3) doped UO2-pellets—for improved fuel economics; and uranium silicide pellets.

|

|

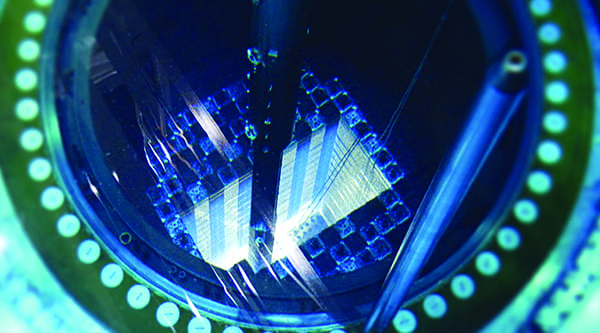

1. Framatome is testing chromium-coated cladding and chromia-doped fuel pellets to improve the performance of current light-water reactor fuels at Southern Nuclear’s Vogtle 2 reactor. The special coating is designed to protect the fuel cladding from damage and oxidation at higher temperatures. The new fuel pellet mixture of chromium oxide and uranium oxide powders is expected to help the pellet last longer and perform better at high temperatures. Courtesy: Southern Nuclear |

Also in April 2019, Framatome completed installation of four GAIA lead fuel assemblies containing enhanced ATF (EATF) pellets and cladding—advanced chromium coating that is added to its proprietary M5 zirconium-alloy cladding—at Southern Nuclear’s Vogtle 2 in Georgia (Figure 1). As Framatome explained, the combination “improves high-temperature oxidation resistance and reduces hydrogen generation during loss of cooling.” The chromium coating, meanwhile, also “greatly reduces creep to maintain a coolable geometry and has mechanical properties that allow for more operator response time. Further, the innovative coating offers increased resistance to debris fretting during normal operations.” The company told POWER in early February that it is now in “early manufacturing stages” for delivering complete fuel assemblies—full-length chromia-coated rods and chromium-enhanced pellets—to Exelon’s Calvert Cliffs reactor in Maryland in 2021.

Around the world, meanwhile, TVEL, Russian state-owned corporation Rosatom’s nuclear fuel fabrication and supply arm, last October loaded two experimental ATF fuel assemblies with VVER (a Russian-designed water-cooled, water-moderated reactor) and pressurized water reactor (PWR) fuel rods at its MIR research reactor at the State Research Institute of Atomic Reactors in the Ulyanovsk Region.

Market Forces Driving Innovation

Framatome, a French nuclear technology giant, notably credited its rapid development for GAIA, a PWR solution, to DOE support and favorable conditions in the U.S. market—including its competitive electricity markets, which demand large cost reductions. “This demand drives for more efficient designs,” it said. The U.S. fleet, which is committed to lifetime extensions, is also receptive to new innovative technologies, it noted. Among other fuel offerings Framatome is advancing in the U.S. market is ATRIUM 11, an 11 x 11 fuel rod array for boiling water reactors (BWRs), whose “unique geometry” inherently boosts safety, fuel cycle savings, as well as plant flexibility capabilities. Since it launched the ATRIUM 11 fuel in the U.S. in April 2015, two unnamed reactors have begun producing power using it, and Framatome recently bagged contracts to deliver ATRIUM 11 to Talen Energy’s Susquehanna plant in Pennsylvania by 2021, and to the Tennessee Valley Authority’s Browns Ferry plant in 2023.

According to Framatome, positive market signals are especially imperative to the development of advanced fuel designs because it is an intensely complex process. Contrary to perceptions that fuel assemblies are produced in a specific plant, “the entire supply chain is global,” it noted. Meanwhile, far from being a commodity, “nuclear fuel assemblies are a highly engineered and complex product built to extremely demanding quality standards,” and they are often “designed to operate flawlessly in an aggressive environment for many years,” the company noted. And though “great advancements” in digital and additive manufacturing have helped improve fuel systems, the industry often bears critical risks, such as those associated with funding, regulations, and with its supply chain.

A World of VVER Fuel Innovations—and Beyond

TVEL, the world’s largest supplier of fuel for VVERs (most of which are in Europe and require distinct hexagonal fuel assemblies), meanwhile, told POWER its drive to advance fuel offerings is boosted by Rosatom’s introduction of new reactor models and improvements to fuel for existing VVER-440 and VVER-1000 reactors—but also by cost considerations. “Our engineering projects for the development/licensing/introduction of new fuel cost very little in comparison with modernization of the main power equipment, reconstruction, [or] construction of new facilities. And the new modified fuel itself will be purchased just within regular operation costs of a power plant,” it said.

In recent years, TVEL has introduced new models of VVER-1000 fuel at the Temelin nuclear power plant (NPP) in the Czech Republic (TVSA-T.mod.2) and the Kozloduy NPP in Bulgaria (TVSA-12). “Soon after that, Unit 6 of the Kozloduy NPP started operations at increased thermal capacity, 104% of the nominal,” the company said. Fuel modifications are also ongoing at the Paks NPP in Hungary and Loviisa NPP in Finland. Last July, the company also signed a key agreement to supply a “third-generation” fuel for a VVER-440 Dukovany NPP in the Czech Republic. Deriving from a prototype fuel installed at Kola 4 in Russia’s Murmansk region in 2010, the new fuel design uses a longer fuel rod pitch that streamlines the water-uranium ratio in the reactor core to increase the fuel efficiency.

As significantly, TVEL in 2016 also began exploring developing fuel for “Western design” reactors with its TVS-K program in a bid to break into the PWR market—which for years had only two suppliers: Westinghouse and Framatome. (Westinghouse in 2018 made a foray in the VVER market backed by a European Union-funded project to help European countries diversify their fuel supply.) TVEL’s first project was a 17 x 17 lattice for Westinghouse reactors slated for Vattenfall’s Ringhals plant in Sweden. In July 2018, Exelon asked the NRC if it could install TVS-K at the financially flailing Braidwood plant in Illinois, but it withdrew its application about six months before the 2019 refuel outage began.

Perhaps TVEL’s most-notable fuel design achievements are closely connected to Russia’s Proryv (or “Breakthrough”) project, which is aimed at closing the nuclear fuel cycle, and, as the company explained, creating “a dual-component nuclear power system, which would involve both thermal and fast neutron reactors.” TVEL in January loaded 18 MOX fuel assemblies at Beloyarsk 4 (a POWER magazine 2016 Top Plant), one of the world’s only commercial fast neutron reactors. It now plans to replace all remaining uranium-based fuel assemblies with MOX fuel by the end of 2021. If completed as planned, it will be the first time a Russian fast neutron reactor operates with a full load of MOX fuel. MOX fuel pellets are based on the mix of nuclear fuel cycle derivatives, such as plutonium oxide bred in commercial reactors and uranium oxide derived by defluorination of depleted uranium hexafluoride—the so-called secondary tailings of uranium enrichment facilities.

As notable is TVEL’s development of REMIX (regenerated mixture) for VVERs, a fuel of up to 17% U-235 that is produced from a non-separated mix of recycled uranium and plutonium from reprocessed fuel. It can sustain burnup of 50 gigawatt-days per metric ton of uranium over four years and be recycled with 100% core load in current VVER-1000 reactors up to five times. The World Nuclear Association notes, “with three fuel loads in circulation, a reactor could run for 60 years using the same fuel, with [low-enriched uranium] recharge.” TVEL told POWER development for VVER REMIX is “at the stage of calculation and experimental validation now.” ■

—Sonal Patel is a POWER senior associate editor.