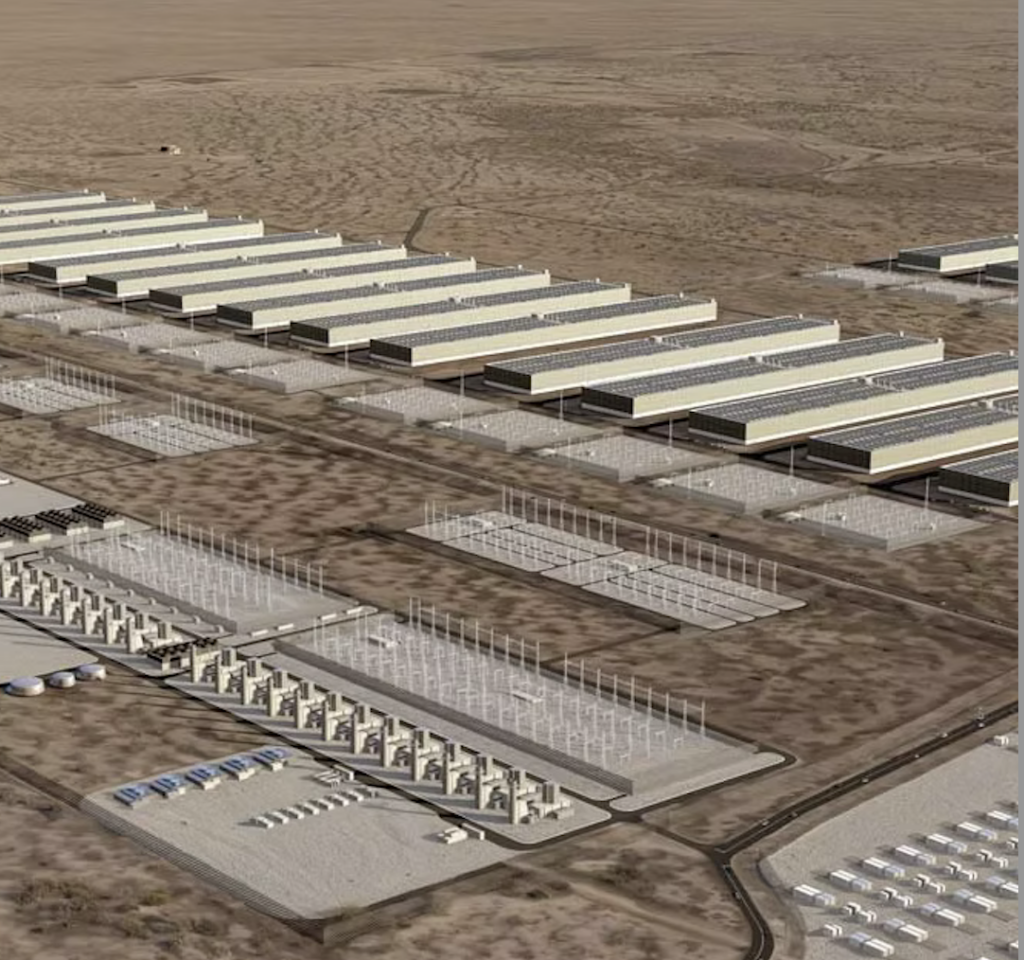

Blackstone, the world’s largest alternative asset manager, said its energy-focused private equity business has a deal to buy the 620-MW natural gas-fired Hill Top Energy Center in Pennsylvania. The agreement announced September 15 will see Blackstone Energy Transition Partners acquire the power station from Ardian, a global private investment firm.

Blackstone officials said the purchase is in line with the company’s strategy to secure power generation assets to support artificial intelligence (AI) and data centers. The company in July announced it would spend as much as $25 billion to buy gas-fired combined-cycle power plants and data center infrastructure in Pennsylvania, as part of its plan to invest $60 billion in the state.

The Hill Top facility, in Greene County, Pennsylvania, opened in 2021. Energy analysts have said Pennsylvania, along with other natural gas-rich states such as Ohio and West Virginia, is a prime region for development of data centers.

“The electricity infrastructure required to power the AI revolution requires a tremendous amount of capital,” said Bilal Khan, a senior managing director, and Mark Zhu, a managing director, at Blackstone Energy Transition Partners, in a statement. “We are proud to make our latest investment in this sector–which is among our highest conviction investment themes–in Western Pennsylvania. Hill Top is among the best-in-class and a highly efficient modern power generation facility that is exceptionally well positioned to help Pennsylvania and the region serve as a key center of AI innovation.”

Acquiring Gas-Fired Power Plants

Blackstone earlier this year acquired the 774-MW natural gas-fired Potomac Energy Center in Loudoun County, Virginia, a state that also is a hotbed for data centers. Northern Virginia is home to about a quarter of U.S. data center capacity. The Potomac plant is located in proximity to more than 130 data centers.

Blackstone in May of this year said it would acquire New Mexico-based utility company TXNM Energy in an $11.5-billion deal. That acquisition plan was filed with state and federal regulators in late August. The companies have said that Blackstone, after taking control of TXNM, would invest $25 million into technologies that support New Mexico’s Energy Transition Act.

POWER is at the forefront of coverage for data centers, particularly related to how technology companies will source the power needed to operate their artificial intelligence ventures. Read our POWER Primer, “Focus on Data Centers,” and register today to attend our inaugural Data Center POWER eXchange event, scheduled Oct. 28 in Denver, Colorado.

Energy demand to support AI and other technologies is growing, thanks to data centers and more widespread electrification of many industries. Natural gas-fired generation at present is considered the most reliable source of baseload power to support higher electricity demand.

Blackstone is the largest data center investor in the world, and recently made major investments in AI companies CoreWeave and DDN. The private capital group also recently entered a joint venture with PPL Utilities to build, own, and operate power plants that would support data centers under long-term service agreements with hyperscalers.

Blackstone officials have said the joint venture would develop power generation including natural gas-fired units. Pennsylvania is among the states with access to abundant natural gas from the Utica and Marcellus basins, and developers can advantage of existing gas pipeline infrastructure.

PPL officials have said the company’s service territory in Pennsylvania alone has received interest in more than 60 GW of potential data center development. The group said more than 13 GW is in advanced stages of planning.

—Darrell Proctor is a senior editor for POWER.