The private sector is traditionally known as a driver of innovation, so it may be surprising to some people that many businesses have only recently begun to consider advanced energy technologies. Looking at renewable energy, for example, the commercial and industrial (C&I) sector has been slow in its adoption, whereas residential and utility buyers of wind and solar power have driven exponential growth.

The pace of C&I adoption of new energy technologies is accelerating, however, as corporate procurement of both wind and solar power is finally starting to take off. The primary reason is a financial one: Wind and solar have reached record low costs that can benefit nearly any company’s bottom line. Government policy, corporate sustainability goals, and more-mature, lower-risk technologies have also played significant factors in this growth trajectory.

Energy Storage Poised to Expand

Battery storage is the next area of explosive growth for C&I companies. A report from Navigant Research estimates that battery storage for C&I companies will grow more than tenfold over the next decade, with annual revenue for the C&I energy sector reaching $10.8 billion in 2025, up from $968.4 million in 2016.

Whether it’s increased energy resilience that protects operations or goals of cutting emissions and creating a truly energy-independent enterprise, C&I companies are realizing the significant benefits of energy storage. There are also financial benefits that are prompting C&I energy users to take a closer look at storage.

Ancillary Services Offer Opportunity

Though there are a growing number of applications for energy storage upon which C&I customers can capitalize, one compelling way to tap into the revenue potential of energy storage is in ancillary services and capacity markets. Both market opportunities are becoming increasingly accessible to storage located on C&I sites.

An ancillary service is anything that supports the system operator in maintaining a stable electricity system. It ranges from frequency and voltage control to reserve or black-start services. A prime example is the role of storage in frequency regulation and other short-term balancing services. Batteries can help grid operators efficiently and effectively regulate frequency because they can deliver maximum power much faster than alternatives such as gas-fired plants. They also allow more precise frequency response services. Batteries streamline renewable energy integration with the grid by reducing the need for fossil fuel-based spinning reserves.

In markets such as PJM, with more than 260 MW of storage employed in frequency regulation alone, ancillary services opportunities for C&I-located storage are evident. In most other market areas, frequency regulation, and other spinning and non-spinning reserves are becoming an important revenue stream for batteries.

Another opportunity for C&I-sited storage is to provide flexibility and capacity services to grid operators. Those services come by different names—resource adequacy in California or reliability pricing model in PJM—but the mechanism is the same: storage owners are paid for reducing their consumption or discharging electricity to the grid when grid capacity is reaching its limits or additional electricity is required to meet peak demand. The exact mechanisms for these capacity services vary between markets and batteries sometimes need to be aggregated with other storage resources to participate. Nonetheless, when applied to these market opportunities, C&I-based storage enables system operators to run their grids more efficiently and can offer owners a reward for providing system flexibility.

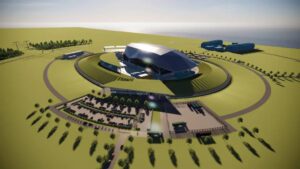

One example is the Peña Station NEXT project in Denver, Colorado. Developed in partnership with Xcel Energy, Panasonic, Younicos, and the Denver International Airport, Peña Station represents a test run for the smart grid of the future, and will be the proof of concept for a variety of forward-looking innovations. These include an intelligently controlled solar-plus-storage microgrid that can support mission-critical loads, among other energy challenges. The facility features a new, state-of-the-art network operations center where real-time monitoring and management of a nationwide network of solar photovoltaic assets is conducted.

The Time Is Now

While markets such as California, Hawaii, and New York are currently leading the way for storage, more and more states are adopting renewable portfolio standards and storage targets. As grid operators improve market access for storage to ancillary, wholesale, and capacity markets, the opportunities for storage-enabled C&I facilities steadily increase in many regions of the U.S.

The Federal Energy Regulatory Commission has issued a notice of proposed rulemaking, RM16-23, enabling storage participation in organized wholesale markets. The proposed rule could further kick-start market access for storage in areas that are currently lagging behind, requiring new rules for storage to participate in all capacity, energy, and ancillary markets and creating additional revenue streams for storage throughout the U.S.

The nation is past the point of waiting for energy storage to arrive. The technology is ready and able to deliver valuable energy services to customers today, which is why so many companies are now taking a closer look and investing in the technology. The business case for C&I energy storage has never been better. The time is now to develop a strategy to leverage these new tools and take control of every energy option. ■

—Jayesh Goyal is managing director with Younicos.