The Department of Energy (DOE) extended its run of federal grid interventions into winter over the past week, issuing a Section 202(c) emergency order on Nov. 18 for Consumers Energy’s 1,420-MW J.H. Campbell coal plant in Michigan and another on Nov. 25 for Constellation’s 760-MW Eddystone Units 3 and 4 in southeastern Pennsylvania in a bid to keep both power plants available for dispatch through mid-to-late February 2026.

The orders direct the respective grid operators—the Midcontinent Independent System Operator (MISO) for Campbell and PJM Interconnection (PJM) for Eddystone—to ensure the plants remain available for operation and to employ economic dispatch to minimize costs to ratepayers. The latest orders—which mark the third round for each plant since spring—push federal intervention past the nine-month mark for Campbell and into early 2026 for Eddystone, well beyond their initially scheduled May 2025 retirements.

In its Nov. 25 PJM announcement, Energy Secretary Chris Wright said the order “is needed to strengthen grid reliability and will help provide affordable, reliable, and secure power when Americans need it most.” In the Nov. 19 MISO announcement, Wright cited “the last administration’s dangerous energy subtraction policies targeting reliable and affordable energy sources,” adding that “Americans deserve access to affordable, reliable and secure energy regardless of whether the wind is blowing or the sun is shining, especially in dangerously cold weather.”

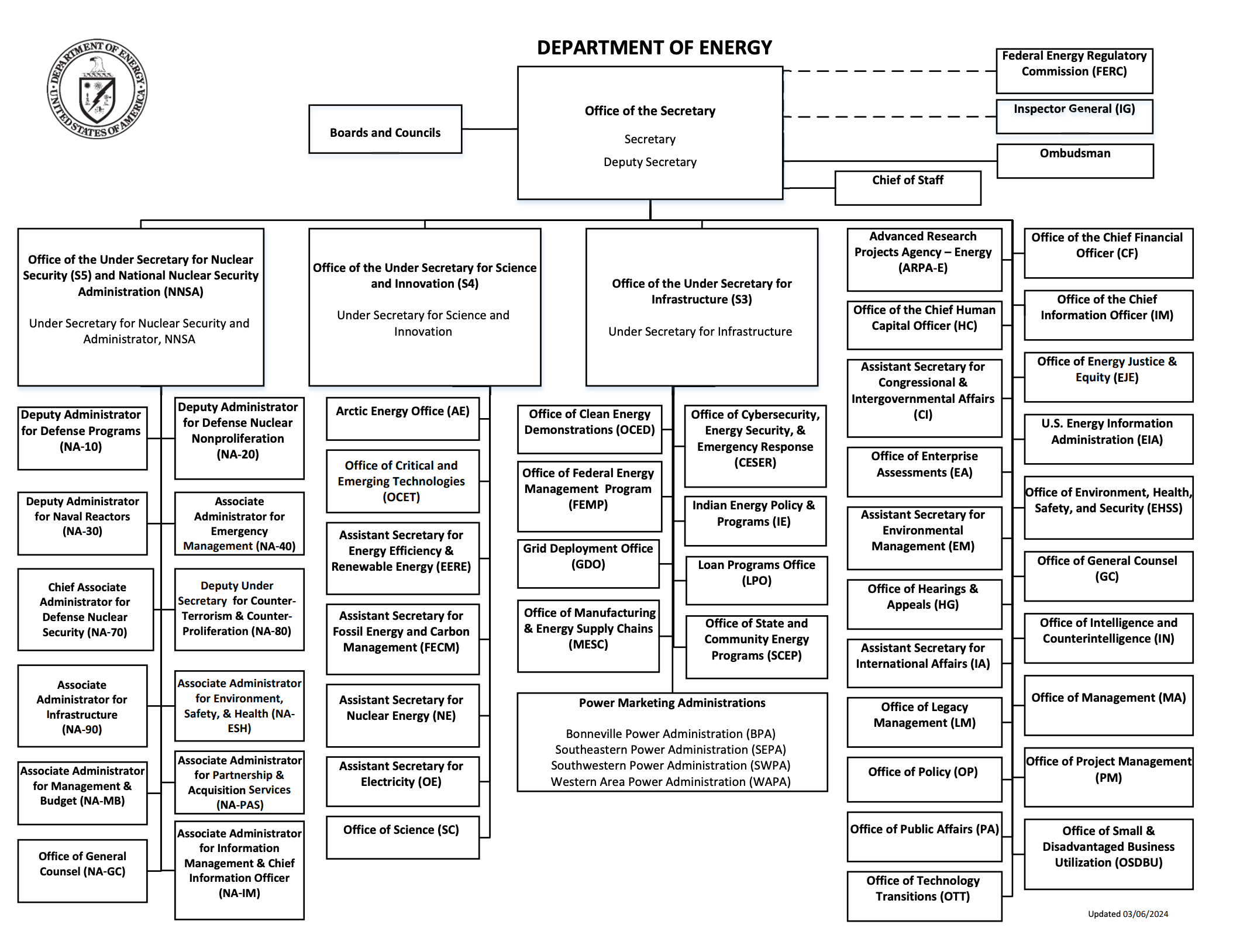

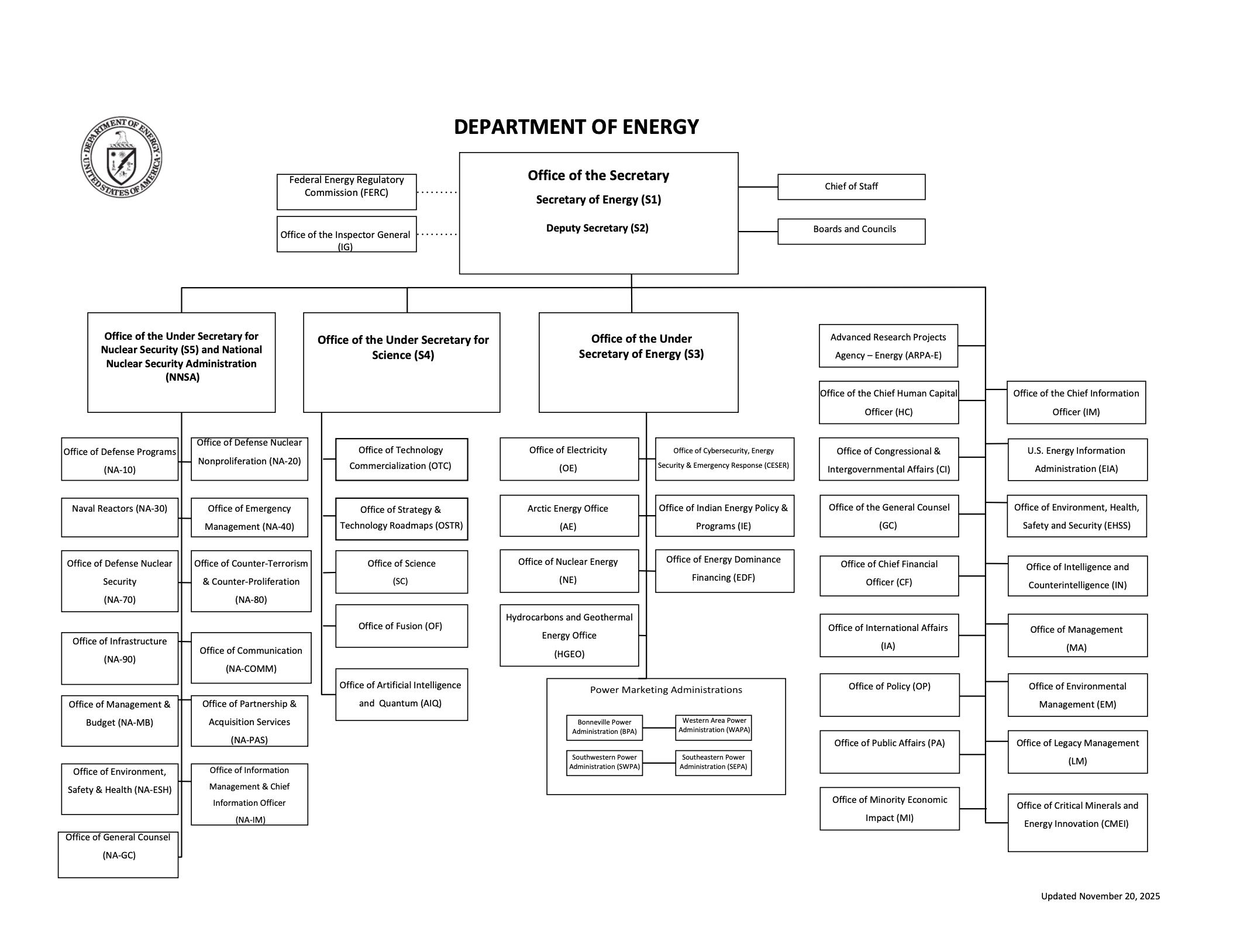

The measures reflect yet another facet in a broader institutional pivot within the DOE. On Nov. 20, 2025, notably, the agency unveiled an updated organizational chart that elevates the Office of Cybersecurity, Energy Security and Emergency Response (CESER)— the office that issued the new Section 202(c) orders—while creating new offices for Hydrocarbons and Geothermal Energy, Energy Dominance Financing, and Artificial Intelligence and Quantum. Compared to the DOE’s 2024 structure, the realignment has effectively eliminated the Office of Energy Justice and Equity, the Office of Clean Energy Demonstrations, and the Grid Deployment Office. The move has seemingly sidelined the Biden administration’s clean-energy infrastructure focus while consolidating the Trump administration’s mission around fossil fuel preservation, emergency grid management, and advanced technology.

Federal Grid Interventions: The Timeline of Section 202(c) Orders in 2025Since May 2025, the Department of Energy (DOE) has issued 12 emergency orders under Section 202(c) of the Federal Power Act directing grid operators and utilities to maintain specified fossil fuel units and other infrastructure. In May, DOE issued separate orders to MISO to keep the J.H. Campbell coal plant in Michigan online (May 23), renewed the order in August (Aug. 20), and extended it again on Nov. 18 through Feb. 17, 2026. Similar emergency directives have targeted Constellation Energy’s Eddystone generating units in Pennsylvania (orders issued in May and August, extended on Nov. 25 through Feb. 24, 2026), Talen Energy’s Wagner station in PJM (orders issued in July and October, continuing through Dec. 31, 2025), Duke Energy Carolinas units during extreme weather on June 24–25, and PREPA generation and transmission assets in Puerto Rico (orders issued in May, renewed in August, and extended on Nov. 12 through Feb. 10, 2026). |

Dispatch Constraints and Cost Recovery

The DOE reasoned that Constellation’s Eddystone Generating Station—located in Eddystone, Pennsylvania—remains critical for grid reliability heading into the winter. Units 3 and 4, each rated at 380 MW, are subcritical steam units capable of burning natural gas or oil and had been scheduled for retirement on May 31, 2025. The plant proved vital during the summer, generating over 26,000 MWh during heat waves, and now stands as a key dispatchable asset in PJM’s increasingly winter-peaking system, the DOE said. Citing a widening gap between retiring generation and new capacity, the DOE echoed PJM’s warnings of “growing resource adequacy concerns” and pointed to the difficulty of restarting oil-fired units once decommissioned as further rationale for keeping the plant online through February 2026.

For Consumers Energy’s J.H. Campbell plant in West Olive, Michigan, the DOE extended a similar order, requiring the 1,420-MW coal-fired facility to remain available through February 17. Once targeted for early retirement, Campbell supplied an average of 509,000 MWh per month this summer, which helped MISO manage dozens of grid alerts triggered by heat, outages, and limited reserves, the DOE claimed. The DOE warned that older dispatchable units are retiring faster than new ones can come online, and despite recent gas investments, cited North American Electric Reliability Corporation (NERC) data showing heightened risks of energy shortfalls in both summer and winter. Restarting a shuttered coal unit like Campbell, the agency noted, could take months—making continuous operation the only viable safeguard for near-term reliability.

Both orders direct the grid operators to employ “economic dispatch” to minimize costs to ratepayers, with daily notification requirements to DOE documenting compliance. Operations are constrained to times and parameters determined by each RTO to minimize adverse environmental impacts, though the orders do not waive obligations to pay emissions fees, allowances, or offsets that occur during emergency operation. All operations must comply with applicable environmental requirements “to the maximum extent feasible” while remaining consistent with emergency conditions, and DOE requires operational updates from both RTOs by mid-December 2025.

One significant limitation in both orders is that the plants “shall not be considered capacity resources” under Section 202(c) emergency dispatch. That designation prevents them from clearing future capacity auctions or being counted toward resource adequacy requirements once the orders expire, and it appears to be designed so that the emergency intervention does not become a permanent market fixture. Utilities are directed to file tariff revisions or waivers at FERC to effectuate the orders, with rate recovery available under Section 824a(c) of the Federal Power Act.

The orders also appear to acknowledge the practical difficulties of restarting retired fossil units. For Campbell, DOE notes that any stop-and-start operation creates heating and cooling cycles that could cause failure requiring 30 to 60 days to repair, and that disassembly or other terminal actions would complicate resumption. Similarly, for Eddystone, DOE emphasizes that once oil-fired units are retired, resuming operations would be difficult due to employment, contract, and permitting challenges. Both utilities are granted sufficient time for an orderly ramp-down following the expiration of the orders, consistent with industry practices.

Brewing Legal Challenges

However, the orders have already drawn sharp criticism and legal challenges. Michigan Attorney General Dana Nessel filed a motion to stay DOE’s third order for Consumers Energy’s Campbell coal plant on Nov. 20, 2025, asserting that the directive is “arbitrary and illegal” and based on an “outdated reliability assessment report to fabricate the emergency.” Nessel also filed petitions for review to the U.S. Court of Appeals for the D.C. Circuit on the prior two Section 202(c) orders that halted Campbell’s planned retirement, though no rulings have yet been issued.

“DOE is using outdated information to fabricate an emergency, despite the fact that the truth is publicly available for everyone to see,” Nessel said. “DOE must end its unlawful tactics to keep this coal plant running when it has already cost millions upon millions of dollars. My office will continue to fight back against these arbitrary orders and ensure residents aren’t forced to foot the bill for these unreasonable costs.”

Consumers Energy disclosed in its latest earnings report that during the initial 90-day J.H. Campbell emergency-order period (May 20–Aug. 20, 2025), the utility incurred a net financial impact of $53 million after accounting for $67 million in MISO market revenues. For the second 90-day order period (Aug. 20–Nov 19, 2025) through Sept. 30, it reported a net compliance cost of $27 million after applying $17 million in MISO revenues. To address regional cost allocation, Consumers filed a complaint at FERC in June 2025 seeking modification of the MISO tariff to establish a cost-recovery mechanism. FERC granted the complaint in August 2025 and ordered MISO to submit a revised tariff. MISO filed its compliance proposal in September 2025, but FERC approval remains pending.

Grid Operators Brace for Tight Margins Despite Adequate Winter Capacity

PJM, the grid operator for 13 states and D.C., said in its Nov. 3, 2025, Winter Outlook that it expects to have 180,800 MW of available resources to serve a projected peak of 145,700 MW—2,000 MW above last winter’s record. While sufficient to meet demand under typical conditions, PJM warned that its reserve margin has narrowed to 7,500 MW, down from 8,700 MW the prior year, and that poor generator performance could leave the system exposed during extreme cold. The organization is implementing several preparedness measures, including unannounced generator tests, expanded site inspections, and enhanced coordination with gas pipelines. “Generator performance will be critical to maintaining reliability this winter,” said Michael Bryson, Senior Vice President of Operations.

MISO, which operates the grid across 15 states and parts of Canada, projected in its Nov. 14, 2024, Winter Readiness Outlook that winter demand could surpass 107 GW, with 122 GW of supply expected to be available under normal grid and outage conditions. While the assessment finds resource levels sufficient for typical winter conditions, MISO cautioned that extreme weather continues to pose serious reliability challenges. “Situational awareness is critical for managing the impact of extreme weather events,” said JT Smith, executive director of Market Operations. The forecast highlights regional weather variation—normal in the North, warmer in the Central region, and drier in the South—and emphasizes the importance of seasonal planning as the grid transitions away from conventional generation. MISO, notably, also pointed to the benefits of its seasonal resource adequacy construct but stressed the need for ongoing stakeholder engagement and improved tools to maintain operator visibility as the system evolves.

NERC Warns of Winter Vulnerabilities

In its Nov. 18–released Winter Reliability Assessment, the North American Electric Reliability Corporation (NERC) reinforced DOE’s concerns, warning that large swaths of the North American grid face elevated risk of electricity shortfalls if extreme cold grips the continent. While resources are expected to be sufficient under normal conditions, NERC suggested that demand has outpaced resource growth, adding 20.2 GW of forecasted peak load compared to only 9.4 GW in additional capacity, and could spike further in deep freezes.

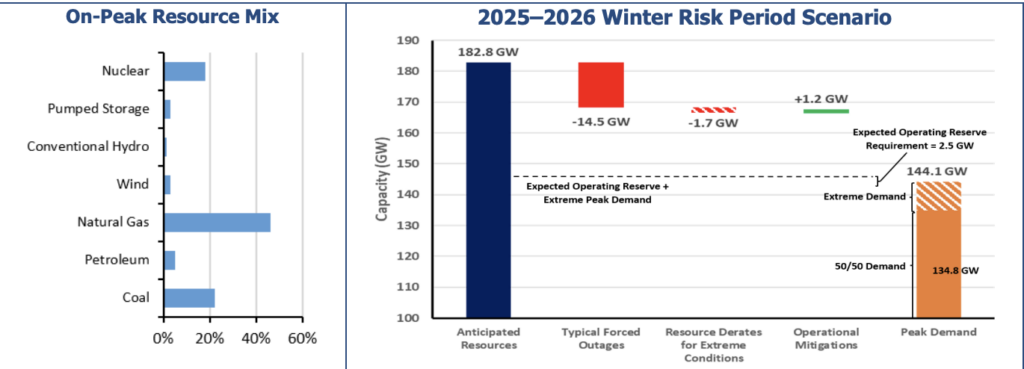

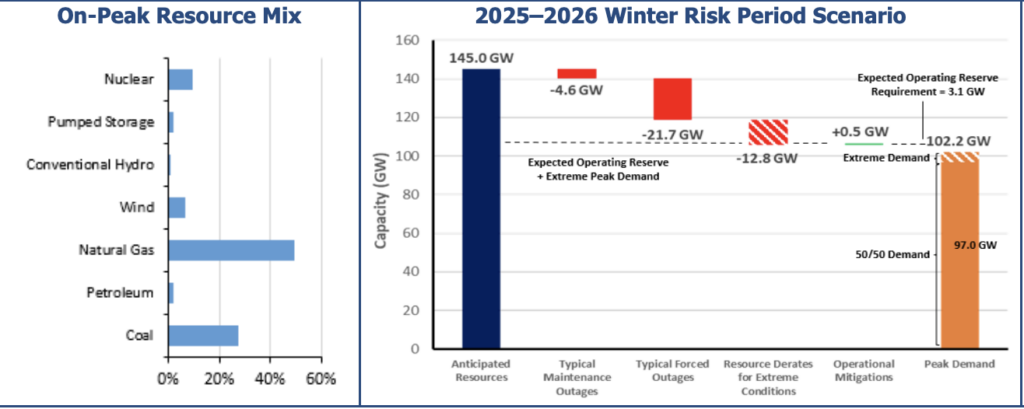

PJM and MISO—the two regions affected by DOE’s latest emergency orders—are both categorized as normal risk in NERC’s 2025–2026 Winter Reliability Assessment, though NERC flags operational challenges that could emerge under extreme conditions.

In PJM, NERC notes that rising peak demand and winter outage patterns could tighten available reserves during severe cold. The assessment says the region “will need to monitor resource performance and deliverability throughout the winter period, especially during high-risk hours where solar is unavailable, and gas constraints could emerge.” PJM’s modeling shows that while the region can reliably meet its 134.8-GW winter peak forecast, extreme conditions could push load above 144 GW, significantly compressing reserve margins once forced outages and derates typical of winter weather are applied.

In MISO, NERC points to similar vulnerabilities in the North and Central subregions. Winter peak demand could reach 102.2 GW under an extreme scenario, compared to 97 GW under the region’s 50/50 forecast. NERC warns that extreme cold, low wind output, and fuel constraints may increase reliance on non-firm imports and emergency demand response. MISO’s own analysis indicates the system could require more than 12 GW of additional capacity under severe conditions without mitigation.

—Sonal Patel is a POWER senior editor (@sonalcpatel, @POWERmagazine).