Top Utility Considerations for Truck Electrification

There are many challenges to overcome before electric trucks fill the road, and the timing for full adoption is many years away. However, now is the time to prepare for the inevitable shift toward electrification of the medium- and heavy-duty trucking sectors.

In 2020, California mandated that all commercial trucks sold in the state would be zero-emissions by 2045. Shortly after, 15 additional states made a similar commitment to a zero-emissions trucks transition by 2050. As these trucks plug into the grid, what do electric utilities need to know to prepare for the shift and potential load increases? How can utilities leverage this opportunity while accounting for current technology, policy, and market constraints?

Trucking 101

When planning the infrastructure to support the transition to electric trucks, it’s important to have a basic understanding of how the trucking industry works. The industry’s operational and regulatory constraints may impact electric truck fleet adoption rates and ultimately power demand.

Trucking is a challenging business. Competition is high and margins are thin. Generally, drivers are paid by the mile but limited in the hours they can operate daily. This means an average truck driver can cover about 500 miles each day. Trucking companies also range from large corporations with 10,000 trucks to single-truck owner/operators.

|

|

1. With the all-electric eActros truck, Mercedes-Benz Trucks is demonstrating that heavy-duty distribution transport for urban areas can be locally emission-free. The eActros, which has a range of about 200 kilometers (125 miles), has been used in a wide range of practical applications by various customers in Europe since 2018. Series production is scheduled to start this year. Courtesy: Daimler Trucks |

Some fleets are owned by shippers, others by independent carriers that contract directly with shippers. Others are brokered moves by a third-party logistics provider or load-matching technology services like Uber Freight or Trucker’s Friend. In general, long-haul firms use heavy-duty trucks, and regional operations use medium-duty trucks (Figure 1). This distinction is critical to understanding the timing of electric truck adoption and why recent state requirements push out full adoption for 25 to 30 years.

Long-Haul Challenges

Current technology limits the practical usability of zero-emissions heavy-duty trucks for long-haul trips. As technology improves, there are a series of success factors electric utilities must understand as they work to support long-haul trucking customers transitioning to electric truck fleets.

Limiting Unproductive Time. Long-haul truck drivers are paid by the mile, and federal regulations limit how many hours they can drive daily. With these constraints, any unproductive time significantly impacts the ability of truck drivers to make a living. With current technology, heavy-duty electric trucks need to stop and recharge every three to four hours, and the duration of that recharge can last more than an hour. Comparatively, diesel trucks refuel every day to day and a half, and take about 20 minutes to fill up.

Understanding Power Requirements. A typical truck stop has about 10 diesel refueling stations. Over 24 hours, those 10 stations can refuel about 720 trucks (at 100% utilization). If a heavy-duty truck has a 500-kWh battery, a recharge would be about 400 kWh. Using a direct-current fast charger, the recharge would take more than an hour. So, a typical truck stop would be able to charge 240 heavy-duty trucks daily without considering the business and regulatory constraints placed on a driver.

Efforts, such as the CharIN e.V. working group, are focused on developing a 1-MW to 3-MW charger that could charge heavy-duty trucks in 10 to 20 minutes, meaning a significant amount of power could be required to keep a major truck stop online, reaching a 10 MW to 30 MW coincidental peak load with 10 chargers (not including the added hotel load needed to serve 50 to 100 trucks overnight). Options to manage peak load include renewable on-site generation (such as rooftop solar panels or hydrogen fuel cell systems), a battery energy storage system, load management software, and participation in demand response programs.

Establishing Resilient and Reliable Power. Truck stops wishing to electrify will likely require a new substation to provide the required power level. On average, the permitting process for a new substation takes three years and might take longer in populated areas where neighboring property owners may be opposed to the substation. In rural areas, truck stops and electric utilities must evaluate not only their ability to provide power, but also resilient power because the grid is not as robust as it is in many more commercialized areas. For example, a rural cooperative would want to ensure its distribution network has the resiliency needed to keep a large truck stop operational during a major thunderstorm or during an evacuation event in areas prone to tropical storms.

Solving the Truck Parking Shortage. As technology advances, electric trucks will be able to travel similar distances as diesel without a recharge and could charge overnight while a driver is sleeping. This would allow the total power load to be spread overnight when peak demand charges are often lower. However, according to the Federal Highway Administration, 98% of truck drivers have reported having difficulties finding parking, particularly overnight parking. Many nighttime drivers have witnessed trucks parked on interstate ramps and other unauthorized areas.

Truck drivers spend a significant amount of time looking for truck parking, often trading productivity for safety and regulatory compliance. The American Transportation Research Institute estimates that drivers lose about $5,000 in productivity annually to this paradox. Complicating things further, federal law prohibits commercial activities (such as selling fuel) at non-tolled interstate rest areas, though this law may change under current surface transportation authorization bill proposals. The trucking industry consistently ranks truck parking among its top issues, and it will be a critical issue to address at the corridor level as heavy-duty trucks begin to electrify.

Building Widespread Partnerships. Almost by definition, long-haul truck routes span several states, jurisdictions, and utility territories. As long-haul fleets begin to electrify, owners will need to partner with truck stops, state regulatory bodies, and multiple utilities to ensure consistent and reliable power can fuel their trucks over the long term. Simply, the long-haul market is not something one utility can face on its own, it will require a partnership between multiple jurisdictions, agencies, utilities, and companies.

Today’s Opportunity—Distribution and Fulfillment Centers

While the adoption of electrically powered heavy-duty trucks is challenging with current technology, local and regional delivery operations are beginning to make the switch. Generally, these operations support regional grocer, restaurant, and e-commerce deliveries. Electric medium-duty trucks can generally support a daily route without a recharge. Drivers can return to their home base and charge overnight, often benefitting from lower rates during non-peak hours.

|

|

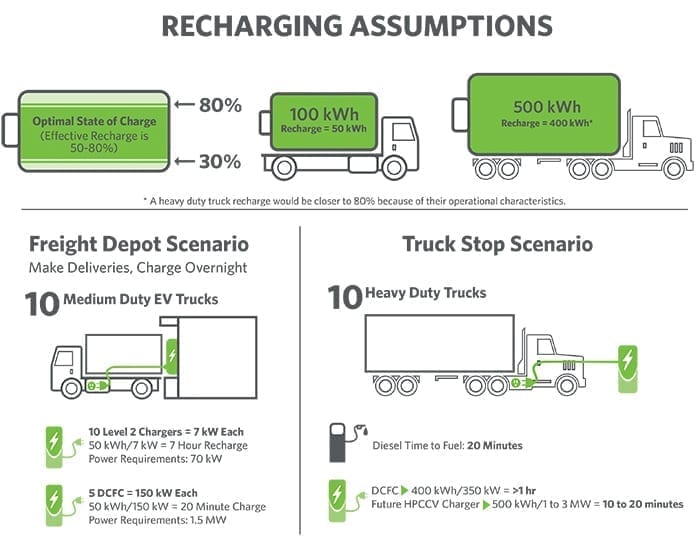

2. This graphic shows medium-duty and heavy-duty electric truck charging examples. Charging times for electric vehicles (EVs) can be drastically reduced with direct-current fast chargers (DCFCs) or with high-power charging for commercial vehicle (HPCCV) systems. Courtesy: HDR |

For example, a regional freight depot could be home to 10 medium-duty electric trucks each with a 100-kWh battery (Figure 2). Because a battery should never be fully depleted and is not recommended to be fully charged on a daily basis, an effective recharge is more in the range of 50%, or 50 kWh. Using Level 2 chargers (7 kW each), all 10 trucks could be recharged within seven hours overnight, with a total power requirement of 70 kW. If a company needed to charge faster, such as for trucks used around the clock, they could use direct-current fast chargers (150 kW each) and charge all 10 vehicles in about 20 minutes, with a total peak load of 1.5 MW. Using either charger, the overall power demand is not unreasonable in most areas.

Preparing for the Future

While electrifying regional deliveries is becoming feasible, heavy-duty electric trucks still require a significant technological development to become a viable alternative to diesel. So, what can utilities do to prepare for that long-term future? The market, regulatory environment, and customers are demanding zero-emissions vehicles. Utilities looking to maximize profitability in this space should focus on three primary objectives.

Building Unconventional Partnerships. Many of the key success factors identified can be overcome by building long-term and strategic partnerships—often with a new set of partners like land-use and state department of transportation freight planners. Involvement with state department of transportation truck parking studies is a great way to have a seat at the table and meet other stakeholders. These stakeholders often include industry groups like the American Trucking Association and Owner-Operator Independent Drivers Association. The National Association of Truck Stop Operators is very active in this space, partnering with electric charging equipment vendors for passenger vehicles and advocating in Washington, D.C., for long-term sustained investment in electric truck infrastructure.

Start Planning. Work with your state department of transportation and/or freight stakeholders to identify major trucking corridors that have potential to become electrified freight mobility corridors. For example, electric utilities in three West Coast states recently joined together to complete the West Coast Clean Transit Corridor Initiative. The study prioritized technology-application solutions based on research analyses, and it provided recommendations to each electric service partner on where to locate charging infrastructure in their territories to accelerate the adoption of medium- and heavy-duty electric trucks. Ultimately, the initiative proposed installing 27 electric charging sites for medium-duty electric vehicles at approximately 50-mile intervals along the 1,300-mile long Interstate 5 corridor. Once the charging stations are in place, a second phase would expand 14 of the 27 charging sites to accommodate charging for electric heavy-duty regional-haul tractors by 2030, when it is estimated that 8% of all trucks on the road in California could be electric.

Demand Modeling. Electric utilities should begin to develop demand models of freight corridors they are likely to cover. Developing an understanding on how well the utility is prepared to provide power is key. While the private sector innovates and solves heavy-duty charging challenges, utilities can continue to make upgrades to infrastructure today to support future demand.

—Daniel Haake is a nationally recognized freight planning expert at global engineering firm HDR.