Nuclear technology firm Terrestrial Energy has quietly been making progress on its Integral Molten Salt Reactor (IMSR) technology, laying the crucial groundwork for a commercial fleet by the early 2030s. Terrestrial Energy Simon Irish answered key questions about the company’s deployment timeline, market positioning, and competitive edge, offering an inside look at the company’s strategy for bringing the IMSR technology to scale.

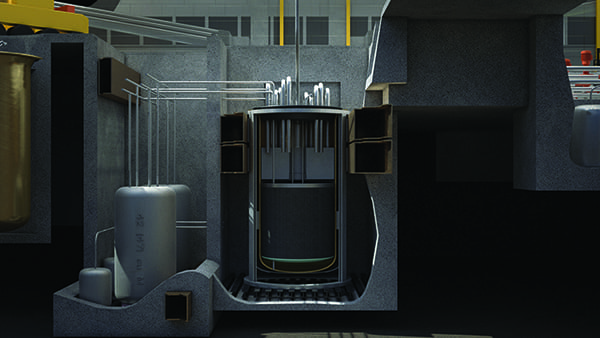

Over the past year, the company redomiciled in the U.S., has marked definitive milestones in the development of its Integral Molten Salt Reactor (IMSR), a 390-MWe Generation IV reactor that utilizes standard low-enriched uranium (LEU) fuel in a molten fluoride salt system. Unlike conventional light-water reactors (LWRs), which rely on solid fuel rods and pressurized water coolant, the IMSR is a liquid-fueled molten salt reactor (MSR), where uranium tetrafluoride (UF₄) is dissolved directly in the molten salt coolant. The fuel salt mixture serves as both the nuclear fuel and heat transfer medium, eliminating the need for fuel cladding, high-pressure cooling systems, and external heat exchangers—which are hallmarks of traditional reactor designs. Operating at 600C, the IMSR integrates high-temperature process heat with electrical generation, making it 50% more thermally efficient than conventional LWRs while producing 40% less nuclear waste, the company says.

The reactor’s high-temperature steam cycle could enable direct industrial heat applications, positioning it as a dual-use energy platform for both grid-scale electricity and process heat-intensive industries, including hydrogen production—supporting solid oxide electrolysis (SOEC) and thermochemical hydrogen pathways—as well as petrochemical and industrial manufacturing, where it could facilitate steam reforming, ammonia production, and high-temperature refining processes. Like many emerging nuclear technology firms, Terrestrial Energy is also targeting the burgeoning artificial intelligence (AI) and high-performance data center market, which requires high-density, stable power delivery.

Since the company signed a manufacturing and supply contract with Westinghouse subsidiary Springfields Fuels for the design and construction of an IMSR fuel pilot plant at Springfields’ UK fuel manufacturing facility in August 2023, the company has made major gains in research and development. In June 2024, the U.S. Department of Energy (DOE) awarded the company a GAIN voucher for IMSR fuel testing, an effort that entails a partnership with Pacific Northwest National Laboratory (PNNL), which will analyze the performance of IMSR fuel salts, demonstrating their stability and safety under commercial operating conditions.

In tandem, the company has made regulatory progress both in the U.S. and Canada. After the DOE in May 2023 awarded Terrestrial Energy USA (TEUSA) a regulatory assistance grant to support its Nuclear Regulatory Commission (NRC) licensing program for the IMSR, the company initiated NRC engagement and pre-application process, submitting a Regulatory Engagement Plan (REP) outlining the strategy for a Standard Design Approval (SDA) under 10 CFR 52, Subpart E. It has since submitted multiple technical reports and white papers to address key regulatory issues early on. Earlier, in April 2023, Terrestrial completed the Canadian Nuclear Safety Commission’s (CNSC) Vendor Design Review (VDR) Phase 2, establishing a clear pathway for commercial licensing in Canada.

To bolster its business operations and align with its largest market, commercial partners, and principal shareholders, the company has now relocated its headquarters to Charlotte, North Carolina. In June 2024, the company joined the Texas Nuclear Alliance (TNA), a move that paid off this February when the company became one of four firms Texas A&M University System selected to explore building and operating small modular reactor plants (SMRs) at its Texas A&M-RELLIS campus near College Station.

Last year, Terrestrial also signed memoranda of understanding (MOUs) with remediation firm EnergySolutions to evaluate siting IMSR plants at decommissioned nuclear sites, and Viaro Energy to develop IMSR plants in the UK, Zachry Group to advance IMSR site evaluations and engineering, and Schneider Electric to integrate IMSR plants into industrial power systems. The company also notably signed an MOU with the Emirates Nuclear Energy Corporation (ENEC) in December 2023 to explore IMSR deployment in the UAE.

Earlier this month, POWER asked Terrestrial Energy CEO Irish to elaborate on its commercialization roadmap, regulatory strategy, and how the IMSR’s molten salt technology positions the company to meet growing industrial and grid-scale energy demands.

POWER: What is the timeline for deploying the IMSR at Texas A&M-RELLIS, and how does this project fit into the broader commercialization strategy for IMSR plants?

We envision commercial operations of an IMSR plant at RELLIS in the early 2030s.

POWER: Terrestrial Energy has made significant progress in both technology development and regulatory pathways. What are the next critical milestones for IMSR commercialization, and what factors could influence the deployment timeline?

We expect that Terrestrial Energy IMSR plants will be front runners among SMR plants deployed commercially. This is partly because of our design and commercialization choices, including using proven molten salt reactor technology and powering it with standard assay low-enriched uranium (LEU) fuel rather than HALEU. Our selection by Texas A&M to site an IMSR at RELLIS also hastens our progress towards commercial deployment.

POWER: The CNSC Vendor Design Review (VDR) Phase 2 was a major regulatory step in Canada. How is Terrestrial Energy now approaching U.S. Nuclear Regulatory Commission (NRC) licensing, and what are the key technical and regulatory challenges to address?

Following completion of the VDR process in Canada in early 2023, we are now fully engaged in the US with the NRC’s pre-application process. This involves multiple submissions of topical reports, technical reports and white papers, organized within our US regulatory licensing strategy for the IMSR plant.

POWER: The IMSR is expected to offer a 50% efficiency gain over conventional LWRs, but economic viability is critical. What is Terrestrial Energy’s estimated levelized cost of electricity (LCOE), and how does the IMSR’s modular factory production model reduce capital costs and improve deployment scalability?

The IMSR’s steam cycle is 50% more efficient, making it significantly more efficient than the Rankine steam cycle of an LWR. The IMSR is also high-power density SMR, giving it major advantage for SMR economics. We want small components that produce a lot of power for factory production and transportation to site for quick assembly. That is the economic principle of a small and modular power plant, but the principle requires high power density reactor technology.

POWER: Terrestrial Energy has established a pilot IMSR fuel production facility with Springfields Fuels Ltd. What additional steps must be taken to secure a reliable fuel supply for commercial deployment, and how does avoiding HALEU simplify supply chain risks?

Terrestrial Energy’s design and development strategy aims to move the IMSR plant rapidly towards commercial deployment.

A key advantage of the IMSR is that it uses uranium fuel enriched to less than 5% standard assay LEU, this is the nuclear fuel that has been used for decades across the world. However, the IMSR plant is one of the very few advanced reactors that does not use HALEU fuel, which is enriched to 15% to 20%.

This is critically important for near-term deployment at fleet scale – standard assay LEU is commercially available today for fleet scale deployment programs, HALEU is not.

POWER: AI and high-performance computing is poised to drive unprecedented energy demand, and that represents a major market for advanced nuclear. How does Terrestrial Energy see the IMSR competing in this space?

IMSR plants are ideal for powering data centers behind AI. They are affordable and generate clean firm electricity efficiently. They can be collocated, and sited close to the point demand. The same principles make the IMSR attractive for many other industrial markets, including powering chemical and petrochemical facilities.

Our focus on rapid fleet-scale commercial deployment, cost-competitiveness, and versatility makes the IMSR plant a strong contender for a significant slice of a $1-plus trillion opportunity to provide clean firm heat and power across major industrial markets, one of which is AI.

—Sonal Patel is a POWER senior editor (@sonalcpatel, @POWERmagazine).