RWE Buying Offshore Wind Projects from Vattenfall in $1.2 Billion Deal

Germany-based RWE, among the world’s leading companies in development of offshore wind energy, said it will acquire three major projects off the East Anglia coast of the UK from Sweden’s Vattenfall in a $1.2 billion deal.

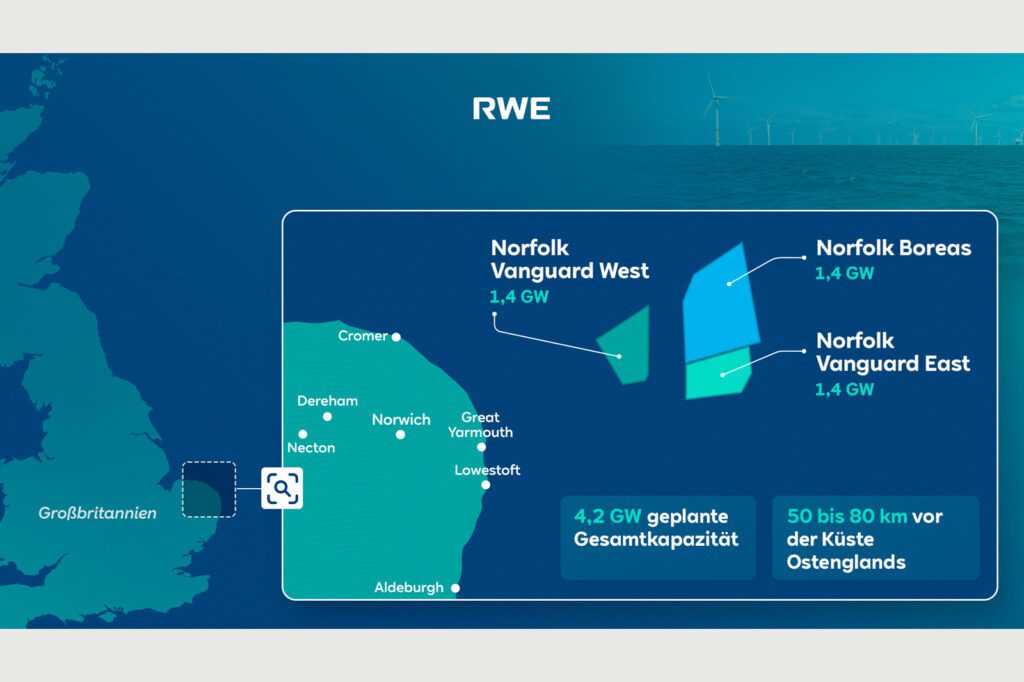

RWE on Dec. 21 said the projects, each with planned generation capacity of 1.4 GW, are in the Norfolk Offshore Wind Zone, sited 50 to 80 kilometers off the coast of Norfolk in East Anglia. The purchase agreement is for the Norfolk Vanguard West, Norfolk Vanguard East, and Norfolk Boreas installations, which are all expected to enter service by 2030.

The three projects, which have been in development for more than a decade, already have secured seabed rights, grid connections, and other key permits for operation. RWE said the Norfolk Vanguard West and Norfolk Vanguard East projects are the closest to entering commercial operation, but still need to secure a Contract for Difference, or CfD, in one of the upcoming auction rounds.

Restart Development

RWE said it will restart development of the Norfolk Boreas project. Vattenfall had paused work on that installation earlier this year, saying Boreas was no longer was financially viable. Anna Borg, Vattenfall’s chief executive, told the BBC the new agreement “with RWE is great news for the UK’s energy security.”

Vattenfall already had signed a preferred supplier agreement with Vestas for turbines for the Norfolk projects, despite previously naming Siemens Gamesa as its preferred supplier. Vattenfall had said it would use 92 of Vestas’ V236-15MW turbines, which are Vestas’ largest model. Vestas was also named in exclusivity agreements for Norfolk Vanguard East and Norfolk Boreas. Vestas said Norfolk Vanguard East and Norfolk Boreas could feature as many as 184 V236-15MW turbines between them.

Sven Utermöhlen, CEO of RWE Offshore Wind, said, “With the acquisition of the Norfolk Offshore Wind Zone portfolio, we are taking over three well-advanced offshore wind projects from Vattenfall. I am very happy that we will work with Vattenfall towards facilitating team continuity to ensure the successful handover and further development of the projects. Equally I am looking forward to continuing the work with the supply chain companies. We will deliver these as part of our Growing Green investment and growth program.”

Billions in Investment

RWE at its Capital Markets Day 2023 earlier this year announced plans to invest €55 billion ($60.7. billion) worldwide from 2024 to 2030, with a goal of growing its clean energy portfolio to more than 65 GW by 2030.

“The UK has been one of our most important core markets for decades. We are delighted that we can now further contribute to achieving the UK’s ambitious build-out targets for offshore wind,” said Tom Glover, RWE’s UK Country Chair. “The timely and efficient deployment of offshore wind is essential to ensure the UK’s domestic energy security, as well as achieving our net zero targets. We very much welcome the UK government’s recent decisions on future offshore wind auctions which provides us with the confidence to invest and represents a positive step in maximizing the UK’s clean energy potential, ensuring sustained and lowest prices for consumers and creating good quality jobs.”

Borg told the BBC that Vattenfall will maintain a presence in the UK, both with onshore and offshore wind farms. The company is continuing development of an 800-MW floating wind farm in the North Sea.

“Both the UK and the offshore market remain attractive over the long term, and we will focus our offshore investments in projects which are appropriate to our current risk appetite while continuing to operate and grow our existing fleet of assets,” said Borg.

—Darrell Proctor is a senior associate editor for POWER (@POWERmagazine).