A Path to Help Speed the Decarbonization of the Global Power Sector

While an important part of the decarbonization equation, renewables alone will not be enough to meet carbon reduction goals while ensuring adequate energy supply. GE believes the global power sector will require a broader array of solutions.

Paul Miller

The daily weather-related news stories detailing catastrophic storms, floods, droughts, heatwaves, and wildfires around the world make climate change virtually impossible to ignore. Global warming is no longer a distant challenge; it already presents a very real and serious threat to our planet and to future generations. It’s imperative to achieve rapid reductions in atmospheric carbon and other greenhouse gas (GHG) emissions, beginning right away.

Depended on how it’s being calculated, the power generation sector is currently either the largest or second-largest contributor to carbon emissions globally. The good news here is that—despite some bumps in the road—GHG-free, renewable electric capacity is growing at record rates. A host of other lower- or zero-carbon technologies can also come into play to help reduce the sector’s overall carbon footprint while meeting global demand for electricity.

A combination of government subsidies; technological breakthroughs; and associated cost reductions in renewable, zero-carbon wind, solar, hydro, and geothermal generation have helped increase the penetration of renewables in the global energy mix. According to the International Energy Agency (IEA), in 2019, wind and solar power accounted for 90% of the entire global power sector’s expansion. The fraction of renewables in the overall mix has grown to almost 30% globally, and huge additions of solar and wind power are set to become the “new normal” going forward. In 2019, 27% of the global electric supply already came from renewables, primarily hydro but with rapidly increasing percentages of wind and solar. In regions with ample wind and solar resources, these renewables can enjoy a cost advantage over thermal power generation and the costs should continue to drop over time as the industry scales and matures.

Additional technological advancements also contribute to the decarbonization of the power generation sector. (In the context of this article, “decarbonization” refers to the reduction of carbon emissions on a kilogram-per-megawatt-hour basis.) These include advances in battery energy storage; pumped hydro energy storage; carbon capture, utilization, and storage (CCUS); electrification; and grid management technologies. In the nuclear energy space, small modular reactors (SMRs) are another promising low-carbon technology on the horizon. On the hydrogen front, while fuels that contain hydrogen have been used in gas turbines for decades, the current focus is in using hydrogen produced specifically to reduce carbon emissions from power generation.

However, for the overall energy transition to succeed, further decarbonization in the power generation sector will need to be accomplished while meeting the world’s rapidly growing demand for more affordable, reliable, and sustainable power. GE has announced that it plans to separate into three independent companies by 2024. One of these new companies, GE Vernova, GE’s portfolio of energy businesses, will focus on addressing this challenge head-on.

A Multi-Pronged Approach to Power Sector Decarbonization

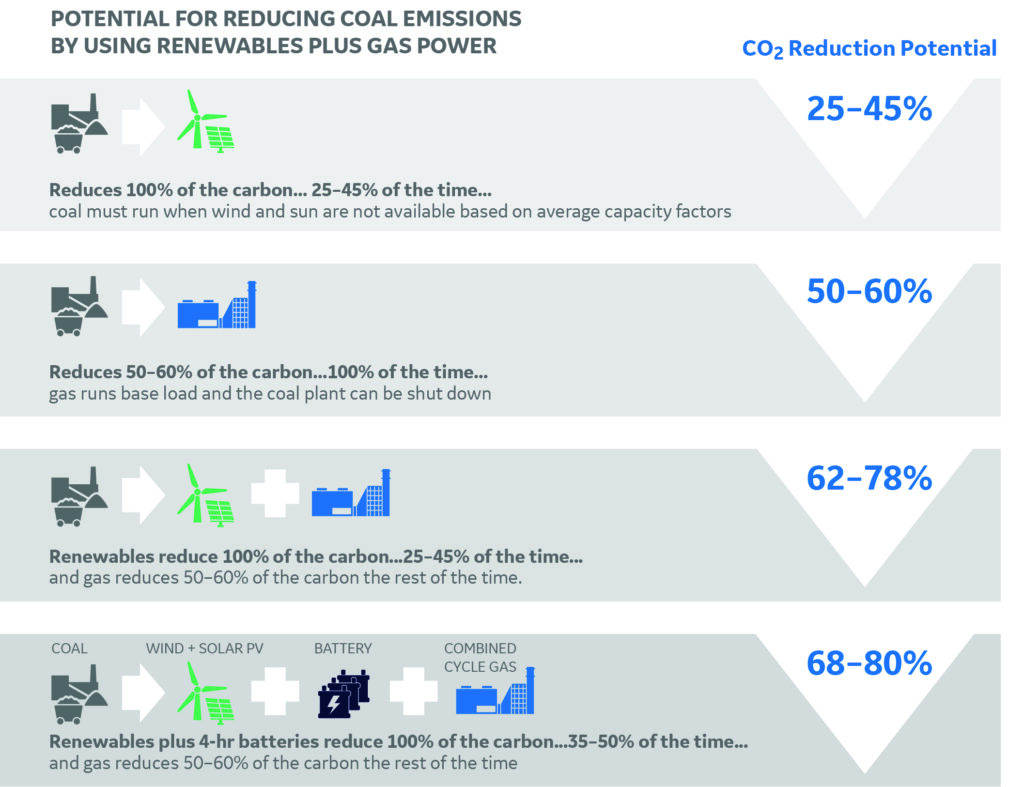

Some might argue that all fossil fuels should be phased out of the energy mix as quickly as possible. However, GE believes that this is not an “either/or” situation. The company has built a compelling argument that continued expansion of renewables supported by strategic deployment of gas power represents the best approach to decarbonize the power sector faster, cost effectively, and at adequate scale. This includes (but is not limited to) accelerated switching from coal-powered electric generation to gas generation (Figure 1).

This approach has already started to pay dividends. In the U.S., for example, according to the latest annual Greenhouse Gas Inventory report produced by the Environmental Protection Agency, while total electric power generation decreased by just 3% in the U.S. from 2019 to 2020, carbon dioxide (CO2 ) emissions decreased 10.3% during that same period due to increasing electric power generation from natural gas and renewables, and decreasing generation from coal. According to that report, “The decrease in coal-powered electricity generation and increase in natural gas and renewable electricity generation have contributed to a 40% decrease in overall CO2 emissions from electric power generation from 2005 to 2020.”

From a capital expenditure perspective, according to Lazard’s Levelized Cost of Electricity analysis, gas power is the lowest-cost generation technology on a dollar-per-kilowatt basis (followed closely by lithium-ion batteries, solar photovoltaic, and onshore wind). And for now, while batteries can be installed quickly and provide dispatchable power at the MW scale, gas turbines provide dispatchable power at larger scales (10+ MW) and can continue to operate for periods well beyond what today’s batteries can support. Furthermore, since GE gas turbines can be retrofitted to burn varying percentages of hydrogen and/or retrofitted for carbon capture, they can provide a pathway to a lower-carbon or even a near-zero carbon future while avoiding the carbon lock-in effect associated with other thermal fuel sources.

GE’s Renewable Electric Generation Portfolio

In a recent interview with POWER, Danielle Merfeld, vice president and Chief Technology Officer of GE Renewable Energy, expanded on the importance of hybridizing the company’s diverse portfolio of renewable and other energy technologies to be able to capitalize on the potential synergies. The company’s global installed base of renewable energy assets includes onshore and offshore wind plants, hydropower, and battery storage, plus hybrid systems, and hardware and software to help automate and integrate renewable generation and battery storage into the grid.

According to Merfeld, what really sets GE Renewable Energy apart is the ability to scale and use a common technology platform to connect and manage the interplay between these assets. This will be key to overcoming the inherent variability of wind and solar energy. “We can combine and hybridize generation assets by combining solar, wind, and/or gas generation with batteries,” she said. “This creates more reliable and efficient hybrid systems that leverage the rapidly falling costs of lithium-ion batteries. In terms of power generation, we’ve learned that the hybridization of our energy technologies is better than the sum of the parts.”

Merfeld mentioned that she was particularly excited about the company’s recent developments in offshore wind. “We’ve launched the Haliade-X turbine, the industry’s first 14-MW offshore wind turbine. This is the first of this whole new category of offshore wind turbines.” A Haliade-X prototype is currently undergoing extensive trials in the Port of Rotterdam in the Netherlands and 64 Haliade-X turbines (Figure 2) will soon be installed at the 800-MW Vineyard Wind project located 35 miles off the coast of Massachusetts. Vineyard Wind, which will be the first utility-scale offshore wind farm in the U.S., is expected to start generating energy in 2023. Experts anticipate that this project alone could help reduce carbon emissions by more than 1.6 million tons per year. Also in the U.S., GE’s smaller Haliade 150-6MW offshore wind turbines are already operating at the 30-MW Block Island Wind Farm off the coast of Rhode Island, which generates enough energy to electrify up to 17,000 homes.

Merfeld also discussed GE’s current initiatives in hydro, grid, and electrification technologies. GE’s hydro group is developing new pumped-hydro energy storage approaches and ways to minimize hydro generation’s impact on fish and other wildlife. And since grid modernization will be key to the energy transition, the company’s Grid Solutions team is exploring the potential of digitalization to develop new hardware and software tools to help automate, balance, and make the grid more resilient. Recent advancements in electrification include high-voltage direct-current (HVDC) products, a Flexible AC Transmission System (FACTS), and products to help ensure power quality. The company also has digital substation and services offerings.

Gas Turbines Complement Renewable Generation

GE’s gas turbines have a well-earned reputation for high-efficiency and technological innovation, which helps explain GE Gas Power’s huge installed base. POWER interviewed Jeffrey Goldmeer, director, Emergent Technologies at GE Gas Power. Goldmeer expanded on GE’s proposition that gas turbines will and should continue to play an important role in the timely decarbonization of the global power generation sector while helping increase grid reliability and stability, something most people take for granted.

“Sure, we all want renewables to grow as fast as possible,” he said. “But the reality today is that if we were just to snap our fingers and turn off all these fossil-based resources we would face huge gaps between supply and demand. In addition, while a lot of work is being done right now to develop ‘synthetic inertia,’ renewable electricity systems like wind turbines don’t have the ability to provide physical inertia. But today’s gas turbines have substantial spinning mass to provide the physical inertia needed to help keep the grid frequency stable.

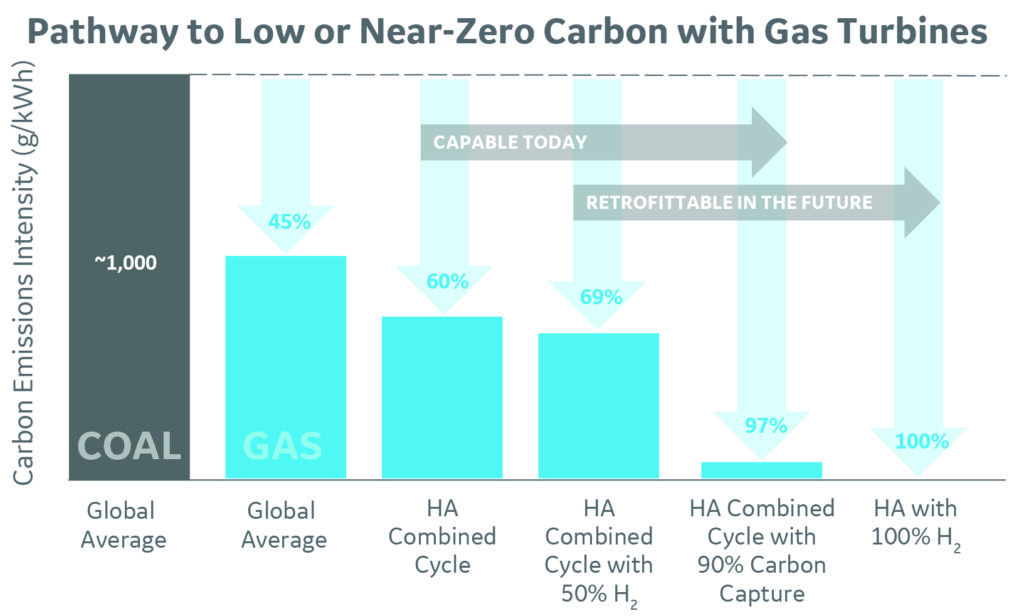

“Gas turbines provide an architecture to support the energy transition,” Goldmeer continued. “There are two ways to decarbonize a gas turbine’s power generation: you can run a fuel that has zero carbon, a pre-combustion approach; or a fuel that has carbon but then manage the emissions post-combustion. Pre-combustion, we’re talking about hydrogen, biofuels, and other near-zero and low-carbon fuels. Post-combustion, we’re talking about carbon capture.”

According to Goldmeer, the hydrogen side is not really new since gas turbines have been running on hydrogen blends for decades. “GE has more than eight million operating hours on fuels of this type and the industry as a whole has more than 17 million hours. GE ran a gas turbine on 100% hydrogen over a decade ago as a demonstration. We have a 44-MW GE 6B turbine unit running commercially for 20 years now in an industrial complex that is taking waste gas from its chemical process. The hydrogen content of that fuel has varied from a low of about 70% to a high of about 95%.”

Goldmeer emphasized that the use of hydrogen to reduce carbon emissions is not new. What is new is using hydrogen for the specific purpose of generating electricity with a lower carbon footprint. “GE helped develop new technology for the U.S. Department of Energy’s High Hydrogen Turbine program in the early 2000s,” he said. “That technology has now become part of what we call our advanced pre-mixer in our DLN [dry low-NOx ] 2.6e combustion system, which is capable of operating on blends of up to 50% hydrogen and natural gas.” This combustion system is running on GE’s advanced 9HA.02, 9HA.01, and 7HA.03 gas turbine units installed at Florida Power & Light’s showcase Dania Beach Clean Energy Center (Figure 3).

He also referred to two more recent hydrogen fuel projects. In spring 2022, GE Gas Power worked with Long Ridge Energy in Ohio to demonstrate a GE 7HA.02 combined cycle gas turbine that ran 5% hydrogen and 95% natural gas without any issues. According to Goldmeer, that turbine has the capability to run at up to 15% to 20% hydrogen. He mentioned that a key part of this project was not just to demonstrate the turbine capability, but also to highlight some of the external supply chain challenges. These will require both growth and investment in the hydrogen supply system to make high levels of regular hydrogen combustion possible.

“Gas turbines provide an architecture to support the energy transition.”

—Jeffrey Goldmeer, director, Emergent Technologies at GE Gas Power

In his second example, Goldmeer discussed a demonstration project GE Gas Power completed at the Brentwood Power Station on Long Island. Here, the company collaborated with the New York Power Authority (NYPA), the Electric Power Research Institute (EPRI), and others to demonstrate running varying blends of “green hydrogen” and natural gas on a GE LM6000 aeroderivative gas turbine. Goldmeer pointed out that while the unit in Ohio operates primarily as a baseload unit, the New York LM6000 is primarily a peaking unit. This helps demonstrate that the technology can be applied across the full range of gas turbines, from small aeroderivatives to large combined cycle units (Figure 4).

Moving on to the post-combustion side, “GE received two FEED (front end engineering design) studies in the carbon capture space. One was from U.S. Department of Energy where we’re working with Southern Company to look at what it takes to apply a carbon capture system to an existing GE 7F combined cycle gas plant,” Goldmeer said. He also mentioned that GE is part of a consortium that received a FEED study award from BP as part of its Net Zero Teeside (NZT) project in the UK. For this FEED study, GE has collaborated with Technip to implement carbon capture at a grassroots combined cycle plant. He explained that these studies are important because, while carbon capture has been applied to coal plants, no one has done it to a combined cycle gas plant.

But the question remains, what do we do with all that captured carbon? Industry think tanks such as the Global CCS Institute point out that CO2 has already been stored underground safely and effectively for more than 50 years. The Institute’s assessment indicates that the earth has adequate underground storage resources available to meet climate targets for more than 400 years at current rates and these resources are distributed throughout most countries around the world.

“Policy certainty is one of the best tools available to enable suppliers to provide lower-cost, higher-quality solutions.”

—Danielle Merfeld, vice president and CTO of GE Renewable Energy

Obstacles to Successful Power Sector Decarbonization

While GE’s Merfeld and Goldmeer both expressed optimism about the potential for this multi-pronged, portfolio-based approach to power sector decarbonization, they also shared what they believed could be key impediments to success.

According to Merfeld, policy certainty is important to help avoid “boom or bust” cycles. “Without consistency to drive uniformity of demand, those supply chains get pulled up and down, which radically changes suppliers’ ability to provide lower-cost, higher-quality solutions.” As a prime example of the kind of policy consistency needed, she pointed to the recently passed Inflation Reduction Act (IRA) in the U.S., which includes record-setting climate spending and a wide array of climate-related tax credits. This legislation extends the production tax credit (PTC) for onshore wind and the investment tax credit (ITC) for offshore wind.

“Storage, hydro, and hydrogen will also benefit from the new act,” Merfeld said. She noted the need for additional policy and support for transmission and grid development, and suggested that governments could also eliminate some current bottlenecks by streamlining regulation and permitting processes. “Policy certainty is one of the best tools available to enable suppliers to provide lower-cost, higher-quality solutions.” Goldmeer commented that governments need to continue to provide financial support, appropriate supply chains need to be established, and appropriate dollar value assigned to low- or near-zero-carbon assets to make them competitive. “Governments also need to support commercial applications at scale,” he added. “We need to do these things at scale and bring the cost down, especially for the first movers. Governments can really help by filling the gaps that the capital markets don’t necessarily do very well.”

Expanding on some of the related supply chain issues, Goldmeer said, “Our gas turbines today could be upgraded to run on some blend of hydrogen and natural gas. So, the question fundamentally comes back to two issues: hydrogen supply and cost. Right now, getting the amount of hydrogen required is very challenging, especially if you want that hydrogen to have a very-low-carbon footprint. The other challenge relates to the cost of hydrogen and how the energy marketplace today is set up. Imagine a scenario where you can get all the hydrogen you want for your gas turbine, but it costs three, four, or maybe 10 times more than natural gas. You’ll not be likely to dispatch, because the Independent System Operator (ISO) or whoever controls the grid will be looking for the lowest cost electricity. In this scenario, we need ways to bridge this gap; this could include allowing a higher cost for dispatchable electricity with a lower carbon footprint or finding ways to reduce the cost of hydrogen.”

Goldmeer noted that the latter option was included in the previously mentioned IRA in the U.S., which includes a hydrogen PTC of up to $3.00 per kilogram (approximately $22.50 per MMBtu). This could open the door to a range of end-use applications, including using hydrogen for power generation. He also mentioned the need for more education on and awareness about the energy transition. To this end, Goldmeer co-hosts the company’s award-winning climate podcast, “Cutting Carbon,” which focuses on making climate change more accessible to all audiences.

GE Vernova and the Future of Power Sector Decarbonization

Last fall, GE announced its intention to become three independent, publicly traded businesses over the next several years. These will focus on healthcare, energy, and aviation, respectively.

In July 2022, the company revealed that its existing portfolio of energy businesses—including GE Renewable Energy, GE Power, GE Digital, and GE Energy Financial Services—will soon sit together under the GE Vernova brand, which will focus on driving the energy transition. This should further amplify the technological and other synergies these businesses already bring to the table, particularly when it comes to power sector decarbonization.

With its deep heritage in power generation, distribution, and electrification; large installed global base; and broad portfolio of relevant technologies—including wind, solar, hydro, gas turbines, energy storage, and grid—this new entity appears to be well positioned to help accelerate the availability of reliable, affordable, and sustainable energy globally.