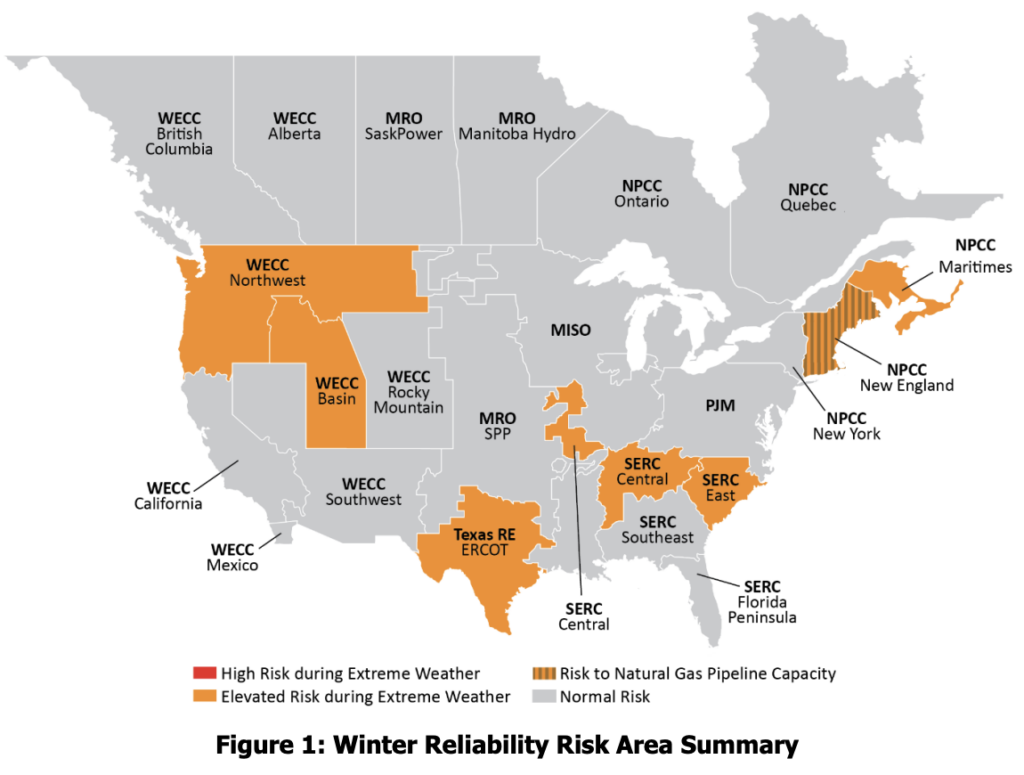

In its recently released Winter Reliability Assessment, the North American Electric Reliability Corporation (NERC) found that while resources are adequate for normal winter peak demand, large swaths of North America face an elevated risk of electricity shortfalls during prolonged, wide-area cold snaps. Noting that four severe Arctic storms have swept across much of the continent since 2021, NERC warns that extreme conditions spanning a wide area could result in electricity supply shortfalls this winter.

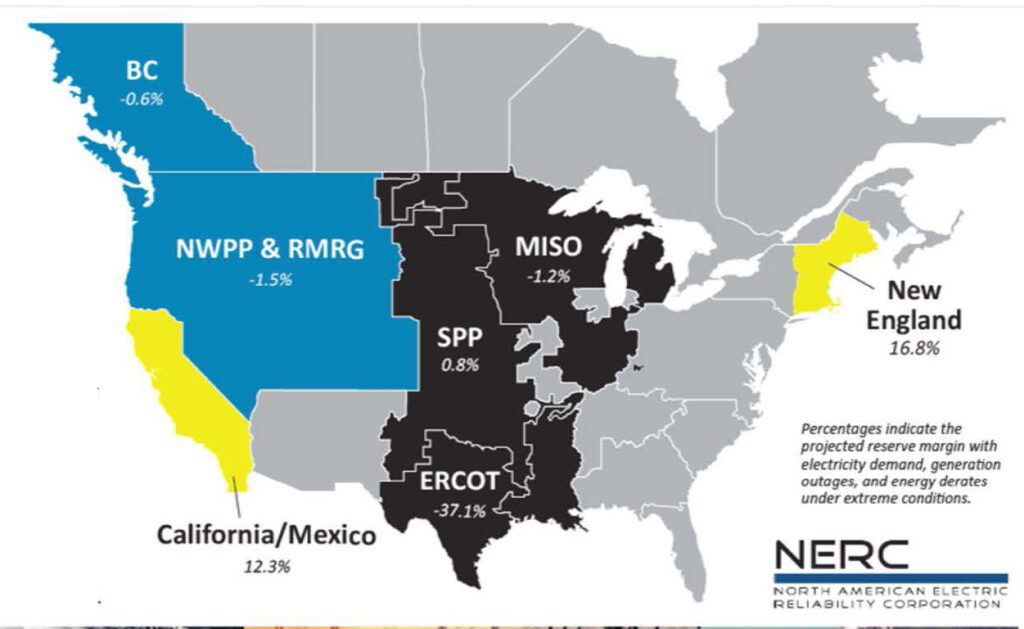

While power supply is expected to be adequate under normal conditions, NERC in its Nov. 18 assessment found that rising electricity demand is significantly outpacing new resource additions—a trend reversal that exposes the grid to elevated risk during extreme winter weather. After several years of flat or low (~1%) peak demand growth, aggregate peak demand for all NERC assessment areas has risen by 20.2 GW (2.5%) since last winter—significantly faster than the addition of 9.4 GW in total resources.

“Electricity demand continues to grow faster than the resources being added to the grid,” said John Moura, NERC’s director of Reliability Assessments and Performance Analysis, “especially during the most extreme winter conditions where actual demand can topple forecasts by as much as 25%—as we saw in 2021 in ERCOT and SPP.”

Changing Resource Mix

NERC noted that while bulk power system (BPS) resources increased by 9.4 GW, growth has come “at a slower rate than demand is rising.” Meanwhile, since last winter, capacity additions have largely come from variable and time-limited assets that introduce new operational complexities during extreme conditions.

Of the 9,447 MW net increase in total winter resource capacity, only 1,335 MW came from new generator capacity—“while the larger share comes from demand response programs,” the report says.

Battery storage led all additions with 19,659 MW resources for winter 2025–2026, only 1,335 MW came from new generator capacity—“while the larger share comes from demand response programs,” NERC reported. Battery storage led all additions, with 19,659 MW in nameplate capacity and 11,121 MW counted toward peak demand. Solar added 11,097 MW in nameplate terms, but only 1,176 MW of on-peak capacity, as “solar resources… often do not supply output during hours of peak winter demand.” Wind resources declined by 562 MW in nameplate capacity and fell sharply—by 14,238 MW—in peak demand contribution, a drop NERC attributed to “revised valuations of wind resource capability at peak demand hours in some areas.”

The report also stresses that the characteristics of the fastest-growing resource types—batteries and demand response—introduce “unique operational challenges” in winter conditions. “Battery energy is reliable when it can be dispatched and has sufficient charge for the period it is needed, yet little time to recharge can be expected during extreme winter weather. System operators will need good visibility on battery state of charge and should anticipate that some extreme winter events will cause these resources to become depleted when needed,” it says. “Demand response is limited by contract terms, which typically specify how often and for how long the resource may be used.”

And, while thermal generation remains indispensable for meeting peak winter loads, its performance will hinge on fuel adequacy, which in turn is linked to extraction, processing, storage, and delivery infrastructure for a variety of fuels, NERC said. “BPS stakeholders across North America note multiple fuel-related issues that are being monitored entering the winter season,” ot warned. “For example, while coal represents a waning share of the overall resource mix, it continues to play an important role in meeting demand during extreme winter weather events, and oil inventories at dual-fuel gas-oil generators lessen risks related to natural gas deliverability in infrastructure-constrained regions, especially during the winter,” it said. “Notably, it is infeasible or prohibitively costly to stockpile natural gas locally at power plants, and this exposes the BPS to the risk profile of the constituent systems that comprise the supply and delivery of this just-in-time fuel.”

Grid Adequacy Likely—in Normal Conditions

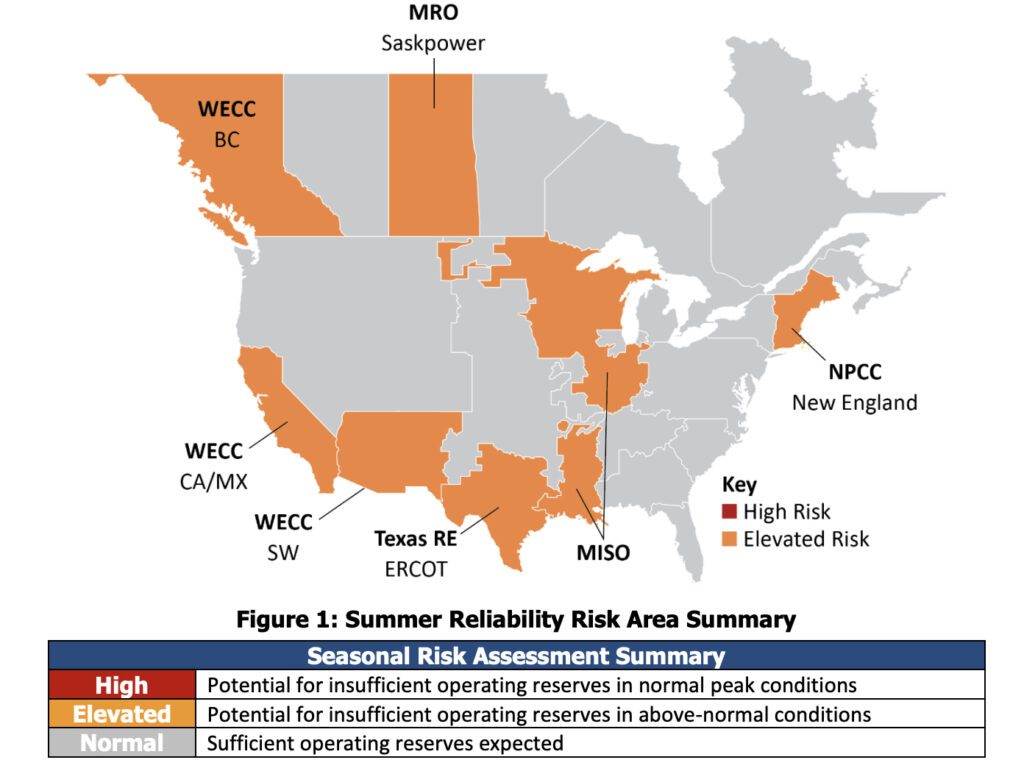

Still, the assessment finds that all areas have adequate resources for normal winter peak-load conditions—defined as each area’s 50/50 peak forecast. However, NERC warned that “more extreme winter conditions extending over a wide area could result in electricity supply shortfalls.”

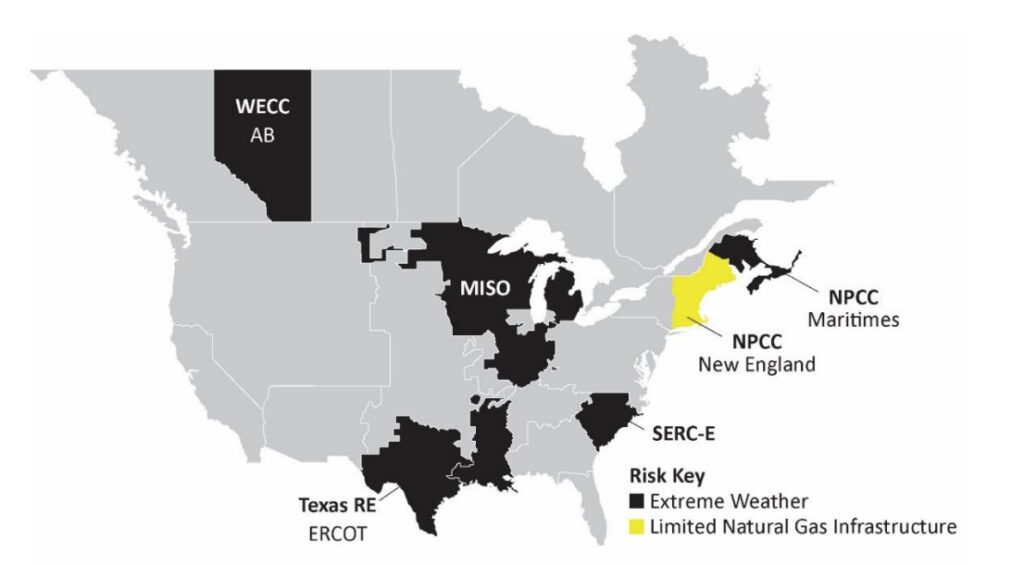

NERC notably flagged seven areas facing risks of electricity supply shortfalls during extreme conditions this winter. In the Northeast, NPCC-Maritimes is the only area that does not meet its reference margin level, with an anticipated reserve margin of 16.9%—270 MW below its 20% target—and operators there are “likely to require emergency operating mitigations and/or energy emergency alerts during above-normal demand or low-resource output conditions.”

New England, while showing limited exposure to shortfalls in ISO-NE’s scenario analysis, faces standing concerns about energy adequacy during extended cold snaps, where “constrained natural gas pipelines contribute to rapid depletion of stored fuel supplies.” In parts of the Southeast, SERC-East has shifted from a summer-peaking area to potentially peaking during both summer and winter—driven by the continued addition of solar PV generation that shaves off summer peak demand and electrification of heating that drives up winter peak demand. The winter peak demand forecast has increased by 700 MW (1.6%) since last winter, while firm capacity has declined, resulting in lower reserves.

In Texas, strong load growth from new data centers and other large industrial end users is driving higher winter electricity demand forecasts and contributing to the continued risk of supply shortfalls, according to the assessment. ERCOT faces reserve-shortage risks during peak and high-net-load hours, particularly under extreme cold conditions. The report also noted that data centers are “altering the daily load shape due to their round-the-clock operating pattern, lengthening peak demand periods.” While additional battery storage and demand-response resources since last winter have helped mitigate shortfall risks, NERC cautioned that “with the continued flattening of the load curve, maintaining sufficient battery state of charge will become increasingly challenging for extended periods of high loads, such as a severe multi-day storm like Winter Storm Uri.”

In the West, WECC-Basin—which includes Utah, southern Idaho, and a portion of western Wyoming—has sufficient capacity for expected peak conditions, but Balancing Authorities are “likely to require external assistance during extreme winter weather that causes thermal plant outages, adverse wind turbine conditions, and natural gas fuel supply issues.” Under an extreme combination of generator derates and outages, the region could be short 1.6 GW before imports. Similarly, WECC-Northwest faces a 9.3% increase in winter peak demand compared to last year. While over 3 GW of new resources—primarily battery storage, solar PV, and wind—have been in development for the area this year, NERC warned that “delays that threaten timely completion of these resource additions will make the area more reliant on imports to meet peak demand.” In both regions, external assistance “may not be available during region-wide extreme winter conditions.”

Cold Standards in Place, But Gaps Remain

Finally, while most U.S. winter generator owners reported readiness under the new federal standards, NERC emphasized that compliance alone does not eliminate the risk of outages. The recently approved cold weather standard—EOP-012-3, effective October 1—requires generator owners to implement freeze protection measures, develop cold weather preparedness plans, and correct known deficiencies that could impair performance during extreme cold, it noted. According to NERC’s first annual Cold Weather Data and Analysis filing submitted in October 2025, among 1,809 generator owners reporting on 6,094 units, 99% of total net winter capacity—more than 1.07 TW—was deemed operable at its self-calculated Extreme Cold Weather Temperature (ECWT).

The ECWT represents the lowest ambient temperature at which each unit can operate reliably for at least one hour without additional mitigation. Roughly 96% of capacity submitted ECWTs at or below 32F, which is the threshold requiring active winterization under the EOP-012-3 standard. However, 4% of total capacity reported ECWTs above that benchmark, mainly concentrated in the southern portions of the SERC, Texas RE, and WECC regions. NERC flagged these discrepancies and said it would monitor ECWT accuracy in those areas during compliance reviews.

Notably, roughly 93% of generators nationwide reported meeting all minimum requirements for freeze protection, including insulation, heat tracing, and enclosure of critical components. A majority also implemented temperature monitoring protocols, revised startup procedures for cold conditions, and conducted refresher training for operators. Still, NERC noted key areas requiring continued focus. More than 60% of generator outages during the January 2025 Arctic event were linked to cold-related mechanical issues—including frozen instrumentation, lubrication system failures, and cracked valves—despite formal preparedness plans being in place. NERC emphasized that the quality and effectiveness of implementation remain uneven across the fleet and reiterated that documented compliance does not guarantee functional resilience during severe events.

To improve long-term reliability, NERC said it will track ECWT trends over time and evaluate whether reported values align with actual generator performance during cold events. It will also use these data to refine expectations around generator weatherization obligations and operator response under evolving standards. The 2025 filing establishes a baseline for future years’ analysis, forming part of NERC’s broader effort to quantify and strengthen cold-weather readiness across the North American bulk power system.

Gas Infrastructure Still a Wild Card

Despite improvements in coordination, NERC reiterated that natural gas infrastructure—which remains critical for winter electricity reliability—remains outside the scope of enforceable reliability standards in most of North America. “Natural gas infrastructure freeze protection mitigations are voluntary for the natural gas industry in most of North America,” the report notes, adding that only Texas has adopted mandatory weatherization requirements for critical gas facilities through rules issued by the state’s Railroad Commission.

NERC underscored that fuel-related outages remain a persistent risk, especially in regions heavily dependent on single-fuel gas-fired generation. “Natural gas generator performance can be threatened when natural gas supplies are insufficient or when natural gas infrastructure is unable to maintain the flow of fuel to critical generators,” the report says. Although dual-fuel capability and on-site fuel storage help mitigate risks in cold-weather regions like New England and Florida, NERC warned that extended cold snaps can rapidly deplete reserves, and that “timely fuel replenishment” is essential to avoid shortfalls.

“Although we are seeing evidence of improved performance, grid operators in areas that rely on single-fuel gas-fired generators are exposed to unanticipated generator loss during cold snaps when gas supply interruptions are more prevalent,” said Mark Olson, NERC’s manager of Reliability Assessment.

The assessment also emphasized growing concerns about infrastructure interdependence, noting that “electricity is used to power some facilities, such as compressor stations and processing plants that make up natural gas infrastructure.” These linkages raise the risk of cascading failures between the power and gas systems during major weather events.

NERC and FERC’s joint review of the January 2025 Arctic events found that while coordination between gas and electric entities has improved since winter storms Uri and Elliott, serious vulnerabilities include scheduling misalignments during holiday weekends, limited data-sharing between sectors, and incompatibility between electric market operations and gas delivery timelines. NERC urged balancing authorities, transmission operators, and gas suppliers to conduct fuel surveys, monitor inventories, and prepare operating plans that account for delivery uncertainty under extreme conditions.

“This latest assessment highlights progress on cold weather readiness,” said Moura, “but underscores that more work remains to ensure energy and fuel supplies can be reliably delivered even during the harshest conditions.”

—Sonal Patel is a POWER senior editor (@sonalcpatel, @POWERmagazine).