A new report from the American Clean Power Association (ACP) and Wood Mackenzie shows the U.S. energy storage market set a record for quarterly growth in April through June of this year. The latest U.S. Energy Storage Monitor from the groups reports 5.6 GW of installations during the second quarter of 2025.

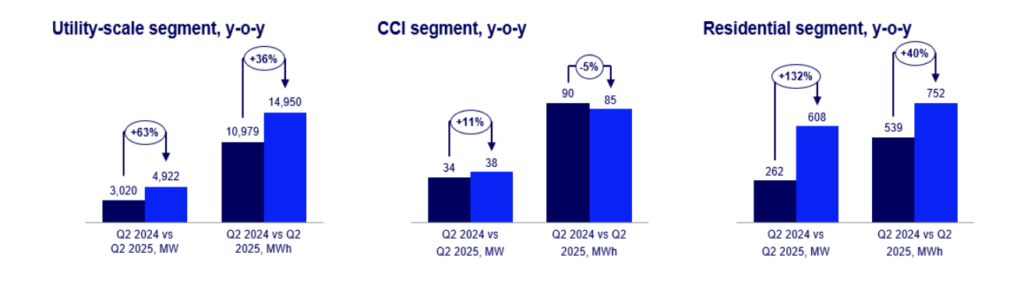

The groups said utility-scale energy storage had a record 4.9 GW of new installations in Q2. The groups in a news release wrote, “While early adopters continue leading in deployment, activity across the country shows clear demand for utility-scale energy storage as a solution to rising electricity prices and soaring energy demand.”

The report said that states of Texas, California, and Arizona each added more than 1 GW of energy storage. It noted that some markets, including the Southwest Power Pool (SPP), saw renewed activity. Three projects were brought online in Oklahoma, the first in that state in three years, while “Florida and Georgia saw major forecast upgrades due to aggressive procurements by vertically integrated utilities,” according to the report.

“Energy storage is being quickly deployed to strengthen our grid as demand for power surges and is helping to drive down energy prices for American families and businesses,” said Noah Roberts, ACP vice president of Energy Storage. “Despite regulatory uncertainty, the drivers for energy storage are strong and the industry is on track to produce enough grid batteries in American factories to supply 100% of domestic demand. Energy storage will be essential to the expansion of the U.S. power grid and American energy production.”

Residential, CCI Markets Expand

The report said the residential storage market expanded by 608 MW in Q2, a 132% increase year-over-year, and an 8% jump quarter-over-quarter. The groups said that growth was led by California, Arizona, and Illinois, as attachment rates hit new highs and higher-capacity systems gained market share.

Community-scale, commercial and industrial (CCI) storage expanded 38 MW, an 11% year-over-year increase.

California and New York led quarterly CCI storage installations, accounting for more than 70% of total capacity. The report said, “Community storage deployment remained limited due to high costs and policy constraints.”

Resilient Market Despite Policy Uncertainty

The report said U.S. energy storage installations will reach 87.8 GW by 2029, with growth “driven by residential and utility-scale segments amidst a constantly evolving policy environment.” The groups noted, though, that “U.S. utility-scale storage installations could drop 10% year-over-year in 2027 largely due to uncertainty over pending Foreign Entity of Concern (FEOC) regulations on battery cell sourcing.”

“Pricing and FEOC uncertainty, and slow community storage development are expected to limit CCI segment growth below 1 GW by 2029, though Massachusetts’ SMART 3.0 may help boost future deployment,” said Allison Feeney, research analyst at Wood Mackenzie. “Residential storage is expected to outpace solar due to stronger policy resilience, high attachment rates in key markets like California and Puerto Rico, and continued ITC access through third-party ownership.”

Allison Weis, Global Head of Storage at Wood Mackenzie, noted that while recent federal legislation preserved the investment tax credit (ITC) for energy storage, there are still challenges to deployment, and the the five-year buildout could be reduced by 16.5 GW.

“After 2025, utility-scale storage projects must comply with new, stringent battery sourcing requirements to receive the ITC,” said Weis. “While domestic cell supply is ramping up, supply chain shortages are possible, although developers are continuing to consider supply from China to fill in any gaps. A rush to start construction under the more certain near-term regulatory framework uplifts the near-term forecast. Projects that have not met certain milestones by the end of 2025 are at risk of exposure to changing regulations. There is additional downside risk if further permitting delays threaten solar and storage projects.”

—Darrell Proctor is a senior editor for POWER.