Cost to Complete Vogtle AP1000 Nuclear Units Could Balloon to $20B

Costs to build the two Vogtle AP1000 units under construction in Georgia could range between $18.3 billion and $19.8 billion—and for now, Southern Co. is pinning its hopes to complete the project on approval from the Georgia Public Service Commission (PSC).

Southern Co. CEO Tom Fanning told investors in a second-quarter earnings call on August 2 that its subsidiary Georgia Power is in the final stages of forming its recommendation to the PSC, and it expects to file its final recommendation in late August.

Georgia Power owns 45.7% of the project, with the remainder owned by Municipal Electric Authority of Georgia (MEAG Power), Oglethorpe Power, and the City of Dalton. Southern Co. in June finalized an agreement with Toshiba, the parent company of the project’s former engineering, procurement, and construction (EPC) contractor Westinghouse, which filed for bankruptcy in March owing to delays and resulting cost increases at the Vogtle and V.C. Summer projects. The agreement requires Toshiba to pay the project owners $3.68 billion ($1.7 billion to Georgia Power) between August 2017 and July 2021, whether or not the project is completed.

“Ultimately, while Toshiba’s financial condition is uncertain, the Toshiba Guarantee agreement puts the Vogtle owners in a better position,” Fanning said.

Fanning also noted that Southern reached a services agreement with Westinghouse on July 27 that will allow the beleaguered company to provide engineering, licensing, support, procurement services as well as give Southern Co. access to intellectual property. The agreement also means Southern Nuclear, the company that operates all of Southern Co.’s nuclear plants and holds the licenses for Vogtle 3 and 4, will take over construction at the project site.

A Wide Schedule and Cost Expectations

According to Southern Co., current assessments—outlined “in a range of potential schedules”—suggest Unit 3 will be placed in service between February 2021 and March 2022, and Unit 4, between February 2022 and March 2023.

Net of the Toshiba guarantee obligation, this schedule will result in $1 billion to $1.7 billion above previous cost estimates of $5.68 billion for Georgia Power’s share alone.

“Based on the preliminary spending curbs, Georgia Power is not projected to exceed $5.68 billion until 2019,” Fanning said. “Assuming proceeds for claims in the Westinghouse bankruptcy proceeding are received by 2019, this crossover point could extend into 2020.”

During the second earnings investor call on August 2, Fanning was asked by an investor, Greg Gordon from Evercore ISI, if he was right to guess total plant costs ranged between $18.3 billion to $19.8 billion. Fanning answered, simply: “Yes.”

Georgia Power had invested approximately $4.5 billion in the project through June 2017 and has recovered approximately $1.4 billion of financing costs, Fanning acknowledged. If a decision were made to cancel the project, Georgia Power’s cancellation cost share would be about $400 million.

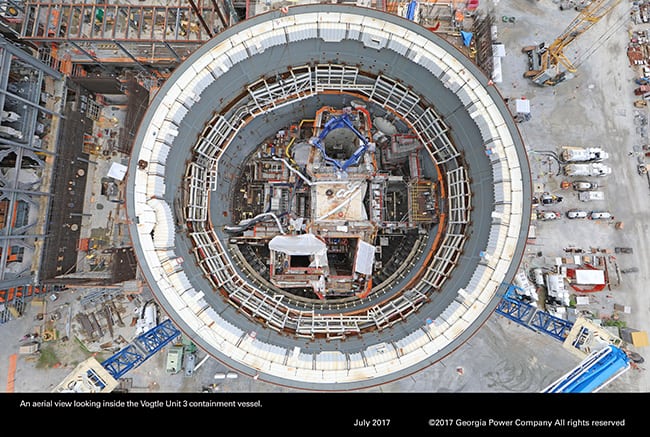

SLIDESHOW: Progress at the Vogtle Construction Site Since January 2017 Courtesy: Georgia Power

Comparing V.C. Summer to Vogtle Is Like Comparing Apples to Oranges

Southern Co. released its second-quarter financials two days after SCANA Corp. and Santee Cooper announced they would cease construction of Units 2 and 3—two AP1000 units that were about 64% complete—at the V.C. Summer Nuclear Station in South Carolina. The companies cited high costs for their decision. Project costs would have surpassed $11.4 billion ($8 billion to complete construction, and $3.3 billion in interest) for Santee Cooper, a 45% shareowner, while SCANA, which owns the remainder, put its share of project costs at $8.8 billion.

SCANA Corp. officials, meanwhile, told investors in a late afternoon call on July 31 that its four-month-long cost and schedule evaluation forecast that Unit 2 wouldn’t be completed until December 2022 and Unit 3, until March 2024. That amounted to years of delay compared to the last approved in-service dates of August 2019 for Unit 2 and August 2020 for Unit 3.

SCANA and Santee Cooper gave Westinghouse full notice to proceed in April 2012, committing Westinghouse to substantially complete Unit 2 in 2016 and Unit 3 in 2019. Westinghouse and its then–consortium partner the Shaw Group, which was eventually absorbed by Westinghouse in a $3 billion deal, received full notice to proceed on Vogtle 3 and 4 in April 2009. The original completion timeline for Vogtle 3 and 4 ranged between 2017 and 2018.

But on August 2, Fanning urged investors not to compare Georgia Power’s potential costs to SCANA’s. “It really is apples and oranges. For example, the commercial terms for the projects were very different, the EPC cost, the guarantee, the different regulatory processes they went through, the cost cap over there,” he said. “So, I really want to resist kind of a reconciliation of where SCANA is relative to where we are.”

Southern Co.’s cost estimates are being prepared by external parties, including companies involved with estimating financials at the Tennessee Valley Authority’s recently completed (but indefinitely shut down) Watts Bar 2 reactor, as well as Bechtel and Fluor, Fanning added. “We feel confident in our estimates.”

Responding to an analyst question about how the company proposed to appease investors about risks it was taking by continuing the project versus just building a gas plant instead, Fanning said Southern had evaluated building a gas plant at the site. “We would need to build a rather lengthy pipeline and maybe other sites around Georgia that may be more suitable for that,” he said.

“Adding the nuclear units give a much-desired quality to the state’s integrated resource plan that is fuel diversity. It is resilience to future carbon potential outcomes.”

Kemper Suspension Hits Southern Co. Hard

Soaring costs at the Vogtle expansion aren’t Southern Co.’s only problem. In June, its subsidiary Mississippi Power announced it would suspend operations and startup of the lignite gasification portion at the Kemper County Energy Facility, which was marred by exorbitant delays and cost overruns. Mississippi Power said it planned to continue running a combined cycle gas turbine (CCGT) plant that was completed as part of the $7.5 billion project three years ago, pending the Mississippi Public Service Commission’s (MPSC) decision on future operations.

Fanning told investors on Wednesday that while startup of the gasifiers and gas cleanup systems “took longer than anticipated,” substantial progress had been made towards putting the project in-service before the company decided to suspend activities at the site. “Along the way, we demonstrated every major facet of the TRIG technology at a commercial scale, including the gasification of lignite, the capture and sale of carbon dioxide and the production of electricity with syngas,” he said.

While Kemper was conceived “at a time when natural gas prices were approximately $10 per million Btu and had significant market volatility,” an economic viability study filed this February indicated that operating the integrated gasification combined cycle on lignite would be less economic than operating the CCGT on natural gas.

Then in May, Fanning said, the company determined the superheater section of the syngas coolers would need redesign and replacement over the next two to three years. Replacement of the critical component would require significant lead-time for design, fabrication, and installation, and would add significantly to cost above the cost cap. “Even though we all felt we could achieve commercial operations in the near-term, this issue hurt the sustainable operating profile of the plan,” he said.

Mississippi Power is actively negotiating with PSC staff and other parties, and it intends to file a proposal that meets the conditions of the PSC’s July 6 order on or before August 21, he said.

The company’s second-quarter financial statements reflected a pre-tax charge of $2.8 billion to write-down the remaining investment of the gasification portion of the facility. Future cancellation costs could range between $100 million and $200 million, Fanning noted.

—Sonal Patel is a POWER associate editor (@sonalcpatel, @POWERmagazine)