Chart a New Course

I examined the magnitude of electricity subsidies for renewables compared with conventional generation technologies in my May 2011 editorial, based on data from a 2008 report prepared by the U.S. Energy Information Administration (EIA). An updated EIA report released in July determined that federal government subsidies have risen substantially during the past three years. In fact, overall renewable energy subsidies have almost tripled, increasing from $5.1 billion to $14.7 billion. In my opinion, we aren’t getting value for the money spent.

A Lucrative Business

My informal survey of the web sites of several wind turbine manufacturers found that the most often cited advantages of wind power are to reduce foreign oil imports (factually incorrect—unless wind power is used to power plug-in electric vehicles—as insignificant oil is used to produce electricity), produce millions of new, high-paying green jobs (we’re still waiting), and reduce carbon emissions. Believing in these goals, the federal government (and many states, for that matter) developed a system of incentives for developers of renewable projects. Federal incentives include the production tax credit (PTC), an investment tax credit, or a cash-back or grant option worth up to 30% of the project value. The PTC is slated to expire at the end of 2012 for most renewable technologies.

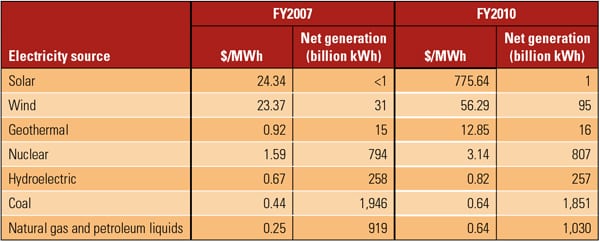

However, the price tag for those incentives is quickly rising. The EIA, in a report covering FY2010, found that the magnitude of those subsidies continues to grow each year, as illustrated in the table. In fact, the subsidies for wind were up over 140% (187% in absolute dollars spent) over the past three years.

|

| Federal energy subsidies and incentives with a federal budget impact and in direct support of electricity production. Source: EIA |

Failing the Carbon-Reduction Test

Wind power’s performance in reducing electricity system carbon emissions also gets low marks. In many regions, wind turbine owners have bid into the electricity market at below cost or even negative prices, often up to the value of the PTC. That forces coal plants to cycle during off-peak hours. In simple terms, the less-than-full-load operation of these coal plants results in less-efficient operation, therefore producing more carbon emissions per MWh produced.

The practical effect is little reduction in systemwide carbon emissions with the introduction of wind energy. The National Academy of Science (NAS), in a report published in early 2007, agrees. The authors of the “Environmental Effects of Wind Energy Projects,” concluded that “Wind power will thus not reduce carbon emissions; it will only slow the increase by a small amount.” Several subsequent independent studies have confirmed the NAS assessment.

Gas Game Changer

The magnitude of proven and potential gas reserves in the U.S. is enormous. As you will read in our special report, “Global Gas Glut,” p. 46, the rules of the power generation game have changed. Proven shale gas reserves in the U.S. can keep the U.S. fueled for a century at today’s level of consumption. In addition, early assessment of deeper shale deposits, located beneath those now being tapped a mile or more below the surface, promise to be of even great magnitude. In other words, the U.S. is awash in natural gas for the foreseeable future. That “new normal” must be taken into consideration when designing or modifying incentive programs, such as those now in effect.

If the net effect of providing enormous incentives to build renewable energy plants is to reduce carbon emissions, then that advantage will also disappear in a future where low-priced natural gas pushes coal plants down the dispatch order, as has recently occurred in many regions. Given that natural gas produces less than half the carbon emissions of coal, the small reduction in carbon emissions previously produced by wind offsetting coal quickly evaporate.

The cost for wind’s little or no environmental benefit is high. The EIA’s latest estimates (Annual Energy Outlook 2011, April 2011) of the annualized cost of energy— inclusive of federal subsidies (2009$)—show how unaffordable renewable power is: solar thermal, $312/MWh; new nuclear, $114/MWh; wind, $96/MWh; and natural gas plants, $62/MWh. Given that the EIA report on renewable subsidies comes after the EIA’s AEO 2011 and that wind subsidies have risen substantially (more than $30/MWh) since these EIA estimates were released, it’s reasonable to estimate that the real market price of wind power is about $130/MWh without subsidies.

The renewable energy development path we’re now following is not sustainable. It’s a mistake to continue to invest in technologies that produce expensive power with no tangible benefit to the economy or the environment. With the unimaginable quantities of natural gas now available, it’s time to cut our losses and chart a new course, without subsidies for any electricity source.

— Dr. Robert Peltier, PE is POWER’s editor-in-chief.