At the Dawn of the Hydrogen Economy

Interest in hydrogen is growing, with demand increasing rapidly. It is clear that the next significant transformation in the energy transition will be based on the hydrogen economy, transforming green electrons to green molecules via water electrolysis to create green hydrogen.

At the moment, 80 million tons of hydrogen is produced each year, and that is expected to increase by about 20 million tons by the end of the decade. Looking even further ahead, by 2050, many studies suggest production will have grown to about 500 million tons. Today, the majority of that fuel is consumed near where it is produced, most often at a chemical plant, but in the future that demand will be broader with blue hydrogen forming a bridge to what will be a green hydrogen future.

Go Green for Success

For a gas that is colorless, tasteless, and odorless, it is ironic that it is designated as grey, blue, and green; the color designated depending on the production method. For hydrogen to reach its potential as an environmentally friendly source of energy, it is vital that the supply chain is made greener.

The current method of producing hydrogen is from fossil fuels such as methane, natural gas, or coal. This type of hydrogen, dubbed grey hydrogen, comprises almost 95% of the quantity produced today, and it is an emissions-intensive process, with more than 10 kilograms of CO 2 emitted to produce each kilogram of hydrogen. An improvement can be made by sequestering the CO 2 that is produced in the process, thereby delivering blue hydrogen.

But green hydrogen is what Siemens is striving to achieve. This is hydrogen that is produced by renewable electricity powering an electrolyzer to create hydrogen and oxygen from water. If the water and power come from sustainable sources, then the hydrogen is classified as pure green hydrogen, which is the focus of Siemens’ New Energy Business. It sees the market for hydrogen migrating from grey, to blue, and then to green, with each having its own role utilizing different transition technologies.

Building Capacity

The key to enabling the potential of the hydrogen economy is a supply chain that can produce green hydrogen at scale and at a price that the market will pay. For the past 10 years that has been a focus at Siemens, and the company is in the formative stages of delivering that technology for the large-scale industrialization of hydrogen.

|

|

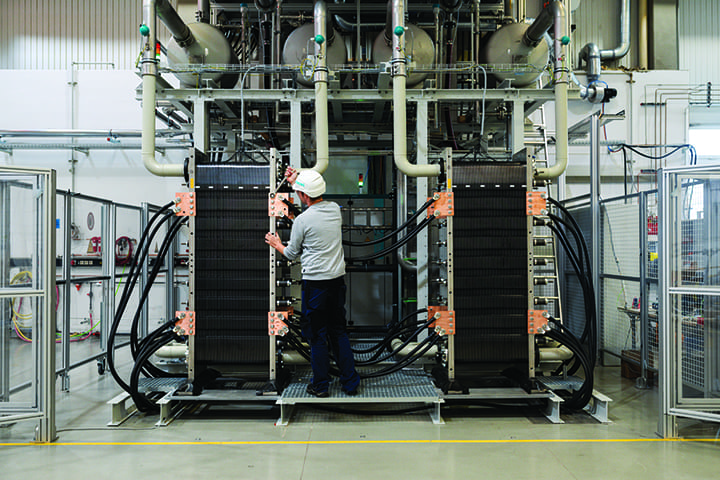

1. The heart of Siemens’ proton exchange membrane electrolysis plant is the Silyzer module. The innovative technology is ideally suited to exploiting the intermittent generation of wind and solar power. Courtesy: Siemens Energy |

A big milestone came five years ago with the launch of Siemens’ 1-MW Silyzer (Figure 1) into the market. Since then, the company has undertaken commercial pilots with customers for different applications. Two years ago, it increased the portfolio with a 10-MW version. Last year, together with partners Verbund and Voestalpine, Siemens built its first installation at a steel plant in Linz, Austria.

As with all emerging technologies, the initial cost base was high, with prototypes and bespoke manufacturing, but as the technology matures and adoption increases the costs continue to reduce. As the production volumes grow, advanced automation can be introduced into the manufacturing process along with leveraging digitalization such as digital twins and modularization, where the company uses standardized modular building blocks that are developed to serve for customer use cases.

Much like the famous Moore’s law for integrated electronic circuits, the scale of Siemens’ technology is rising year on year, with an increase in power ratings by a factor of 10 every four years. The company is now in the bidding phase for 100-MW projects, and moving forward it is talking to partners about installations that would break the 1 GW barrier. As time moves on, hydrogen can become as big as wind and solar, but in terms of maturity (market and technology), it is 15 to 20 years behind the more established renewable technologies. Similar cost reductions as have been witnessed in the photovoltaic sector are expected over time.

Show Me the Money

Ultimately, despite the environmental pressures that every facet of industry is under, it will come down to cost. For it to become mainstream, the hydrogen economy cannot be based on subsidies; sustainable markets must be created and getting the cost right is one of the first boxes that must be checked.

The present price of industrial-scale grey hydrogen production is about €2 per kilogram (kg), sometimes less, depending on local conditions. When it comes to using hydrogen as a transportation fuel, consumers pay about €9 per kg at a filling station—when they can find one—and that needs to be reduced by at least a third to make it attractive.

When it comes to comparative cost, it makes no sense to compare green hydrogen to conventional fossil fuel options that contribute heavily to global greenhouse gas (GHG) emissions. The mobility sector is on a path to decarbonize and reduce its GHG emissions, so clearly fossil fuels must play a diminishing role.

Today, national climate policy focuses on emissions from light vehicles. In most of the Group of 20 (G-20) member economies, fuel economy or efficiency standards are used to regulate emissions from conventional light vehicles, and 18 of the 20 countries have proposed conventional vehicle bans and/or developed incentives and targets to accelerate sales of lower-carbon vehicles. That is why when considering the fuel needs for light-duty transport, cost and performance of hydrogen-fueled vehicles should be compared with battery-based electric vehicles (EVs).

There are far more EV models available today, and for some consumers, it is a great plus to be able to recharge their cars at home. However, cars powered by green hydrogen are superior when looking at both recharging times and driving range. For example, less than 1 kg of hydrogen is needed to drive 100 kilometers with a medium-sized car, and fueling takes only three to five minutes. This speed is especially attractive for emergency vehicles or taxis that cannot afford to waste too much time charging.

Even more important is the medium- and heavy-duty transport sector, where green hydrogen is the most promising zero-emission fuel. Hydrogen’s low weight, long driving range, and fast recharging is especially relevant for heavy-duty vehicles and trains.

However, rather than cost per liter, a more relevant calculation is total cost of ownership (TCO). In its report “Path to hydrogen competitiveness: A cost perspective,” the Hydrogen Council expects that the TCO per vehicle will fall by about 45% compared to current costs at a manufacturing scale of about 600,000 vehicles per year.

For green hydrogen to meet these price points there are three primary challenges that must be overcome: the cost of electricity, the loading factor of the electrolyzer plant, and the capital and operational costs. These are dependent on a variety of factors, some outside the control of the producer, such as the cost of electricity, but with renewable energy becoming a larger part of the energy mix, that factor should take care of itself.

When it comes to capital cost, as with most process manufacturing scenarios, it depends on scale and commercialization of the electrolyzer plant to reduce cost of purchase. As to the operational cost, electrolyzer plant digital twins can be used to optimize the design and to improve the productivity, while maximizing the plant’s lifecycle. In areas that have advantageous conditions, costs to produce green hydrogen could already be about €3 per kg.

Depending on the application, green hydrogen can be purified and compressed to levels needed for direct use, storage, or distribution. If storage and transportation is required, there are several options. It can be stored in tanks as a compressed gas or as a liquid, stored in caverns, or in the natural gas grid for different applications and if the grid fulfills all technological requirements.

When it comes to transportation the two main methods for transporting hydrogen are tankers for road transportation and via gas pipelines for short and medium distances, depending on the specific customer use case. When looking at large-scale applications in the hundreds of MW or even GW-scale, it makes the most sense to locate the production near the renewable generation facilities, such as on- and offshore wind parks at locations with very favorable wind resources. This is because the cost of electricity is the major input factor for green hydrogen, comprising more than 70% of the production cost. Because hydrogen is costly to transport, these locations typically require a further synthesis process to green methanol or ammonia, which can easily be transported—these are goods traded globally. This can be perceived as a green hydrogen export business.

Achieving Market Penetration

The power sector is often seen as a prime target for using green hydrogen to power turbines, but as the share in global CO 2 emissions of the power sector is less than 40%, it is vital that it penetrates other sectors as well. Today, there is probably no economically viable business case for producing hydrogen specifically for having it re-electrified directly afterward in a hydrogen-capable gas turbine—and efficiency wise, today it would not make sense either, because there are more applications with higher CO 2 reduction potential at lower total cost. But for pilot applications or in a vastly decarbonized world, to further decarbonize the power sector, beyond what can be achieved by installing more renewables, green hydrogen can realize long-term, seasonal power-to-power storage on a large scale.

Re-electrification will be achieved in hydrogen-capable gas turbines, engines, or fuel cells to provide security of electricity supply in periods of low renewable energy supply, such as lack of wind. This use case will become attractive in the mid- to longer-term. It is not an either-or situation, hydrogen (in cars and trucks) can help to decarbonize the mobility sector, decarbonize the industry sector (for example in steel production), and the power sector later.

More than half of global emissions come from industry, transport, or the built environment, so solutions need to be offered to decarbonize those sectors. Traditional renewable energy sources such as wind, solar, and hydro will play their part, but there is also a significant role for hydrogen produced from renewable energy and water, whether used directly or combined with chemicals to create green methanol and green ammonia. These chemicals can be stored, transported, and used in all kinds of sectors as synthetic fuel or fertilizer.

There is keen attention on the transportation sector and there are signs that it could be among the early adopters, especially when it comes to buses, trucks, and trains. Hydrogen fuel cells are already being used for regional trains, which will replace diesel-powered engines. In China, South Korea, and Japan, there is promising growth in cars with hydrogen fuel cells and electric drive trains in cars. In this region, it has been helped by research funding that has increasingly focused on fuel cells instead of batteries. Also, German original equipment manufacturers (OEMs), which are intensively focused on batteries, are developing cars and trucks with fuel cells.

There was a time over the past decade when several automotive OEMs were looking into both fuel cell and EVs, some of them prioritizing fuel cells. The cost of developing two revolutionary concepts in parallel may have driven some to focus mainly on EVs, but now OEMs are returning to the idea of fuel cells. It seems that they are beginning to understand the challenges and limitations of batteries in vehicles.

New development is also being seen in China, where in recent years EVs were supported massively, bringing high growth to the industry. The “Ten Cities, Thousand Vehicles” program that propelled EVs in China is being replicated now for hydrogen transport in cities such as Beijing, Shanghai, and Chengdu.

Going forward, green hydrogen will command a premium price when compared to its less environmentally friendly hydrogen counterparts—blue and grey. The early stages of any technology curve must have some support, much as was seen in the early days of wind and solar power. But in the medium- to long-run, hydrogen must and will stand on its own legs and be viable without external support. When exactly that will happen, depends on several factors, including the adoption rate, economies of scale, and the regulatory frameworks. ■

—Armin Schnettler, PhD is executive vice president and CEO of the New Energy Business at Siemens Energy.