IEA: Coal Boom Is Over

If broad policy commitments announced by various countries are implemented, coal will not only lose its rank as the dominant fuel for power generation to renewables by 2040, but the world’s coal fleet will be significantly transformed by technology advances, the International Energy Agency’s (IEA’s) newly released World Energy Outlook (WEO-2016) forecasts.

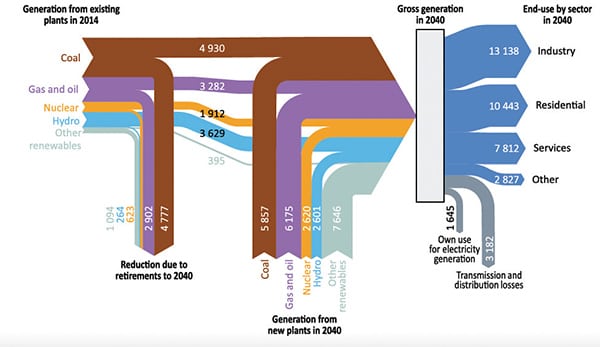

Under a baseline (“New Policies”) scenario that assumes national decarbonization pledges will be satisfied and fossil fuel subsidies will be phased out, the forecast predicts that recent growth of coal use in the global power sector (coal accounted for a hefty 41% share of global power generation in 2015) will slow substantially. Coal generation will grow only modestly, to 10,785 TWh in 2040, up from 9,700 TWh in 2014. The WEO-2016 starkly notes: “[T]he boom is over: global coal demand declined in 2015 for the first time since the late 1990s.”

One reason is that by 2040, the world’s coal fleet will be transformed by efficiency improvements underpinned by a shift in boiler technology. Today, about 70% of the world’s coal fleet operates at subcritical steam conditions. By 2040, the share of subcritical plants will plummet to 45%. Meanwhile, around 400 GW of new supercritical and 330 GW of new ultrasupercritical plants will be built over the next 25 years, the IEA said.

The agency also doled out dim predictions for global gas-fired generation. The power sector accounts for about 34% of growth in global gas, but gas will face stiff competition in some import-dependent markets—especially in Asia—where it cannot compete with coal on price or with renewables for policy support. “In key Asian power systems new gas plants would be a lower cost option than new coal plants for baseload generation by 2025 (when gas prices reach $11/MBtu and coal prices approach $75/tonne), only if coal prices were $150/tonne,” the agency said.

The European Union (EU) has seen “subdued” economic growth along with a rapid build-up of renewable generating capacity, the agency noted. This has created slack in the EU Emissions Trading System, reducing the carbon dioxide (CO2) price and “helping to tilt the economic calculation away from gas and towards coal,” the IEA said. In a notable reversal, gas use in the EU power sector has fallen by nearly 12% per year, on average, between 2010 and 2014. Even in countries showing strong power demand growth—as in much of Asia—gas has struggled to gain ground. “In China, the double-digit growth rates in gas demand have faded: liquefied natural gas (LNG) imports to China hardly increased in 2015,” the IEA said. Gas, which is carbon intensive, could also be impacted by the Paris Agreement, it added.

Notably, the IEA underscored widespread uncertainty owing to shifting policies during what it deems will be a period of unprecedented transformation. Clear winners may emerge over the next 25 years, such as wind and solar, said Dr. Fatih Birol, the agency’s executive director. “But there is no single story about the future of global energy: in practice, government policies will determine where we go from here.”

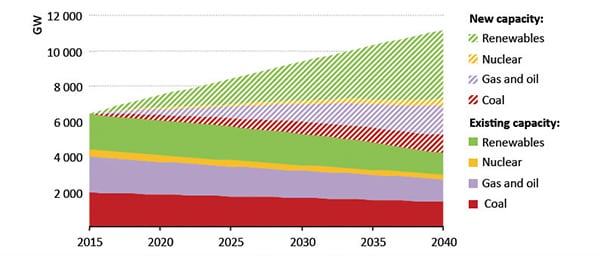

However, by 2040, the world’s electricity supply will likely diversify and decarbonize, the agency predicted (Figure 1). For the first time, in 2015, additions of renewables-based generating capacity worldwide exceeded those from all other energy sources combined, while total installed renewables capacity (including hydropower) surpassed that of coal. Wind and solar and bioenergy-based renewables are also poised to increase their market share from 6% in 2014 to 20% in 2040. “Globally, by 2040 producing a unit of electricity is projected to emit one-third less CO2 than today; but emissions from the power sector still rise by 6%,” said the IEA.

Nuclear power will play a mammoth role in decarbonization efforts. Between the start of 2015 and late 2016, 19 new nuclear reactors commenced operation (two-thirds of them in China), and construction began on nine new reactors over the same period. Today, about 64 GW of new nuclear capacity is under construction, a third of it in China, but also in Russia, the United Arab Emirates, the U.S., South Korea, the EU, and in India. And, the IEA stressed, while 14% of the global nuclear fleet is 40 years old or more, some countries are moving to extend nuclear plant lifetimes to 60 or even 80 years.

However, the IEA expects that a majority of the world’s currently existing power facilities—of all fuel types—will be retired by 2040. Only 36% of total generation will come from existing plants, it said, highlighting what it expects will be a massive challenge in attracting investment for new generation capacity (Figure 2). Cumulative global investment in the power sector will hover at $19.2 trillion over the period between 2016 and 2040—averaging $770 billion per year. About 42% will be spent on transmission and distribution, 14% on fossil fuels, 13% on wind, 11% on solar, 9% on hydro, 7% on nuclear, and 4% on other renewables, it projected.

—Sonal Patel, associate editor (@POWERmagazine, @sonalcpatel)