While still in its infancy, power-to-gas provides a promising approach to convert renewable power into “green” hydrogen and methane, furnishing the renewables sector with a potentially lucrative array of end-uses. A newly announced set of dramatically larger and ambitious projects indicate it has made serious inroads within the energy transition.

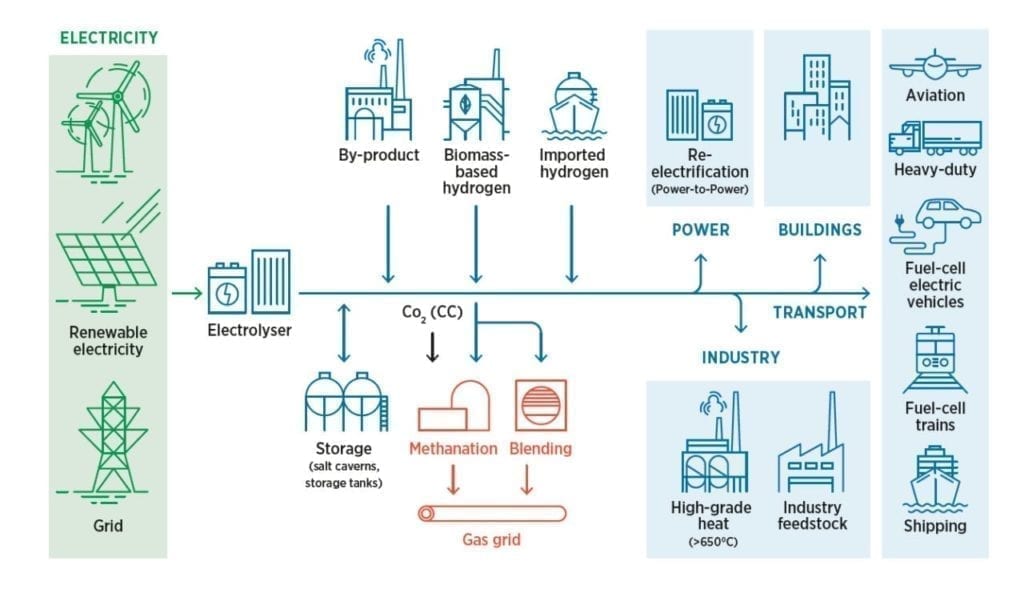

Power-to-gas (sometimes abbreviated P2G or PtG) describes the process of converting renewable energy to gaseous energy carriers such as hydrogen or methane via water electrolysis—mainly alkaline electrolysis, proton exchange membrane (PEM) electrolysis, and solid oxide electrolysis cells (SOECs). In its most basic sense, the electrochemical process (see sidebar “Electrolyzer Technologies”) splits water into hydrogen and oxygen, and to convert it into methane, the hydrogen is reacted with carbon dioxide in the presence of bio-catalysts. The produced “green” hydrogen can be used in a range of pathways that promise to decouple renewable generation from electricity demand—helping to avoid surplus curtailment and potentially providing the sector with an assortment of new revenue streams (Figure 1).

Electrolyzer TechnologiesInterest in electrolytic hydrogen has ramped up of late, owing to solar PV and wind’s declining costs and widespread uptake, and larger projects have been installed over the last five years. According to the International Energy Agency’s (IEA’s) June 2019–released “The Future of Hydrogen” report, three main electrolyzer technologies exist today: alkaline electrolysis, proton exchange membrane (PEM) electrolysis, and solid oxide electrolysis cells (SOECs). Alkaline electrolysis. Introduced in the 1920s, this technology, which uses an aqueous alkaline electrolyte, has been in use for decades, mainly for hydrogen production in the fertilizer and chlorine industries. While it has a conversion efficiency that tangoes between 65% and 70%, it generally has the lowest investment cost and is considered robust, but challenges remain in dynamic modes, because efficiency and hydrogen quality may be severely affected in partial load operation. It also needs a larger plant footprint compared to other options. PEM electrolyzers. Commercialized in the 1960s by General Electric, PEMs use a polymer electrolyte membrane and pure water as an electrolyte solution, which avoids the recovery and recycling of the potassium hydroxide electrolyte solution that is necessary with alkaline electrolyzers. Because its efficiency is higher than alkaline electrolysis—from 65% to 83%—and because these units are compact, better suited to dynamic operations, and respond quicker to load changes, a number of demonstrations have chosen this technology. Its drawback, however, is that PEMs need expensive electrode catalysts (platinum and iridium) and membrane materials, and their lifetime is currently shorter than that of alkaline electrolyzers. SOECs. The least developed electrolysis technology of the three, SOECs have not yet been commercialized, though efforts are underway to bring them to market. They use ceramics as the electrolyte and have low material costs. But because they use steam for high-temperature electrolysis, they need a heat source, which is why experts suggest SOECs could thrive at nuclear, solar thermal, and geothermal projects. Another benefit is that SOECs can be operated in reverse mode as a fuel cell, converting hydrogen back into electricity. |

The produced hydrogen, for example, can be used as a fuel—either for transport, displacing oil in light vehicles, railways, and marine applications—or as a feedstock for industry. In another prominently lauded application, it can be stored and reused as a fuel to generate power through gas turbines or fuel cells—and in an advantage over current battery storage, it can store larger quantities of power over longer time periods.

But, it could also be injected into the natural gas grid, albeit with certain limits, because too high a hydrogen content raises technical and safety issues. The UK, for example, only allows injection of 0.1% hydrogen by volume, while in parts of the Netherlands the limit is 12%. Advancements to loosen these constraints are underway, however. In November 2018, for example, a UK project led by HyDeploy—a partnership that involves Northern Gas Networks, Progressive Energy, and electrolyzer-provider ITM Power—began a year-long trial to explore injection of up to 20% of green hydrogen into a small gas network.

And, if converted to synthetic methane, the gas can be used as a direct replacement for fossil natural gas in gas networks, or as seasonal energy storage. That’s important because, as the UK-based Oxford Institute of Energy Studies notes in an October 2018 paper, P2G can introduce considerable flexibility into the energy system, resulting in “system coupling”—a closer integration between the gas and electricity system that could be more cost-efficient than full electrification of gas-fueled sectors.

The Many Avatars of Power-to-Gas

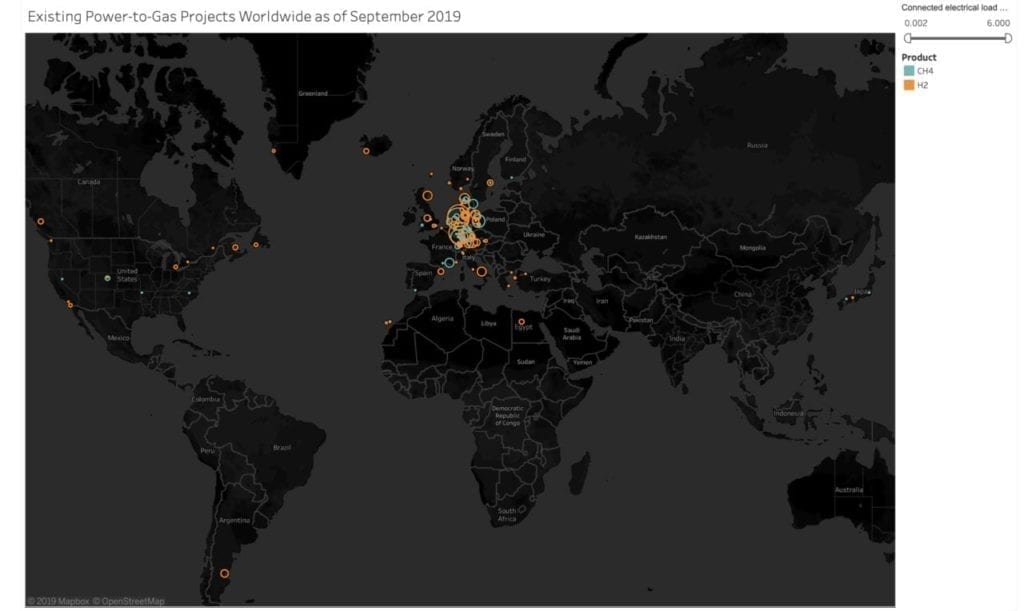

According to Martin Therma, F. Bauer, and M. Sterner, experts from Technical University of Applied Sciences (OTH) in Regensburg, Germany, who recently reviewed the world’s existing P2G hydrogen and methane projects, about 143 P2G projects have operated since 1988 in 22 countries. Only 56 hydrogen and 38 methanation projects were active in 2019. While the existing fleet mostly comprises pilot or demonstration projects under 1 MW, nearly 45% of these projects fed or planned to feed gas into the grid or reconvert it into power or heat.

The bulk of projects to date—64—were installed in Germany, followed by Denmark, the UK, France, the U.S., Switzerland, Spain, Canada, and Japan. Location is important because the choice of “process pathway” typically hinges on requirements of the “embedding energy system, such as hydrogen-tolerance of gas networks, gas buffering, mobility, [and] heat applications,” the experts explained in a paper published this September in the journal Renewable and Sustainable Energy Reviews.

Examples of notable projects follow. A full list is here.

- ■ One of the largest existing P2G projects in the world is the 6-MW PEM electrolysis Energiepark Mainz project in Germany, which began operation in May 2014. The system uses a first-generation Siemens Silyzer 200 electrolyzer to convert surplus power from wind farms. The hydrogen is then fed into the local grid, delivered to surrounding industrial companies, or provided to regional filling stations.

- ■ German utility Uniper in March began producing 1,400 cubic meters per day of synthetic methane derived from 1 MW of wind power via a 2-MW alkaline electrolyzer and is feeding it into gas pipeline networks at its Falkenhagen, Germany, site. The WindGas Falkenhagen project, which began operating in 2013 and had previously only injected pure hydrogen into the gas grid, is part of “STORE&GO,” an initiative spearheaded by 27 partners from six countries under the European Union’s Horizon 2020 program. In tandem, STORE&GO is demonstrating P2G projects in Solothurn, Switzerland, and Troia, Italy. The 200-kW Italian project, sited in a rural Mediterranean area, uses a 1-MW alkaline electrolyzer to convert solar PV and wind power, as well as an innovative pilot methanation plant that captures carbon dioxide, and a small-scale gas liquefaction unit. The 700-kW Swiss project is demonstrating biological methanation from a combined heat and power plant using a 350-kW PEM electrolyzer and a hydrogen injection plant.

- ■ In July 2018, hydrogen generation and fuel cell firm Hydrogenics and Enbridge Gas Distribution began operating the 2.5-MW Markham Energy Storage Facility in Ontario, Canada, to provide regulation services to the regional Independent Electricity System Operator. The plant uses a 1.25-MW PEM stack and a fuel cell (Figure 2).

|

|

2. The Enbridge-Hydrogenics 2.5-MW Markham Energy Storage Facility in Ontario, Canada, designed and built on a 5-MW scalable platform, provides grid regulation in Ontario. Shown here are the plant’s 1.25-MW proton exchange membrane (PEM) electrolyzer stacks, which are notable for their small footprint. Courtesy: Hydrogenics |

- ■ This August, Southern California Gas Co. (SoCalGas) and Danish P2G technology provider Electrochaea commissioned the first “scalable” biomethanation reactor system in the U.S. at the National Renewable Energy Laboratory (NREL) Energy System Integration Facility in Golden, Colorado. The two-year demonstration will assess commercial viability of the 25-foot-tall bioreactor system, which uses a thermophilic microorganism that feeds on hydrogen produced via and wind and solar–fueled 250-kW PEM electrolyzer and carbon dioxide to produce pipeline-quality methane. NREL said, with improvements, the project could be scaled up to between 10 MW and 15 MW.

Ambitious Future P2G Projects

More recently, owing to increased discussions about P2G’s place in future energy systems and technology advancements, several much larger and more ambitious projects are in planning. “Even if today many projects are pilot plants with lifetimes of 1–3 years and still need funding, large-scale implementation is in planning in the mid- and long-term … and a growing number of projects [are] designed to be in operation for up to 10 years,” the OTH experts noted.

■ In February, for example, German transmission grid operator Amprion GmbH and European pipeline owner Open Grid Europe announced a 100-MW electrolysis plant along with dedicated hydrogen infrastructure in Emsland, Germany. The partners expect project costs for the “Hybridge” project will hover around €150 million. “We want to successfully implement this technology for the German economy on an industrial scale. We have everything we need: a technical concept, a suitable location and potential hydrogen users. We’re ready to start,” said Dr. Thomas Hüwener, a board member at OGE. If the project receives necessary approvals, it could begin operations by 2023.

■ Last December, industrial hydrogen producer H2V contracted GE Power’s Grid Solutions business for turnkey supply of two 225 kV/30 kV substations to feed the first 100-MW H2V Industry production units near Le Havre and Dunkirk, France. The two projects will feature 26 electrolyzers supplied by HydrogenPro and produce an average 14,000 tonnes of hydrogen per year. The Dunkirk project could be expanded to 500 MW, and the first unit is scheduled to be online in 2021.

■ Grid operators TenneT Netherlands, TenneT Germany, Energinet, Gasunie, and the Port of Rotterdam, which make up the North Sea Wind Power Hub (NSWPH), want to build one or more hubs at a suitable location in the North Sea with interconnections for 12 GW of offshore wind to bordering Denmark, The Netherlands, and Germany. The project, which could be completed after 2035, will employ P2G technology to couple wind to the the regional gas system.

A prominent driver for the scale ramp-up is soaring demand for renewable hydrogen, which is backed by policy rooted in P2G’s potential to decarbonize multiple sectors. This October, for example, Siemens and Hydrogen Renewables Australia introduced a massive project—the Murchison Renewable Hydrogen Project in Western Australia—that could use up to 5 GW of solar and wind generation to power Siemens’ Silyzer electrolyzer and produce hydrogen for gas pipeline injection—and later, to export to gas-hungry Asian markets, notably Japan and South Korea.

Another driver involves falling costs for electrolyzer technology. According to the International Energy Agency (IEA), electrolyzer stacks are responsible for 50% and 60% of the capital expenditure (CAPEX) costs of alkaline and PEM electrolyzers, respectively, while power electronics, gas-conditioning, and plant components account for most of the remainder. Today, CAPEX requirements range from $500 to $1,400/kWe for alkaline electrolyzers; $1,100 to $1,800/kWe for PEM electrolyzers; and an estimated $2,800 to $5,600/kWe for SOEC. By 2050, costs for high-temperature electrolysis could plunge 85%, predict the OTH experts. Echoing the IEA, the experts peg future cost declines on increased automation, economies of scale, production capacities, as well as technology advancements.

As the Oxford Institute points out, P2G’s other challenges surround its heavy water consumption. “A life cycle analysis of water consumption required for hydrogen production shows that around 10 U.S. gallons (38 kilograms) water is required per kilogram hydrogen production from electrolysis,” it noted. Locational constraints, and perhaps most significantly, its conversion efficiency, are also key hurdles. At this early stage of deployment, “there is a wide range of system losses and overall conversion efficiencies (that is: energy output as a percentage of energy input) from the P2G chain,” it said. Broadly, conversion efficiency of production of hydrogen from P2G ranges from 50% to 75%, and adding a methanation step reduces that efficiency by about 10 percentage points, it said. Owing to technology advancements as the technology matures, conversion efficiencies could also markedly improve over the long-term.

Despite current high costs and conversion losses, “Exponential development of the technology concerning cost on one hand and installed capacity on the other indicate, that market implementation of [power-to-gas] is under way,” concluded the OTH experts.

The Oxford Institute, too, offered measured optimism for the fledgling technology’s future. “The first challenge for the industry is to start a process to scale up the technology to demonstrate further the potential for cost reductions and how P2G could play an expanded role in the decarbonising energy system,” it said. “Whichever route is followed, P2G can also play the additional role of providing seasonal storage to help balance an electricity system increasingly reliant on intermittent renewables.” ■

—Sonal Patel is a POWER senior associate editor (@sonalcpatel, @POWERmagazine)