What Is ERCOT and What Does It Do?

To understand what the Electric Reliability Council of Texas (ERCOT) is, it helps to understand how the North American electric power system is configured. The contiguous U.S. is comprised of three power grids or “interconnections.” The Eastern Interconnection reaches from central Canada eastward to the Atlantic coast (excluding Québec), south to Florida, and west to the foot of the Rockies (excluding most of Texas). The Western Interconnection stretches from western Canada south to Baja California in Mexico, reaching eastward over the Rockies to the Great Plains. Meanwhile, the Texas Interconnection covers most of the state of Texas.

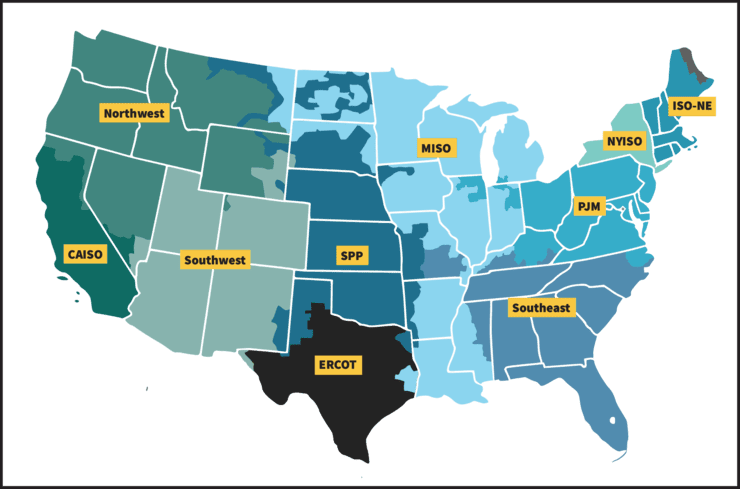

In many parts of the country, including most of Texas, California, New York, New England, and the Midwestern states, independent system operators (ISOs) and regional transmission organizations (RTOs) manage grid operations (Figure 1). ISOs grew out of Federal Energy Regulatory Commission (FERC) Orders 888 and 889, both of which were issued on April 24, 1996. In the orders, the commission suggested the concept of an ISO as one way for existing tight power pools to satisfy the requirement of providing non-discriminatory access to transmission. Subsequently, in FERC Order No. 2000, issued on Dec. 20, 1999, the commission encouraged the voluntary formation of RTOs to administer the transmission grid on a regional basis throughout North America, including Canada.

Nonetheless, traditional wholesale electricity markets still exist, primarily in the southeastern, southwestern, and northwestern U.S. In these regions, utilities have remained mostly vertically integrated, meaning, they own the generation, transmission, and distribution systems used to serve electricity consumers. Thus, they are responsible for system operations and management, and, typically, for providing power to retail customers.

The Texas Interconnection

ERCOT was founded in 1970. It was designated as an ISO in 1996, and ERCOT provided the platform upon which Texas’ electric utility industry made the transition to retail competition on Jan. 1, 2002.

As the ISO for the Texas Interconnection, ERCOT currently manages the flow of electric power to more than 26 million Texas customers—representing about 90% of the state’s electric load. ERCOT schedules power for an electric grid that connects more than 52,700 miles of transmission lines and 1,100 generation units, including private use networks. It also performs financial settlement for the competitive wholesale bulk-power market and administers retail switching for 8 million premises in competitive choice areas, according to a fact sheet published by ERCOT in November 2023.

ERCOT is a membership-based 501(c)(4) nonprofit corporation, governed by a board of directors and subject to oversight by the Public Utility Commission of Texas (PUCT) and the Texas Legislature. Its members include consumers, cooperatives, generators, power marketers, retail electric providers, investor-owned electric utilities, transmission and distribution providers, and municipally owned electric utilities.

“At its core, ERCOT is about reliable system operation,” Scott Bruns, director of Power Markets with Enverus, said during a webinar hosted by POWER. “What that means is that ERCOT maintains the grid and makes sure that the most precious commodity that we have in Texas, which is the energy and electricity grid, never goes down.”

While the primary goal of ERCOT may be to maintain the reliability of the grid, as Bruns suggested, which involves balancing electricity supply and demand in real-time and ensuring stable grid operation (Figure 2), it also performs several other functions. In his presentation, Bruns outlined five additional roles ERCOT plays, which are:

- To Facilitate Competition. ERCOT operates a competitive wholesale electricity market. It aims to foster competition among generators and other market participants, which reduces costs for consumers.

- To Manage Electricity Flow. A key function of ERCOT is managing the flow of electricity from generators to consumers.

- To Ensure Grid Modernization. ERCOT is responsible for the planning and study of new generation, loads, and the transmission lines that enable a modern reliable power grid.

- To Confirm Regulatory and Standards Compliance. ERCOT must ensure compliance with national and state regulations. In partnership with market participants, ERCOT codifies the standards.

- To Respond to and Manage Emergency and Crisis Situations. ERCOT is responsible for implementing emergency procedures during crises, such as extreme weather events, ensuring the continuity of power and minimizing disruptions to the grid.

What ERCOT Doesn’t Do

Bruns said many consumers have misconceptions about ERCOT. As such, he wanted to clear the air concerning some of the things ERCOT does not do. For example, ERCOT does not set retail electricity rates. Rates are determined in Texas by retail electric providers (REPs) and are influenced by various market factors. Furthermore, ERCOT doesn’t bill consumers—that’s also handled by individual REPs.

ERCOT does not own any power generation facilities. It simply coordinates independent power producers, who own and operate those facilities. ERCOT also does not sell electricity directly to consumers. It merely calculates the price at which buyers and sellers in the wholesale market agree to trade the next unit of electricity.

While ERCOT manages grid stability, it does not directly control power outages at the consumer level. Outages are managed by local utilities, and/or transmission and distribution service providers. ERCOT doesn’t decide the energy mix used in Texas either. This is determined by market dynamics and generator owner decisions.

ERCOT doesn’t build or maintain the physical electricity grid. This responsibility lies with transmission and distribution utilities. And last, but not least, ERCOT does not create energy policies. It operates within the framework of the PUCT, federal regulation, and policies set by the Texas Legislature.

The ERCOT System

The generation mix in ERCOT’s system relies heavily on natural gas–fired power and wind energy. On its November 2023 fact sheet, ERCOT reported 41.8% of its more than 98-GW generating capacity in the summer of 2023 was fueled by natural gas. Wind accounted for 28.6% of the capacity, while solar (11.0%), coal (10.8%), and nuclear (4.0%) filled the majority of the rest.

However, it’s important to understand that power capacity does not equal energy production. The intermittency of solar and wind resources mean they do not produce at the same capacity factors as a baseloaded nuclear plant, for example, or some of the more regularly dispatched gas and coal units.

Bruns noted that energy consumption from ERCOT’s grid has changed quite dramatically over the years. Coal-fired generation is down 38% since 2018, now filling only 14% of the mix due to retirements and stiff competition from renewables. Solar production has climbed from 1% in 2018 to 10% of the daytime mix today. Wind production averages about 24% of the total mix, but varies from 21% by day to about 32% overnight. Meanwhile, nuclear has been a consistent filler of 9% to 10% of the energy mix since the early 1990s.

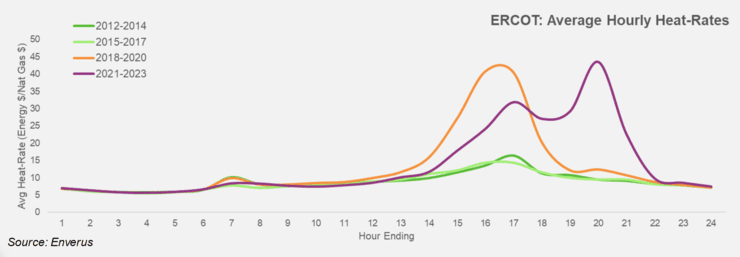

Enverus reports more than 15 GW of new solar generation has been added to the ERCOT grid since 2020. “ERCOT has had a bloom of solar over the past 18 months, and with that bloom of solar, it has shifted our evening peak, which is the time of day where the net demand is the highest,” said Bruns. In his presentation, Bruns revealed a chart showing the impact of this shift on wholesale prices (Figure 3).

Managing Potential Shortfalls

One mechanism the PUCT directed ERCOT to implement in an effort to improve reliability was a reliability adder, known as ORDC, which stands for Operating Reserve Demand Curve. ERCOT does not have a capacity market to incentivize generation for being available when it is needed. In lieu of a capacity market, the ORDC was developed to incentivize additional capacity. In the longer term, this mechanism acts as a price signal for investment into new generation that can take advantage of these adders.

Bruns explained that the ORDC rewards traditional capacity and investment in new technologies, such as batteries, and nimble quick-start thermal units, such as LM6000 gas turbines, which are often used as peaking units. The calculation of ORDC is complex and took many years of workshops to be formalized. In its essence, Bruns said, as system reserves begin to fall, the ORDC adder starts to kick in. It begins in small amounts—pennies added to the systemwide wholesale price. As reserves get closer to a predefined level, called the minimum contingency level, the adder grows quickly to top out at the price cap.

To address the intermittency issue, ERCOT launched the ERCOT Contingency Reserve Service (ECRS) in June 2023. In rolling out the service, ERCOT said the ECRS will “complement and provide support to the four procured Ancillary Services ERCOT currently uses: Regulation Up, Regulation Down, Responsive Reserve Service and Non-Spin Reserve Service.”

Bruns explained the ECRS allows ERCOT to hold offline a certain segment of generation that has the ability to dispatch for at least two hours to be available to maintain system reliability when solar goes offline at dusk. Prior to ECRS implementation, it was a significant challenge for thermal assets to backfill the gap.

The Cost of Reliability

The ORDC calculation has been tweaked a few times since implementation on Jan. 1, 2022. Michael Enger, interim vice president of Energy Market Operations and Resource Planning with Austin Energy, who also participated in the webinar hosted by POWER, said the ORDC has had less of an impact on customers than the ECRS, which has caused retail prices to increase.

“A generator can only go from 50 MW to 100 MW so fast. So, oftentimes, the sun is coming down maybe faster than we have ramping capacity, which then allows the batteries to set the price,” Enger explained. “What we saw this year was a large proportion of those batteries were putting their offer curves right at the cap or near the cap at $5,000.” Enger said this behavior increased the cost to all Texans by $1.8 billion over four days during the summer of 2023, based on an ERCOT report that he cited, which compared prices to the cost associated with a $150 cap.

Enger also noted that the cost for ancillary services (AS) have skyrocketed due to ECRS. “In August, the cost of all the AS was $808 million in ERCOT. If you look back at August 2022 and August 2021, each one of those months was right around $75 to $80 million—so, 10x has occurred—$400 million of that was ECRS,” he said. “Those are costs borne by load. Load is the one that has obligations for ancillary services. So, it’s a little bit of a boon for some of those generators, which will help make them more economic, but for all the consumers in Texas, it’s increased costs.”

Room for Improvement

Bruns suggested future changes could solve some of ERCOT’s problems. He said implementing Real-Time Co-optimization (RTC), which is a key market design feature that most other ISOs already have in place, could help. RTC would create a market in which ERCOT dispatches energy and ancillaries at the same time with the same model. RTC doesn’t appear to be a quick fix, however. In a presentation given during the Technology and Security Committee Meeting on Dec. 18, 2023, by ERCOT Vice President and Chief Information Officer Jayapal Parakkuth, the timeline for RTC to go live was March 2026.

Bruns also mentioned the Performance Credit Mechanism (PCM) electric market design option, which the PUCT voted unanimously in January 2023 to adopt. In a statement issued by the PUCT, it says, “the PCM market design meets the requirements of Senate Bill 3, as passed by the 87th Texas Legislature and signed into law by Governor Greg Abbott, which directs the PUCT to create grid reliability standards that ensure on-demand generation is available ‘during times of low non-dispatchable power production.’ ” While the specifics are still vague, Bruns expects the PCM to potentially be an offset to some of the ORDC adjustments that have been made.

ERCOT has endured several weather-related challenges in recent history, but its system seems to have emerged stronger and more resilient as a result, having incorporated many corrective actions based on the lessons learned. ERCOT says its vision is to “lead with independent insight on the future of electricity reliability, markets and technology in Texas in order to facilitate grid and market change for the benefit of all stakeholders.” The power grid is constantly changing, with renewable energy resources being added daily. ERCOT will undoubtedly be required to continue changing with it.

—Aaron Larson is POWER’s executive editor (@POWERmagazine).