U.S. Natural Gas Supplies High, Prices at Record Low

The winter heating season, which is often defined as November through March in the U.S., is coming to an end with natural gas inventories 37% above the five-year average, according to the U.S. Energy Information Administration (EIA). Reduced consumption in the residential and commercial sectors this winter has been blamed for the high natural gas inventory.

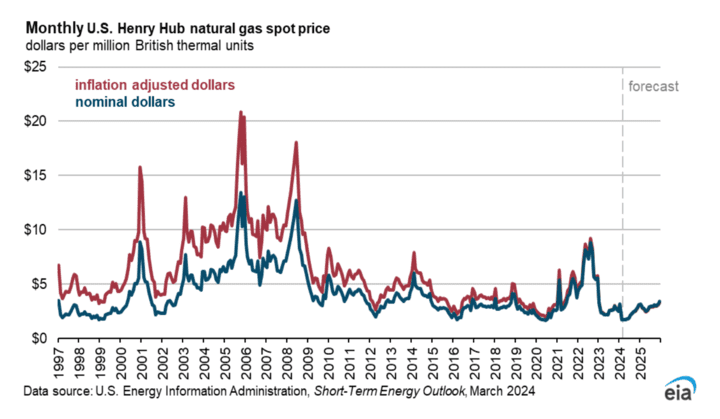

Meanwhile, high inventories have resulted in very low prices for natural gas. The EIA said the Henry Hub spot price averaged $1.72/MMBtu in February (Figure 1), a record low (when adjusted for inflation) and significantly less than the EIA had predicted it would average (about $2.40) just a month ago. The Henry Hub is a nexus of interconnections in Erath, Louisiana, which gas insiders consider a benchmark for the market due to the ready access to interstate and intrastate pipelines available at the location. The EIA said it expects the Henry Hub spot price to remain below $2.00/MMBtu in the second quarter of the year (2Q24).

“Some producers have announced curtailments in production or reductions in upstream spending on natural gas-directed activities this year,” EIA Administrator Joe DeCarolis said in a statement issued with the release of the EIA’s March Short-Term Energy Outlook (STEO) report. “But with so much domestic natural gas production tied to growing crude oil production, we expect natural gas production to decrease far more slowly than prices have.”

The STEO predicts strong increases in solar electricity generation both this year and next. It says the electric power sector added 19 GW of solar capacity in 2023, and it expects that number to almost double this year (36 GW) and remain fairly steady in 2025 (35 GW). “With this new capacity, we expect solar will provide 6% of total U.S. electricity generation in 2024 and 7% in 2025, up from a share of 4% in 2023,” the STEO says.

Meanwhile, fossil-fueled power generation is expected to suffer as a result. “We expect the share of U.S. generation fueled by natural gas will fall from an average of 42% in 2023 to 41% in 2025, while the U.S. coal generation share falls from 17% last year to 14% by 2025,” the report says. The EIA does not expect low gas prices to lead to significantly more electricity generation fueled by natural gas. The reason is that significant coal plant retirements over the past few years have left “the most efficient coal plants still in operation,” which it expects will mostly continue running even if natural gas prices are low.

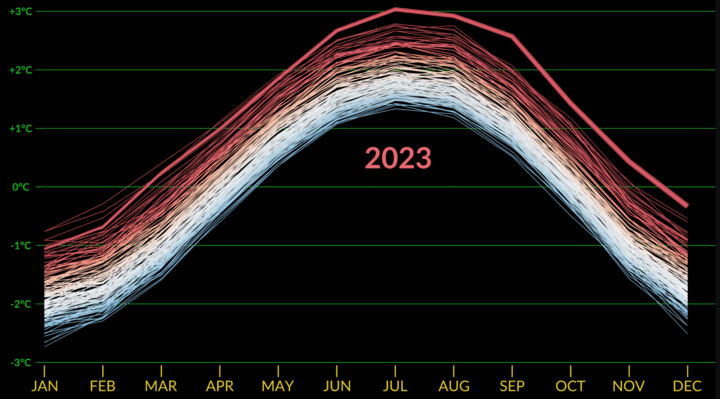

Notably, the STEO says sales of electricity to U.S. end-use customers are forecast to increase by 2% in 2024 and by 1% in 2025 after falling by 2% in 2023. The EIA said it expects a warmer summer this year “with 7% more forecast cooling degree days in 2Q24 and 3Q24 than the same quarters in 2023.” This is somewhat surprising considering 2023 was reported to be the hottest year on record. Scientists who maintain the world’s temperature records announced in mid-January that every month from June through December 2023 came in as the hottest on record for each of the months. In fact, July 2023 ranked as the hottest month ever recorded (Figure 2).

—Aaron Larson is POWER’s executive editor (@POWERmagazine).