Trends Suggest New Directions for Global Hydropower

While hydropower installations worldwide fell slightly in 2016 to 31.5 GW compared to 33 GW in 2015, the sector marked a colossal jump in pumped storage installations last year, the International Hydropower Association (IHA) reported in a briefing surveying key trends in hydropower released this March.

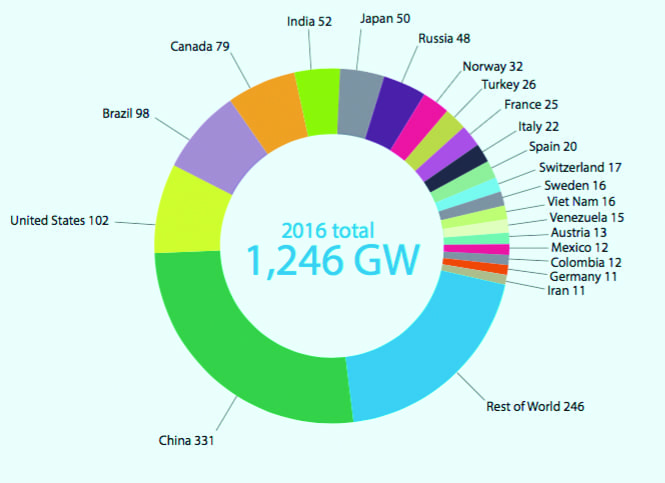

The organization pegged the hydropower installation decrease to a slowdown of development of new projects in China, a country that is generally seeing a generation capacity glut. China has the world’s most hydropower capacity, with 331 GW in service at the end of 2016 (Figure 3). But in 2016, the country started up only 11.7 GW of new hydropower projects, including 3.7 GW of pumped storage. That compares with 19.4 GW of new capacity installed in 2015 and 21.9 GW in 2014.

|

| 3. Global total installed hydropower capacity (GW) by country at the end of 2016, including pumped storage. Courtesy: International Hydropower Association |

Last year, Brazil contributed a total of 6.4 GW, bringing online a handful of projects, including the 3.7-GW Jirau plant. Other countries leading installations worldwide were: Ecuador (2 GW), Ethiopia (1.5 GW), South Africa (1.3 GW), Vietnam (1.1 GW), Peru (1 GW), and Switzerland (1 GW). Drivers for hydropower’s growth include a general increase in demand for renewable power as countries seek to meet carbon reduction goals set out in the Paris Agreement, the IHA said.

A noteworthy development highlighted by the organization was that about 6.4 GW of pumped storage systems were installed worldwide in 2016—more than twice the 2.5 GW installed in 2015 (see this issue’s “THE BIG PICTURE: Pumped Storage”). The surge in pumped storage system installations is in tandem with soaring interest in energy storage technologies to support the integration of variable generation and support grid stability, it noted. Projects brought online last year include three of four units at Eskom’s Ingula Pumped Storage Scheme (Figure 4) in South Africa.

In its assessment of key trends, the IHA suggested that momentum is building for the establishment of a support facility for hydropower project preparation. Such a facility, it said, would optimize private sector engagement by managing a revolving fund to support the selection of the most appropriate project type and location according to the local context. It also noted that it is seeing an uptick of floating photovoltaic projects on hydropower reservoirs, as well as surging interest from major energy companies in China, Japan, Russia, and South Korea around the creation of an “Asian Super Grid,” in which an ultra-high-voltage grid would link electric grids across regions, countries, and continents.

It also said asset management is becoming increasingly challenging across the sector as a growing number of hydropower assets reach the end of their expected life. “By 2050, it is estimated that roughly half of the entire fleet of existing hydropower equipment will require modernisation,” the IHA said. “The digitisation of hydropower plants, control systems and surrounding networks is an emerging industry trend that promises to optimise asset management and performance.” Digital innovations include cybersecurity, plant and fleet optimization, outage management, condition monitoring equipment, and energy forecasting.

Finally, the IHA noted that financing institutions are seeking to address climate-related risk by ensuring projects are planned and operated to be resilient to climate change. The World Bank, for example, has launched a study to develop guidelines for designing resilient projects and enabling them to take advantage of opportunities arising from climate change.

—Sonal Patel is a POWER associate editor