EU Power Markets Show Improvements After Bucking Reliance on Russian Gas

European Union (EU) electricity markets appear to be successfully bucking their reliance on Russian gas. Several recent reports point to improved market fundamentals in the region, suggesting the region is on track to overcome the crippling energy crisis it suffered last year.

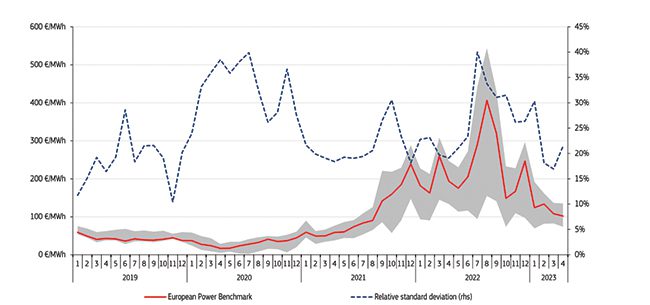

The European Commission (EC) in a report published on Oct. 5 said that compared to a spike in power prices during the third and fourth quarters of 2022, the European Power Benchmark averaged €122/MWh ($130/MWh) over the first three months of 2023. That’s “40% lower than in the same period twelve months earlier,” it noted (Figure 1). “The highest prices during the quarter were recorded in Italy and Greece (€158/MWh and €157/MWh, respectively) and these were 37% and 34% lower than in the first quarter of the previous year,” it said.

|

|

On a yearly basis, 26 member states “experienced a decline in prices in their wholesale electricity markets (ranging from –57% to –11%),” it added. “The largest year-on-year price falls in member states were registered in Spain and Portugal (–57%) and France and Croatia (–43%).”

Downward Trend in Wholesale Gas Prices

The EC said that the price decreases were partly driven by a downward trend in wholesale gas prices. Prices fell from an all-time high of €320/MWh recorded on Aug. 26, 2022, to an average spot price of €53/MWh. Among key trends the EC highlighted is that Russia’s share of total gas imports in the EU (pipeline gas and liquefied natural gas [LNG]) dropped 42% in the same period last year.

Representing a possible trend, total EU pipeline imports also fell nearly 32% year-to-year. Norway remained the EU’s largest pipeline gas exporter, sending more than 21.7 billion cubic meters (bcm), or 53% of the EU’s total, followed by North Africa (18%, 7.3 bcm), and Russia (12%, 5 bcm). LNG, meanwhile, accounted for 42% of EU gas imports, a significant increase from 33% a year earlier. The U.S. supplied 41.5% of the EU’s LNG imports, but it was followed by Russia (19%) and Qatar (12%). “The EU remained the number one LNG importer in the world with 31.2 bcm or 22% of global LNG import, followed by Japan and China,” the EC noted.

Data-driven energy think-tank Ember in a September report said these trends followed a similar trajectory through the first half of 2023. It said power prices averaged €107/MWh from January to June 2023. That represented a drop of more than 40% compared to the same period in 2022 (€185/MWh), but it’s still “twice the price in the first half of 2021 (€55/MWh),” it noted.

The think tank also underscored falling natural gas prices. “With an average of €44/MWh from January to June 2023, gas prices have fallen by more than 50% compared with the levels seen in the same period last year (€97/MWh). However, they are still double the prices in the first half of 2021 (€22/MWh),” it said. Ember warned that gas is poised to remain costly for EU markets at least through the rest of this year owing to “the threat of curtailed LNG supplies from Australia.” It serves as a “reminder that the risks of gas price surges remain, increasing as winter and the heating season approach,” it noted.

Shifting Fundamentals

The EC noted falling electricity consumption is a key driver of shifting fundamentals. The EC reported demand in the first quarter fell 6% compared with last year’s levels. “Demand levels for the first quarter of 2023 were also well below the 2017–2021 range, registering the lowest value in February 2023,” it noted. Ember suggested demand fell 5% overall in the first half of 2023.

Ember, however, highlighted several significant trends in the EU’s power mix. “Between January and June, fossil fuels generated 410 TWh in the EU, making up the lowest-ever 33% of demand,” it said. “This collapse was led by coal, which fell by a staggering 23% (–49 TWh) in the EU in the first half of the year, while gas decreased by 13% year-on-year.” In May, notably, coal power “set a record” by generating less than 10% of the EU’s electricity generation for the first time ever, it said.

Coal’s decline was partly offset by a 13% (13 TWh) growth in solar power compared to the same period in 2022. Wind generation also rose by 5% (10 TWh). “Following the rapid expansion of renewables ambition in recent years, both the EU and individual countries continue to break records. Wind and solar accounted for more than 30% of electricity production in the EU for the first time in both May and July, and surpassed total fossil generation in May,” it noted.

Hydropower played a heftier role with an 11% (15 TWh) recovery compared to last year. “This was driven by significantly higher output in Southern Europe and the Baltic States, while Nordic countries’ performance has been similar to 2022 but lower than 2021,” Ember said. Hydropower has suffered increasingly “poor and volatile” output since 2000, stricken by severe droughts, it noted.

Nuclear generation in the EU also fell in the first half of 2023 compared to the same period last year. The drop was precipitated by Germany’s nuclear phase out, a closure of Belgium’s Tihange 2, outages in Sweden, and closures of France’s fleet related to stress corrosion issues. France, notably, took offline more than half of its 56-reactor fleet when it discovered 16 reactors were affected by stress corrosion issues. In October, EDF reported that its nuclear generation since the start of 2023 had jumped 11.4% compared to last year, and that it expects to produce 300–330 TWh this year and 315–345 TWh in 2024. The start of Finland’s Olkiluoto 3 is expected to partially offset closures.

—Sonal Patel is a POWER senior associate editor (@sonalcpatel, @POWERmagazine).