Moving Toward a Hydrogen Economy in the U.S. and Beyond

While using low-carbon hydrogen is not a viable economic option in most markets today, the wheels are set in motion for hydrogen to support the decarbonization of the world’s energy supply. It is a journey that will take time but is necessary if we want to achieve carbon-neutrality by mid-century. This article provides an outlook on how the hydrogen economy can be expected to unfold regionally in the U.S. as well as globally.

Though it may not be the golden age of hydrogen, its time has certainly come. Just look at the U.S. There, the Infrastructure Investment and Jobs Act, passed in 2021, appropriated $9.5 billion for clean hydrogen, while the Inflation Reduction Act (IRA) the following year created additional policies and incentives.

Other countries are also pushing low-carbon hydrogen and other clean fuels. For example, the European Union has several programs supporting hydrogen, such as the Clean Hydrogen Partnership and the European Clean Hydrogen Alliance. Likewise, China plans to get 50,000 hydrogen fuel cell vehicles on the road by 2035. In addition, China will use hydrogen for energy storage, electricity generation, and industry. Overall, there are 25 countries worldwide that have launched national hydrogen initiatives.

The Power of the Universe’s Most Abundant Element

What’s behind all this is a simple assessment. First and foremost, green hydrogen, but also other clean fuels such as bioethanol, biodiesel, and e-ammonia, will be critical success factors for the energy transition of the world’s economies. They are necessary for decarbonizing economies that to this day rely heavily on fossil fuels, and by extension, are crucial for fighting climate change. At the same time, hydrogen is an essential building block for ensuring the energy security of countries in the coming years. While hydrogen needs extensive infrastructure to concentrate it at high volumes in pure form, it is also the world’s most abundant element and it is available virtually everywhere.

Generally speaking, though, how will a hydrogen economy materialize, in the U.S. and elsewhere? And more specifically, how can we expect green hydrogen to decarbonize various parts of the economy, such as transportation, heavy industries, and especially power generation?

New Gas Turbines Must Be Ready to Burn Hydrogen

When it comes to the current state of hydrogen, there is good news. While the majority of new energy generation is built using renewables, we will still need gas power plants to supply dispatchable energy for the times when the wind doesn’t blow and the sun doesn’t shine. However, while gas is a low-carbon fuel, it is not carbon-free. And so, hydrogen is a carbon-free alternative to natural gas in power plants.

To be prepared for that transition, any new gas power plant requires hydrogen-ready gas turbines, capable of burning hydrogen mixes and eventually 100vol% (100% hydrogen by volume) for emission-free energy generation. Industrial gas turbines capable of pure hydrogen operation, such as Siemens Energy’s SGT-800 and SGT-400, are already “in sight.” In addition, original equipment manufacturers such as Siemens Energy have also announced they are working toward making all gas turbine frames 100% hydrogen-capable starting in 2030.

Building a Hydrogen Infrastructure

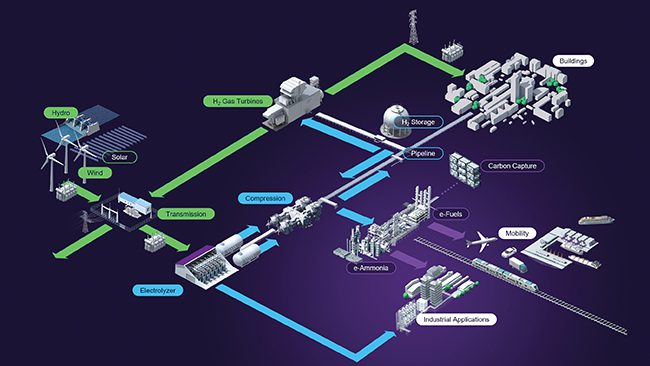

Still, hydrogen-ready gas turbines alone don’t make up an entire hydrogen economy. What is lacking is infrastructure (Figure 1), and more specifically, production capacity for hydrogen. Due to this scarcity, prices are still high. Likewise, sufficient hydrogen pipelines, transportation capacity, and storage facilities are lacking in most places. And where companies are pushing for building the necessary infrastructure, another hurdle exists—the permit process is lengthy and difficult in the U.S. and in other countries.

|

|

1. Additional hydrogen infrastructure is needed to fully capitalize on the benefits of green and blue hydrogen. Courtesy: Siemens Energy |

But that doesn’t mean the industry is idle. On the contrary, pioneering hydrogen infrastructure is being built virtually all around the globe. In the U.S., for example, existing hydrogen infrastructure will be expanded. This includes building out six to 10 clean hydrogen hubs, supported by up to $7 billion from the federal government. Part of this expansion includes work on the existing U.S. Gulf Coast hydrogen network, one of the largest in the world, spanning approximately 300 miles from Freeport, Texas, to Lake Charles, Louisiana.

Other existing hydrogen infrastructure exists, such as in the Chemical Triangle in the German state of Saxony-Anhalt. Others are in the works, such as H2Benelux or the Hydrogen Valley in Britain. Governments around the world are also considering converting existing natural gas pipelines for the transport of hydrogen, as is also the case with liquified natural gas (LNG) terminals. But key to all these projects is large H 2 offtakers such as the steel, fertilizer, mobility, and power industries.

Infrastructure as an Enabler

One target of this buildup is the heavy use of fossil fuels for processes that cannot be easily electrified. That includes, among other things, heat generation in hard-to-abate industries such as steel and cement. For example, the Salcos project aims to nearly eliminate the use of natural gas with the help of green hydrogen.

Another application area is the replacement of fossil feedstock in the chemical industry, such as using green hydrogen to produce methanol. Finally, green hydrogen can also be used to produce various types of synthetic fuels like e-kerosene, e-methanol, and e-gasoline, which supports the decarbonization of the aviation, shipping, and heavy-road transport industry. One example is Haru Oni in Chile, the world’s first integrated industrial-scale hydrogen plant for making synthetic climate-neutral fuels. All this is attractive to corporations that have committed themselves publicly—alongside governments—to reach carbon neutrality by mid-century, such as General Motors, Cemex (a cement manufacturer), and Honeywell, just to name a few among many.

Looking Forward: Power Plants

These industrial markets have commercially lower hydrogen breakeven prices and should therefore materialize first. But the use of hydrogen in power plants should also pick up due to the regulatory pressure to fully decarbonize the power sector, which will see conventional fuels become more expensive due to CO 2 penalties. Several countries have also pledged to become carbon-neutral before 2050. Sweden and Germany, for example, are aiming for 2045. The Group of Seven (G7) leading industrial nations, meanwhile, committed to decarbonize their power sector by 2035.

And while the U.S. intends to reach overall net zero emissions by 2050, it has also set a goal of carbon-pollution-free electricity by 2035. In addition, the U.S. Environmental Protection Agency (EPA) proposed a new emission regulation that will implement nearly 100vol% cofiring of low-carbon hydrogen in the power sector by 2038. In line with this, Siemens Energy has observed increased interest in both industrial and heavy-duty size turbines capable of firing 100vol% hydrogen.

Opening the Door for Hydrogen-Ready Power Plants

This push for decarbonization in the power sector lays the groundwork for hydrogen-ready gas-fired power plants. Today, more and more of the global electricity demand is met by renewables. In addition, many countries still see nuclear as an important supplier of baseload power. However, gas-fired power plants can be used for residual load when renewable output wanes or when demand peaks.

The natural gas these power plants use today should be considered as a transition gas to clean fuels such as green hydrogen. In fact, the demand for natural gas is expected to increase its share of global energy demand over the next 10 to 15 years, making it the only fossil fuel with an upward trajectory. To prepare for this transition, given a gas turbine’s lifecycle, it makes sense to start installing new hydrogen-ready gas turbines, or modify existing turbines to make them hydrogen-ready. They can be retrofitted quickly once low-carbon hydrogen becomes available at scale and for a reasonable cost.

The Color Shades of Hydrogen

It is worth noting that not all hydrogen is cut from the same cloth. Hydrogen is classified by different colors, from blue to yellow to pink to turquoise, depending on the production path. Currently, more than 90% of hydrogen is produced conventionally from natural gas with steam gas reforming (grey), lignite (brown), or bituminous coal (black) using coal gasification. These processes are the most carbon intensive.

The next step is blue hydrogen produced from natural gas with most of the generated CO2 captured and sequestered in underground aquifers, depleted oil and gas fields, or used in industry. Finally, green hydrogen is produced with zero CO2 emissions, such as with electrolysis using electricity from 100% renewable sources.

According to the International Energy Agency’s special report Net Zero by 2050: A Roadmap for the Global Energy Sector, blue and green hydrogen are the future—and they will coexist for a considerable timespan. By 2050, approximately half of hydrogen production is predicted to come from reforming of fossil fuels with CCS (carbon capture and storage, blue) and half from renewable sources (green), with green hydrogen becoming more competitive over time.

A Path Forward for Hydrogen

Clearly, there is a path not just for the industrial use of hydrogen, but for gas power plants as well. And while on pure commercial grounds wide adoption of hydrogen would not be expected to happen this decade, regulatory measures and programs like the IRA will help to achieve positive business cases within the next few years.

|

|

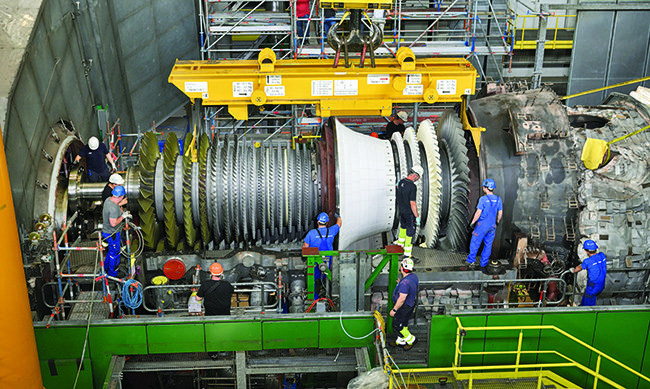

2. The Donaustadt combined heat and power plant is one of Austria’s largest thermal power stations. Originally fired by natural gas, it is being upgraded to run on blended hydrogen. It is one of the first such upgrades of a major heavy-duty gas turbine in commercial operation. Courtesy: Wien Energie/Johannes Zinner |

So, it is unsurprising that the groundworks for the re-electrification of hydrogen are already being laid down. There are smaller demonstration and pilot projects, such as Hyflexpower, an industrial power plant at a paper factory in Saillat-sur-Vienne in France, which has successfully tested cofiring hydrogen. In the beginning of 2023, a large Siemens Energy SGT6-6000G turbine, with only minor modifications, also operated on a blend of 38vol% hydrogen in a power plant in the U.S., making it the largest operating gas turbine in the world to achieve this percent blend. And finally, at the Austrian Donaustadt combined heat and power plant (Figure 2), the first test run with a fuel blend of 15vol% hydrogen took place in July 2023. For the next stage, the test will double the hydrogen content to 30vol%.

It Will Take Time—but Must Still Be Fast-Tracked

Finally, while nothing we achieve this decade will be enough, today’s progress will be critical to the eventual success of hydrogen adoption. And we need to be patient. Today, we should neither be surprised nor disheartened by the status quo. We are just at the beginning of utilizing hydrogen to decarbonize our emissions-intensive economy. And just as oil infrastructure was built over many decades, hydrogen infrastructure will also take time. Still, it is essential that we fast track its development.

—Chris Ferraro is head for New Products, North America, at Siemens Energy.