From artificial intelligence-driven efficiency to transmission bottlenecks, power industry insiders share their perspectives on the opportunities and obstacles shaping 2026 and beyond.

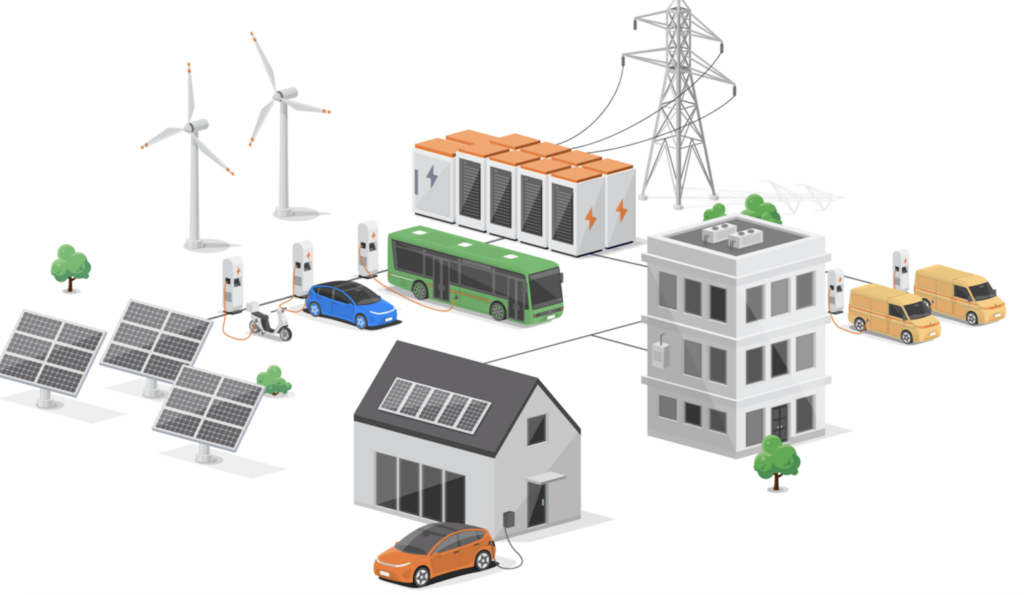

The power generation sector enters 2026 at a critical inflection point. Electricity demand is surging—driven by data centers, manufacturing reshoring, and transportation electrification—even as the industry navigates an unprecedented transformation in how power is generated, transmitted, and consumed. Utilities and independent power producers face the dual challenge of maintaining grid reliability while transitioning to cleaner energy sources, all amid regulatory uncertainty and shifting market dynamics.

This year promises to be pivotal for decisions that will shape the industry’s trajectory for decades. From the continued buildout of renewable capacity to the integration of artificial intelligence (AI) into grid management, 2026 will test the sector’s ability to balance innovation with pragmatism.

AI Enhances Efficiency

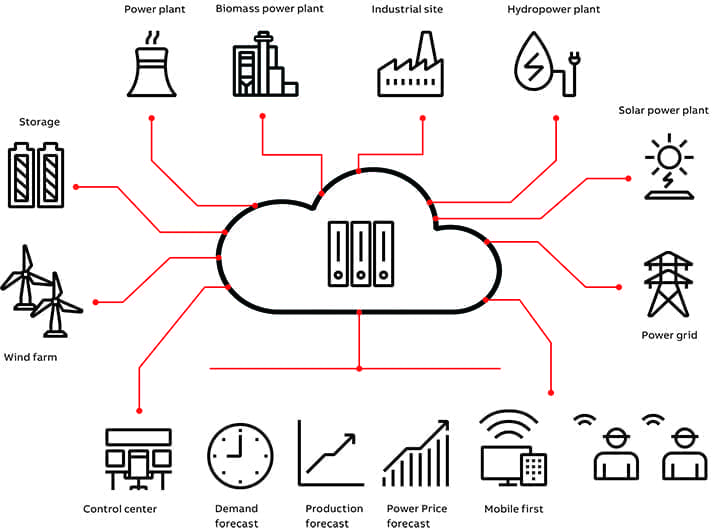

“The grid will become even more AI-enabled in the next year as AI becomes necessary for utilities to be more efficient,” Pradeep Tagare, head of Investments with National Grid Partners, told POWER. “In our recent Utility Innovation Survey, we saw this in real time: utilities are no longer treating AI as ‘nice to have,’ but rather as a strategic tool to manage load growth, enable reliability, and accelerate grid expansion. Due to the pressures that the electrification of heating, transport, and data center expansion place on the grid, AI-driven forecasting, risk mitigation, and infrastructure planning tools will become essential.”

Albert Hofeldt, Chief Product Officer with Power Factors, said optimization has always been a priority for renewable energy operators, but it has taken on a new significance over the past few years. “Returns for renewable energy projects are shrinking, a sign of our current economic context and a signal of maturity for the market. Rising interest rates have increased the cost of capital, while financial support from state and federal governments disappear, pushing costs back onto developers. The renewable energy market is mature enough now to handle these changes, but it increases the pressure to build a bulletproof business model. In many cases, renewable energy companies are realizing that improving production and reducing future costs can actually deliver a greater and safer return over time than a new development,” he told POWER.

“Machine learning and AI have a big role to play in increasing production from existing assets,” Hofeldt added. “AI can predict issues with underperforming assets earlier, making it possible to conduct maintenance with less downtime, ultimately maximizing energy production and revenue. It can also identify the root cause of underperformance, helping operators prioritize issues quickly and plan maintenance so that the highest-impact fixes are done first.”

How Much Power Will AI Demand

While AI is rapidly becoming indispensable for optimizing grid efficiency and predictive maintenance, this very success is fueling a new massive challenge, that is, meeting the unprecedented increase in power demand that is predicted from the data centers that house AI infrastructure.

“For years, the conversation was about gradual electrification,” Sonya Montgomery, CEO of The Desoto Group, told POWER, referring to electric vehicles (EVs) and heat pumps, as examples of the slow but steady shift. “Recently, however, the need to find gigawatts, not megawatts, almost overnight due to AI-computing demands is something the industry must adapt to.”

A report published in December 2024 by the Lawrence Berkeley National Laboratory under contract with the U.S. Department of Energy projected total data center energy use through 2028. Researchers presented a range of estimates to reflect various scenarios. Their low- and high-end projections were roughly 325 TWh and 580 TWh in 2028, which represented 6.7% to 12.0% of total U.S. electricity consumption forecasted that year. However, since that time, new developments have put in question almost all estimates of future data center energy demand.

“The DeepSeek R1 model release was probably the most pivotal point in 2025,” Ryan Luther, director of Energy Transition Research with Enverus, reflected. “It made the entire market second guess the load growth from data centers.”

Developed by Chinese startup DeepSeek, R1 is a powerful open-source reasoning model known for its high performance in coding and mathematics at a fraction of the cost of its American counterparts. DeepSeek R1’s efficiency breakthrough showed that algorithmic innovation could drastically reduce the energy footprint per AI task, casting doubt on the exponential power-growth curves currently driving data center planning.

“I think we will continue to see moments like that in 2026 that will have major impacts on the outlook for power markets,” Luther continued. “For instance, Meta is clearly losing the AI race and wasting hundreds of billions pursuing it. If they don’t turn it around quickly, they might have to abandon the endeavor. That would cut a fifth of the data center build-out and reset expectations on power demand growth.”

Utility-Scale Solar Surges On

Regardless of what happens with data center demand, solar photovoltaic (PV) technology will remain the powerhouse of the energy transition (Figure 1). Its unprecedented growth will continue to reshape power markets in 2026 and beyond.

|

|

1. The Hale Kuawehi Solar and Battery Storage Project reached commercial operations on March 25, 2025. The project, located on Hawaii Island, integrates 30 MW of solar photovoltaic capacity with 30 MW/120 MWh of battery storage, ensuring a stable and reliable supply of clean electricity to the Hawaiian Electric grid. Courtesy: Innergex Renewable Energy Inc. |

“Renewables and storage will continue to do the bulk of the heavy lifting,” said Peter Davidson, CEO and co-founder of Aligned Climate Capital. “Solar, wind, and batteries are the fastest, cheapest, most scalable way to add firm power—and anyone who thinks otherwise is clinging to an outdated narrative.”

The International Energy Agency (IEA) projects in its Renewables 2025 report, which was released in October, that solar will account for about 80% of the total increase in global renewable power capacity over the next five years. It estimates about 3.68 TW of solar capacity will be added by 2030. This is an astounding figure. At least one detailed study suggests fixed-tilt PV systems require on average 2.85 acres per MW and that tracking systems take even more space—4.17 acres/MW. (Tracking systems use mechanisms to follow the sun, which increases energy yield but requires more spacing between rows to avoid shading as panels tilt and rotate.) Assuming 3.5 acres/MW are used on average for all the new solar PV being added in the next five years, nearly 13 million acres of land will be needed. To put that into perspective, that’s like covering the entire country of Slovakia or most of the state of West Virginia completely with solar panels.

“The solar industry’s resilience is real, but it’s not guaranteed,” Jorge Vargas, CEO of Aspen Power, told POWER. “The biggest potential disruptor would be supply chain friction, especially if trade policies shift in the coming years. Another leading indicator is the health of the tax equity market. If there’s any contraction in available tax credit capital, that would slow growth more than any technical factor.”

Residential Solar Has Gone Mainstream

Driving the decentralized energy movement, U.S. residential solar installations are now measured in the millions, with the Solar Energy Industries Association (SEIA) reporting well over 5 million total installations across the country. However, recent economic headwinds and policy transitions have led to a notable contraction in the rate of new residential installations through the first half of 2025. Still, SEIA’s base case forecast projects that the residential solar market will grow by 3% annually on average from 2025 to 2030.

SolarTech, a leading solar company with offices in California and Arizona, released its own study on the state of solar in December, which was created based on a survey of 2,000 homeowners. “What we’re seeing in the 2025 State of Solar report is a decisive shift in homeowner mindset,” Sonny Gonzalez, director of Marketing at SolarTech, told POWER. “Solar is no longer viewed as an experimental or early adopter investment—it’s becoming a standard part of long-term home planning. With roughly 70% of homeowners either already using solar or expecting to adopt it within the next five years, the market has clearly moved into the mainstream. This level of interest reflects not just improved technology and affordability, but a growing desire among homeowners to take control of their energy future.”

“Right now, the biggest driver is still the fundamental economics,” said Vargas. “Solar is cost-effective, scalable, and increasingly flexible across customer segments. Utility rates are expected to rise sharply over the next several years, which makes solar an even more compelling hedge against those escalating costs. The Inflation Reduction Act [IRA] provided a significant tailwind for project development, but as those incentives begin to phase out, developers and customers will have to rely more heavily on intrinsic project economics and risk management. Going forward, development will increasingly be driven by cost savings, energy resilience, and load-side management. The projects that get built will be those that help customers control costs and mitigate exposure to rising utility prices, even in a world without IRA-backed subsidies.”

“While utility savings remain the single strongest motivator for going solar, the data shows that homeowners are thinking far beyond monthly bills,” said Gonzalez. “Rising concerns about grid reliability, unpredictable outages, and increasing electricity rates are reshaping how people evaluate their energy options. Solar is now seen as a pathway to stability and independence. For many homeowners, adopting solar is as much about resilience and control as it is about reducing costs—and that marks a major evolution in the residential solar mindset.”

FEOC Rules Take Hold

The Foreign Entity of Concern (FEOC) requirements are a set of restrictions established by Congress across several laws, beginning with the Infrastructure Investment and Jobs Act and the IRA, and later expanded by the One Big Beautiful Bill Act (OBBBA, Figure 2). They are designed to prevent entities with strong ties to adversarial nations from benefiting from U.S. clean energy tax credits and to reduce U.S. reliance on these nations—specifically China, Russia, North Korea, and Iran, which are defined in statute as “covered nations”—for critical components in the clean energy supply chain, such as solar panels and electric vehicle (EV) batteries.

|

|

2. President Trump delivers remarks at an event on the “One Big Beautiful Bill Act.” Source: White House |

FEOC and related “prohibited foreign entity” restrictions represent a significant shift in how clean energy projects qualify for federal tax incentives. Building on IRA and modified by OBBBA, these rules can deny technology‑neutral tax credits—including the Section 48E Investment Tax Credit, Section 45Y Production Tax Credit, and Section 45X Manufacturing Tax Credit—to power plants, energy storage projects, and U.S.‑made products that have too much ownership, control, or critical content traceable to entities linked to covered nations. Compliance analyses focus on several dimensions, including whether the taxpayer is a specified foreign or foreign‑influenced entity, the share of project or product costs attributable to covered‑nation equipment and materials, and whether contractual or financing arrangements give a prohibited foreign entity effective control or “material assistance” in the project.

“We may hear a lot more about FEOC in 2026,” Jim Nutter, managing director with Stout, told POWER. “Developers have tried their best to prepare, but the new part of the law and its interpretation might be hard to navigate in practice.”

Luther suggested uncertainty around the requirements remains. “For 2026, everyone is looking at FEOC to see where the rules end up,” he said.

The stakes are high. For certain technology‑neutral investment tax credits, projects can face full or substantial recapture if, within 10 years of being placed in service, the taxpayer makes payments that give specified prohibited foreign entities effective control or otherwise trigger the new ownership and “applicable payment” restrictions, depending on how the U.S. Department of Treasury ultimately interprets those rules. As the industry awaits clearer Treasury guidance, many developers are working to start construction before key effective dates to take advantage of grandfathering provisions, while also navigating tariff exposure and trying to secure FEOC‑compliant supply chains in a constrained and rapidly evolving market.

Supply Chain Issues Persist, but Some Improvement Seen

Supply chain disruptions have plagued the power industry since at least 2020 when the pandemic upset the normal flow of products, creating cascading delays in everything from transformers to turbines to solar modules. For years, developers have grappled with extended lead times, price volatility, and equipment shortages that stretched project timelines and squeezed margins.

Brandy Johnson, Chief Technology Officer with Babcock & Wilcox (B&W), suggested the problem was lingering long before the pandemic. “The power industry supply chain has retracted because power build-out in the U.S. has been so minimal for so long. But now, especially due to growing demand from AI and data centers, we have a projected build-out in the U.S. energy sector for more generation capacity in a shorter period of time than we’ve potentially seen in our lifetimes,” she told POWER.

“But the lack of manufacturing capacity means supply chains are really showing weakness in their ability to meet the industry’s needs,” Johnson said. “We’re seeing very long lead times on gas turbines, for example, because demand is greatly outpacing the rate at which they can be manufactured. The capacity to build pressure parts for boilers in the U.S. also is diminished, which means suppliers have to look overseas. It’s not just one thing. It’s all of the pieces of the supply chain that are affected.”

Still, it’s not all doom and gloom—the pressure is lessening in some areas. “We’re seeing some easing in the supply chain for basic construction materials, such as steel, which was a major bottleneck during the pandemic,” said Montgomery. “However, more complex materials are still facing delays, particularly those related to transmission line components and high-voltage equipment. High-voltage direct-current cables are an example of procurement that can take up to 24 months to source. The North American Electric Reliability Corp. states that the lead time, the wait between placing an order and the product being delivered, has reached around two years, with large power transformers [Figure 3] taking up to four years.”

|

|

3. The demand for transformers has led to major investments by manufacturers such as Siemens Energy, which announced in September 2025 it was investing about €220 million to expand its transformer factory in Nuremberg, Germany. In 2024, the company invested $150 million to expand operations at its transformer factory in Charlotte, North Carolina. Courtesy: Siemens Energy |

“We will begin to see supply chain … challenges easing for sectors tied to electrification or distribution level, but continue to see long lead times for power transformers,” said Charles Murray, CEO and co-founder of Switched Source. “New investments in domestic transformer manufacturing at the distribution level are starting to have an impact, but do not expect prices to come back down for transformers or cables.”

“There have been major investments in domestic manufacturing of grid-critical equipment,” Tagare said. “In fact, National Grid is investing £35 billion over the next six years to help strengthen and unlock long-term supply chain capacity and skills across England and Wales.”

Luther suggested developers need to consider all of their options when sourcing components, not simply focus on one possibility while belaboring its lack of availability. “Everyone is talking about the backlog on utility-scale gas turbines, but there’s over 25 GW in annual global production of sub-100-MW generators that could be used,” he noted. “It’s a significant amount of smaller-scale generation that no one is talking about.”

Johnson also suggested developers should think about alternatives when an originally contemplated form of generation is unavailable. “Especially with data centers, B&W is trying to offer alternatives to build new power generation capacity when supply chain issues limit developers’ options,” she said. “For example, if a developer can’t get gas turbines for a combined cycle plant, we have alternatives that can help them get their plant online much sooner. Alternative technologies are coming to light because they may have supply chains that are more readily accessible.”

Another way companies can find a workaround for supply chain issues is through standardization. “One of the things B&W is doing to address this is more standardization in our boiler and plant designs,” Johnson said. “We’re telling customers that we can speed up the design and construction of a plant if we do less customization. With power producers wanting to bring projects online quickly, speed through standardization is critical.”

The T&D Dilemma

Even as supply chain constraints are overcome, or accounted for, a more fundamental bottleneck threatens to limit how quickly new generation can actually reach customers: the transmission and distribution (T&D) infrastructure itself. Interconnection queues have swelled to historic levels, with gigawatts of ready-to-build projects waiting years for grid connection studies and upgrades. While new solar farms and battery storage facilities can be constructed in months, the transmission lines needed to deliver their power often require a decade or more of planning, permitting, and construction. This growing mismatch between generation development timelines and grid infrastructure timelines has pushed T&D constraints to the forefront of industry challenges (Figure 4) for 2026 and beyond.

|

|

4. Robert Blue, chairman and CEO of Dominion Energy, told attendees at the Data Center POWER eXchange event that his company had invested $2.1 billion last year in transmission—about 18% more than the year before—and it plans greater than $2.8 billion in annual transmission capital spending starting in 2027. Source POWER |

“Much of the focus on electricity growth is on new power generation, but power transmission and distribution constraints don’t seem to get as much attention in public discourse,” David Carter, industrials senior analyst at RSM US, told POWER. “Further, just like in generation, these transmission and distribution constraints need an ‘all-of-the-above’ approach. That includes not just new power lines, but expanding the capacity of existing ones by ‘reconductoring’ them with more modern cables and using technology solutions to make better use of what is already in place. In a time where permitting is such a challenge, having options to increase capacity without a years-long process to obtain new rights of way will be key.”

“Queue reform and transmission buildout are make-or-break for the [solar] industry’s ability to scale sustainably,” said Vargas.

Mark Feasel, vice president of Sales with Mission Critical Group, suggested limitations in power delivery could force developers to find other options. “Grid constraints will push organizations toward rapid adoption of distributed generation and on-site power strategies that bring energy closer to the load this year,” he said. “As data centers consume increasing portions of available capacity, hospitals, manufacturers, and other critical infrastructure operators will be forced to rethink how they secure not just reliable power, but resilient power, when the utility can no longer meet their needs.”

Luther suggested self-generation is already a growing trend. “A lot of hyperscalers are looking to bring their own generation and go behind the meter to avoid the long lead times of getting grid connected, which means the load might not materialize on the grid but off of it,” he said. “At the same time PJM, MISO [Midcontinent Independent System Operator], and SPP [Southwest Power Pool] are all accelerating queue timelines for dispatchable assets. So, if both of these trends emerge, its very likely these markets end up being better supplied than they are today.”

Meanwhile, leaders in Washington could also play a role this year. “The administration and Congress both seem to recognize the importance of permitting reform, and a streamlined process that reduces uncertainty would help power projects come online faster, with better project economics,” Carter noted.

Closing Thoughts

All of the leaders POWER spoke to expressed genuine optimism about the year ahead. Their confidence stems not from abstract hope but from tangible opportunities they see emerging in many areas. Yet, aside from the big talking points—AI, data centers, solar power’s future, supply chains, and infrastructure—three interesting items emerged.

“There is a growing importance of collaboration across the utility-startup ecosystem. Too many promising technologies stall in the ‘pilot doom loop’ because utility leaders and innovators lack the shared frameworks, data access, and operational pathways needed to move from experimentation to real system impact,” Tagare said. “The most successful solutions emerge when utility leaders and startups collaborate on deployment models early—aligning on integration requirements, regulatory considerations, and measurable value from day one.”

“With the increasing electrification of things such as transport, heating, and cooking, it’s important to recognize and plan for a shift in peak power from a summer afternoon to a winter evening as the heat gets going, dinner is cooking, and EVs are charging,” said Carter. “One leader for a distribution utility recently highlighted the importance of how ‘EVs come in gangs’ to neighborhoods as neighbors influence other neighbors on EV adoption, it can quickly overload local transformer capacity during peak periods without proper planning or load-shifting capabilities.”

“Most people understand that storage is important for solar, but the reality is that it still does not always make financial sense. Making storage work requires careful project design, timing, and alignment with grid needs. That is why we are so focused on it. Projects that get storage right will capture real value, while others risk underperforming,” Vargas said. “Another misconception is that solar growth will stall once IRA incentives fade. Projects with strong underlying economics will continue moving forward, and developers who integrate storage effectively will lead the market.”

The common thread running through these perspectives is clear: success in 2026’s power sector will belong to those who move beyond siloed thinking, whether that means utilities partnering earlier with innovators, grid planners anticipating neighborhood-level adoption patterns, or developers designing projects around actual grid value rather than subsidy availability. It’s a fascinating time to be involved in the power industry—the challenges are out there to be solved, and pioneering industry leaders are finding the answers.

—Aaron Larson is POWER’s executive editor.