Hydroelectric power generation hit a 10-year high in Europe in 2024, while hydro growth in other regions—most notably China—kept the technology at the top of the list when it comes to global energy output from renewable resources. The International Hydropower Association (IHA) in its “2025 World Hydropower Outlook” said hydro is playing a “stablizing role” in Europe and elsewhere when it comes to power supplies at a time of heightened concern about volatile markets and shifting policies around energy, particularly in the U.S.

The report released June 25 in the UK (June 24 in the U.S.) said global hydropower capacity grew by 24.6 GW last year, including 16.2 GW of conventional hydropower and 8.4 GW of pumped storage hydropower. The IHA said the global hydropower development pipeline now exceeds 1,075 GW, including 600 GW of pumped storage and 475 GW of conventional projects.

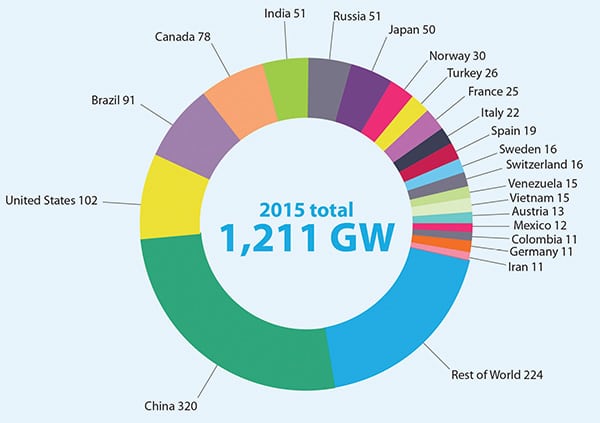

The group noted that China continues to lead global hydropower development, with 14.4 GW of new capacity added in 2024. That total includes 7.75 GW of pumped storage hydro. According to data from Global Energy Monitor (GEM), a group that develops and analyzes data on energy infrastructure, resources, and uses, China has more than 354 GW of operating hydropower capacity, with another 577-plus GW of projects either under construction, in pre-construction, or announced. Brazil ranks second with more than 101 GW of operating hydropower generation capacity, with the U.S. third with nearly 92 GW of hydro in operation, according to GEM.

India is second to China in terms of “prospective” capacity additions, according to GEM, with about 114.6 GW of capacity in the construction/pre-construction/announced queue. The report noted that Africa last year more than doubled that continent’s previous three years’ development of hydropower, bringing 4.5 GW of new capacity online in 2024.

“Hydropower continues to act as a baseload and also providing necessary flexibility and ancillary services when needed. Hydropower remains the largest individual source of renewable electricity generation at 14.3% compared to solar [6.9%] and wind [8.1%],” said Eddie Rich, CEO of IHA. “It also remains one of the most vital renewable energy sources globally due to its ability to provide reliable, dispatchable electricity and support grid stability. It plays a key role in the transition from fossil fuels by replacing traditional thermoelectric power plants that are water-intensive and polluting. As countries shift toward clean energy, hydropower is increasingly critical for balancing water and energy demands, especially in water-stressed regions.”

Rich told POWER: “Hydropower also contributes significantly to water storage, which is crucial for climate adaptation, irrigation, and urban water supply. In many parts of the world—like China, South America, and parts of Europe—it is a cornerstone of national electricity supply, though its share may vary regionally depending on geography, water availability, and infrastructure investment.”

Gregg Semler, CEO of InPipe Energy, a San Francisco-based renewable energy and smart water technology company, told POWER: “Hydropower supplies about one-sixth of global electricity generation, making it the single largest source of low-carbon power—more than all other renewables combined. Its unmatched flexibility and storage capabilities are crucial for integrating variable renewables like wind and solar, ensuring grid reliability and supporting the energy transition.

“Hydropower remains a cornerstone of the global clean energy transition, valued for its reliability, flexibility, and storage capabilities,” said Semler. ” As the sector modernizes, hydropower’s role in enabling net-zero targets and securing energy systems will only increase.”

“Hydropower is a foundational pillar of the global clean energy transition, already supplying roughly 16% percent of the world’s electricity—and more than 60% of all renewable generation,” said Charles Hunsucker, president of Power Systems at Rehlko, a global company focused on energy resilience. “Its reliability, long-term storage capabilities, and ability to provide baseload power make it an indispensable complement to variable renewable sources like wind and solar.”

U.S. Projects at Risk

The IHA in a separate June 25 release noted funding for U.S. hydropower projects continues, “but incentives for renewables fall under threat” from Trump administration policies designed to stall the growth of renewable energy. The IHA said the U.S. Dept. of Energy (DOE) under the Biden administration awarded $76 million to four proposed hydropower projects—three in Alaska and one in the state of Washington—and also announced $430 million for maintenance and upgrades to 293 hydroelectric projects across 33 states.

The group said pumped hydro storage in the U.S. “is also gaining momentum, as 67 new projects across 21 states are poised to add over 50 GW of storage capacity. However, licensing and policy challenges persist. Nearly 40% of the non-federal hydropower fleet must be relicensed by 2035—a process that is often prohibitively complex and costly without more government support.” The IHA noted that “incentives for hydropower and other renewable energy projects are now at risk,” as the “new U.S. government restricts or eliminates incentives for projects from the previous administration.”

IHA’s data on U.S. hydropower capacity differs from that compiled by GEM. The IHA said the U.S. has about 102 GW of installed hydro, including 79.9 GW of conventional hydropower, and 22.2 GW of pumped storage hydro. The group said generation from U.S. hydropower last year was 242.2 TWh.

The IHA noted that its new report looks at market conditions for hydropower, “identifying the economic and regulatory levers needed to enable reinvestment, digital upgrades and climate resilience. Alongside this, the publication will examine how the growing share of variable renewable energy is reshaping the investment environment, influencing project bankability, risk appetite and infrastructure planning.”

Industry experts have said that infrastructure planning is of particular importance for hydropower. The recent 2025 Infrastructure Report Card from the American Society of Civil Engineers highlighted ongoing challenges in the U.S. hydropower sector, noting that about 70% of U.S. dams are now more than 50 years old, raising concerns about how they could meet modern safety standards “and withstand increasing climate-related threats.”

Hunsucker said equipment and infrastructure upgrades are important for hydro projects, certainly “as energy systems grow more integrated and decentralized.” Hunsucker said, “collaboration across sectors—including hydropower, advanced grid technology, and digital controls—will be key. Winners will be operators who pair legacy hydro assets with advanced controls, high-efficiency turbine runners, and real-time digital twins. The most resilient energy infrastructure will be built by aligning legacy assets with emerging innovation, creating a more resilient and secure backbone for tomorrow’s electrified economy.”

Mike Silvestrini, co-founder and managing partner at Energea, a sustainable renewable energy solutions provider, told POWER: “Hydropower is an essential pillar of the global clean energy landscape. At Energea, we manage run-of-river power plants in Brazil, and one thing I can say with confidence is that run-of-river hydro projects—small hydro without a reservoir—are far more challenging than they appear during development.”

Silvestrini added, “Even small hydrological events can do serious damage to the [hydropower] plant or leave it sitting along the shore of the river like a tourist, watching the fish swim by. That’s why careful design, ongoing monitoring, and experienced management are so important for making these kinds of hydropower assets both resilient and productive over the long term.”

‘Exceptional Rainfall’ Supports European Hydro

The IHA said hydropower generation in Europe reached a 10-high of 680 TWh in 2024, thanks to what the group called “exceptional rainfall” across the continent. It also said that European Union (EU) “and national-level policy measures are driving momentum for pumped storage, as the Europe pipeline reaches 52.9 GW,” with total installed hydropower capacity in Europe rising to 262.7 GW.

The 2025 report said “Europe’s energy system is shifting toward a more flexible, renewable-based future, with hydropower playing a growing role in balancing wind and solar and reducing peak-time reliance on fossil fuels.”

IHA President Malcolm Turnbull, former prime minister of Australia, said, “Encouragingly, this year’s World Hydropower Outlook shows that global new capacity is accelerating after several years of stagnation. Hydropower is playing an increasingly vital role in the global energy transition. Continued momentum will require bold policy action, including reforms to reward hydropower’s multiple benefits, and faster permitting. The only resource we lack is time.”

The group said Europe “saw a landmark year for renewables in 2024, with frequent monthly peaks where hydropower, wind, and solar led the EU power mix. Driven by exceptional rainfall, hydropower output surged to 13% higher than average production between 2014 and 2017, reaching a decade-high of 680 TWh. This underscores hydropower’s critical role alongside wind and solar.

“Pumped storage hydropower [PSH], the world’s most proven technology for storing electricity at scale, is gaining political and investor attention amid market volatility and system stress. With major policy reforms underway and over 60GW of PSH projects in development, Europe has a clear opportunity to turn momentum into delivery.”

Rich noted the growing importance of pumped hydro storage to the global energy sector. “As the renewable energy market continues to grow, the story of this year’s ‘Outlook’ is clearly that pumped storage hydropower is at the forefront as the world looks to more energy storage,” said Rich. “It also reaffirms that all forms of hydropower remain essential to achieving global climate and development goals.”

Hunsucker told POWER: “We expect to see targeted growth in pumped hydro storage projects, particularly in regions aiming to stabilize grids with high renewable penetration. In grids where variable renewables exceed 40% penetration, these projects can shave net-load peaks and deliver fast-frequency response. Hydropower’s ability to provide grid flexibility and energy security will only become more valuable as electrification demands continue to rise.”

Rich said future hydropower growth is expected particularly in Central Asia, which has “potential for multipurpose dams and pumped hydro storage, which supports energy-water balance in water-stressed areas.” Rich told POWER that Scandinavia and parts of Central Asia are “benefiting from increased precipitation and early snowmelt, which may enhance hydropower potential without major new installations.” Rich added that regions needing more water infrastructure include areas where rising water demand (e.g., for irrigation, drinking water) coincides with underdeveloped storage infrastructure are likely to see new dam and reservoir construction.

“Only 8% of Africa’s potential has been untapped,” said Rich. “There is also likely to be investment in upgrading existing hydropower systems, improving efficiency and adding pumped storage to integrate intermittent renewables like solar and wind. However, every region globally has a healthy pipeline of both conventional and PSH. Africa and South America have a large pipeline for conventional. [The] USA has a large pipeline of PSH, with Australia and Philippines [having] a large PSH pipeline as well. India has a large pipeline in both technologies. China has the largest pipeline and will see massive growth over next decade.”

The IHA said the UK is particularly bullish on pumped storage hydro, with more than 13 GW of PSH projects announced and at various stages of development. Italy’s PSH pipeline is nearing 4 GW of capacity, while Greece has more than 3 GW of PSH in development. Austria has about 1.3 GW of PSH under construction, with another 2.8 GW in early development, according to IHA.

“EU climate goals and the Green Deal are pushing for increased renewable energy penetration and grid flexibility, which supports pumped hydro growth,” said Rich. He told POWER, “Capacity markets and storage incentives in countries like Germany and Austria further strengthen the case for new PSH projects. There’s also rising investment in modernizing older dams and digitizing operations to improve hydropower flexibility.”

Major Challenges

Rich listed several challenges for the hydropower sector, including water scarcity and competition, where “agriculture, industry, and urban areas increasingly compete with hydropower for limited water supplies.” He also cited “aging reservoirs … many existing reservoirs suffer from sediment buildup, reducing their capacity and efficiency.” There also are impacts from climate change, including “hydrological variability … increased unpredictability in river flows, earlier snowmelt, and extreme rainfall lead to seasonal mismatches in water availability and generation needs.”

Rich continued: “Hydropower is essential, not optional, for tackling climate change and increasing climate volatility. As a low-carbon, renewable energy source, it provides clean, reliable electricity while also balancing the variability of wind and solar. Its unique ability to store energy, manage water, and respond quickly to grid needs makes it critical for resilient, decarbonized power systems.

“Modern hydropower projects are more sustainable than ever, offering environmental safeguards, water storage, flood control, and support for agriculture and drinking water,” said Rich. “Without more investment in hydropower, through both new projects and upgrades, the global energy transition will falter, especially in developing regions facing growing energy and water insecurity.”

—Darrell Proctor is a senior editor for POWER.