How the Energy Transition Is Impacting the Transformers Market

Power grids around the world require upgrades to accommodate growth and incorporate new clean energy resources. Transformers are a necessary component in the modernization. Estimates suggest hundreds of billions of dollars will be spent on grid infrastructure, including transformers, each year through 2030 and beyond.

Governments across the globe, especially in the advanced economies, are moving to reduce greenhouse gas (GHG) emissions to mitigate the impact of climate change. The power sector is a significant contributor to GHG emissions, which is why countries are moving toward renewable energy as power produced from it is clean. As a result, renewables are set to account for almost 95% of the increase in global power generation capacity through 2026. Similarly, electric vehicle (EV) demand is also expected to grow at an annual rate of 23% in the next ten years.

There are several challenges associated with the rapid rollout of renewables and EVs. One of these major challenges at hand is whether existing grid infrastructure is capable of dealing with these modern technologies. Additional capacity calls for modernization and upgradation of the grid giving rise to the demand for legacy grid equipment including transformers.

Snapshot of Evolving Climate and Energy Policies

The policies revolving around climate and energy across the globe have evolved over the years including in the European Union (EU), U.S., Middle East, and Central Asia. For instance, in the EU, in order to align the region’s climate, energy, transport, and taxation policies with the target of reducing GHG emissions by at least 55% by 2030 compared to 1990 levels, the European Commission (EC) has adopted a set of proposals.

Similarly, the U.S. came up with a Federal Sustainability Plan, which has set out several objectives that are in line with President Biden’s goal of reducing GHG emissions by 50% to 52% from 2005 levels by 2030. Furthermore, around 32 countries in the Middle East and Central Asia have committed to reducing their GHG emissions from 13% to 21% under the Paris Agreement. However, only 13% reduction in GHG emissions is unconditional; whereas, 21% reduction in emissions is subject to availability of external support.

Energy Transition and Rollout of Renewables. According to the International Energy Agency (IEA), global renewable generation capacity is expected to increase by almost 2,400 GW (75%) from 2022 to 2027. As the share of renewables in the generation capacity mix of countries will increase, it will require replacement of conventional transformers with digital transformers as conventional transformers are unable to provide required safety, productivity, and reliability in the electrical network.

Integration of EVs into the Grid. Globally, economies are moving toward electrification of the transport sector, especially the developed economies. To mitigate the impact of EVs on the electricity grid, many utilities are deploying smart grid technologies, including smart transformers that are more efficient and reliable as compared to conventional technology. It is noteworthy that the global EV industry has been observing tremendous growth in recent years. According to the IEA, EV sales doubled in 2021 (accounting for 6.6 million units).

Upgradation of Grid Infrastructure. As wind and solar are being rapidly integrated with the electricity grid, it has created need for the upgradation of decades-old grid infrastructure globally. Utilities are replacing outdated grid technology with the latest equipment, which is not only efficient but also improves the reliability of grid operations. This in turn has created demand for digital transformers that offer not only higher efficiency but also have a lower climate impact as well.

Under Project Stratus of UK’s Power Network, smart transformers will be installed in the streets across East Sussex. These smart transformers are expected to provide live data on electricity usage and demand, which in turn would not only increase the resilience of the network but will also pave the way for a low-carbon future. Smart transformers are equipped with state-of-the-art power electronic technologies that allow the transformer to balance the load, control the flow of electricity in an efficient manner, and protect the system against potential faults.

Transformer Market Overview

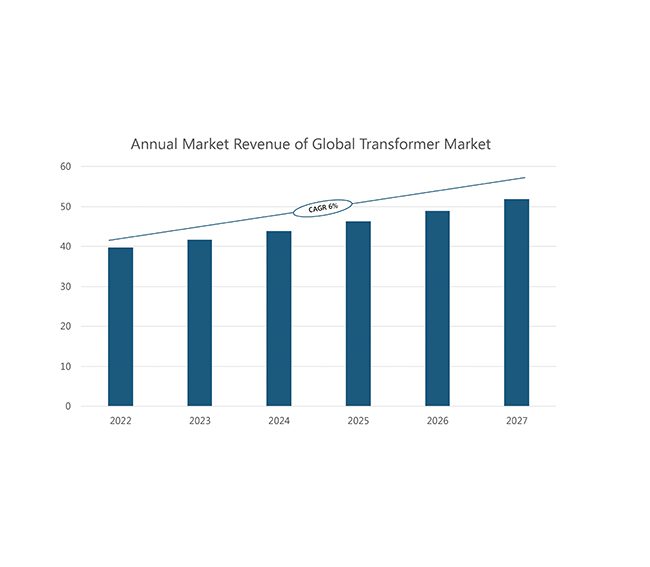

According to PTR Inc., the global transformer market accounted for nearly $40 billion in terms of annual market revenue in 2022 (Figure 1). In 2023, as per the estimates of PTR Inc., the global transformer market is expected to generate a revenue of $41.6 billion posting a growth of 4.73% year on year. Furthermore, the global transformer market is expected to grow to about $52 billion in 2027 with a compound annual growth rate (CAGR) of 6%.

|

|

1. Annual market revenue of global transformer market in billions of dollars (2022–2027). Courtesy: PTR Inc. |

Regulations for Transformers Driven by Climate Goals. Multiple regulations and standards are either in place or are being proposed in advanced economies, especially in the EU and U.S., that focus on improving the efficiency of transformers. According to EC estimates, about 2.9% of all the energy generated across the EU’s 27 member states and the UK is wasted through transformer losses. These transformer losses amount to 93 TWh annually, which sheds light on the magnitude of the impact of potential improvements in transformer efficiency. In the EU, the Ecodesign Directive Tier 2 regulation became effective in July 2021, replacing the Tier 1 regulation. The Tier 2 regulation aims to reduce energy waste by 10%, compared to Tier 1 (2015) levels.

The U.S. Department of Energy (DOE) has proposed new energy efficiency standards for different categories of distribution transformers, aiming to improve the resilience of America’s power grid, reduce utility bills, and drastically curtail domestic carbon dioxide emissions. Nearly all the transformers manufactured under the proposed standard would be built with amorphous steel cores that are highly energy efficient as compared to the traditional grain oriented electrical steel. The new rule, if adopted within the proposed timeline of DOE, is expected to come into effect in 2027.

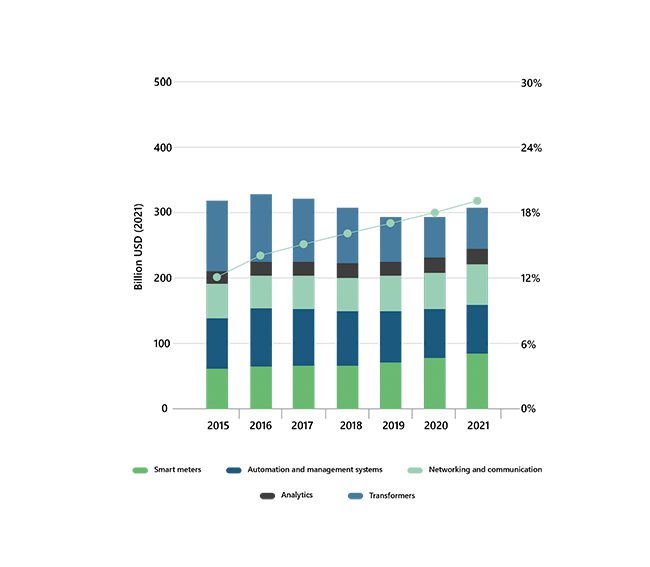

Investment in Grid Infrastructure. According to the IEA, in 2021, global investment in electricity grids accounted to $309 billion, which is a significant 6% year-on-year increase. These investments were mainly driven by advanced economies, which accelerated their efforts for electrification of buildings, industry, and transportation, and to accommodate intermittent renewables. Furthermore, the IEA believes that in order to achieve net-zero emissions these investments need to average about $600 billion per year through 2030.

In Europe, one third of the grid infrastructure is 40 years old, which can’t be overhauled overnight, so the grid equipment is being supported with the help of digital technology. The digital technology is preparing the grid infrastructure for integration with the intermittent renewable energy sources followed by an increase in demand due to EVs, heat pumps, and other sectors. It is expected that about $600 billion will be invested in the European grid infrastructure from 2020 to 2030, out of which $200 billion will be spent on the digitalization of the grid infrastructure.

|

|

2. Investment in electricity grids globally from 2015 to 2021. Courtesy: PTR Inc. |

New Technology Trends in the Transformer Market to Support the Energy Transition

A range of latest technological solutions including internet of things (IoT), digital twin, and smart meter technologies have emerged in recent years, which are now commercially available in the global market. These technological solutions, when used with transformers, assist utilities in their transition from fossil fuel to clean energy sources. IoT sensors, for instance, can be installed on power transformers in order to collect real-time information on temperature, vibration, and oil level. The data can assist utilities in proactive maintenance planning, which in turn reduces operations and maintenance costs over the lifespan of grid equipment.

Digital twin solutions for transformers, on the other hand, are a somewhat nascent technology. Yet, when used with transformers, a digital twin can simulate several operating scenarios. These simulations enable utilities to optimize the performance of transformers. Furthermore, smart meters also collect data on energy consumption and demand, and when paired with a distribution transformer helps the utility to divide the distribution region into geographically smaller chunks that are more manageable.

OEMs Enhancing Portfolio of Digital Transformers

Leading transformer original equipment manufacturers (OEMs) are employing digital technology with their products and solutions in order to meet the requirement for improved reliability and real-time data for asset health monitoring and management. It is expected that the electricity grid equipment in the future, especially transformers, will be equipped with several sensors that enable real-time monitoring.

Hitachi Energy, for example, has introduced the next generation TXpert solution for the digitalization of transformers recently. The technology enables transformers to collect relevant data, which in turn assists in reducing cost, optimizing operation, extending lifespan, and improving performance of the equipment. Siemens Energy, on the other hand, offers Sensformer, which also enables digitalization of the transformer, leading to reduced downtimes, flexible transformer operation, improved environmental protection, and reduced costs.

Looking Forward

PTR Inc. believes that the energy transition is inevitable, which will radically alter the way legacy grid equipment is designed including power and distribution transformers. The global transformer market in the future is expected to be mainly driven by smart transformers, which is why OEMs are consistently experimenting and innovating with new products and solutions in order to align with the changing grid needs.

Furthermore, PTR Inc. expects that in the future economies across the globe, other than the advanced economies, will also come up with stricter energy efficiency standards regarding legacy grid equipment including transformers (distribution and power transformers). Investment in electricity grid infrastructure, including transformers, is crucial in achieving net neutrality as stipulated in the Paris Agreement. Over the last few years global investment in the electricity grid infrastructure is averaging about $300 billion per year, which needs to be raised to about $600 billion per year through 2030 in order to achieve long-term climate goals.

—Shaista Naz is a power grid analyst at PTR Inc. ([email protected]). She is currently working on the power and distribution transformers market where she is responsible for analyzing the latest market trends and innovations in different regions.