POWER Notebook: Deriva Energy Launches; Arizona Gets New Battery Factory; Mini-Grids For Africa, Asia

Brookfield Asset Management announced the launch of Deriva Energy, the new name for Duke Energy’s former unregulated commercial renewables business that Brookfield acquired earlier this year.

Deriva, which considers itself a leading operator and developer of clean power projects in the U.S., is headquartered in Charlotte, North Carolina. Brookfield on Oct. 25 said it had completed the acquisition of the renewables business from Duke Energy. The $2.8 billion deal, which includes a portfolio of about 3.4 GW of generation capacity, was announced in June.

“Today is a significant milestone for our business and opens an exciting new chapter in our history,” said Chris Fallon, president of Deriva Energy. “We are now an independent developer, owner, and operator of clean energy projects, with the backing of Brookfield, one of the world’s largest owners and operators of renewable power. As part of Brookfield, we have access to capital for growth and a wealth of operating expertise, which will enable us to continue our leadership in clean energy for many years to come.”

Brookfield, a Canadian company headquartered in Toronto, Ontario, has $850 billion under management. The company said it has about 90,000 MW of combined capacity either operating or under development across and pipeline capacity across the U.S.

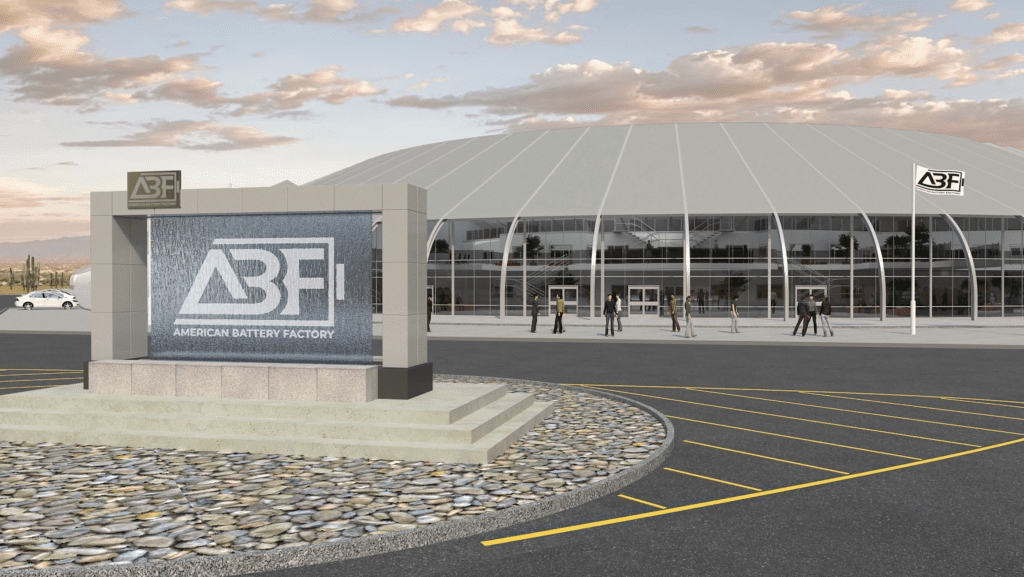

Battery Manufacturer Announces Major Arizona Facility

American Battery Factory (ABF), an Utah-based battery manufacturer, on Oct. 26 said it has broken ground for a 2-million-square-foot factory in Tucson, Arizona. The company is developing a network of lithium iron phosphate (LFP) battery cell gigafactories in the U.S.

ABF said the Tucson plant will provide about 1,000 jobs, and represents a $1.2 billion investment. The first phase of construction, overseen by Utah-based Sprung Instant Structures, is expected to be completed by 2025.

“We are honored to continue our company’s mission of global energy independence in Arizona, a premier destination for emerging technologies,” said John Kem, president of ABF. “We are pleased to join this thriving region and call Tucson our home and look forward to enhancing Pima County’s already growing economy by fostering innovation as well as attracting and retaining residents to Tucson.”

“Today’s groundbreaking represents a significant milestone for Arizona’s battery industry,” said Arizona Gov. Katie Hobbs. “With this transformational investment, American Battery Factory advances Arizona’s clean energy industry and bolsters continued economic growth in Tucson and Pima County.”

ABF in a news release said the global market for lithium batteries is expected to reach $105 billion by 2025. The new plant will be located on 267 acres in Pima County’s Aerospace Research Campus. The company said the facility will include headquarters and a research and development center along with the manufacturing plant.

Husk Power Details Plan, Financing for Electrification Project

Husk Power, a mini-grid and microgrid developer based in Fort Collins, Colorado, said it has secured $103 million in funding from several banks to support electrification projects in sub-Saharan Africa and South Asia. The company said the money, a combination of equity and debt financing, will help build about 2,500 solar mini-grids on the two continents. Husk Power currently operates about 200 solar mini-grids in sub-Saharan Africa and South Asia.

The company in September of this year launched its Africa Sunshot initiative, a plan designed to raise $500 million to finance solar-powered mini-grids in at least six African countries by 2030. Manoj Sinha, Husk’s CEO, in a statement said, “We are delighted to put this new equity and debt at the service of Husk’s growth and to unleash the full economic and social potential of a generation of rural Africans and Asians, particularly women and young people, who would otherwise be left behind.”

Funding for Husk’s projects is coming from financial institutions including the U.S. International Development Finance Corp.; Proparco, a subsidiary of the French Development Agency; and STOA Infra & Energy, a French investment firm. Money also is coming from groups in the Netherlands, as well as from Shell. Sinha said the European Investment Bank, and the International Finance Corp., part of the World Bank Group, also are supporting Husk’s efforts.

Husk Power currently operates about 200 solar mini-grids in sub-Saharan Africa and South Asia.

—Darrell Proctor is a senior associate editor for POWER (@POWERmagazine).