Three Key Transmission Links Get $1.3B Boost With Federal Capacity Contracts

Three interregional transmission lines connecting six U.S. states will receive the first $1.3 billion tranche of $2.5 billion in federal funding designated under the Transmission Facilitation Program (TFP), a revolving fund enacted by the 2021 Bipartisan Infrastructure Act.

The U.S. Department of Energy (DOE) Grid Deployment Office’s (GDO’s) first picks under the TFP, unveiled on Oct. 30, will provide federal investment and initial cost recovery, serving as “capacity contracts” to provide up-front “anchor tenant” funding on new and upgraded transmission lines.

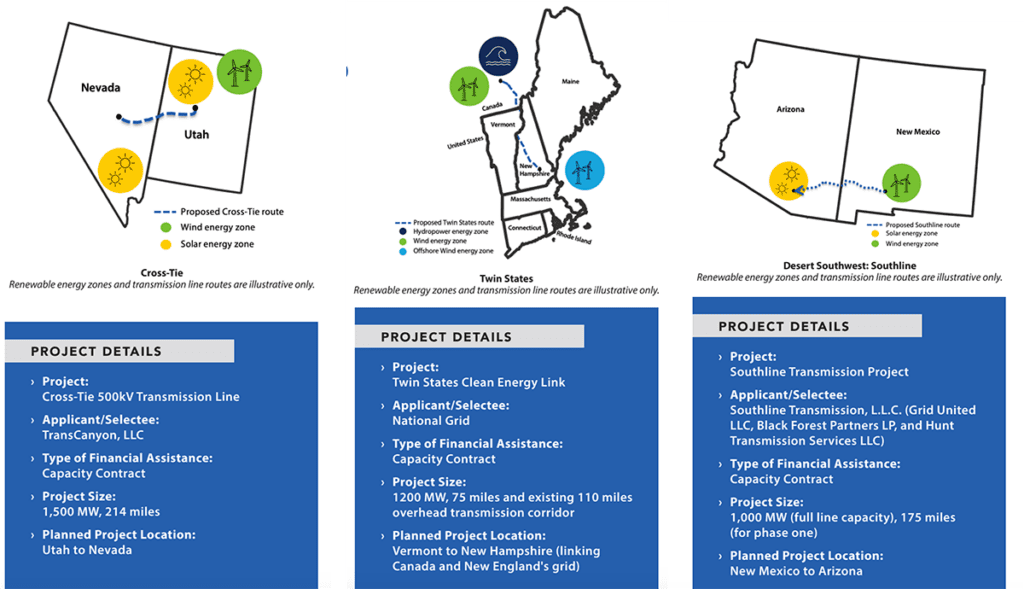

The DOE’s TFP selections—a combined transmission capacity of 3.5 GW—unveiled on Monday include:

TransCanyon’s 1.5-GW Cross-Tie 500 kV Transmission Line. The 214-mile project will connect Utah and Nevada when it goes into service in 2027 and potentially relieve congestion on other key transmission lines in the region. It is also designed to allow California, Nevada, Utah, and Wyoming to import and export renewable energy. TransCanyon estimates the project’s estimated cost is $750 million.

National Grid’s Twin States Clean Energy Link. The 1.2-GW high voltage direct current (HVDC) project is proposed to serve as a bidirectional line between New England and Québec, Canada. “As a bi-directional line, Twin States will enable clean energy producers in New England, such as offshore wind, to export excess capacity to Quebec during times of lower domestic demand, providing a critical boost to the region’s clean energy economy,” National Grid notes. National Grid estimates the Twin States proposal could cost of “under $2 billion to design, engineer, permit, and build,” though it notes the figure “is subject to change as we receive more information and conduct outreach to stakeholders.” It suggests project construction would occur between late 2026–2030, with the project going online in 2030–2031.

Desert Southwest: Southline. This 1-GW double-circuit 345-kV project seeks to build a 175-mile transmission line from Hidalgo County, New Mexico, to a substation in Vail, Pima County, Arizona, as the first phase of a larger planned transmission project to address the need for increased transfer capability in the Desert Southwest. “The design provides the capability to transport power bi-directionally and will enable wind and solar resources from the Desert Southwest to reach key markets while improving the grid reliability of the border region,” Southline says. The TFP selection is for the first 175-mile phase (Hidalgo, New Mexico) to Vail, Arizona) of the project, which is expected to begin operations by the end of 2027. Southline anticipates Phase 2 (Afton, New Mexico, to Hidalgo, New Mexico), which will expand the line to 280 miles, will be completed by 2028.

“With TFP’s endorsement, Southline’s timeline will be meaningfully accelerated to reliably and cost-effectively deliver new resources to meet the region’s growing energy needs,” said Doug Patterson, managing partner of Black Forest Partners, a firm that serves as the project’s managing member. “We have worked collaboratively with stakeholders over the past 14 years to get Southline ready in a way that maximizes benefits and minimizes impacts, and the TFP capacity contract is the catalyst we and other award recipients need to get these critical projects into service.”

A Big Step to Address Transmission’s ‘Chicken and Egg’ Challenge

The DOE’s TFP selections stem from a phased solicitation approach that began in 2022. The first solicitation was limited to requests for capacity contracts for new or replacement projects of at least 1 GW and upgrades of existing lines of at least 500 MW that could be completed by December 2027. In addition, Congress requires that the TFP program prioritize technologies that enhance the capacity, efficiency, resilience, or reliability of a power transmission system, facilitate interregional capacity to support equitable economic growth and contribute to subnational goals to lower greenhouse gases.

The TFP allows the DOE to borrow up to $2.5 billion through capacity contracts, loans, and DOE participation in public-private partnerships within an electric corridor that serves a national interest. The selections on Monday—all capacity contracts—will now move into a due diligence and contract negotiation phase. The DOE expects to sign contracts by the end of the year.

Under a capacity contract framework, the DOE essentially serves as an “anchor tenant,” buying up to 50% of the total proposed transmission capacity for terms of up to 40 years, it has explained. The federal government then contracts with a third party to market the capacity, seeking to maximize the government’s returns. It then sells the capacity contract to recover the remaining costs incurred once the project’s long-term financial viability is secured. TFP capacity contracts represent “the contractual right to schedule and use transmission service for the term of the agreement,” the DOE notes.

As Rob Gramlich, president of power sector consulting firm GridStrategies LLC, told POWER, the TFP is a “novel and exciting” program that could address a “perennial ‘chicken and egg’ problem” that has challenged the nation’s much-needed transmission expansion. “The program is a small program, but I think a really important one,” he said. “Congress could do more with the budget for the program in future years,” he said, but the TFP sequence—allowing for the DOE’s capacity reservation before transmission construction, and then allowing the line’s subscribers to pay back the government—is a notable step forward. “That sequence promises to work a lot better than the current stalemate,” he said.

A Glaring Need for More Transmission

As it unveiled its first TFP selections on Monday, the DOE also published the finalized The National Transmission Needs Study, the latest iteration of its three-year transmission constraint assessment through 2040. The DOE considers the study a “state of the grid report that identifies pressing national transmission needs. While the Needs Study does not prescribe solutions or identify a master transmission plan, it is statutorily required under Section 216(a) of the Federal Power Act as a crucial prerequisite before the DOE can designate a corridor.

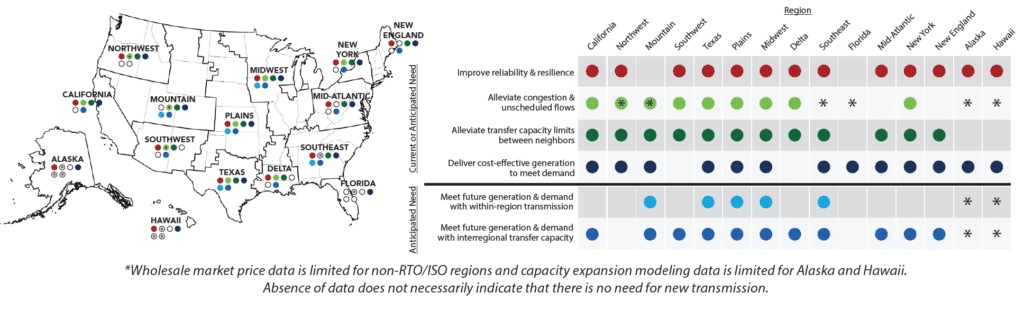

The freshly released Needs Study underscores three points. One is that “there’s a pressing need for new transmission infrastructure.” Second, “interregional transmission results in the largest benefits,” and third, and perhaps crucially, “needs will shift over time” as the energy transition, evolving regional demand, and increasingly extreme weather affect the grid.

Nearly all regions in the U.S. “would gain improved reliability and resilience from additional transmission investments,” it suggests, and some regions have acute reliability and resilience needs that additional transmission deployment can address. In addition, “Regions with historically high levels of within-region congestion—the Northwest, Mountain, Texas, and New York regions in particular—as well as regions with unscheduled flows that pose reliability risks—California, Northwest, Mountain, and Southwest regions—need additional, strategically placed transmission deployment to reduce this congestion,” it says.

Among the study’s key findings is that by 2030, “large relative deployments of interregional transfer capacity are needed between the Delta and Plains, Midwest and Plains, and between the Mid-Atlantic and Midwest regions to meet future demands of the power grid.” By 2040, a significant need arises “for new interregional transmission between nearly all regions.”

Another key finding is the proportion of overall transmission circuit-miles installed to address specific system reliability needs “has grown with time, from 44% in 2011 to 74% in 2020.” At the same time, however, transmission investments decreased during the second-half of the 2010s. Yet another concern is that the share of energized projects historically borne by nonincumbent developers—also known as merchant developers—decreased from 40% in 2013 to less than 5% in 2020.

These challenges have had a significant impact on the grid. Congestion has driven up wholesale electricity prices in specific regions. While the Needs Study suggests that wholesale market price differentials are the largest between Arizona and Texas, it also demonstrates “the highest value of new interregional transmission exists across the three electrical interconnections,” the DOE said.

The study also highlights interconnection queue backlogs. As an April 2023–released research by Lawrence Berkeley National Laboratory (Berkeley Lab) suggests, at the end of 2022, more than 10,000 interconnection requests were active throughout the U.S., representing more than 2,000 GW of potential generation and storage capacity (95% of which was solar, battery storage, or wind energy). While the DOE suggests many reasons exist for interconnection backlogs, it highlights that power plants don’t have adequate access to existing transmission systems. “There’s a need for serious upgrades on the transmission system, and those costs can sometimes be cost prohibitive for the power generators versus making those upgrades in a transmission planning setting,” it says.

Gradual Policy Improvements, More on the Horizon

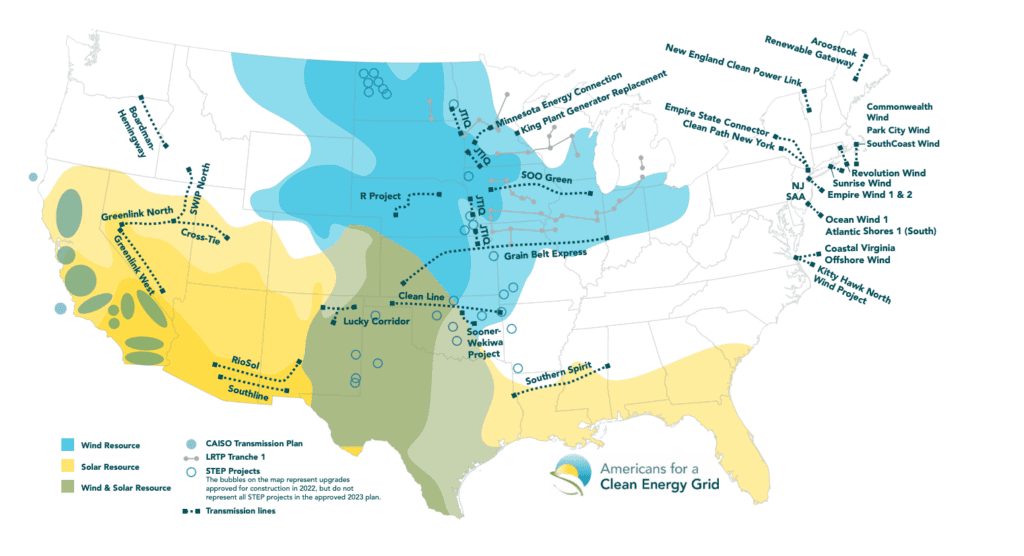

Owing to recent reforms, the much-needed transmission expansion seems to have begun an upward trajectory. According to a GridStrategies September 2023–issued update on the progress and status of U.S. transmission, an estimated 36 high-voltage transmission projects—compared to 22 recorded in 2021—are “shovel ready,” and could interconnect around 187 GW of generating capacity.

“Much of the growth is from new transmission projects to interconnect offshore wind projects in the Northeast and MidAtlantic,” the GridStrategies report notes. But new projects “serving a range of purposes” have also emerged in other regions. “Significant load growth, increasing U.S. manufacturing, data center demand (fueled recently by artificial intelligence), customer demand for clean generation, and increasingly favorable economics for renewable energy due to market trends as well as the Inflation Reduction Act and other policies, are likely driving greater market interest in transmission,” it says.

If completed, the 36 projects could add approximately 10,000 miles and 132 GW of new transmission capacity. “For reference, the current U.S, transmission system contains approximately 240,000 circuit miles of transmission that operate at 230 kV and above, so these new projects only add about 4% to the total mileage of the high-voltage transmission system,” the report notes. “However, most of the proposed lines are extra-high voltage, which allows them to carry more power with lower losses than typical existing transmission lines. As a result, these grid expansion projects increase the transmission system’s capacity by about 15%.”

Still, according to the report, cost recovery remains the most important barrier to a transmission expansion. “Transmission is classic public good, where the beneficiaries are broadly dispersed. Market demand doesn’t come until five years in the future, but you have to sink the capital now into the permitting and construction,” Gramlich explained.

Along with the TNF, which Gramlich noted is “well-structured” to overcome some cost-recovery hurdles, the DOE earlier this month unveiled $3.5 billion in Bipartisan Act funding under the Grid Resilience and Innovation Partnerships (GRIP) program to improve grid flexibility and power system resiliency. As POWER reported, nearly $1 billion will be invested in comprehensive transformational transmission projects.

Permitting remains another substantial challenge. Many projects have spent a decade or more under development before beginning construction, slowed by the pace of federal permitting and interagency delays. Gramlich, however, suggested new efforts could improve permitting timeframes.

“I’m excited about the DOE’s recent actions related to its lead agency authority,” he said. In August 2023, the DOE proposed a rule designating it as the lead agency for federal authorization and permits. The rule, notably, sets a two-year deadline for federal administrative action on all transmission lines. Permitting reforms passed in the June 2023 debt-ceiling agreement also streamline National Environmental Policy Act (NEPA) application and documentation processes, and set limits for agency reviews.

—Sonal Patel is a POWER senior associate editor (@sonalcpatel, @POWERmagazine).