Energy in Transition—Where Are Investors Looking Next?

Renewables are far from the primary power source in the U.S. No longer is the cost of renewable energy, particularly onshore wind and solar, the most substantial hurdle to the energy transition.

New obstacles loom large. Predominant among these is connecting the infrastructure dots between new alternative sources and the current grid, all while maintaining resilience amid a move to non-dispatchable energy sources.

COMMENTARY

This is a common trend when it comes to dramatic advances—consider the Internet’s coming of age. In the early 90s few could grasp the extent to which this new technology would profoundly change our daily lives. Advance a decade to the early aughts, when market froth made it seem each Internet company would grow to take 100% market share.

The subsequent bursting of this bubble, industry consolidation, and eventual recovery showed some ideas may have been ahead of their time, but their time did come. Consider online sales of pet products; the dot-com bubble saw a frenzy around the possibilities and yet by 2015, only 8% of pet products were bought online. Look ahead five years to 2020 and this figure jumped to 30%.

While drawing direct parallels can be dangerous, one has to consider the following: between 2015 and 2020 wind and solar’s contribution to the grid more than doubled from 5.3% to 10.7%. In 2022, it reached 13.7%.

The increased use of such renewables can largely be attributed to a 42% drop in the unsubsidized levelized cost of energy (LCOE) of solar and a 27% reduction in the LCOE of wind between 2015 and 2020. Still, there’s a long way to go to reach the 56% share the U.S. Energy Information Agency (EIA) associates with the uptake of the Inflation Reduction Act (IRA).

Transition Headwinds

While the economics, as depicted by LCOE, of renewables looks like a clear win, some of the greatest headwinds to renewables are inherently ignored in the calculation of their cost. Principally, the inability to produce electricity when and where it’s needed. The result is that many are overlooking the need to build out grid infrastructure and improve energy efficiency.

Grid infrastructure and related permitting are substantial near-term hurdles. Optimal locations for solar and wind production are routinely isolated from transmission and distribution lines, and building infrastructure to those areas requires a complex permitting process and buy-in from myriad stakeholders across jurisdictions.This has led to idle queues of solar, wind, and battery projects that cumulatively exceed the overall installed grid capacity.

As of July 2023, more than 2,000 GW of renewable power languished in line. That’s nearly double the amount of U.S. generation capacity, according to the Federal Energy Regulatory Commission (FERC). Add to this a series of loosely connected grids rather than one robust network and it becomes clear that reaching about a 50% renewable energy share of the grid will be much harder than reaching about 15%.

Investments Flow to Efficiency

With the current effects of climate change readily apparent and the looming threat growing larger, the inexorable march toward more efficient, reliable, and resilient distribution tells us that tying renewables to the grid is only a matter of time and technology. Forward-looking investors and utilities alike recognize that increasing use of renewables will require improving energy efficiency.

Accordingly, the International Energy Agency (IEA) estimates that average annual investments in energy efficiency will need to more than double to $777 billion during the 2021-2030 period from the 2016-2020 period. A win-win, such efficiency investments would provide 16% of the emissions reductions needed by 2030 to stay on a net-zero path (by comparison, solar and wind would contribute 33%).

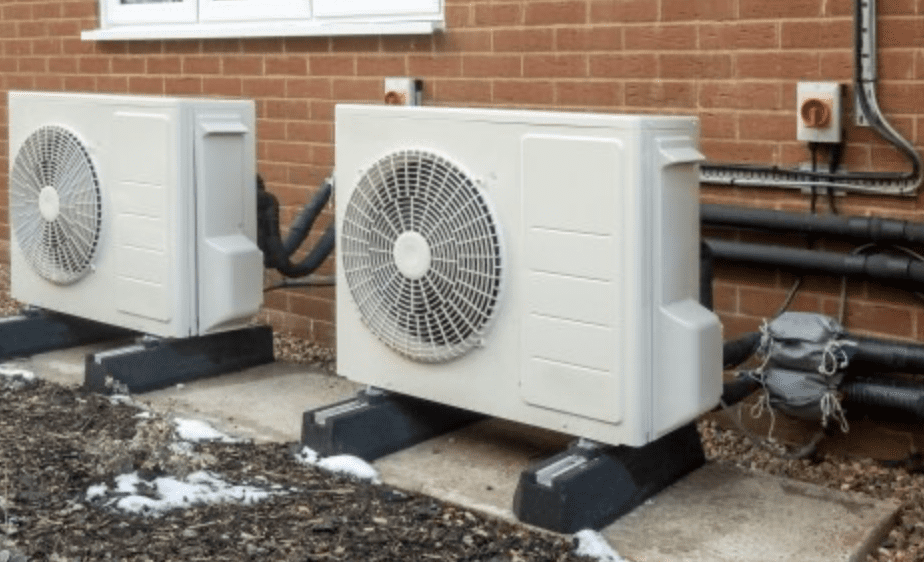

Further adding to the beauty of investments in efficiency is that much of the technology is already available. The goal is deploying it at scale, and the groundwork has already been laid. One particularly attractive technology that stands to bring additional demand to the grid are heat pumps.

In 2020 heat pumps had a 7% share of energy demand for heating, and by 2030 the IEA estimates this could reach closer to 20%. Amid the transition to a net-zero emissions economy, the IEA asserts heat pumps have the fourth-largest potential to reduce CO2 emissions across technologies with “market uptake,” right behind EVs

There is no easy switch to flip and bring renewables online. On the contrary, even as consumer demand increases and technology advances, the gap between the current state and widespread adoption looms. Nevertheless, unhiding the “hidden” energy resource and investing in energy efficiency presents both a bridge to, and a corridor through, the transition to a low-carbon economy.

—Levi Zurbrugg is a Senior Investment Analyst and Portfolio Manager at Saturna Capital.