Duke Energy to Shed 3.4-GW Unregulated Renewable Business Segment in $2.8B Deal

In a bid to transition to a fully regulated business, Duke Energy will sell its unregulated utility-scale solar and wind group—a portfolio of 3.4 GW—for an enterprise value of $2.8 billion to pure-play renewable power platform Brookfield Renewable.

The companies announced the transaction for a portion of Duke Energy’s Commercial Renewables business segment on June 12, noting benefits for both sides. The sale portfolio includes 1,813 MW of wind, 1,613 MW of solar, and 18 MW of battery storage, net of Duke Energy’s joint venture ownership. Brookfield in a statement noted that the acquisition includes a 6.1-GW development pipeline.

Duke Energy said it expects net proceeds from the transaction will add up to approximately $1.1 billion, which would “strengthen its balance sheet and avoid additional holding company debt issuances.” The proceeds will “allow the company to focus on the growth of its regulated businesses, including investments to enhance grid reliability and help incorporate over 30,000 MW of regulated renewable energy into its system by 2035,” it said.

Brookfield Renewable CEO Connor Teskey separately noted that the “scale-operating” renewable platform” is located in “highly attractive markets.” Brookfield expects the deal will “immediately contribute meaningful cash flows with significant upside from potential asset repowering and synergies,” he said. “We are also adding to our pipeline of renewable development projects, solidifying our position as one of the largest renewable energy businesses in the U.S. with almost 90,000 MW of operating and development assets.”

The sale could be wrapped up by the end of 2023, though it is “subject to satisfaction of customary closing conditions, including regulatory approval by the Federal Energy Regulatory Commission and the expiration of the waiting period under the Hart-Scott-Rodino Act,” the companies said.

Duke Energy on Monday noted that the sale of the remaining portion of its Commercial Renewables segment, which comprises its distributed energy business, is also slated to close by year-end 2023. “The carrying value of these assets was approximately $450 million as of March 31, 2023,” the company said.

A Notable Sale as Duke Energy Cultivates Net-Zero Ambitions

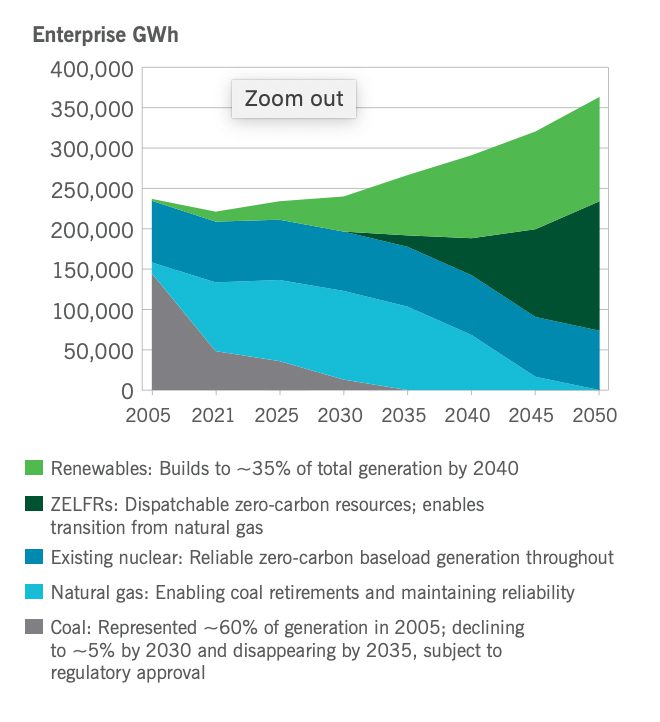

The sale is notable for Duke Energy, the largest utility in the U.S., which has committed to reduce its carbon emissions from power generation by at least 50% by 2030, and ultimately achieve net-zero emissions by 2050. The company is also targeting energy generated from coal to represent less than 5% by 2030, and it intends to achieve a full coal power exit by 2035, which will mean retiring 16 GW of coal over the next 27 years.

While the company says it has so far reduced its power-generation carbon emissions by 44% compared to 2005, it expects to deploy over $145 billion of capital into its regulated businesses over the next decade to execute a significant transition to clean energy.

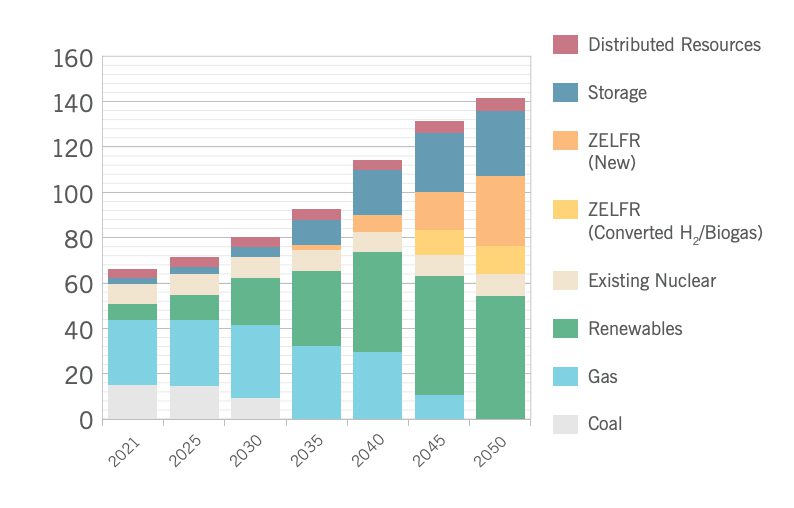

In 2022, Duke Energy’s enterprise-wide fleet (a combined 50 GW) generated 263,812 GWh, mostly (42%) from natural gas, followed by nuclear (33%), and then coal and oil (17%). Renewables produced 8% of its total generation. But part of the company’s strategy to net-zero will involve boosting its renewable capacity to 30 GW by 2035 along with 28 GW of energy storage. It says renewables are slated to make up 40% of its energy mix by 2050.

The company may also depend heavily on “zero-emitting load following resources (ZELFR)”—a placeholder in the modeling for new commercially available dispatchable utility-scale technologies to complement high penetrations of renewables—which it anticipates will be commercially available for deployment in the mid-2030s. It projects it may need more than 40 GW of ZELFRs, which could be combined cycle power plants equipped with carbon capture or use hydrogen and biofuels, small new nuclear units, and advanced energy storage.

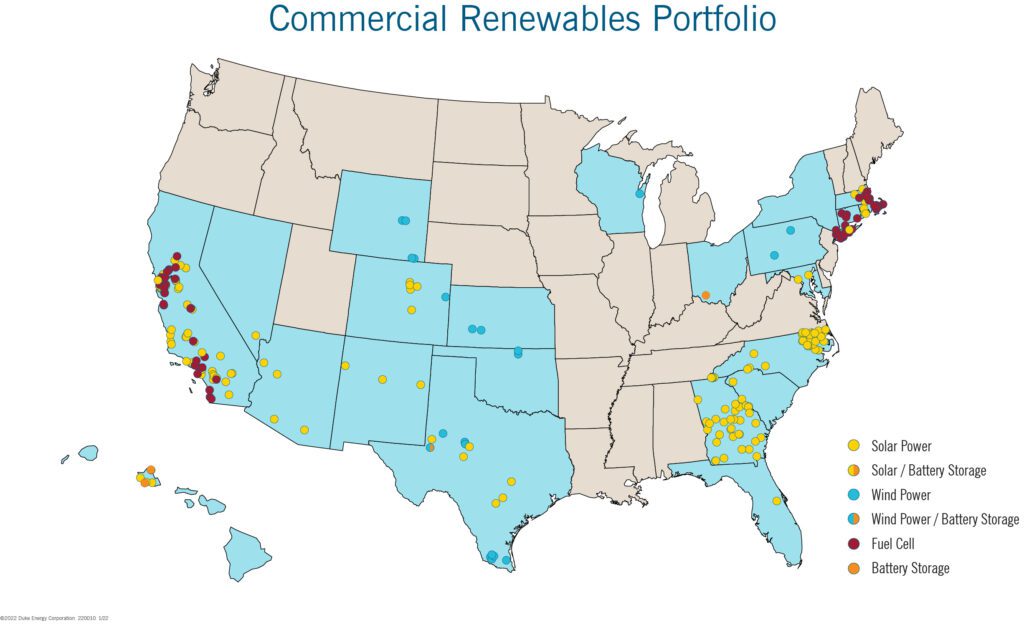

Moving to a Pure-Play Regulated Company

Duke Energy has cultivated its Commercial Renewables business since 2007 alongside its other two regulated segments, which include Electric Utilities and Infrastructure and Gas Utilities and Infrastructure. Primarily composed of merchant utility-scale wind and solar assets located across the U.S., the Commercial Renewables segment has acquired, developed, built, owned, and operated a substantial asset base. It has earned the majority of its revenues through long-term power purchase agreements (PPAs), and it generally sells all of its wind and solar facility output and renewable energy certificates (RECs) to customers. At the start of 2022, the 3,554-MW segment comprised 23 wind facilities, 178 solar projects, 71 fuel cell sites, and two battery storage facilities across 22 states.

However, following a strategic review of the business segment in August 2022, Duke Energy in November 2022 committed to selling the Commercial Renewables segment—with the exception of the offshore wind contract for Carolina Long Bay (which it won in a May 2022 auction)—as two separate “disposal” groups: the utility-scale solar and wind group and the distributed generation group. In March 2023, however, Duke removed assets for certain projects from the utility-scale solar and wind group and placed them in a separate disposal group.

In November 2022, as the company announced its move to sell the Commercial Renewables segment, Duke Energy Chair, President, and CEO Lynn Good said the majority of proceeds from the sale of the disposal groups would be used to reduce holding company debt. “This will strengthen the balance sheet and allow us to fund our clean energy transition with our common equity issuances through at least 2027,” she said.

“I am very proud of our commercial team who has remained focused on maximizing the value of the portfolio, continuing to expand our robust development pipeline and operating a renewables fleet with excellence.”

On Monday, Good added that the sale is an “important step in our transition into a purely regulated company with significant grid and clean energy investment plans that will deliver benefits to our customers and stakeholders.”

Following the deal’s close, primary operations of the Commercial Renewables business will remain in Charlotte, North Carolina. Duke Energy employees that support the business will transition over to Brookfield to maintain business continuity for its operations and customers, the company noted.

—Sonal Patel is a POWER senior associate editor (@sonalcpatel, @POWERmagazine).