A bitter dispute concerning subsidies for nuclear generation that has divided the power sector grew more intense over the past week as Connecticut, Ohio, and Pennsylvania advanced efforts to keep nuclear plants operating. At the same time, legal challenges to existing measures in Illinois and New York continued in two federal courts.

In Connecticut, Gov. Dannel Malloy on October 31 signed a bill—with apparent reservations—that was approved by the state’s General Assembly last week. The new law allows state energy officials to modify rules and permit how Dominion Energy may sell up to 75% of output from its Millstone nuclear plant in Waterford in a competitive solicitation with other zero-carbon resources.

In Ohio, 15 bipartisan co-sponsors introduced H.B. 381, “Ohio Clean Energy Jobs,” which essentially reworks a controversial zero-emission nuclear proposal to help protect the state’s nuclear plants.

And in Pennsylvania, in an effort to stem economic losses from the premature retirements of coal and nuclear power plants in the state, both houses in the state legislature on October 25 approved resolutions urging the Federal Energy Regulatory Commission (FERC) to strongly consider the Department of Energy’s (DOE’s) Grid Resiliency Pricing Rule.

That rule essentially introduces federal action into the longstanding dispute. It directs FERC—an independent regulatory government agency that is officially organized as part of the DOE—to exercise its authority under sections 205 and 206 of the Federal Power Act (FPA) and require that independent system operators (ISOs) and regional transmission organizations (RTOs) “establish just and reasonable rates for wholesale electricity sales” for power plants that show “reliability and resiliency attributes.”

Connecticut to Dominion: Show Me the Money

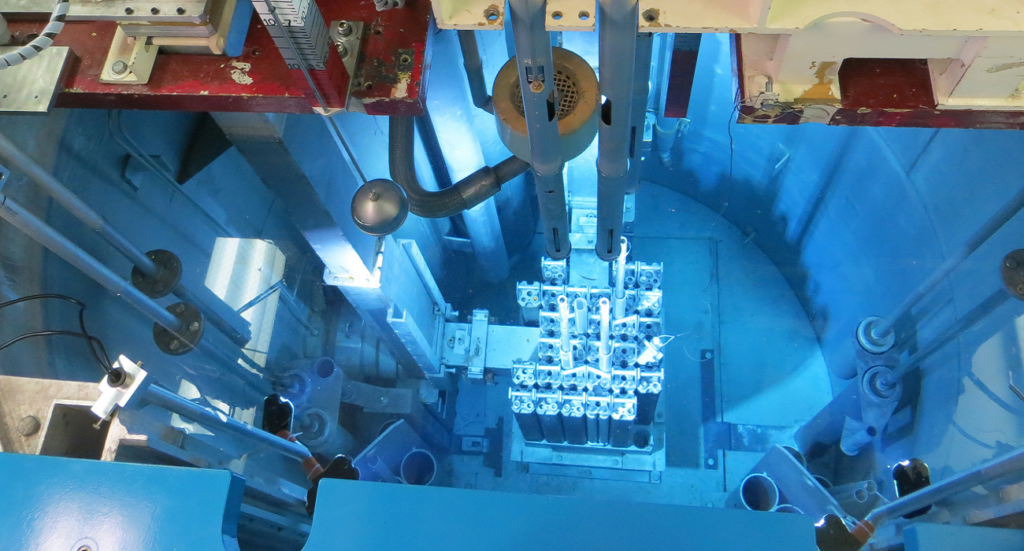

A week after Connecticut’s General Assembly approved a bill that could allow Dominion’s Millstone plant—its sole nuclear plant (Figure 1)—to bid its power into a competitive auction that has so far been reserved for hydro and renewables, the state’s governor signed the bill, noting: “The importance of this asset to both the state and the region cannot be overstated. If we are to realize the goals set out by this legislation, there is more work to be done.”

Senate Bill 1501 (An Act Concerning Zero Carbon Procurement) has its roots in authority granted to the Department of Energy and Environmental Protection (DEEP) by the legislature in 2011—in a bid to mitigate soaring residential electric rates—to pursue multiple competitive processes to serve retail electric customers directly.

Dominion, which currently sells Millstone’s output in long-term bilateral agreements to hedge funds and other financial institutions, has long argued that if Connecticut wants low-cost, long-term resources that meet economic and environmental goals, the solicitation process had to be expanded to include nuclear power. This June, after state legislators effectively blocked a similar bill that would have provided it a mechanism to bid for state contracts reserved for renewables, the company said it would begin a “strategic reassessment” of its plans for the 2,111-MW plant that produces the bulk of the state’s power.

At the end of July, meanwhile, Gov. Malloy signed Executive Order 59 directing DEEP and the Public Utilities Regulatory Authority (PURA) to conduct a “resource assessment” to evaluate the current and projected economic viability for the continued operation of Millstone.

But while the agencies asked Dominion for proprietary cost data associated with Millstone’s fuel costs, operation and maintenance costs, and capital expenditures, Dominion refused to provide that information, citing reservations regarding aspects of Connecticut’s Freedom of Information Act (FOIA).

“The information requested is financial and considered proprietary,” Dominion spokesperson Ken Holt explained to POWER on October 31. Holt noted the company’s reasons are elaborated in a letter sent to the agencies on October 18. “We have offered to meet with the state and discuss this information face to face. There is a concern that if it is submitted it could be subject to FOIA,” he said.

Failing to get that data, which it requested two months ago, DEEP and PURA hired Levitan & Associates (LAI) to draw up a credible picture of Millstone’s profitability. Based on the “best available information,” the energy management consultant firm reported that Millstone is “likely to operate profitably” from 2022—the first year for which the plant won’t have an existing obligation to run through the forward capacity market—through 2035.

“Even under harsh market and operating cost assumptions, LAI has concluded that Millstone’s financial prospects are bright,” the agencies told the governor’s office in a preliminary progress report on the plant’s viability.

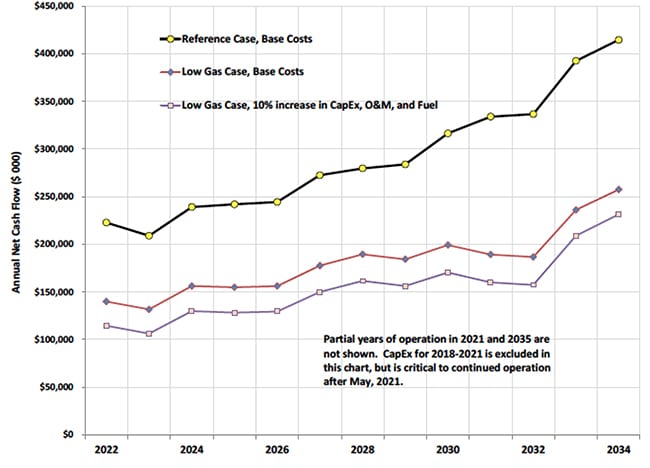

Under expected market conditions, the present value of Millstone’s after-tax cash flow between 2021 and 2035 is about $2.3 billion—and even under lower than anticipated natural gas prices, it would still hover at about $1.4 billion (Figure 2). “Under low natural gas prices and higher than anticipated Millstone operating costs, the present value is $1.2 billion, which is deep-in-the-black,” the agencies reported.

In an October 31 letter, the state agencies pointed out to Gov. Malloy—who had the General Assembly’s bill on his desk for signature—that the primary impetus for Executive Order 59 was “the claim from Dominion that Millstone was experiencing the same types of severe financial challenges that other nuclear facilities in deregulated markets have faced due to low natural gas prices and other factors.” Exelon Corp., for example, provided “evidence of their distressed financial position to justify ratepayer-backed financial support mechanisms in those states.” That’s why the state agencies believed that “it is reasonable to expect such a demonstration from Dominion.”

But because the LAI analysis shows that Millstone is expected to be “highly profitable through 2035,” when Unit 2’s license expires, “there is unlikely to be a basis upon which to conclude at this time that Dominion requires electric ratepayers to provide financial support outside the regional market in order for Millstone to continue operating profitably,” the agencies concluded.

Gov. Malloy still signed the bill, saying in a statement October 31: “I sign this legislation with the hope that Dominion will work in partnership with DEEP and PURA to provide the necessary information to complete an accurate assessment of Millstone.

“The state needs significantly more engagement from Dominion as other nuclear facility owners have engaged under similar circumstances in other states. I look forward to continuing this conversation and to increased cooperation from the party seeking assistance.”

For Dominion, the news was positive. “On behalf of the 1,500 women and men who work at Millstone, I want to thank Governor Malloy for signing this important legislation,” said Thomas F. Farrell, chairman, president and CEO of Dominion Energy.

For a group of utility companies that serve Connecticut and have backed a digital campaign called “Stop the Millstone Payout,” alleging Dominion was asking for “a corporate handout straight from consumers’ pockets, while refusing to open its books and prove that it actually needs the money,” the news was also welcome.

“The interim findings by DEEP and PURA only affirm what we have been saying all along: Millstone is highly profitable and has no good rationale to seek special treatment. The regional electric markets are working as they should, by encouraging competition and capital investments, while providing options for plants that are truly struggling,” it said on an October 31 statement.

Ohio Revitalizes ZEN Measure and FirstEnergy Is Buoyant

On October 13, meanwhile, Ohio lawmakers introduced a fresh bill backed by FirstEnergy Corp. to help prop up its Davis Besse and Perry nuclear power plants.

House Bill 381, sponsored by Rep. Anthony DeVitis (R-Green) and co-sponsored by Rep. Ron Young (R-Leroy Township), among others, essentially sets up a zero-emission nuclear resource program (ZEN). But unlike a previous proposal, it burdens residential customers with a smaller increase on their bills, and, significantly, it shortens the proposed ZEN program from 16 years to 12 years.

In a third-quarter earnings call on October 27, FirstEnergy CEO Charles Jones lauded the bipartisan measure. “While revenue resulting from this legislation will be a reduction from the previous versions, it would likely make the plants economically viable, particularly in a restructuring scenario at FES. We believe this effort is imperative for Ohio’s energy security,” he noted.

The Public Utilities Committee is expected to hold hearings on the bill over the next several weeks and a vote is possible before the end of the year while a final legislature vote could come in the middle of the first quarter, Jones said.

“Whether these state or federal activities result in meaningful and timely support remains to be seen, but it is encouraging to see the much needed attention on these very important issues.”

The outlook was positive, Jones noted. Responding to an analyst question about why state nuclear subsidy actions have progressed even though the state’s governor is opposed to them, Jones said: “I think the fact that New York and Illinois have – already taking measures to protect these fuel-secured nuclear facilities in particular, the DOE initiative on top of it, the fact that other states concurrently are looking at it, all are creating an awareness about what’s going on in our nation and the importance of these assets to not only physical security, but also economic security.”

Yet, Jones noted that the company will push ahead with plans to exit commodity-exposed generation owing to several factors. At the same time, the company will continue weighing its options about whether FirstEnergy Solutions, its competitive generation subsidiary, will seek bankruptcy protection. Jones pointed to “several key considerations in making that decision, including the outlook for the DOE’s proposed rule and FERC’s actions as well as the status of discussions with creditors’ advisors.”

Pennsylvania, Backed by Powerful Nuclear Caucus, Takes Action

In an effort to stem economic losses from the premature retirements of coal and nuclear power plants in Pennsylvania, both houses in the state legislature on October 25 approved resolutions urging FERC to strongly consider the DOE’s Grid Resiliency Pricing Rule.

The State Senate resolution (No. 227) was sponsored by Sen. Ryan Aument (R-District 36) and Sen. Donald White (R-District 41). Co-sponsors of the House measure are: Rep. Jeffery Pyle (R), Rep. Pam Snyder (D), Rep. Becky Corbin (R), and Rep. Robert Maize (D).

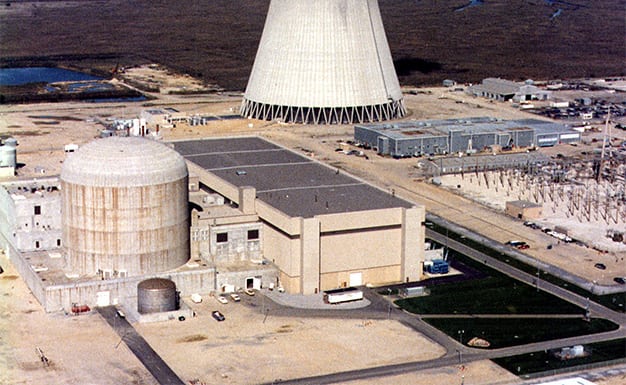

All are members of the state’s unique nuclear energy caucus and its coal caucus, who have been raising concerns over the loss of baseload nuclear and coal plants in Pennsylvania. The nuclear caucus—convened this March as the first of its kind in the nation—has specifically advocated for keeping open Three Mile Island Nuclear Generating Station (Figure 4) owned by Exelon Corp. The lawmakers have said that closure of the plant could mean “a significant loss of family-sustaining jobs, high capacity baseload clean energy, and the many direct and indirect economic benefits that surround the production of electricity from a nuclear power plant.”

Predictably, passage of the resolution by the General Assembly was lauded by Exelon Corp., the nation’s largest nuclear generator, which owns three of the state’s five nuclear power plants. The company in May warned that it will be forced to retire the Three Mile Island nuclear plant by September 2019 unless policy reforms are enacted in Pennsylvania. Industry observers, however, point out that the gambit is similar to one employed in Illinois to help enact the Future Energy Jobs Act in December 2016 (it went into effect this June) and keep Exelon’s Clinton and Quad Cities plants running. Exelon also strongly backed a measure that became effective this April to preserve the at-risk Nine Mile Point, FitzPatrick, and Ginna reactors in upstate New York.

Exelon spokeswoman Robin Levy told POWER on October 20, after the concurrent resolution was introduced in the Pennsylvania General Assembly, that the company has been in “regular discussions” with lawmakers and policy makers in all states in which it does business.

In Pennsylvania, she said, nuclear power provides 92% of the Commonwealth’s clean energy, supports 16,000 jobs, and contributes $2 billion to the economy. “As such, policy makers are naturally incented to keep nuclear power at the forefront for Pennsylvanians, and we support swift adoption of the resolution that has been introduced,” she said.

“Absent action at the federal level, other measures at the state level such as zero-emissions credit programs that promote zero-carbon energy and create and preserve clean-energy jobs will be necessary for Three Mile Island to remain operational.”

The Chasm Widens in Court

New York and Illinois, the two states that have already implemented “bailout” programs to keep nuclear plants operating for economic reasons, defended their nuclear subsidies in comments to FERC earlier this month even as they strongly opposed the DOE’s proposed grid resiliency rule.

But the fight is far from over. The states’ measures are being legally challenged by several independent power producers—including Dynegy, Eastern Generation, NRG Energy, and Calpine Corp.—and, prominently, competitive power producer trade group the Electric Power Supply Association (EPSA). The consortium has long argued that the state rules interfere with FERC’s jurisdiction over wholesale electric rates and unlawfully interfere with interstate commerce.

This July, federal courts in Illinois and New York separately rejected claims by the multiple plaintiffs. On July 14, the U.S. District Court for the Northern District of Illinois let stand Illinois’ zero-emission credit (ZEC) program, dismissing two lawsuits and ruling in favor of motions by the state and Exelon Corp. Hard on the heels of that decision, on July 25, U.S. District Judge Valerie Caproni in Manhattan dismissed challenges against New York’s Clean Energy Standard nuclear subsidies, ruling that federal law does not preempt the state and its Public Service Commission from using a ZEC program.

The plaintiffs on July 17 appealed the Illinois case to the U.S. Court of Appeals for the Seventh Circuit, and then on August 24 appealed the New York case to the Second Circuit. In a October 13 reply brief filed with the Second Circuit, the plaintiffs pointedly said that New York’s original ZEC proposal issued in January 2016 was designed to provide subsidies facing “financing difficulties” with the subsidy amount based upon differences between the anticipated operating costs of the units and forecast wholesale prices. However, after the U.S. Supreme Court unanimously ruled in April 2016 (Hughes v. Talen Energy Marketing) that state subsidies to power generators are pre-empted by the Federal Power Act if they are tethered to FERC-regulated wholesale power prices, New York’s Public Service Commission revised the recommendation in July 2016 and based the subsidy’s formula on an estimated “social cost of carbon.”

It is clear that legal battles to thwart state measures subsidizing nuclear power may not be resolved until next year—perhaps even longer—though at least one federal court has ordered an expedited review of the issue.

Meanwhile, the chasm dividing the power sector continues to widen as entities on both sides escalate the rhetoric. In its comments to FERC on October 23, NRG—the nation’s largest independent power producer—said the greatest threat faced by its existing fleet “is the uneconomic price suppression caused by state programs designed to keep economically failing nuclear plants alive and participating in the market.” It also railed against preferential treatment of renewables.

“Corporate bailouts targeted to specific fuel types or companies, whether they are being implemented on a state-by-state basis or at the national level, are directly contrary to the uniform American experience that competition drives down prices, increases quality of service, and encourages technical innovation,” the company said.

At the heart of the issue, explained Abraham Silverman, NRG’s vice president and deputy general counsel for its regulatory division, in an August 3 interview with POWER, is “where the appropriate line is between cooperative federalism and the state’s ability to tailor their own energy future consistent with the Federal Power Act and putting FERC in charge of the wholesale markets.”

Essentially, “The states are putting their thumb on the scale and still asserting that the market is fair,” added David Gaier, a senior spokesperson at NRG.

A better solution to deal with carbon pollution, Silverman asserted, would involve “something that’s competitively neutral,” such as a price on carbon. “The worst thing you can do, from a public policy standpoint, is point to specific corporations and say we’re going to give you money without ever putting it out for bid, without ever testing to see whether that’s the best use of consumer money.”

NRG also often points out that nuclear units have a fixed lifetime, and bailouts may only save the reactors for a maximum of about 10 years. “After which they’re most certainly going to retire so we’re effectively renting the carbon free generation from these nukes at a very exorbitant price even if you ignore the billions of dollars that consumers have paid for these plants in the past through restructuring,” Silverman said.

“Even if you ignore the billions of dollars that they made in profits during the 2000s and the massive money they made during the Polar Vortex, now we’re basically talking about renting these nukes for 10 years. And what’s the alternative? The alternative is to take that $10-12 billion and really invest it in green infrastructure.”

Crutches for Nuclear’s Ails

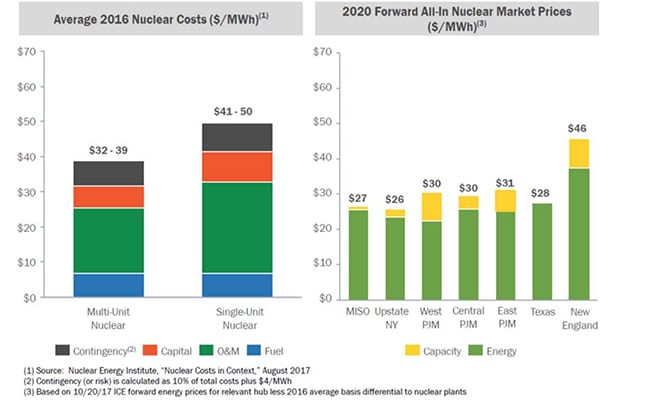

For Exelon, however, much more is at stake. In its comments to FERC on October 23, the company painted a dire picture for the future of nuclear power, noting that between 2002 and 2016, 4.7 GW of nuclear generating capacity—about 5% of the U.S. total—has announced retirement, and another eight nuclear reactors of about 7 GW have announced retirement plans since 2016. Merchant nuclear plants in all regions are meanwhile facing a shortfall of market revenues relative to costs (Figure 5), it noted, and without corrections to the market and full compensation for the attributes, “the nation will suffer a massive wave of premature retirements,” it said. (For more, see POWER’s August infographic, “The Big Picture: Nuclear Financial Meltdown,” which suggests that about two-thirds of the nation’s 100-GW nuclear capacity is in economic jeopardy.)

However, Exelon called on FERC to ensure it will not impede New York’s and Illinois’ efforts to support nuclear plants at risk of retirement. “While the primary goal of these programs was environmental, the programs have the additional benefit of preserving units needed for system resiliency. These programs benefit nuclear units within the organized markets covered by the DOE [rule] and are targeted at units that otherwise would permanently retire,” it said.

FERC should also “make clear” that units receiving state support “should not have their capacity or energy offers subject to mitigation,” it said, even though natural gas generators have called for it. “FERC should be mindful that natural gas and oil receive tens of billions of dollars annually in tax and other subsidies, and additionally enjoy the benefit of using the atmosphere on a mostly unrestricted basis as a place to release carbon and other pollutants.

“Indeed, those who complain most vigorously about the need to preserve ‘free markets’ are in fact the largest beneficiaries of tax and other subsidies,” it added.

—Sonal Patel is a POWER associate editor (@sonalcpatel, @POWERmagazine)