Congress Approves Ban on Imports of Enriched Uranium From Russia

The U.S. Senate on April 30 passed—by unanimous consent—a bill to ban imports of unirradiated low-enriched uranium (LEU) produced in Russia. The bill now heads to the president’s desk for signature into law.

The Senate passed the Prohibiting Russian Uranium Imports Act (H.R. 1042), which the House of Representatives passed (also by unanimous consent) by a voice vote on Dec. 13, 2023. H.R. 1042 was introduced by Rep. Cathy McMorris Rodgers (R-Washington) in February 2023, but it received the backing of a bipartisan group of Senators, including John Barrasso (R-Wyoming), Joe Manchin (D-West Virginia), Jim Risch (R-Idaho), Martin Heinrich (D-New Mexico), Cynthia Lummis (R-Wyoming), Chris Coons (D-Delaware), and Roger Marshall (R-Kansas).

H.R. 1042 essentially amends the USEC Privatization Act (42 U.S.C. 2297h–10a). It specifies that 90 days after the bill’s enactment, no unirradiated low-enriched uranium that is produced in the Russian Federation or by a Russian entity can be imported into the U.S.

“Unirradiated” means fresh fuel that has not yet been used in a reactor, while “low-enriched uranium” refers to uranium products in any form, including uranium hexafluoride (UF6) and uranium oxide (UO2), in which uranium contains less than 20% uranium-235 (U-235). That includes natural uranium and other forms, regardless of whether the uranium is incorporated into fuel rods or complete fuel assemblies. (The prohibition, however, does not apply to imports for national security purposes.) The ban applies through at least 2040.

To reduce supply disruption risks, however, H.R. 1042 also grants the U.S. Energy Secretary (in consultation with the Secretary of State and the Secretary of Commerce) waiver authority to allow certain imports of LEU if “no alternative viable source of low-enriched uranium is available to sustain the continued operation” of a nuclear reactor in the U.S.

In addition, it requires the Energy Secretary to conduct a “thorough market evaluation” of the anticipated LEU supply to determine “what, if any, U.S. federal assistance may be needed to support expansion of production capacity sufficient to replace Russian supplies.”

An Urgent Measure to Fortify Domestic Supply Chains

A House report in December argued that the measure would “create the market conditions for the long-term commercial contracts that domestic fuel producers need to invest in new U.S. supply capacity, including uranium conversion and enrichment capacity, which has atrophied substantially over the past decade.”

While the effort partly responds to Russia’s invasion of Ukraine—which in February 2022 precipitated a “looming threat to global energy security created by dependence on Russian-supplied fuels”—the bill’s objective is to create “long-term certainty that Russian fuels will not enter the U.S. market,” the report noted. “This allows accurate evaluation of the market response, and other priorities for nuclear infrastructure, to identify what, if any, additional federal support is necessary to assist diverse and adequate capacity expansion.”

The report also notes that the House Committee on Energy and Commerce considered implementing the ban after constructing the necessary fuel cycle infrastructure. However, it indicates that the committee ultimately concluded this approach would “get the sequencing backwards,” potentially leading to market distortions and wasteful taxpayer spending.

Russian-origin Enrichment Fuels 24% of U.S. Utility Demand

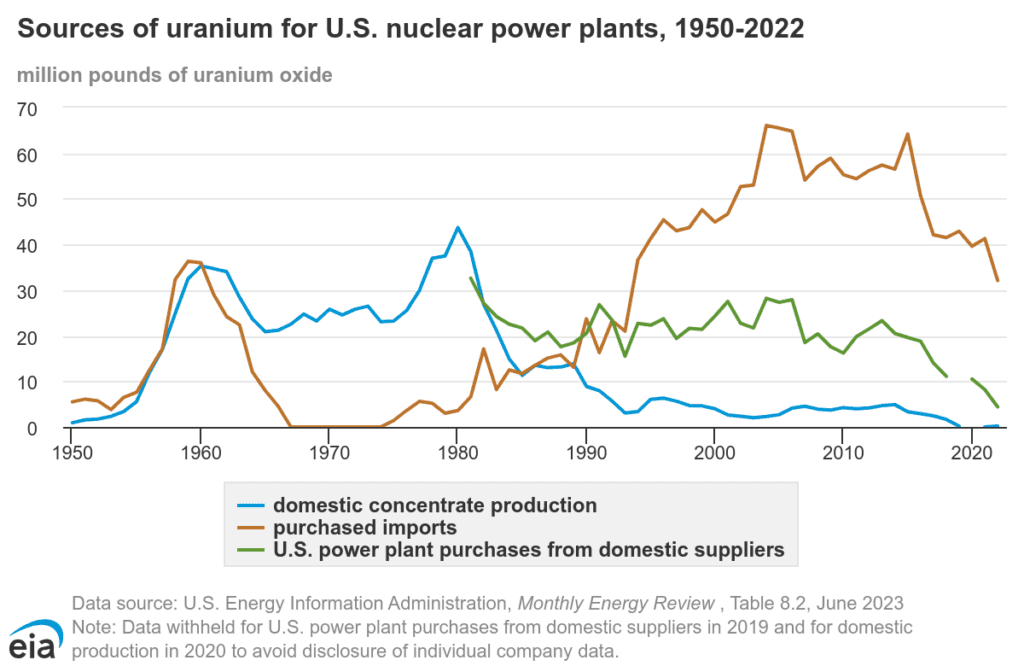

The ramifications of the ban are expected to be extensive. According to the Energy Information Administration (EIA), the U.S. imports most of the uranium it uses as fuel, a trend it has followed since 1992. Owners and operators of U.S. civilian nuclear power reactors purchased 40.5 million pounds of U3O8e (equivalent) from U.S. and foreign suppliers in 2022, the agency suggests.

Most (27%) came from Canada, followed by Kazakhstan (25%), Uzbekistan (11%), Australia (9%), and six other countries combined (16%). Only an estimated 12% of U.S. purchases of uranium were sourced from Russia, even though Russia dominates the world’s uranium capacity (with a market share of about 45%).

However, U.S. utilities purchased an estimated 3.9 million Russian-origin separative work units (SWU) in 2023—representing 24% of U.S. enriched uranium demand. U.S. enrichment plants provided the remaining 27% while Western European plants provided 49%.

A key concern voiced by lawmakers in the House report is that Russia has maintained “an influential position in global nuclear fuel supply chains, particularly in uranium conversion and enrichment,” owing to the country’s “production capacity that far outstrips its own domestic requirements and a vertically integrated, state-owned system that excludes external competition.”

The size of the “Russian state-owned enrichment capacity, along with its large enriched-uranium inventories, enables it to export enriched uranium products at prices that would undercut allied and domestic producers, to the detriment of domestic supply chains, as U.S. International Trade Commission (ITC) investigations have repeatedly found over the past 30 years,” the report notes.

“In point of fact, this past March 2023, the ITC’s five-year review of uranium from Russia found that absent current import limits, Russian suppliers would likely undersell domestic supplies and depress prices, to the detriment of U.S. supply chains.”

The Ban’s Potential Impact on Fuel Supply, Costs

POWER has reached out to industry organizations to learn how the ban might affect nuclear fuel supplies and nuclear power economics over the short and long term.

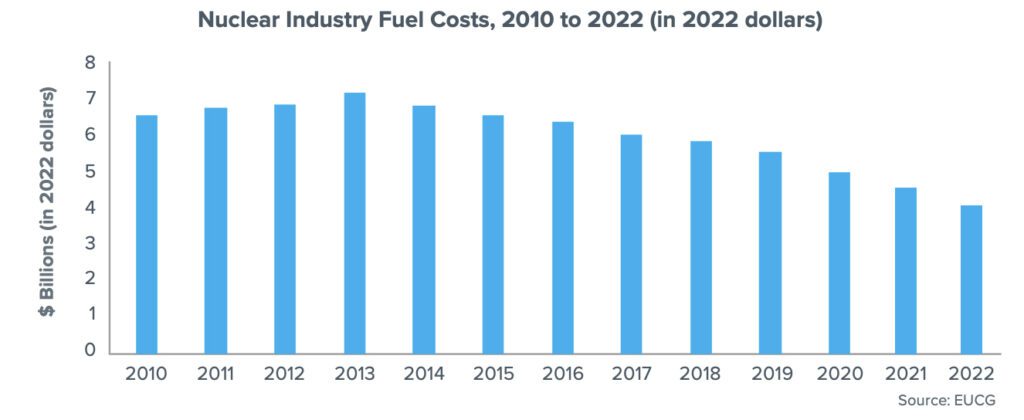

According to the Nuclear Energy Institute (NEI), in 2022, fuel costs represented about 17% of total generating costs. “Fuel costs experienced an increase from 2009 to 2013, largely as a result of an escalation in uranium prices, which peaked in 2008. Since uranium is purchased far in advance of refueling and resides in the reactor for four to six years, the effect of this commodity price spike occurred much later after the uranium price increase occurred,” NEI explained in a recent report.

“Afterwards, uranium prices remained low for many years, and some utilities moved to shorter contract cycles. Despite an increase in the price of uranium since 2020 due to the COVID-19 pandemic and the Russia-Ukraine war, fuel costs for the U.S. fleet remained low in 2022.”

However, utilities have continued to be cautious about the risks to their fuel supply chains, especially considering the wide-ranging sanctions on Russian imports implemented in February 2022, which notably did not include uranium imports.

In a recent filing, Constellation, a company heavily reliant on nuclear power, said that the Russian-Ukraine conflict has not yet impacted its nuclear fuel deliveries. However, the company has proactively increased its nuclear fuel purchases to boost its inventory, projecting that 44%–47% of its capital expenditures for 2024 and 2025 will be dedicated to acquiring nuclear fuel. The strategy is designed to ensure the long-term operation of its fleet and provide the necessary fuel “to bridge potential Russian supply disruption through 2028, which is the date multiple suppliers are expected to have incremental additional capacity online,” it said.

Rebuilding the U.S. Enrichment Landscape

The bill marks a significant juncture by the U.S. to address a long-standing vulnerability in its nuclear fuel supply chain. While once robust, the decline of the U.S. front-end fuel cycle is pegged to significant disruptions in the nuclear fuel market following the 2011 Fukushima accident. The events suppressed global demand for nuclear fuel, affecting domestic uranium mining, conversion, and enrichment services, and sent market prices for uranium plummeting.

Domestic efforts to revive the front-end of the nuclear cycle kicked off in earnest in 2020, after the Trump administration found that uranium imports posed a threat to national security, and the U.S. convened a Nuclear Fuel Working Group. The group essentially outlined a three-pronged strategy to revive the uranium mining industry, support conversion services, and end reliance on foreign uranium enrichment capabilities.

The strategy was partly fruitful: While most U.S. uranium mines halted production after 2018, primarily owing to low prices, following a sharp rise in prices and demand expectations, several U.S. mines restarted operations in 2022 and 2023, with more re-openings planned. Still, “While the U.S. maintains the largest market globally for nuclear fuels, its current domestic enrichment capacity can supply just 30% of domestic fuel requirements at present,” the House report notes. “Its one conversion facility is restarting and will be able to supply the equivalent of about 40% of U.S. market demand in the near term.”

Uranium enrichment involves “enriching” the U-235 isotope in a multi-step process. Mined uranium consists of about 99.3% U-238 and 0.7% U-235, which is fissionable when enriched to beyond 3% (as well as less than 0.01% of U-234). At a conversion plant, uranium oxide is converted from powder into a UF6, a gas whose fluorine element does not contribute to the weight difference while separating U-235 from U-238. Honeywell last year reopened Metropolis Works plant in Metropolis, Illinois—but it remains the U.S.’s sole uranium conversion facility. During enrichment, meanwhile, the UF6 gas is separated into two streams, one with more U-235 than before and the other with less. Centrus Energy and Urenco currently host the nation’s only enrichment capacities.

A Five-Country Effort to End Reliance on Russia

In addition to its domestic measures, the U.S. has recently moved to pursue international collaborations to boost its global nuclear supply chain. In December 2023, it joined with Canada, France, Japan, and the UK to mobilize $4.2 billion to boost enriched uranium production capacity “free from Russian material and establish a resilient uranium supply market free from Russian influence.” On April 18, Dr. Kathryn Huff, assistant secretary of the Department of Energy (DOE) Office of Nuclear Energy, suggested the “Sapporo 5” collaboration has already made “incredible strides” to support enrichment activities, pointing to recent announcements from global commercial nuclear fuel manufacturers.

In July 2023, London-based Urenco said it would add multiple new centrifuges at its UUSA facility in Eunice, New Mexico (which is operated by Louisiana Energy Services). “New commitments from U.S. customers for non-Russian fuel underpin this investment, which will provide an additional capacity of around 700 tonnes of SWU per year, a 15% increase at UUSA, with the first new cascades online in 2025,” it said. And in December 2023, Urenco pledged another 15% capacity increase (of around 750 tonnes of SWU per year) for its Netherlands plant. It also said it is “re-fitting an existing space with more modern centrifuge technology” to enhance the capacity of its facility in Gronau, Germany.

In tandem, Urenco recently moved to amend a Nuclear Regulatory Commission (NRC) license to support allowable U-235 enrichment levels to 10% to support industry development and implementation of accident-tolerant fuel (ATF). It has also provided the NRC with a notice of intent to submit a license amendment to support the production of high-assay, low-enriched uranium (HALEU), a nuclear fuel material enriched to a higher degree (between 5% and 20%).

In the U.S., where the DOE posits more than 40 metric tons of HALEU may be needed by 2030 to support advanced reactor needs, Centrus Energy in October 2023, kicked off enrichment operations at its American Centrifuge Plant cascade in Piketon, Ohio. As of April 19, the facility had enriched more than 100 kilograms (kg) of HALEU and was working toward an additional 900 kg, the DOE said.

Meanwhile, in October 2023, French nuclear fuel giant announced plans to increase uranium enrichment capacity at its Georges Besse 2 facility in France by nearly a third by 2028. “Future enhanced supply remains under consideration to support advanced reactor fuels with enrichments up to 6% for LEU+ [enriched uranium up to 10%] and up to 19.75% for HALEU in various fuel forms,” Orano said.

Orano is also reportedly mulling plans to build a uranium enrichment facility in the U.S. That news is significant considering that Orano’s predecessor AREVA had once made solid progress in developing the $3.3 billion Eagle Rock enrichment facility in Idaho Falls, with the DOE in 2010 offering the French firm a conditional $2 billion loan guarantee to complete the project. But while the 3.3 million-SWU centrifuge project garnered an NRC license in 2011 to build and operate the facility, it was repeatedly delayed in the wake of the Fukushima disaster and finally shelved. The NRC terminated the license in 2018.

“Additionally, Japan has committed to increase their enrichment from 75 tons per year to 450 tSWU per year by 2027, the UK announced a £300 million investment to launch Europe’s first domestic HALEU program, and Canada continues to mine and convert uranium to support a safe and secure supply chain,” Huff noted in April.

Buoyed by Significant Investments

But, as POWER has reported, nuclear fuel firms have underscored a need to underwrite the significant capital investments that will be required to expand enrichment capacity. The investments require firm commitments by reactor developers or government entities, they have noted.

To support the Sapporo 5 objectives, the U.S. recently made available $2.7 billion as directed in the FY2024 spending bill to build out LEU and HALEU development. The funding was contingent on a ban on Russian uranium imports that is currently being considered by Congress, Huff noted.

France has meanwhile mobilized $1.8 billion, and the UK has pledged approximately $383 million. The combined funding has notably already exceeded the Sapporo 5 pledge made late last year, the DOE said.

At the same time, DOE efforts to address the nuclear fuel cycle appear to also be making headway. As of March 22, the agency had closed requests for proposals (RFPs) for the purchase of enriched and deconverted high-assay low enriched-uranium (HALEU), crucial parts of the advanced nuclear fuel supply chain. The measure is furnished by $700 million allocated by the 2022 Inflation Reduction Act (IRA) to support activities under the HALEU Availability Program (which Congress established in the Energy Act of 2020). The DOE plans to award contracts enrichment and deconversion services “later this summer to help spur demand for additional HALEU production and private investment in our domestic nuclear fuel supply infrastructure,” Huff noted.

Russian Uranium Ban Fuels Optimism

American nuclear stakeholders on Wednesday responded with optimism to the Senate’s passage of H.R 1042, heralding its potential to jumpstart the nation’s long-dormant fuel cycle.

“This legislation, which has now passed both chambers of Congress, not only prohibits the importation of Russian uranium but also unlocks $2.72 billion that was appropriated in the Consolidated Appropriations Act of 2024 to bolster the U.S. domestic nuclear fuel supply chain,” said Judi Greenwald, executive director at the Nuclear Innovation Alliance (NIA). “This funding was contingent upon the enactment of a Russian uranium ban, underscoring the critical role H.R. 1042 plays in advancing nuclear energy innovation efforts,” she emphasized.

Greenwald, nevertheless, suggested substantial market challenges still lay ahead. She pointed to a recent NIA technical analysis, which recognizes that despite recognition of the need for a domestic HALEU market and pivotal actions by Congress, the DOE, and private companies, the industry still grapples with a lack of detailed public discussion and a clear financial strategy to effectively encourage private investment in HALEU production. NIA’s report notably provides a comprehensive analysis of HALEU production costs, detailing expenses related to uranium enrichment and deconversion. It also evaluates two government initiatives—a material off-take agreement program and a production services agreement program—that could address economic challenges.

Greenwald’s assessment was echoed by the NEI, an industry trade group whose members include U.S. power plant operators and owners, reactor designers, and fuel suppliers and service companies. NEI President and CEO Maria Korsnick also heralded the ban’s role in the release of the $2.72 billion in Congressional funding, which she said will “revitalize a competitive domestic enrichment and conversion capability.” However, she stressed: “It will take many years to expand U.S. capacity to supply the existing fleet and the deployment of next generation nuclear. The implementation of a meaningful program to support capacity expansion is critical.”

NEI and its members have been working to create a “path to a reliable, secure domestic supply of fuel for more than two years, following Russia’s invasion of Ukraine,” Korsnick noted. The trade group plans to keep working with the DOE on the design and implementation “of an effective program to spur expansion of U.S. capabilities as well as establish a predictable and efficient waiver process,” she said.

Think tank Third Way, meanwhile, lauded the bill’s potential to provide more certainty. “To challenge the growing influence of authoritarian regimes, the U.S must lead commercialization of new nuclear technologies by 2035,” said Josh Freed, senior vice president for Third Way’s Climate and Energy Program. “This bill will provide the long-term market certainty needed to support this mission and position the U.S. as a major global energy partner for decades to come.”

Uranium Energy Corp. (UEC), a North American–focused uranium company, in a statement, suggested the bill demonstrates U.S. commitment to nuclear energy. “This new law, in conjunction with the recently passed Nuclear Fuel Security Act, creates a firm foundation for long-term growth of the U.S. uranium industry to supply the fuel that powers American households, data centers, and industrial base with clean baseload power,” Amir Adnani, UEC president and CEO. “As the fastest growing U.S. uranium company, we are delighted to have this exciting backdrop along with positive global uranium market fundamentals and advance the re-start of uranium production in Wyoming this August, followed by the resumption of our South Texas operations next year.”

—Sonal Patel is a POWER senior editor (@sonalcpatel, @POWERmagazine).