The power industry’s ambitious expansion plans for 2026 face an unexpected obstacle that has nothing to do with technology, regulations, or capital: there simply aren’t enough skilled workers to build and operate the infrastructure the grid desperately needs.

As utilities race to meet surging electricity demand driven by data centers, manufacturing reshoring, and transportation electrification, a sobering reality has emerged. Construction employers in the transmission, distribution, and storage sector reported acute hiring challenges, with 89% indicating at least some difficulty finding qualified workers, according to the U.S. Department of Energy’s 2025 United States Energy and Employment Report. Meanwhile, the International Energy Agency (IEA) warned in its December-released World Energy Employment 2025 report that more than half of 700 energy-related companies, unions, and training institutions surveyed reported critical hiring bottlenecks that threaten to “slow the building of energy infrastructure, delay projects, and raise system costs.”

The numbers paint a stark picture. The power industry may need more than 750,000 new workers by 2030, according to Goldman Sachs Research. The IEA report warns that in advanced economies there are 2.4 workers nearing retirement for every young worker under 25 entering the energy sector. It says nuclear- and grid-related professions face some of the steepest demographic challenges, with retirements outnumbering new entrants by ratios of 1.7 and 1.4 to 1, respectively. Notably, Goldman Sachs reports the transmission and distribution (T&D) sector needs to increase active apprenticeships from 45,000 in 2024 to 65,000 per year going forward just to meet the expected increase in workers needed. It would require even more to replace retiring workers.

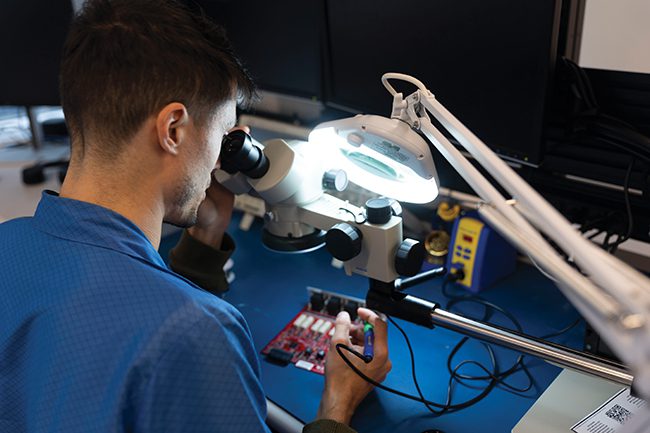

Applied technical roles are particularly scarce. Electricians, pipefitters, line workers, plant operators, and nuclear engineers are in especially short supply, according to the IEA. Significantly, these occupations have added 2.5 million positions globally since 2019 and now represent more than half of the entire energy workforce, it said.

A recent article published by IEEE Spectrum suggests the workforce shortage is creating a bottleneck effect across the entire value chain. In the article, the CEO of a small engineering firm reported spending six to nine months filling open positions. She recounted how a junior engineer—trained at considerable expense—was poached by a competitor within months. It’s clear that smaller firms find it difficult to compete with industry giants that can offer higher salaries and more comprehensive benefits.

Technology as a Force Multiplier

Faced with a shrinking talent pool, many companies are turning to technology to amplify the capabilities of their existing workforce rather than simply trying to hire their way out of the crisis.

“Automation of both business and industrial processes continues to be a key solution to workforce constraints, with AI [artificial intelligence] and machine learning, powered by an industry rich in data, expanding the bounds of automation capabilities,” David Carter, industrials senior analyst at RSM US, told POWER. “Generative AI and AI agents will also help companies to upskill workers faster, expanding the pool of labor.”

Utilities are deploying augmented reality tools that enable senior technicians to assist less experienced colleagues remotely. AI-driven predictive maintenance systems help operators identify and address issues before they escalate, reducing the need for large maintenance crews while improving reliability.

Yet, the very technology that promises to ease workforce constraints is also creating new skill gaps. “This year showed us that AI is a top strategic focus for utilities,” Pradeep Tagare, head of Investments with National Grid Partners, told POWER. “In our recent Utility Innovation Survey, 96% of utility leaders said AI is a new strategic focus. Yet, 66% said the talent gap is the biggest obstacle to AI deployment in the industry. We need to find ways to bridge this gap in 2026.”

The paradox is clear: utilities need AI to manage growing complexity and compensate for workforce shortages, but they lack the talent to deploy AI effectively.

Investing in the Next Generation

Forward-thinking companies are recognizing that short-term hiring fixes won’t address the fundamental structural challenge. Instead, they’re taking a longer view focused on workforce development.

“The most successful companies are focusing on long-term workforce development rather than trying to fill positions quickly,” Sonya Montgomery, CEO of The Desoto Group, told POWER. “Investing in the younger generation is crucial to breaking out of the silo and demonstrating that there is a viable career path within T&D. Many young people are unaware of how fruitful a career in this field can be and how quickly they can be making six figures. The industry provides training, mentorship, and opportunities to build a meaningful career.”

Companies are partnering with community colleges and trade schools to create pipelines of skilled workers, often funding specialized training programs. Some are broadening their outreach to underrepresented groups, both to increase the candidate pool and to support diversity goals.

“Cross-training within the company is another strategy that’s paying off,” Montgomery said. “Employees who are trained in multiple areas are more adaptable and better positioned for growth.” This approach creates workforce resilience by ensuring companies aren’t dependent on individuals with specialized knowledge, while simultaneously offering employees more varied career paths that can improve retention.

A Strategic Imperative

Perhaps most critically, industry leaders are beginning to recognize that workforce investment is not merely a human resources issue but a strategic imperative that directly affects project execution and competitive positioning.

“The most critical differentiator for an EPC [engineering, procurement, and construction company] right now is whether they invest in their workforce,” Montgomery said. “If your partner isn’t actively training the next generation of linemen and project managers, they are a risk to your project’s timeline. The companies that will succeed are the ones utilizing EPCs that view labor as a renewable resource they need to cultivate, not just a cost line item to minimize.”

This reframing is essential. In an era when project delays can mean millions in lost revenue and missed market opportunities, workforce capability becomes a competitive advantage that separates successful developers from those that struggle to execute.

As the industry confronts the dual challenges of an aging workforce and unprecedented growth in electricity demand, success in 2026 and beyond will require companies to fundamentally rethink their approach to talent—not as a commodity to be acquired, but as a strategic asset to be systematically developed, nurtured, and retained. Those who make this shift will be positioned to capture the opportunities that lie ahead. Those who don’t may find their ambitious plans for growth limited not by technology or capital, but by something far more fundamental: the people needed to make it all work.

—Aaron Larson is POWER’s executive editor.