Batteries Are Carving Out Space on the Grid

Falling prices and technological improvements have brought battery storage systems into direct competition with traditional distributed generation, demand response, and peaking generation resources. But making one work efficiently and profitably is not just plug and play.

Falling prices and technological improvements have brought battery storage systems into direct competition with traditional distributed generation, demand response, and peaking generation resources. But making one work efficiently and profitably is not just plug and play.

Last fall, Southern California Edison (SCE) had some big decisions to make. The giant utility, which serves 14 million people across the southern half of the state, needed to procure just over 2 GW of power from a welter of options to meet its projected needs. Among many elements to consider was SCE’s mandate from the California Public Utilities Commission (CPUC) to procure at least 50 MW of energy storage by the end of 2014. This requirement was part of the CPUC’s directive to the state’s investor-owned utilities to procure 1.3 GW of storage by 2020.

The competitive bidding was robust, and SCE received more than 1,800 offers of all sorts. When the dust settled, no one was surprised that SCE had met its 50-MW storage requirement.

What was a surprise to nearly everyone was that SCE exceeded that target by more than five times.

The 260 MW of storage resources—more than 50% of its 2020 requirement—that SCE signed agreements for included 235 MW of battery storage resources, covering both grid-connected and behind-the-meter facilities. The largest contract was a 100-MW, 400-MWh Advancion lithium-ion battery system to be supplied by AES Energy Storage at AES California’s Alamitos facility in Long Beach.

What made SCE jump so far ahead of its mandate? Simply put, it made economic sense.

“This solicitation is the first time that such a wide range of new diverse resources were directly competing in the purchasing process,” Colin Cushnie, SCE’s vice president of energy procurement and management, said at the time. “No single energy source can give us everything we need all of the time, particularly with our emphasis to use environmentally clean resources. To provide for flexibility, we need to accommodate a mix of energy resources.”

And in considering its options, SCE concluded that the range of battery storage systems provided a cost-effective means of enhancing reliability.

SCE’s decision was significant for several reasons, according to AES Energy Storage President John Zahurancik, who spoke to POWER in March.

“It’s one of the first times we’ve seen storage go head-to-head with other types of resources and come out selected as the economic option,” he said. “We’re now seeing storage get the kinds of commercial structures that other resources have traditionally gotten.”

The 100-MW Advancion system will be the largest battery-based storage system in the world—provided it comes online before larger systems are developed, which is no certain thing. Because it will be able to supply both conventional generation as well as load-shifting and peak-shaving services, it’s essentially equivalent to a 200-MW resource.

SCE considered it for a role that would traditionally have gone to a gas-fired combustion turbine–based peaker plant, and in doing so found that battery storage was more flexible and beneficial to the system, and thus more economic in the long run, Zahurancik said.

Zahurancik lauded SCE for doing its homework on energy storage to understand what it needed and what would best meet its requirements.

“I think Edison did a good job of really coming up with a framework to try to evaluate what they were buying and then make sure that they understood the process,” he said. “They did the analytic work and came up with a case of, ‘Not only should we meet the target, but we should be moving beyond that.’”

Lithium Leaders

GTM Research projected earlier this year that installed non-hydro storage capacity in 2015 would triple the 61.9 MW installed in 2014, resulting in a cumulative 2.5 GW by 2019. Navigant Research predicts similar trends, with 2.4 GW of distributed energy storage by 2018. (These numbers represent mostly, though not entirely, battery storage.) Though a variety of battery technologies are available (see “The Year Energy Storage Hit Its Stride” in the May 2014 issue and “Energy Storage Technologies Primer”), two of them—lithium-ion (li-ion) and redox flow—are dominating current installations and projects in development.

Li-ion batteries alone accounted for 70% of storage installations in 2014, in large part because of their established technology, reliability, and efficiency. But the very ubiquity of li-ion batteries—which are used in everything from consumer electronics to electric vehicles to aerospace applications, in addition to energy storage—has placed pressures on global manufacturing.

Electric vehicle company Tesla aims to address that issue with its much-discussed “gigafactory” (shown on the cover), which broke ground near Reno, Nev., earlier this year, with a projected 2020 startup date. The factory has a planned 35-GWh annual production capacity, which is more than the total worldwide production of li-ion batteries in 2013. The company expects that about one-third of the production will go toward storage applications.

Zahurancik agreed that li-ion has an advantage in that the systems are manufactured in a factory, which means “production capacity can increase very, very, quickly,” he said. That matters because the costs of earlier one-off demonstration systems have confused some people as to current li-ion storage costs.

“People will sometimes take something that’s a technology demo and extrapolate the costs, when in a lot of cases these are not baseline costs,” he noted. “What something costs at 1 MW or 5 MW is not a good indication of what it will cost at utility scale.”

Going with the Flow

Flow batteries, however, are attracting their share of research and development because of the number of different technologies that are available. Each offers different characteristics, but in general, flow batteries offer better economies of scale than li-ion batteries, according to Craig Horne, chief strategy officer and co-founder of Sunnyvale, Calif.–based EnerVault.

EnerVault has developed a grid-scale iron-chromium (Fe-Cr) redox flow battery that went online in a demonstration pilot project near Turlock, Calif., last July. That 250-kW, 1-MWh facility (Figure 1) is only the first step in what could potentially be 100-MWh-and-up applications. The key advantage, Horne said, is that the technology scales very economically because of its modular design and inexpensive Fe-Cr electrolyte.

|

| 1. Groundbreaker. This 250-kW, 1-MWh iron-chromium redox flow battery built by EnerVault went online in an almond grove near Turlock, Calif., last year. Source: POWER/Tom Overton |

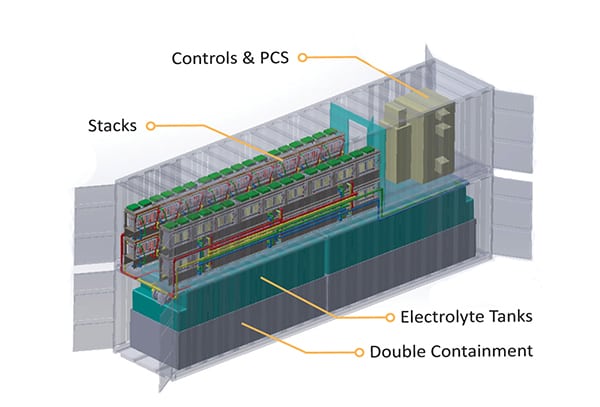

Fremont, Calif.–based Imergy Power Systems this year introduced its largest offering yet, the ESP250. This 250-kW, 1-MWh system uses vanadium-based redox flow technology and is installed inside two stacked 40-foot shipping containers, one holding the electrolyte tanks and the other holding the stacks (Figure 2). Imergy has also developed a proprietary process for extracting high-purity vanadium from secondary sources such as mining slag, oil field sludge, and fly ash. It says this lowers its vanadium costs by 40% compared to virgin vanadium sourced from mining, and the firm projects that it will be able to lower its battery costs to under $300/kWh. The first ESP250 system is being deployed at a data center in India.

|

| 2. Modular flow. Imergy’s ESP250 flow battery system is delivered inside two stacked 40-foot shipping containers. Courtesy: Imergy |

Zinc-iron redox flow batteries are also attracting attention because of their low cost and abundant raw materials. Montana-based ViZn Energy recently introduced its GS200 design, which consists of a block of five of its Z20 battery systems using a single large underground electrolyte tank. ViZn says the GS200 can deliver up to 3 MWh of energy at a price below that of vanadium-based technology. Several Z20 systems are currently in operation, including a facility owned by the Flathead Electric Cooperative in Montana.

Hayward-based Primus Power offers yet another permutation using a zinc-bromine-based design. Primus’s technology is centered around individual 72-kWh energy cells, which can be combined to scale up capacity as needed. Though Primus offers a 240-kW, 720-kWh containerized unit (called an EnergyPod), it views the energy cells as its primary product given their flexibility, Andrew Marshall, director of product management, told POWER. In addition, unlike traditional redox-flow designs, Primus uses metal electrodes, with a single-tank, single-loop electrolyte flow without a membrane. Jonathan Hall, Primus’s vice president of engineering, said this creates a more rugged, durable product that can last up to 20 years.

So You Want to Buy a Battery?

For utilities and generators that are just starting to look at battery storage as an option, the first concern may be the cost. And while prices have come down, a multi-megawatt grid-scale system is not cheap. But the up-front cost is rarely the most important consideration, and may actually be deceptive.

“Sometimes people don’t know exactly what they want to use a battery storage system for, so they are comparing it to nothing,” Zahurancik said. “The better question is, ‘Expensive compared to what?’”

Paradoxically, the most expensive system up front may end up being the most economic because the right management system can extract the most life from such a system compared to cheaper options, according to John Jung, CEO of Emeryville, Calif.–based storage software and solutions firm Greensmith, who spoke to POWER in March.

What do you need to think about before you buy a battery system?

“Number one,” Jung said, “just absolutely make sure there is a clear understanding—not only in the near term but in the long term as well—how you will benefit from energy storage.”

That’s a more complicated question than it may seem, because a battery system that is profitable in one site or region may be unprofitable somewhere else, and possibly even illegal for your firm to operate in a third. A clear plan for what the system will do and how it will generate revenue is essential. Battery systems have been deployed for grid firming, ramp-rate control, frequency regulation, peak-shaving, and renewable backup, among other functions. Each one of these has different requirements and market value, and each one requires different battery characteristics and management.

“You have to have a strategy for energy storage,” Jung said, “as well as a strategy for your market participation as opposed to just opportunistically looking at things.”

Greensmith delivered five systems totaling 23 MW in 2014, about one-third of all grid-scale capacity installed in the U.S. The company’s latest energy storage management software platform, GEMS4, is used to integrate and manage the systems. It’s a measure of how fast the storage market is heating up that that 23 MW figure is dwarfed by the systems in Greensmith’s pipeline, which exceed 500 MW total, Jung said.

With the storage market evolving rapidly, competition between storage resources is becoming an issue as well, Jung noted. “You want to have a plan that focuses more on differentiating yourself in a way that is smarter and better, not just deploying a lot of resources.”

That means being careful not to lock your system into one role or market niche.

“You want to be able to access as many application markets as possible, so it’s important in terms of the ways you select sites and project opportunities, depending on the region and regulatory framework.”

With a clear plan for what you want to do, you then need to think about the best technology and architecture. This again can be challenging because no single battery technology can do everything. And, because the technology is still developing, you need to make sure your system retains sufficient flexibility and options for the future.

Flexibility is a matter not just of the battery technology but also the management and support systems that keep it running smoothly and efficiently. “You’ve really got to know the architecture and know the configurability so that if a particular battery technology does not improve in performance and costs, you’re not out of the market as a result of that,” Jung noted.

Making the wrong choices can result in spending too much money and potentially putting your system at risk.

“If you don’t design your system with a mature, robust architecture and platform, you can oversize it and spend way too much money. You also may not get lasting value out of that energy storage system, which is measured over five to 20 years,” Jung noted. “If your software does not work well, you not only may have suboptimal performance but actually damage the battery, perhaps even catastrophically. Some people have learned that the hard way.”

Hooking It All Up

Then there’s the issue of interconnection. As grid-connected storage systems proliferate, they are drawing attention from independent system operators (ISOs), who must decide how these resources will be treated.

The California ISO (CAISO) produced a roadmap for implementation of the state storage mandate in December 2014. In it, CAISO found that its current rules could accommodate interconnection of storage projects consistent with the treatment of generation. “To be treated consistently with generation means that it must respond to ISO dispatch instructions, including curtailment, to manage power flow on the transmission system during both charging and discharging operations,” it said.

In other words, a storage resource is treated as producing positive generation during discharge mode and negative generation during charge mode, and curtailment instructions would apply to both modes. The advantage of this approach is that it avoids a bifurcated process in which a single storage facility is treated as both generation and load.

Two caveats would apply, however. This approach would be limited to stand-alone and generation-connected storage, but not to storage combined with load. In addition, storage treated as generation would not have the freedom to charge at will, since it would be subject to curtailment. A project wanting that ability would have to negotiate firm load service from its transmission owner.

Not surprisingly, CAISO plans to monitor deployment of grid-connected storage systems carefully and update its rules going forward, as needed.

The PJM Interconnection’s controversial and much-debated Capacity Performance proposal last year, which would have increased both payments and penalties for providers who committed to “no excuses” performance, contained both pluses and minuses for battery storage. In deciding to punt the proposal over to the Federal Energy Regulatory Commission (FERC) in February, PJM said the plan offers a variety of opportunities for storage resources to participate, among them combining their offers with other demand response and efficiency measures. “[T]he ability of these resources to receive revenues for superior performance provides a new revenue stream that does not exist under today’s capacity construct,” it said in its filing with FERC.

Market Potential

There’s little dispute that battery storage is only just getting started. Navigant Research projected in January that the global storage market would total $68.5 billion through 2024.

“We’re seeing several markets move beyond the ‘Will it ever be economic?’ stage,” Zahurancik said. “Not everyone is there yet, but you have leading markets in California, New York, and PJM, that have done these things. I don’t think the general market is there yet, but the progressive leaders in the industry are there, and they’re understanding this is a better economic solution for some of the jobs they have to do.”

AES is looking at a number of projects that are larger than what it’s doing for SCE, both in California and elsewhere, such as Texas, Arizona, and New York. New York is the No. 2 market for energy storage after California, though for somewhat different reasons. Both states offer generous policy support, but in New York—particularly the New York City area—the primary impetus is a heightened concern for grid resiliency in the aftermath of Superstorm Sandy and the uncertain future of the Indian Point Energy Center, rather than booming solar generation. (See “New York’s Reforming the Energy Vision” in this issue for more on New York’s approach to storage and evolving markets.)

Texas is also considered a fertile market for storage—assuming Electric Reliability Council of Texas (ERCOT) rules can be tweaked to allow energy storage to function economically. Currently, ERCOT rules prohibit utilities from owning generation, which is a problem for a solution that straddles that divide and can perform functions across the grid. Texas utility Oncor—which owns ERCOT’s largest grid—said in November that it wants to install up to 5 GW of storage on its system, but it can’t do so unless the rules are changed.

Oncor’s proposal would allow transmission and distribution system owners to auction off the wholesale generation portion of their storage resources to independent generators, who would then sell the generation directly into the ERCOT market. While, at press time, the Texas Legislature had not yet taken up the issue, ERCOT has been looking at revising its ancillary services market to make it friendlier to storage. Proposed changes announced last year would open up the grid-balancing market to make it profitable for fast-responding reserve resources like batteries to operate. In addition, such responsive reserve requirements will be calculated in the short term, rather than as a year-ahead market.

Behind-the-meter storage has thus far been almost entirely confined to commercial systems designed to reduce demand charges (Figure 3). But storage paired with solar photovoltaic (PV) generation is drawing increasing attention. IHS predicted this year that by 2018, 9% of solar PV systems in North America—around 700 MW—will include storage. Almost all of these will be commercial and utility-scale systems because very few residential customers pay demand charges, meaning there is no economic incentive to install storage.

|

| 3. Backstop. This 1-MW, 3-MWh lithium-ion battery storage system in Southern California was one of five deployed by storage solutions firm Greensmith in 2014. Courtesy: Greensmith |

That, however, may change rapidly because of the pressures on net metering and its effect on utility revenue. A possible harbinger of things to come occurred in late February when Arizona utility Salt River Project changed its rate structure to include a demand charge for customers with rooftop solar. While the intent was to close a revenue gap, observers noted that the move also opens the door to residential storage (see “Fixed Solar Fees Are Tesla’s Best Friend and a Utility Own Goal” on the POWER blog). Rooftop solar firm SolarCity immediately sued to overturn the decision, but it is also poised to cash in on it through its partnership with Tesla—the two companies have paired to offer solar-plus-storage systems. Solar developer SunEdison is also taking aim at the residential market, having acquired li-ion battery firm Solar Grid Storage earlier this year.

While the model of residential storage connected to solar PV systems has grown more strongly in Europe than North America—largely due to electricity markets that make home storage economic—Europe is about two to three years behind the U.S. when it comes to both the pace of grid-scale installations and manufacturing. Navigant Research estimated in January that 696.7 MW of energy storage projects (of all sorts other than pumped storage) have been announced in the 2014–2015 period. Of that, North America accounts for the large majority, with 436.4 MW, half of it in California. Asia Pacific, with 165.1 MW, and Western Europe, with 95.2 MW, lag well behind.

Meanwhile, not long after Tesla broke ground on its gigafactory, German firm BMZ announced a similar factory initiative—said to be Europe’s largest—though one with a projected production capacity of 5 GWh per year, far less than Tesla’s planned output. While Europe is home to one of the leading battery storage vendors—French firm Saft—much of its recent activity has been outside Europe, such as a 1-MW, 520-kWh system on the Japanese island of Niijima to be built for a subsidiary of Tokyo Electric Power Co. later this year (Figure 4).

Still, Zahurancik is optimistic about the European market, saying he expects to start seeing pockets of activity emerging this year and next. AES is currently developing a 100-MW facility in Northern Ireland that will be integrated into existing AES infrastructure at the Kilroot power station on the country’s east coast.

Outlook

Zahurancik said he expects to see battery storage upend the power sector over the next few years in much the same way that solar PV has, for many of the same reasons: falling costs and dramatically expanded manufacturing capacity.

“I think we can see growth happen very, very quickly. I think we’re going to see significant amounts of new storage facilities coming online across a whole variety of markets,” he said. “You just don’t have the long construction timeline that you might have with a big power plant.”

Jung agreed that the potential impact of battery storage is huge. “It is just such a pervasive market and set of technologies that are really going to touch and affect pretty much everything that is happening on the grid,” he said. “It’s no longer just about batteries in a box.” ■

— Thomas W. Overton, JD is a POWER associate editor.