This year will be a pivotal period for the global energy transition. The International Energy Agency’s recent revision to its net-zero roadmap reveals a changing narrative: we are no longer waiting on breakthrough technologies. Sixty-five percent of the emissions reductions we need are achievable with tools sitting on the shelf today.

So, the debate is no longer about whether the energy transition is technically feasible. It is about whether operators can balance the energy trilemma—reliability, affordability and sustainability—at speed, under pressure, and using the assets they already own.

COMMENTARY

Digital tools, from cloud data platforms to artificial intelligence (AI)-infused analytics across the energy lifecycle, will remain critical for onboarding and accelerating innovation while optimizing how existing assets perform. But 2026 will mark a shift in mindset. This will be the year industrial operators begin wielding digital transformation as their primary decarbonization weapon.

Four dynamics will define this shift:

1) Survival will demand sweating every asset. Expect companies to double down on asset optimization. Prompted by price and policy pressures, nearly three-fourths (70%) of U.S. oil and gas companies say they plan to restructure portfolios, optimize costs and divest noncore assets that are misaligned with near-term returns.

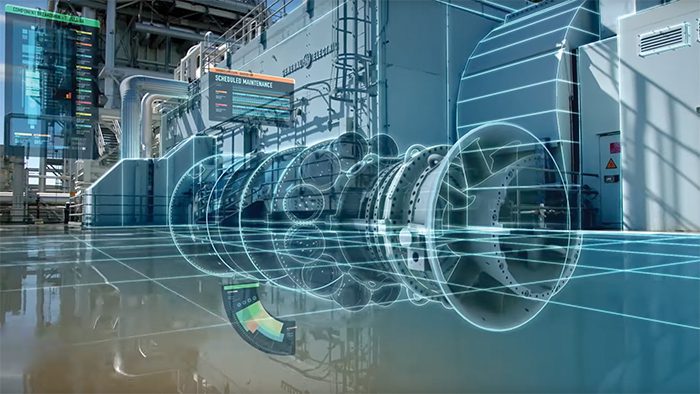

This is where digital twins and real-time optimization platforms come into their own. By connecting fragmented systems and dissolving organizational silos, operators can extract incremental efficiency from ageing infrastructure. In 2026, the winners will be those that optimize relentlessly, rather than waiting for new build cycles.

Meanwhile, task-specific AI agents will accelerate this shift. Automated monitoring, predictive maintenance and real-time diagnostics will deliver productivity gains, while also augmenting human capability in remote and dangerous environments.

2) AI will move faster than policymakers. Following years of tentative pilots, AI technologies—generative models, machine learning and advanced analytics—are finally moving into the enterprise deployment phase. Their most profound impact will be on decarbonization itself.

By enabling multivariate analysis and automated decision-making, AI will reshape engineering workflows and facilitate a more collaborative, data-centric approach to system design. Generative design tools will hasten development timelines for everything from LNG infrastructure (demand rising 60% by 2040) to renewable installations.

The companies that master AI-driven engineering workflows in 2026 will be the ones designing the energy systems of 2035.

3) Capital discipline and boardroom pressure. As digital tools reveal inefficiencies in real time, boards and investors will become far less tolerant of underperforming assets and slow execution. Capital will increasingly flow to operators that can demonstrate measurable operational improvements.

In 2026, credibility will be earned through data-backed performance. The ability to prove emissions reductions, cost savings and reliability gains inside existing operations will become a prerequisite for investment, insurance and regulatory confidence.

4) Connected ecosystems prove sustainability and profitability aren’t trade-offs. As upstream, midstream and downstream operations become digitally connected, the energy value chain will start behaving like a fully connected ecosystem rather than a collection of silos.

This means operators, suppliers and partners will share real-time data, enabling sustainability gains to scale faster without eroding margins. But it’s important to note that this shift will not happen through idealism. It will happen through pragmatism.

Energy companies must satisfy today’s shareholders while meeting environmental requirements, and that can only be achieved within existing operational flows. Every energy source must be integrated, optimized, and scaled with discipline.

As the world enters an era of energy addition, oil and gas companies’ deep legacy of managing complicated and volatile global supply chains will prove invaluable – not a liability. Real-time intelligence will be essential to meeting rising demand while driving down emissions.

In sum, the energy transition will be accelerated through operational excellence and integration. The companies that connect their operations, trust their data and deploy intelligence at scale will be best placed to solve the energy trilemma. Reliability, affordability and sustainability can coexist, but only when backed by ruthless operational discipline and real-time intelligence.

—Joseph McMullen is Energy Transition Director for AVEVA.