TVA Exploring Carbon Capture Feasibility for Two Gas-Fired Power Plants

The Tennessee Valley Authority (TVA) is poised to study the feasibility of retrofitting two gas-fired power plants—a combined capacity of 1.8 GW—in Mississippi and Kentucky with post-combustion carbon capture technology to remove more than 90% of their carbon emissions.

The non-profit U.S. corporate agency and Canadian energy infrastructure firm TC Energy on Sept. 14 said they will jointly invest $1.25 million in a feasibility study “to determine the costs, technical challenges, and operational impacts” of carbon capture at TVA’s 713-MW Ackerman Combined Cycle Plant in Ackerman, Mississippi, and 1.1-GW Paradise Combined Cycle Plant in Drakesboro, Kentucky. “Information from this study will be used to assess future asset decisions for the TVA fleet,” the companies added.

TVA told POWER the first phase of the feasibility study is slated to take about a year. “Based on the conclusions reached, TVA and TC Energy will either begin more detailed engineering work to refine estimates for decision-making or conclude that carbon capture is not an immediate fit for these sites,” it said.

As a key partner in the study, TC Energy said it will “advance the carbon capture study in conjunction with a subsurface feasibility to decarbonize baseload generating assets in TVA’s service territory.” While TC Energy has several gas-fired assets in Canada and is “always evaluating ways to decarbonize its fleet in the most cost-effective way,” the company told POWER this study will focus on TVA’s plants.

“This is early evaluation work,” a TC Energy spokesperson noted. “Carbon capture has several tailwinds, including the recently passed Infrastructure Bill and the Inflation Reduction Act, along with technology improvements with scale-up. Additionally, TVA, our customer has recently released ambitious decarbonization goals that TC Energy will help them provide.”

An Integral Evaluation for the TVA’s Gas Power Fleet

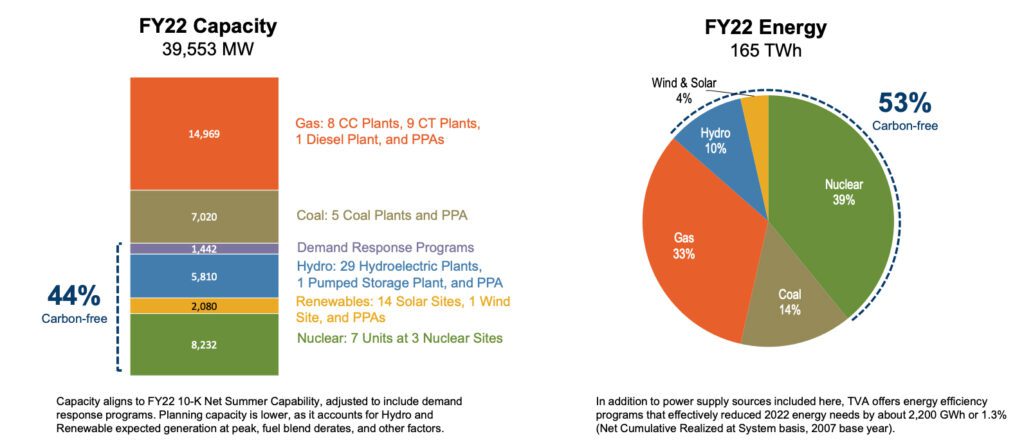

The study is poised to play an integral role in determining TVA’s investments to abate carbon dioxide from its massive gas-fired fleet. As the nation’s largest public power provider, TVA at the end of 2022 held a 40-GW resource portfolio, the bulk (15 GW) of which is gas-fired, and 7 GW which is coal-fired. Its gas plants include eight combined cycle gas turbine (CCGT) power plants, nine combustion turbine plants, and one diesel plant. Combined, “TVA operates 101 natural gas- and fuel oil-fired generators at 17 sites—nine in Tennessee, five in Mississippi, one in Alabama and two in Kentucky,” the company noted. Gas power generated 33% combined 165 TWh in 2022.

TVA, however, has been assessing the long-range outlook for its future power needs. While it is currently executing a plan to achieve a 70% reduction of carbon by 2030 and aspires to be net-zero by 2050, in July, it kicked off its Integrated Resource Plan (IRP) process to study how it will meet customer demand for electricity through 2050.

The company intends to publish a final IRP in the summer of 2024, following environmental studies and public comments. The IRP process evaluates “future uncertainties beyond TVA’s control (scenarios) and business options within TVA’s control (strategies) and will incorporate input from the IRP Working Group and other stakeholders,” it has said. “The IRP process will generate a number of potential resource plans (portfolios) within the context of the scenarios and strategies. TVA will analyze all the portfolios and select the preferred portfolio or a targeted power supply mix.”

In tandem, TVA in February initiated a “Valley Pathways” decarbonization study with the University of Tennessee Baker Center for Public Policy to develop a pathways roadmap for a net-zero greenhouse gas (GHG) emission economy across the Valley—a vast region that spans most of Tennessee, northern Alabama, northeastern Mississippi, southwestern Kentucky, and portions of northern Georgia, western North Carolina, and southwestern Virginia. TVA says the study, which is also expected to be completed by 2024, “will highlight priority areas for driving forward decarbonization, including identifying near-term actions and longer-term optionality.” The Valley Pathways study will serve as a “living document providing a foundation and guidance for other key TVA initiatives, such as IRP.”

“This is a perfect time to conduct this study,” TVA spokesperson Scot Fiedler told POWER on Friday. “We are exploring all feasible technologies to decarbonize our system. Plus, we need to prepare now as we add 10,000 MWs of solar by 2035. Natural gas is the only mature technology at this time that can provide dispatchable power when the sun is not shining and will help bridge our system to future generation technologies while providing reliable power for our customers,” he said.

Navigating Uncertainty

But like many others in the power industry, TVA is navigating an uncertain regulatory landscape, made more complex by the U.S. Environmental Protection Agency’s (EPA’s) May-issued proposed New Source Performance Standards for GHGs from new, modified, and reconstructed fossil fuel-fired units. The rule proposes to limit best system of emission reduction (BSER) pathways for baseload new combustion turbines to CCGTs with 90% carbon capture and storage (CCS) starting in 2035 or CCGTs with capabilities to co-fire 30% hydrogen by volume by 2032. Proposed pathways available to existing combustion turbines of more than 300 MW (and a capacity factor of more than 50%) include CCS coupling by 2035 or 30% hydrogen co-firing by 2032 and 96% hydrogen co-firing by 2038.

In comments submitted to the EPA on Aug. 8, TVA argued the EPA had not justified CCS or gas blending as adequately demonstrated and can be BSER. CCS, it noted, “remains prohibitively expensive even after use of funds or tax credits made available through the Inflation Reduction Act. The location of the [generating unit] in relation to the site for carbon storage is a significant factor in determining feasibility,” and “geographic constraints restrict the application of CCS in many parts of the country.”

Echoing many U.S. gas generators, TVA also pointed out that parasitic loads associated with CCS range from 20% to 25%, resulting in less power available to the grid from new units that are replacing coal. TVA in addition noted that the EPA has limited capabilities to adequately permit underground injection and control wells to meet the compliance deadline of 2030. Building out infrastructure to transport captured carbon could also pose significant cost and complexity, it said.

On Friday, TVA said the feasibility study at Ackerman and Paradise would shed more light on future CCS prospects. “TVA is a clean-energy leader. We are working to be net-zero. We need to let the study data guide us,” Fiedler said.

But in the meantime, TVA will continue its legacy of innovation to explore other pathways, including assessing its assets for hydrogen, he said. “TVA is part of the Southeast Hydrogen Hub. Hydrogen will play an important role in our region’s clean energy transition and TVA’s path to net-zero emissions, and we continue to evaluate if and when to implement hydrogen for power generation,” Fiedler added.

For now, TVA has set out to upgrade its natural gas fleet, starting with new units in Colbert and Paradise. “We are also adding 10 natural gas-fired [aeroderivative combustion turbines (CTs)] at the Johnsonville Reservation. The Aero CTs would generate approximately 550 MW and are expected to be in commercial operation by December 31, 2024.”

The feasibility study’s focus on Ackerman and Paradise will provide input on two gas-fired plants that offer different regional attributes. TVA acquired Ackerman Combined Cycle Plant in 2015 from Quantum Choctaw Power. The plant, built in 2007 in a 2×1 configuration, features two SGT6-6000G Siemens Energy gas turbines. TVA says the project is an intermediate generation asset that “allows for greater transmission flexibility and improved reliability” in its Mississippi region.

TVA’s Paradise Combined Cycle Plant, which it completed in 2017 to replace two 704-MW coal-fired units that went online in 1963, is in a 3×1 configuration. Each train features a GE 7FA.05 gas turbine/generator and a Vogt heat recovery steam generator (HRSG). The plant’s design allows for “simple cycle operation with a summer capacity of 600+ MW, or combined cycle operation with a baseload capacity of 1,025 MW and additional supplemental duct-firing operation of 1,100 MW,” TVA notes. The Kentucky plant is a “highly flexible and dynamic facility providing responsive, clean, and reliable power to TVA’s customer. The facility can operate in 1×1, 2×1, or 3×1 mode or operate in simple cycle mode as needed,” it adds.

—Sonal Patel is a POWER senior associate editor (@sonalcpatel, @POWERmagazine).