The experiences of the electric and gas markets in the Northeast this past winter highlighted better than any article, speech, or prediction the interesting and urgent challenges and opportunities arising from increased reliance on natural gas to heat and power homes, offices, and factories.

The use of natural gas has risen so much that demand at times this past winter outstripped the capacity to transport it into the Northeast. The result: When natural gas prices elsewhere in the U.S. were under $5/MMBtu, prices in the Northeast climbed to over $100/MMBtu on one cold day in New York. In the Northeast, wholesale electric prices follow gas prices. Thus, New England, for example, saw bills for wholesale power increase more than 70% over the previous winter.

Advantage: Natural Gas

Abundant domestic supply, favorable costs, and environmental advantages are driving consumers to natural gas. Moreover, new environmental mandates have helped drive up costs for coal- and oil-fired power plants, while Fukushima has challenged nuclear. Consequently, competition with gas-fired generation has become increasingly difficult. Indeed, recently there have been significant announced retirements of non-gas generation plants in the Northeast, such as the 625-MW Vermont Yankee nuclear power plant and the 1,525-MW Brayton Point coal plant. More retirements will certainly be forthcoming. While new technologies or higher wholesale power prices might slow this trend, for the foreseeable future, all signs point to continued growth in the consumption of natural gas.

The Missing Link: Gas Deliverability

Unfortunately, the ample natural gas supplies are not located in the Northeast, and last winter suggests that there is not enough infrastructure to meet the growing demand for domestic, lower-cost natural gas. The key production area for natural gas for the Northeast is the Marcellus shale in the Appalachian region, and existing pipelines that can deliver that gas to the Northeast have been running at or near full capacity nearly every day of the year of late. The impact of these pipeline constraints is most acute during the winter months, when gas demand is at its highest. With gas demand peaking and the available capacity to get it to market, gas prices skyrocketed (once by more than 20-fold) and were highly volatile over the winter.

What Next?

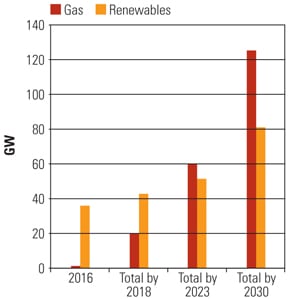

With prices like those experienced this past winter, expansion of gas infrastructure in and into the Northeast is inevitable. Pundits debate whether natural gas is the future or a bridge to a future with new technology supporting broad deployment of distributed generation, massive expansion of renewables, and/or smaller-scale nuclear power. In a rare show of solidarity, governors from all six New England states agreed and issued a unanimously supported policy objective to increase both transmission into New England for the delivery of at least 1,000 MW of clean energy resources and natural gas pipeline capacity by at least 1 Bcf above 2013 levels. New York, which lies between these abundant domestic gas supplies and New England, is encouraging the expansion of both electric and natural gas transmission capacity in and into New York.

The debate decidedly has shifted to how best to meet these growing infrastructure challenges. Free market advocates resist government intervention and financing of new infrastructure and argue that markets will provide the capital when and where needed. Others fear that electric market design is inadequate to support new investment in the fuel delivery system. Moreover, pipeline capacity will not be expanded without long-term contracts with creditworthy counterparties.

Some public policy advocates, including environmental advocates, are working actively to minimize investment in new gas pipeline, which some fear will make gas generation the future rather than a bridge to reduced consumption and increased renewables. Investors in alternative fuels such as nuclear and liquefied natural gas oppose government intervention in the markets, which they see as potentially unfairly suppressing market prices and favoring principally gas and wind over their technologies. And while virtually all consumers want the economic benefits of more infrastructure, many are intent on ensuring it is not in their back yard.

State regulators and elected officials find the current path to new infrastructure too uncertain and are poised to drive forward with their vision of expansion, financed by electric customers. This picture ensures continued controversy and litigation. Market rules for the purchase and sale of wholesale power will continue to evolve, along with new laws and regulations. Much more will be written and said about the topic. Consumers will continue to be faced with the dizzying pace of change and the ever-growing opportunities to impact their rising energy costs through wise investments, smart contracts, and careful energy management.

In short, there promises to be much turbulence ahead. Few would or should quarrel with the fact that these challenges are much better problems than those created by excessive reliance on high-cost foreign oil. So, for those in the Northeast, buckle your seat belts and enjoy the ride. ■

— David T. Doot is chair of Day Pitney’s Energy and Utility Law group, serves as secretary and general counsel for the New England Power Pool, and counsels energy and utility providers and customers across the country on energy transaction and regulatory issues. Joseph H. Fagan is a partner and member of Day Pitney’s Energy and Utility Law group, and Sebastian M. Lombardi is an associate in the firm’s Energy and Utility Law group.