SPP Set to Become First RTO Straddling Eastern and Western Interconnections

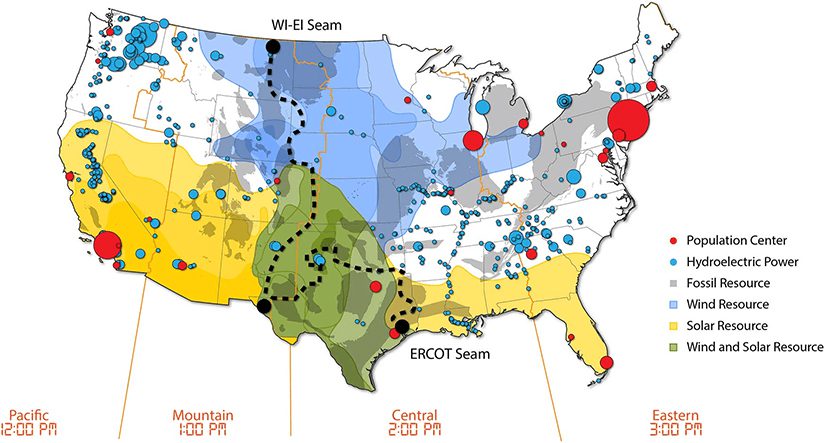

The Southwest Power Pool (SPP) is poised to become the first regional transmission organization (RTO) to provide coordinated operation across the Eastern and Western Interconnections, bridging a historic gap to potentially boost regional reliability, savings, and efficiencies.

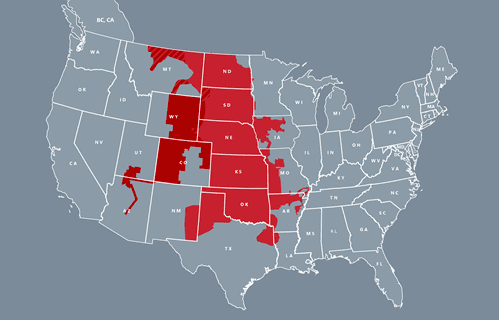

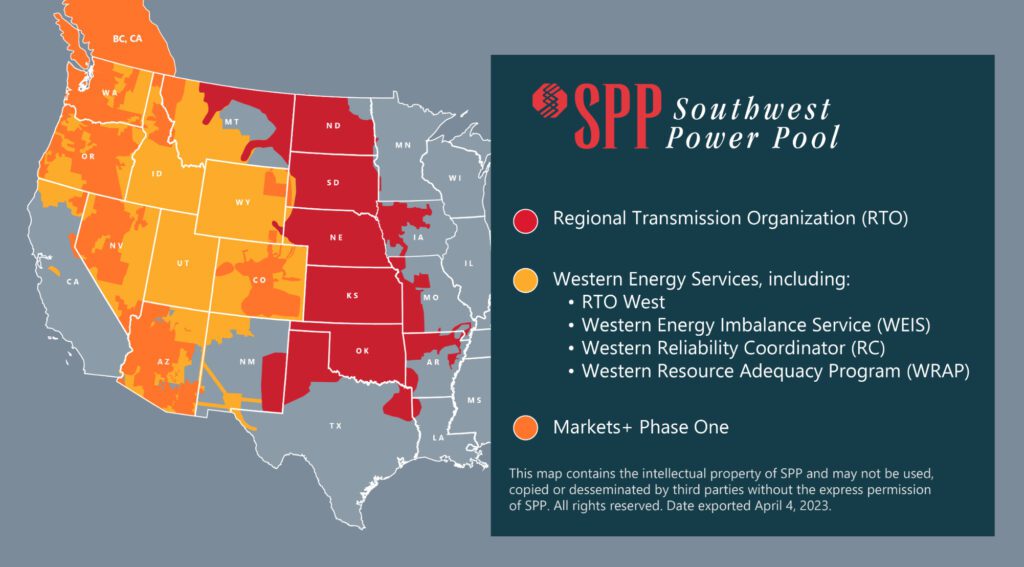

SPP, which has operated as an RTO since 2004, currently has 110 member companies in its Eastern Interconnection service territory of 552,885 square miles. Earlier this month, the entity announced that seven western utilities are preparing to join the RTO as full members when SPP’s RTO West—an expansion of its Integrated Marketplace—goes live in spring 2026.

The utilities include Basin Electric Power Cooperative, Colorado Springs Utilities, Deseret Generation and Transmission Cooperative, Municipal Energy Agency of Nebraska (MEAN), Platte River Power Authority, Tri-State Generation and Transmission Association, and three regions of the Western Area Power Administration (WAPA): Colorado River Storage Project (CRSP), Rocky Mountain Region (RM) and Upper Great Plains-West (UGP).

On Sept. 12, WAPA, a Department of Energy (DOE) entity that markets and transmits hydropower from federal hydropower plants, said CRSP, RM, and UGP would pursue final negotiations to expand their participation in the SPP RTO West.

SPP earlier this month also revealed that Basin Electric has committed to pursue membership. While Basin Electric, MEAN, Tri-State, and WAPA’s UGP-East Region are already members of SPP—having joined the RTO in 2015 when they placed their respective facilities in the Eastern Interconnection under SPP’s tariff—membership will effectively include their Western Interconnection facilities, an SPP spokesperson told POWER.

“This is the first major expansion of SPP’s RTO service territory since October 2015 when it grew from 9 to 14 states by incorporating the Integrated System into its full suite of market and transmission services,” the grid operator noted.

Leaving the WEIS for RTO West

The group of seven western utilities has negotiated terms and conditions of joining the RTO, which SPP’s board approved in July 2021. Membership agreements must be signed by Oct. 10, SPP noted.

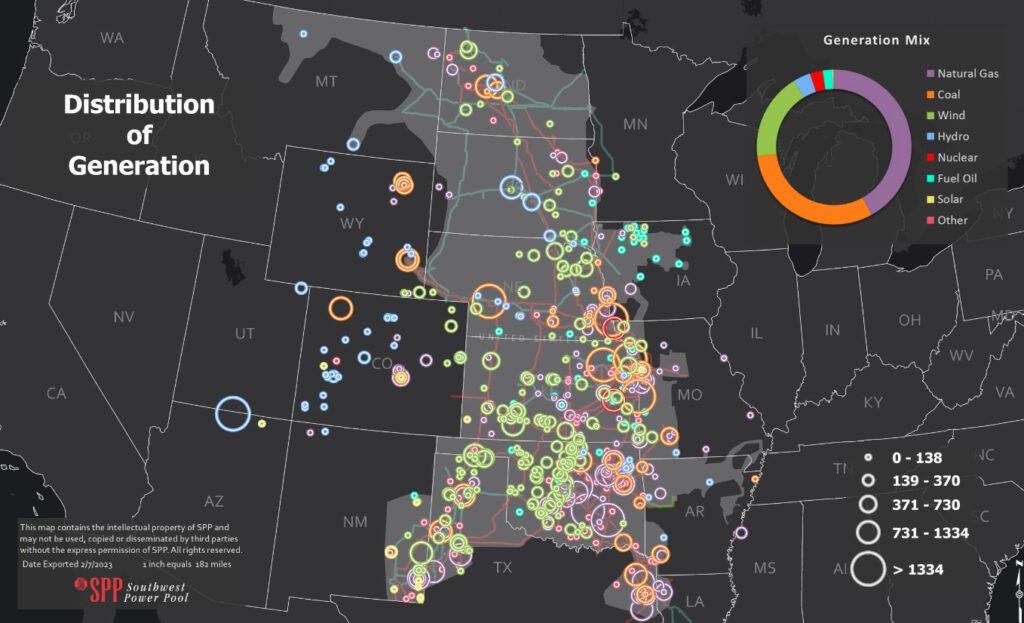

All seven utilities currently participate in SPP’s Western Energy Imbalance Service (WEIS) market, which SPP launched in 2021. The WEIS balances the demand for real-time energy and the power produced by more than 150 generating units in its footprint. “The WEIS, which facilitates efficient real-time energy dispatch, provided an estimated $31.7 million in net benefits for participants in 2022 and reduced wholesale energy costs by $1.35/MWh,” SPP said.

However, when the group officially joins the RTO in 2026, they will leave the WEIS and participate in the RTO integrated market, in which all members, both eastern and western will participate. “The noted enhancements to reliability and increased value for participants was a key driver for making the move to full RTO membership,” SPP added.

A Larger Grid Expansion Envisioned

According to SPP, RTO West is part of a long-term market expansion strategy designed to deliver increased value to its existing and new members. The growth will allow “SPP and its members to enhance sustainability and reliability in the west and involves optimizing energy markets across three DC ties, creating new opportunities for energy transfers and increased resilience for both current and future members,” it has said.

Looking further ahead, the grid entity plans to integrate additional members starting in 2027. “Other western entities interested in joining SPP’s growing RTO market footprint have a deadline of March 1, 2024, to signal their interest if they wish to participate in the market by March 2027,” it noted.

The announced commitment by the seven utilities follows years of consultation. Several utilities have explored SPP’s RTO expansion in the Western Interconnection since October 2020, evaluating the terms, costs, and benefits of putting Western facilities under the RTO’s tariff.

An SPP Brattle study published in 2020 suggested the move would be mutually beneficial, poised to produce $49 million a year in savings. Updated modeling assumptions about participant footprint, generation portfolios, natural gas prices and projected hydrology conditions made public in September 2022 suggested expanding SPP to the West could produce a net total of $55 million to $73 million.

“In the 2022 study, the Eastside sees [adjusted production cost (APC)] benefits of $3 to $8 million/year, compared to $17 million/year in the 2020 SPP Study; the Westside sees APC benefits of $68 to $81 million/year in the 2022 Study, compared to $16 million/year in the 2020 SPP Study,” Brattle said. “Additional benefits not calculated include increased reliability and resiliency, system flexibility, and reduced administrative fees.”

WAPA noted that its participation in RTO West is expected to provide “operational and reliability benefits along with enhanced transmission planning and development mechanisms.” The initiative “is consistent with WAPA’s commitment to develop alternative ways of doing business to retain and increase the value of WAPA’s resources in a dynamic energy industry,” it said.

WAPA suggested the move is designed to help the entity keep pace with industry changes. Joining RTO West could “ensure that we, along with our customers, are well-positioned for the continued success of our mission to safely provide reliable, cost-based hydropower and transmission to our customers and the communities we serve,” it added.

A Bold New Direction for SPP Electricity Market

For SPP, the prospect is poised to deliver a step change. SPP was formed in the Eastern Connection in 1941 when 11 regional power companies banded together to keep an Arkansas aluminum factor powered around the clock to meet critical defense needs. While the organization was retained to maintain regional electric reliability and coordination, after the 1965 Northeast blackout, SPP joined 12 other entities to form what became the North American Electric Reliability Corporation (NERC). In 1991, SPP implemented operating reserve sharing, and in 1997, it became a certified reliability coordinator. It earned its RTO designation from the Federal Energy Regulatory Commission (FERC) in 2004.

In 2007, SPP launched its first real-time balancing market and then transitioned to a day-ahead market to become a single, consolidated balancing authority in 2014. In December 2019, it began serving customers in the West when it launched its Western Reliability Coordination service on a contract basis. In February 2021, it successfully expanded its services with the successful launch of the WEIS.

Market Competition

According to data-driven grid analysis service GridStatus, SPP’s move to integrate Western facilities—the “largest RTO/ISO expansion since MISO South in 2013”—could result in “greater connectivity and unified planning over the patchwork of the West,” and it could help “facilitate a reduction in both power prices as well as total emissions.”

GridStatus points out, citing the National Renewable Energy Laboratory’s 2021 Seams study, that the eastern and western grids are interconnected by only about 1.3 GW of high-voltage direct current ties. “In one sense, these utilities joining SPP is simply the continuation of the same trends seen elsewhere over the past 30 years, but this is a particularly notable step in that it brings consolidated operational management to a substantial portion of both the eastern and western interconnects,” it said.

As GridStatus notes in a recent blog post, while the eastern grid is dominated by wholesale markets, the California Independent System Operator (CAISO) is the only ISO/RTO in the West. CAISO, notably, manages the Western Energy Imbalance Market (WEIM), the West’s first real-time energy market, which, established in 2014, currently has 22 participants. SPP’s potential RTO West members are all participants in the SPP WEIS market, but none participate in CAISO’s WEIM.

“With real-time trading established, the next goal has been more fulsome day-ahead participation and optimization. CAISO’s variant is the Extended Day-Ahead Market (EDAM), while SPP is working on Markets+,” GridStatus said. “Despite over a decade of work towards westward expansion from CAISO it seems possible that SPP has taken pole position,” given that CAISO is “uniquely controlled by California’s legislature.”

However, GridStatus predicts that in early 2024, “a major shoe will drop” in the “ongoing battle” for real-time options and day-ahead proposals. The Bonneville Power Administration (BPA), an entity that markets wholesale electrical power from 31 federal dams in the Northwest, is slated to “decide which day-ahead market, if any, they will join,” it says.

“CAISO has long relied upon hydropower imports from the Pacific Northwest and certainly covets that large, clean, and perhaps most importantly, dispatchable, resource as a planning tool. Despite their proximity to California, the fact that BPA is still considering SPP’s Markets+ in a clear sign of the aforementioned political trepidation.”

—Sonal Patel is a POWER senior associate editor (@sonalcpatel, @POWERmagazine).