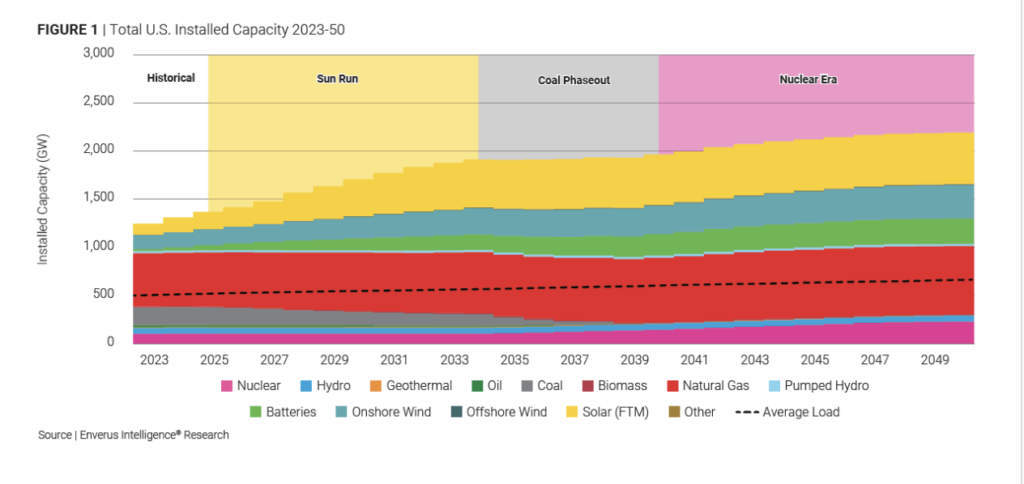

An energy research group said U.S. power generation capacity will be led by solar power in the short term, natural gas in the mid term, and nuclear power in the long term as coal-fired units continue to be retired.

Enverus Intelligence Research (EIR), a subsidiary of Enverus, an energy-dedicated software-as-a-service company that leverages generative artificial intelligence (AI) across its solutions, released its latest U.S. power capacity expansion outlook on November 18. The report is based on the group’s proprietary load forecasts, interconnection queue analytics, and technology cost curves.

EIR projects a 57% increase in installed U.S. power capacity by 2050. The group said it expects rapid solar energy growth through 2028, despite a more difficult regulatory environment. EIR said it expects remaining coal-fired generation will be replaced by natural gas, and also nuclear power, with what the group said would be “steady long-term growth led by the ramp-up of the U.S. nuclear industry.” EIR said renewable energy installations are expected to peak in 2028, but will remain competitive into the future, “supported by ongoing demand for power purchase agreements (PPAs) and low costs.”

“Our analysis shows the U.S. grid is entering a transformative period, with solar installations surging in the near term and nuclear power taking a leading role in the decades ahead. The retirement of coal and the rise of new technologies will reshape regional generation mixes and drive innovation in grid reliability and energy sustainability,” said Juan Arteaga, PhD, a principal analyst for Power Markets Intelligence at EIR.

Arteaga told POWER that despite the Trump administration’s support for coal, it’s difficult to see a path forward for the fuel in the U.S. “We see limited prospects for coal in the U.S. going forward. Regulatory and societal trends point toward increasing environmental pressures in the long-term, which will make compliance more costly and complex. At the same time, the existing coal fleet is aging, and retrofitting plants to meet tightening standards will require significant investment that is increasingly difficult to justify,” Arteaga. “As a result, we expect the economics of older coal plants to deteriorate over time, accelerating retirements. Based on these dynamics, we assume all coal generation will be phased out by 2040.”

Key Takeaways

EIR said installed U.S. power capacity is forecast to grow 57% by 2050 (Figure 1 above), with the next quarter-century defined by three eras: rapid solar energy growth (2025–2035), coal replacement (2035–2040), and steady nuclear expansion (2040–2050). The group said it expects U.S. coal-fired power will be fully retired by 2040, even with current federal government policies propping up the sector despite continued poor economics for coal-burning power plants. The researchers said they expect coal-fired capacity will be evenly replaced by natural gas and nuclear power generation.

The group noted that the Midcontinent Independent System Operator (MISO), which oversees the power grid in 15 states from the Upper Midwest to the Gulf Coast, will experience more than 25 GW of fuel switching. EIR said wind energy, natural gas, and nuclear power “are the most load-sensitive technologies, with capacity buildout remaining relatively inelastic to changes in demand. Battery storage and gas peaker plants will play a crucial role in grid reliability, while combined-cycle natural gas and nuclear plants provide essential baseload support.”

Arteaga told POWER his group expects “solar installations to peak around 2028, driven by accelerated project timelines to capture tax credits before they expire under the OBBBA [One Big Beautiful Bill Act]. After that, growth will slow, but demand will persist, primarily from corporations seeking PPAs to meet clean energy targets. Looking further ahead, by 2040, front-of-the-meter solar economics may face headwinds due to widespread adoption of rooftop solar, which would reduce utility-scale opportunities.”

Power demand from data centers, and how to serve that demand, is top of mind for those in the electricity sector. Said Arteaga, “Enverus does not expect a single dominant fuel or technology for powering data centers. As the generation mix continues to diversify, we anticipate significant near-term growth in solar and wind installations because they offer fast deployment and a cost-effective way of supplying power. However, natural gas will remain a critical backbone of the U.S. grid, providing the reliability needed to support intermittent renewables.”

As for nuclear power, Arteaga said: “We expect the current investment trend to continue, even though large-scale deployments are still years away, because today’s funding is essential to enable the industry’s transition. Nuclear is moving away from traditional large reactors toward small modular reactors (SMRs), which require significant R&D [research and development], licensing, and demonstration before commercial rollout. These investments are laying the foundation for SMR technology to scale in the 2040s. In the meantime, most nuclear additions before 2035 will come from repowering or incremental capacity upgrades at existing plants, not new builds. So, while the visible ramp-up happens later, the groundwork being funded now is critical for that future growth.”

Analysts Agree With Findings

Energy industry analysts who have spoken with POWER generally agree with EIR’s analysis, based on their own forecasts for U.S. power generation for 2026 and beyond. Jim Dawe, senior vice president and general manager of Generac, in an email said, “Hybrid systems will go mainstream. Solar, storage, generators, and smart controls will converge into seamless home-energy ecosystems as outages and rising rates make resilience the top priority.”

Rex Liu, vice president of product management for Generac, told POWER: “Installers will become full-stack energy advisors. Solar companies will expand into HVAC, storage, smart home tech, and backup power, evolving from single-product sellers to comprehensive home-energy providers.”

EIR’s findings in part are similar to those in a recent report from Bloomberg NEF (BNEF), which noted in its latest New Energy Outlook that renewable energy resources (and electric vehicles)—despite “points of resistance,” including higher interest rates, volatile costs, and rising trade barriers—”continue to show advantageous and improving economics, which ultimately drive their adoption to unprecedented levels.” The group said generation from renewables globally rises 84% between now and 2030, “and then doubles again by 2050.” The group forecasts that the “share of coal, gas and oil in the [global] power system drops to 25% in 2050, from 58% in 2024,” which “results in a 21% reduction in absolute fossil-fired generation levels. Between now and 2035, some 6.9 TW of solar is constructed globally, alongside 2.6 TW of wind.”

BNEF said coal-fired generation will continue to decline, and noted that “most of the incremental coal capacity and one-third of the gas capacity associated with data-center demand is from existing plants that avoid or delay retirement.” The group said global coal consumption falls 25% over the next decade.

A coalition of more than 60 countries, including the U.S., Canada, Mexico, the UK, Germany, and South Korea, are part of the Powering Past Coal Alliance (PPCA). The group in an announcement Monday at the COP30 climate talks in Belém, Brazil, reaffirmed commitments to phase out coal-fired generation over the next several years.

Kim Sung-hwan, minister of Climate, Energy and Environment for South Korea—which joined the coalition on Monday—said: “By joining the PPCA, we are demonstrating the Republic of Korea’s commitment to accelerating a just and clean energy transition. Through the Alliance, we will kickstart our coal phase-out, as well as help the Alliance advance the coal transition worldwide. The shift from coal to clean power is not only essential for the climate. It will also help both the Republic of Korea, and all other countries increase our energy security, boost the competitiveness of our businesses, and create thousands of jobs in the industries of the future.”

—Darrell Proctor is a senior editor for POWER.