Operators of aging F-class units face a narrowing window to plan for rotor life extensions as supply chains tighten and demand surges.

The late 1990s and early 2000s marked a frenetic period in American power generation. Deregulation opened the floodgates for independent power producers racing to bring quick-build gas turbine plants online. GE’s 7FA and 7EA units became go‑to resources for this expansion, with the manufacturer more than tripling its annual heavy‑duty gas turbine production capacity to meet surging demand.

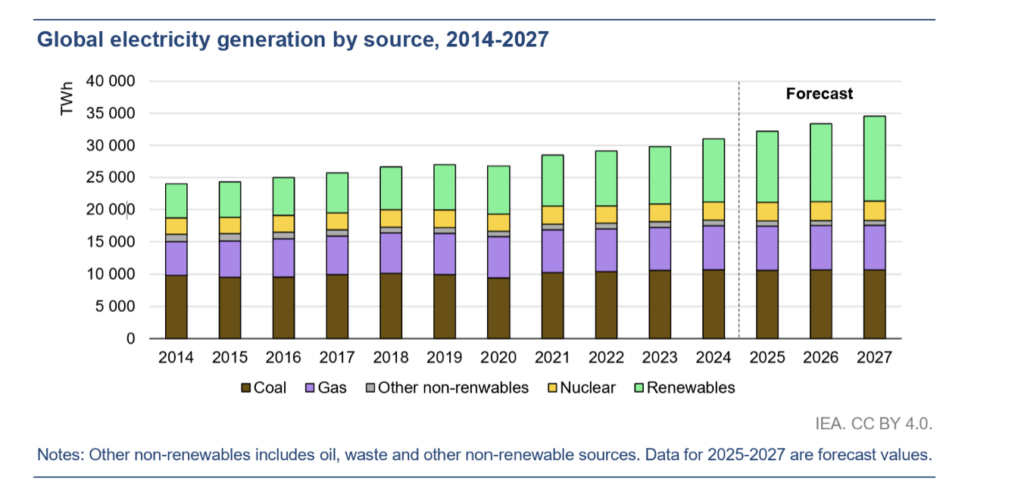

Now, a quarter-century later, those turbines are approaching critical end-of-life thresholds—just as an artificial intelligence (AI)-driven surge in electricity demand is pushing them harder than ever. Industry experts warn that operators who fail to plan for rotor life extensions could find themselves in serious trouble.

“If you’re not thinking two to three years down the road on your rotor, then you’re already behind, because that’s how long it’s going to take to manufacture those wheels,” Jason Wheeler, General Manager of Gas Turbine Rotor Repairs at MD&A, said as a guest on The POWER Podcast.

A Perfect Storm of Constraints

The urgency stems from a confluence of factors that have compressed the window for action. The 7FA fleet, which was deployed en masse during what industry veterans call “the bubble,” is now reaching the hour and cycle limits that the original equipment manufacturer (OEM) established for critical rotor components. At the same time, the power generation sector is experiencing a demand renaissance driven by data center construction and electrification.

Dave Fernandes, MD&A’s Gas Turbine Program Manager, experienced the original boom firsthand as a GE field engineer specializing in 7F and 9F units from 1996 to 2001. He sees important differences between then and now.

“There seems to be a lot more concrete reasons and a much stronger foundation for this current bubble than the previous one that took place two and a half decades ago,” Fernandes said. “There are a lot of things that are all stacking up at the same time that put more of an emphasis on getting out in front of extending the life of your current assets now, probably more than ever.”

Supply chains have become particularly challenging. The specialized superalloy forgings required for turbine wheels are produced by a limited number of facilities worldwide, and those forging houses are simultaneously serving aerospace, military, and new power generation equipment markets.

“You’re going to be competing with those new unit sales across various industries in an attempt to get in line with what is perceived from some angles as higher priorities,” Fernandes explained. “That further complicates the scenario that the customer base is facing when they’re trying to extend the rotor life of their existing assets.”

Prices have risen accordingly, and Fernandes expects the trend to continue. “Supply and demand have forever been a part of every industry, and the demand is high and the supply is squeezed right now, so we should all expect the price tag to increase.”

Understanding the Failure Mechanisms

The OEM-imposed life limits on 7FA rotors exist for sound metallurgical reasons. The turbine section wheels are manufactured from Incoloy-based superalloys that perform exceptionally well in high-temperature environments but exhibit specific failure characteristics when pushed beyond their design limits.

“It’s a very robust superalloy that holds up well in high-temperature conditions,” Fernandes said. “The downside of it is when there’s a crack initiation, which is a fallout from low cycle fatigue.”

Unlike creep, which affects some high-temperature components, the primary concern in 7FA turbine wheels is low cycle fatigue leading to microcracking. The danger lies not in the initial microcracks themselves, but in their progression.

“Those microcracks themselves aren’t a problem, but when they start connecting, that’s when you can get into some problems—and quickly on the superalloys,” Fernandes noted. “They’re a robust material. They’re great for the environment in which they operate, but when they crack, they oxidize and crack propagation accelerates in these superalloys.”

On the compressor side, operators should watch for cracking in the aft-stage dovetails. Design improvements, including round slot bottoms to replace the original flat slot bottoms, have addressed known issues. “Most people that run these assets know that the flat slot bottoms, when they open the unit up and they inspect them, they’re going to have cracking on the trailing edges,” Fernandes said.

Detection Requires Diligence

The insidious nature of fatigue cracking means that some damage mechanisms will only reveal themselves through comprehensive rotor life analysis. While vibration monitoring may catch certain problems, such as T1 stage bolting issues, and borescope inspections can identify visible cracking, microstructure cracking in turbine wheels requires more sophisticated approaches.

“There’s cracking you can only find through a rotor life analysis,” Fernandes said. “You’re going to have to go through the whole rigor of predictive and preventive maintenance in order to ensure that you’re guarded against it all.”

Wheeler noted that inspection technologies have evolved since these units were first installed, particularly in specialized non-destructive examination (NDE) techniques. MD&A partners with industry-leading NDE vendors that employ advanced volumetric phased array inspection, which Wheeler described as allowing inspectors to “basically fly through the part and look for imperfections.”

Beyond NDE advances, Fernandes pointed to improvements in reverse engineering capabilities, citing blue light scanning as one example of more precise methods that enable better component reproduction.

Not All Rotors Are Created Equal

While 7FA rotors are generally considered interchangeable, operators should understand that variations exist across the fleet. Some stem from evolutionary improvements the OEM introduced over time, while others reflect choices made during previous maintenance interventions.

Fernandes and Wheeler highlighted several upgrades available during life extension work, including enhanced dovetail geometries, modifications to turbine-side coupling features that mitigate cracking in cooling slots, and balance weight groove enhancements. A critical consideration involves material selection. Both MD&A and the OEM use the same Incoloy-based superalloy for replacement turbine wheels in the 7FA, which Fernandes considers appropriate for the application.

“The more expensive options—that are used in the H machine—aren’t necessary for the 7FA application,” he explained. “The material in the H machine, for instance, is Inco 718. Inco 718 is necessary to guard against creep in the H machine, which operates at much hotter conditions than the 7FA. . The 7FA rotor operates at cooler conditions than the H machine; hence utilizing Inco 718 for the 7F rotor is not necessary, It would just increase your costs.”

The Single-Source Trap

Perhaps the most consequential decision operators face involves maintaining competitive options for future service. Certain choices made during rotor life extension can inadvertently limit an owner to a single solution provider.

“If you make certain decisions and you’re not aware of the intellectual property constraints that ties you to, you’re going to have a single option solution,” Fernandes warned. “If you limit your options to one single source right now, you probably are going to be in a tough spot.”

This concern takes on additional weight given current market dynamics. With new unit sales commanding significant attention from the OEM, operators locked into single-source arrangements may face extended lead times when their assets require attention.

Spencer Hamilton, MD&A’s Gas Turbine Services Sales Director, emphasized that early engagement gives operators more flexibility. “I don’t think every customer needs a full-blown new rotor,” he said. “Maybe they can get away with something else. But if you’re reacting to coming up on the time clock, the only option would be a new rotor. So, the more advanced notice, the more time they have to do their homework and see what options are out there.”

Planning Horizons Have Extended

The traditional rule of thumb for major steam turbine work—planning six months to a year out—doesn’t apply to gas turbine rotors. “You’re going to need to be two to five years out planning if you want to be set up for success,” Wheeler said.

The 7EA fleet provides some insight into what may lie ahead for 7FA operators. Originally, 7EA units were expected to undergo only one rotor life extension. Some have now been extended twice. Whether the same will prove true for the 7FA remains to be determined.

“Before anybody can say the 7FA can be extended a second time, the fleet leader needs to get there. Some destructive testing probably needs to take place on multiple components, and then a determination can be made,” Fernandes said. “The most likely scenario is they will also be able to be extended, but the number of components that will have to be replaced will be expanded beyond what the current standards are.”

Start the Conversation Now

All three MD&A experts offered the same fundamental advice: operators managing aging gas turbines should begin conversations with potential service providers now, regardless of where their units stand in their life cycles.

“Pick up the phone and start a conversation,” Wheeler urged. “Nobody knows everything. You don’t know what you don’t know. Operators know how to run their units. They don’t necessarily know the fleet-wide problems or have the experience of a shop seeing 20 rotors go through the shop at once.”

Hamilton recommended site visits to multiple vendors. “Take the opportunity to visit multiple vendors, go look at their shops, ask the tough questions,” he said.

For Fernandes, the key is understanding what options remain open—and which doors might be closing. “Get educated on what is going to limit your options,” he said, “because if you limit your options to one single source right now, you probably are going to be in a tough spot.”

To hear the full interview with Fernandes, Hamilton, and Wheeler—including why Fernandes says operators should “never even consider” running these rotors to failure—listen to The POWER Podcast. Click on the SoundCloud player below to listen in your browser now or use the following links to reach the show page on your favorite podcast platform:

For more power podcasts, visit The POWER Podcast archives.

—Aaron Larson is POWER’s executive editor.