Facing a projected surge in power demand across the country, NextEra Energy is taking steps to potentially restart its shuttered 615-MW Duane Arnold nuclear plant in Iowa as early as 2028, while also signing a new partnership with GE Vernova to develop natural gas generation projects that could be paired with renewable energy and storage.

In its fourth-quarter earnings report on Jan. 24, the Juno Beach, Florida–based company said it filed a request with the Nuclear Regulatory Commission (NRC) to request a licensing change for the Duane Arnold plant, which it shut down in 2020 after a derecho event caused extensive damage to the station’s cooling towers. The effort marks an “important first step in establishing the regulatory pathway to restore the facility’s operating license and potentially restart plant operations as early as the end of 2028,” it said.

Separately, NextEra announced a new framework agreement with GE Vernova that has the potential to support “multiple gigawatts” of new gas-fired generation projects to serve data centers, manufacturing facilities, utilities, and other large customers. “Nobody has built more gas-fired generation over the last decade than NextEra Energy, and nobody has sold more gas turbines than GE Vernova,” said NextEra Energy CEO and president John Ketchum in a call with analysts. “This collaboration brings together the nation’s leading operator of natural gas-fired generation and the world leader in natural gas and electrification technology.”

The prospects factor into NextEra Energy’s massive planned expansion to double its 64-GW generating fleet by 2027. So far, NextEra has been one of the country’s largest investors in energy infrastructure, spending more than $150 billion over the past decade on projects ranging from nuclear upgrades to natural gas pipelines and renewables. “Over the next four years alone, we plan to invest roughly $120 billion across the country, which would allow us to grow our combined fleet to roughly 121 GW,” Ketchum noted.

Adapting to the Changing Power Landscape

The dual announcements come as NextEra, one of the country’s largest power producers, grapples with surging electricity demand that it says must be met with a mix of generation sources, including renewables, natural gas, and nuclear.

“Our industry’s mandate is to deliver new generation and capacity solutions at the lowest cost possible in order for the U.S. to achieve the new administration’s energy dominance agenda,” Ketchum said on Friday. “If we don’t build new generation to keep up with increasing demand for electricity, power prices are going to go up, or, perhaps worse, new technology or manufacturing load won’t be able to connect to the grid, which would slow economic growth.”

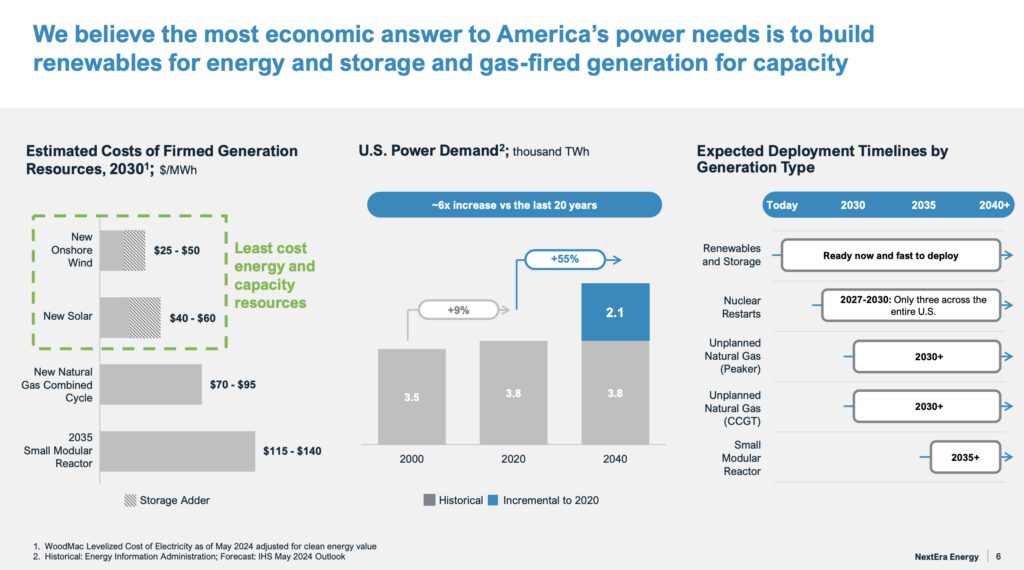

While NextEra owns Florida Light and Power (FPL), the largest electric utility in the U.S., it also owns NextEra Energy Resources, a competitive energy business that it says is the “world’s largest generator of renewable energy.” The company is currently readying for power demand that could surge 80% over the next five years and sixfold compared to the last 20 years. “The only close analogy you could draw is to the last industrial revolution,” Ketchum said.

For now, FPL is focusing on delivering high reliability while maintaining some of the lowest customer bills in the industry. As it approaches its 100th year, FPL has leveraged investments in smart grid technology to avoid more than 2.7 million customer outages in 2024, including over 800,000 outages during Hurricanes Debby, Helene, and Milton. In 2024, the company also commissioned over 2.2 GW of new, cost-effective solar capacity and improved its already best-in-class non-fuel operations and maintenance (O&M) costs per customer, which are approximately 70% better than the industry’s national average. Additionally, FPL filed a test year letter in December to begin its rate proceeding for new rates that will take effect in January 2026. Ketchum said the stability of multi-year rate plans has allowed FPL to focus on efficiency in the business, which is critical to keeping customer bills as low as possible.

Meanwhile, NextEra Energy Resources achieved another record year in 2024, commissioning over 6 GW of new renewable energy and storage capacity. The company grew its adjusted earnings by more than 13% compared to the prior year and added more than 12 GW of new renewables and storage to its backlog, including 3.3 GW since its last earnings call. Notably, NextEra Energy Resources announced framework agreements in 2024, including with two Fortune 500 companies and a joint development agreement with Entertgy that could lead to up to 15 GW of new renewable and energy storage opportunities.

“Renewables are here today,” said Ketchum. “You can build a wind project in 12 months, a storage facility in 15 and, you know, solar project in 18 months. With gas-fired generation … the country is starting from a standing start, and we’ve got to go find the sites. We’ve got to develop these sites. We’ve got to get gas to those sites. We got to get hands on gas turbines,” he said. “If you take all those things together, when is gas really going to be able to contribute at scale? We’re looking at 2030, and [for] nuclear, later than that. We need shovels in the ground today because our customers need power right now.”

Nuclear’s Prospects Look Promising

On the nuclear front, Ketchum said near-term opportunities lie in restarting existing plants, such as Duane Arnold, rather than building new ones from the ground up. Duane Arnold remains a key contender, given “a lot of interest in the plan” and in nuclear plant recommissioning. In September 2024, Microsoft and Constellation Energy committed $1.6 billion to restart the Unit 1 reactor of the shuttered Three Mile Island plant in Pennsylvania by 2028, now known as the Crane Clean Energy Center, while efforts to restart the 800-MW Palisades nuclear plant in Michigan are also showing fruition, he noted.

Along with Duane Arnold, “those are really the ones that I think I would confine to the timeframe of being over the next three, four, five years,” he said. Duane Arnold, itself, “remains in very good condition,” he noted. “The only damage that we ever sustained at Duane Arnold was the derecho that took down the cooling tower. But building a cooling tower, that’s run of the mill,” he said. “It’s pretty conventional construction, so not a whole lot of risk there.

Ketchum also said that the company is in active discussions with potential customers about the Duane Arnold plant but declined to provide a cost estimate. “We’re certainly not going to put the cost estimate out there that would hurt our negotiating position in those discussions,” he said.

The move aligns with broader industry efforts to diversify power generation portfolios with nuclear and gas as versatile, reliable options. Earlier this month, Constellation, the nation’s largest nuclear generator, announced a $16.4 billion deal to acquire Calpine, a major gas and geothermal power producer. The merger, expected to create a 60-GW competitive generation goliath, is designed to meet growing customer demand for dependable, flexible energy in key markets like ERCOT and PJM while supporting decarbonization goals and enhancing market competitiveness.

Last week, South Carolina state utility Santee Cooper set out to explore completing two partially constructed AP1000 nuclear units at the V.C. Summer Nuclear Station, which were abandoned in 2017. Citing the urgent need for reliable, carbon-free electricity, the utility said the effort underscores renewed national interest in recommissioning nuclear projects to diversify generation portfolios and address surging electricity demand more efficiently.

Comparatively, small modular reactors (SMRs) still face “first-of-a-kind” risks and uncertainties, Ketchum suggested. “If we’re thinking as a country about their ability to contribute to all the power demand that we see that’s here right now, my only comment is that I would think about them more as a ‘next decade’ solution—probably middle of the latter part of the next decade,” he said. NextEra continues to evaluate alternatives, but the practical reality is that the company is “unlikely to add multiple gigawatts of new nuclear to the grid over the next decade,” he said.

Gas Build Out Must Start Now for Energy Security

For now, NextEra is looking to natural gas as a bridge fuel. Over the next four years, bolstered by its partnership with GE Vernova, the companies plan to jointly identify locations on the grid that would benefit from new gas-fired generation. GE Vernova will incorporate its “world-class natural gas generation technologies and critical electric electrification solutions while leveraging its financial service capabilities,” Ketchum said.

Demand for new gas power is beginning to ramp up domestically and around the world, which is putting significant pressure on costs. “I look back to just our last gas-fired facility that we built here in Florida— Dania Beach,” a 2022-opened plant that featured state-of-the-art GE 7HA.03 turbines. “If we take the cost we paid for that facility on a $/kW basis to today, I mean, the cost has tripled in price,” he said.

Today, driven by soaring demand, gas turbines and engineering, procurement, and construction (EPC) labor are in short supply, and “costs there have tripled,” Ketchum said. He noted that the country is “starting from a standing start” on gas generation, explaining, “When you look at finding a site, getting it permitted, getting gas to the facility, getting interconnected, and then the equipment limitations of actually getting a turbine slot, getting access to that turbine, and then the EPC labor—remember, this is an industry that really hasn’t seen any active development or construction in years. That’s my comment earlier about really beginning from a standing start, and all of that puts pressure on cost.”

In terms of a timeframe, Ketchum estimated new gas-fired generation could come online in “2030 and beyond,” with exceptions in regions like the Electric Reliability Council of Texas (ERCOT). “In ERCOT, you can build more quickly than you can in other parts of the country,” he said. In other parts, including PJM, “it’s just not easy to get the gas to those facilities and get gas infrastructure built.”

While the new Trump administration is likely to explore reforms to make that easier, prospects face risks, including potential litigation. Policy impacts expected from the new Trump administration aren’t otherwise expected to make a big impact on NextEra’s planning, Ketchum suggested, noting 80% of the company’s capital spending has gone to Republican-led states.

The partnership with GE Vernova will add another layer of certainty to allow NextEra to provide customers with integrated renewable, storage, and gas-fired solutions while leveraging both the companies’ scale, experience, technology, and development skills. The agreement sets another example of why NextEra’s energy resources business has the “most comprehensive power generation business in the world” and is well-positioned to capitalize on long-term growth prospects, he added.

—Sonal Patel is a POWER senior editor (@sonalcpatel, @POWERmagazine).