In a hearing that underscored the mounting challenges facing the American power sector, industry leaders warned Congress that the nation’s power infrastructure is approaching a precarious juncture as unprecedented demand growth collides with retiring baseload generation.

At the House Energy Subcommittee hearing on March 5, titled “Scaling for Growth: Meeting Demand for Reliable, Affordable Electricity,” lawmakers heard from witnesses—including from PJM Interconnection, Basin Electric Power Cooperative, Southern Co., and Duke University—who warned that demand is rising faster than new generation is being added and that retirements of dispatchable power threaten grid stability. But, while witnesses also emphasized that permitting and interconnection delays remain significant barriers to expanding capacity, the hearing generally revealed ongoing partisan divisions on energy policy.

The Specter and Opportunity of Unprecedented Demand

Witnesses, who represent niche sectors of the industry, all confirmed that the power sector is grappling with an unprecedented demand surge driven by the rapid expansion of artificial intelligence (AI) data centers, manufacturing reshoring, and widespread electrification.

Tyler Norris, a James B. Duke Fellow at Duke University’s Nicholas School of the Environment, suggested AI-driven data centers are a primary factor in the dynamic surge. “While significant uncertainty remains, particularly following the release of DeepSeek, data centers are expected to account for the single largest growth segment, adding as much as 65 GW through 2029 and up to 44% of U.S. electricity load growth through 2028,” he said.

Demand projections remain in flux at PJM Interconnection, the largest grid operator in North America. The grid operator’s 2025 Long-Term Load Forecast, issued in January, predicts “substantial demand increases” compared to an assessment last year, noted Asim Haque, PJM senior vice president of Governmental and Member Services. “According to our most recent forecast, PJM expects its summer peak to climb about 70,000 MW, to 220,000 MW, over the next 15 years. The record summer peak for the PJM footprint occurred in 2006 at 165,563 MW,” he testified. “While winter peaks will remain slightly lower, the forecast shows winter closing the gap in peak electricity use, estimated at 210,000 MW by 2039. PJM’s record-high winter peak occurred in January, when PJM served a preliminary load of approximately 145,000 MW on the morning of Jan. 22, according to preliminary load estimates.”

Haque noted that while PJM has a diversified generation portfolio, it is undergoing a significant transition toward renewable generation. “Dispatchable generators, i.e., those generators that can quickly respond to directions from PJM operators regardless of weather, are retiring at a rapid, date-certain pace, largely due to state and federal policies. Although today the category of dispatchable generators largely refers to fossil-fuel-based resources, longer-duration batteries and potentially other technologies could also serve in this role in the future to the extent they can become more cost-effective and be deployed at scale,” he explained.

For now, PJM estimates 40 GW of retirements by 2030, 60% of which is coal, and 40% natural gas-fired. “Renewable resources do not replace thermal dispatchable resources ‘1 for 1,’ and any system will require multiple megawatts of renewable resources to replace one megawatt of a retiring dispatchable resource due to [renewables’] lack of availability/capability in certain hours of the day and seasons of the year,” Haque underscored.

Meanwhile, though PJM has moved to reform its interconnection process, “we certainly have quite a few projects that are through the queue right now that aren’t constructing at the pace needed to keep pace,” he said. “Last year we interconnected 4,800 MW into an otherwise 180,000 MW system,” he noted. What it means, he said, is that “Supply is coming off of the system and new supply additions are not keeping pace.” He reiterated: “Again, about 50,000 MW through the queue—nothing left to do with PJM—not interconnecting or not constructing,” he emphasized.

Regulatory Hurdles, Supply Chain Woes Threaten Power Sector Expansion

As POWER has reported, the concern extends to other grid operators across North America. Power companies have cited an array of hurdles, including a tight supply chain for key components—among them gas turbines and transformers—and project financing.

On Wednesday, Todd Brickhouse, CEO of Basin Electric Power Cooperative, an electric cooperative with a nine-state footprint in the North, also called attention to significant “regulatory red tape,” related to federal permitting and regulatory policies. One of the biggest challenges stems from the complex and often redundant permitting requirements under the National Environmental Policy Act (NEPA), he said.

“For example, Basin Electric’s [345-kV, 35-mile] Roundup-to-Kummer Ridge transmission project [energized in December 2024] required two separate Environmental Assessments—one from the Bureau of Land Management and another from the Bureau of Indian Affairs,” he explained. “While both agencies report to the Secretary of the Interior, their NEPA processes do not align, and complying with both resulted in added time, expense, and red tape to a critical transmission project.”

Although Congress passed NEPA reform measures in 2023 to streamline environmental reviews and impose firm time limits, Brickhouse emphasized that these reforms must be fully and faithfully implemented by all federal agencies. “Congress should also curb lengthy, costly litigation that can cause unnecessary and often indefinite delays that hold up projects that communities badly need,” he urged.

Brickhouse also warned that the U.S. Environmental Protection Agency’s May 2024–finalized Power Plant Rule could significantly impede the development of new power plants—particularly gas power—at a time of surging electricity demand. Under the rule’s stringent emissions limits, new gas-fired plants will be required to capture 90% of their carbon emissions—a technology the power industry argues has not yet been commercially demonstrated at scale—or operate under severe output restrictions. “For example, a 100 MW plant may only be permitted to generate 40 MW of electricity if used as baseload or may run at 100 MW for only 40% of the calendar year,” he said. The uncertainty is already affecting Basin Electric’s planning for a proposed 1,470 MW combined-cycle natural gas plant. “The requirements and near-term uncertainties of this rule will affect whether it can operate a brand-new plant at full capacity “and makes future planning very difficult,” he said.

He also highlighted the staggering financial impact of regulatory compliance. The company estimates that adhering to the rule could require nearly $10 billion in additional capital expenditures—on top of the $12 billion needed to meet projected load growth by 2035. Combined, costs could lead to a 60% rate increase for Basin Electric members by 2035, he said. He urged Congress to support the immediate repeal of the GHG Rule and provide compliance relief to electric cooperatives. Additionally, he called on lawmakers to reform the EPA’s New Source Review (NSR) permitting requirements, which, he argued, create unnecessary regulatory hurdles for power plant operators seeking to enhance efficiency or reduce emissions at existing facilities.

Finally, the power sector is also grappling with a dire need for adequate natural gas pipeline infrastructure, he noted. “Basin Electric’s natural gas needs are expected to triple from 2024 to 2030—40 million MMBtus annually in 2024 and 120 million MMBtus annually in 2030,” Brickhouse noted. “Strong coordination between the electric and gas sectors will also be critical as their interdependence grows to avoid significant and unacceptable service curtailments to consumers, particularly during winter months and extreme weather,” he added.

Noel Black, senior vice president of Regulatory Affairs at Southern Co., echoed that call, stressing that new gas infrastructure will be integral to support the demand momentum. “The reality is clear: infrastructure, including natural gas infrastructure, is required now to meet rising demand in an affordable and reliable way. Pipelines, transmission systems, and generation capacity must keep pace with an expanding economy and evolving energy needs,” he testified.

An Urgency for Action

Brickhouse, like other witnesses, underscored an urgency for action. “Technology-based loads, such as cryptocurrency and data centers, can become operational in as little as three years—far faster than the seven years required to build the dispatchable generation infrastructure needed to support them,” he noted. The cooperative’s load growth is projected at 3.3% over the next decade, already outpacing the national average of 2.4%. But, if large industrial loads materialize as expected, growth could nearly double to 5.9%, Brickhouse said, with the Bakken oil and gas region slated to see some of the highest increases in power demand nationwide. Upper Missouri Power Cooperative, one of Basin Electric’s largest members, has seen record demand growth of over 800% in total megawatt-hours since 2009, he noted.

To meet this challenge, Basin Electric and other cooperatives are working closely with federal agencies, particularly the Department of Energy (DOE), to access critical grid resilience and reliability programs. Federal assistance will remain crucial to bolster supply chain bottlenecks, he suggested. He noted transformer shortages have grown into a major bottleneck, given lead times that have surged from 18 months to 3–5 years. “Some providers have stopped taking new orders completely, costs have increased significantly, and backlogs for American-produced transformers have made meeting Buy American requirements challenging,” he said.

“To help address these challenges, Congress should provide targeted federal financial support for critical grid component manufacturing here in America to expand production and reduce lead times. Basin Electric is grateful to many on this Committee who weighed in with DOE last year to ensure their updated distribution transformer energy conservation standards did not exacerbate this problem and instead allow use of the existing core material—grain oriented electrical steel—while supporting development of amorphous core transformers.”

Lawmakers could also play a crucial role in enhancing grid reliability by supporting advanced conductors, strengthening cybersecurity measures, and preserving federal hydropower resources, Brickhouse said. He pointed to advanced conductors as a cost-effective solution that could “reduce the size and quantity of grid structures required, in turn reducing cost to members and lessening impacts to landowners.” Additionally, he urged Congress to rescind the 2023 Memorandum of Understanding on the Lower Snake River Dams, warning that the policy “could devalue hydropower and set an unacceptable precedent of dam breaching for PMA hydropower nationwide.”

One Solution: Leveraging Data Center Flexibility to Provide System Headroom

While recent discussions about how the power sector will meet surging electricity demand have often taken on an alarming tone, given mounting hurdles, Duke University Fellow Norris—a former independent power producer executive—offered a more measured perspective. “I am here to testify that the U.S. can support the orderly integration of new electricity demand, provided we make strategic use of existing infrastructure, provide a stable policy environment, and take a proactive approach to plan and invest in long lead resources,” he stated.

An author of a February 2025 Duke University study, Rethinking Load Growth: Assessing the Potential for Integration of Large Flexible Loads in U.S. Power Systems, Norris argued that while concerns over rising electricity demand are valid, they are often overstated, particularly given the potential for large electricity consumers to shift their consumption patterns. “In short, our findings suggest that with modest flexibility from new large electricity customers, the existing U.S. power system can accommodate substantial load additions without compromising reliability,” he said. He stressed that leveraging existing infrastructure in the near term is critical, as “given the time required to develop new generation and transmission at scale, flexibility measures can provide a crucial bridge, buying time and conserving capital while longer-lead resources are planned and built.”

A key finding from Duke University’s research is that large flexible loads—such as AI-driven data centers, cryptocurrency mining operations, and industrial manufacturers—can play a pivotal role in stabilizing the grid rather than destabilizing it. “While the demand growth outlook is real, it is often mischaracterized as a reliability crisis rather than an opportunity to harness new large loads in ways that help the grid,” Norris testified. He pointed to demand-side adjustments as a critical tool, noting that even small curtailments during peak hours—just 0.5% of uptime—could integrate up to 98 GW of new load without needing major new infrastructure. “Data centers, for example, do not need to operate 24/7 at maximum capacity, and by leveraging flexible operations, we can dramatically reduce peak demand stress,” he explained.

“To contextualize these figures, the $500 billion data center megaproject announced by President Trump, Project Stargate, would entail 15-25 GW of new load. In other words, if new AI data centers can adjust their electricity consumption during a limited number of hours when power grids experience peak stress, equivalent to 0.5% of their maximum uptime, the existing U.S. power system could accommodate up to four or five Project Stargates. This is equivalent to more than $2 trillion in data center investment,” he said.

A key benefit would be avoiding the risks of overbuilding natural gas infrastructure. Norris cautioned that a hasty expansion of gas capacity in response to load growth “could undermine private investments in clean firm technologies like advanced nuclear and enhanced geothermal, while exposing ratepayers to the risk of rising gas prices and market volatility.” He warned that “if investors perceive that policymakers are tilting the playing field to favor gas over other resource options, or that gas overbuild could depress capacity market prices, they are less likely to make higher-risk, long-term investments in clean firm technologies.”

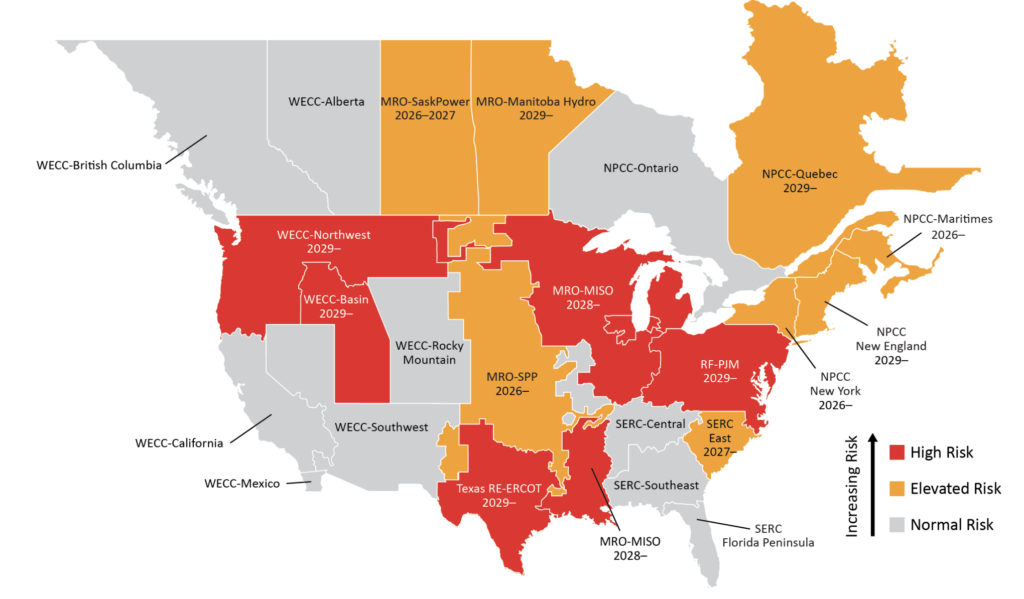

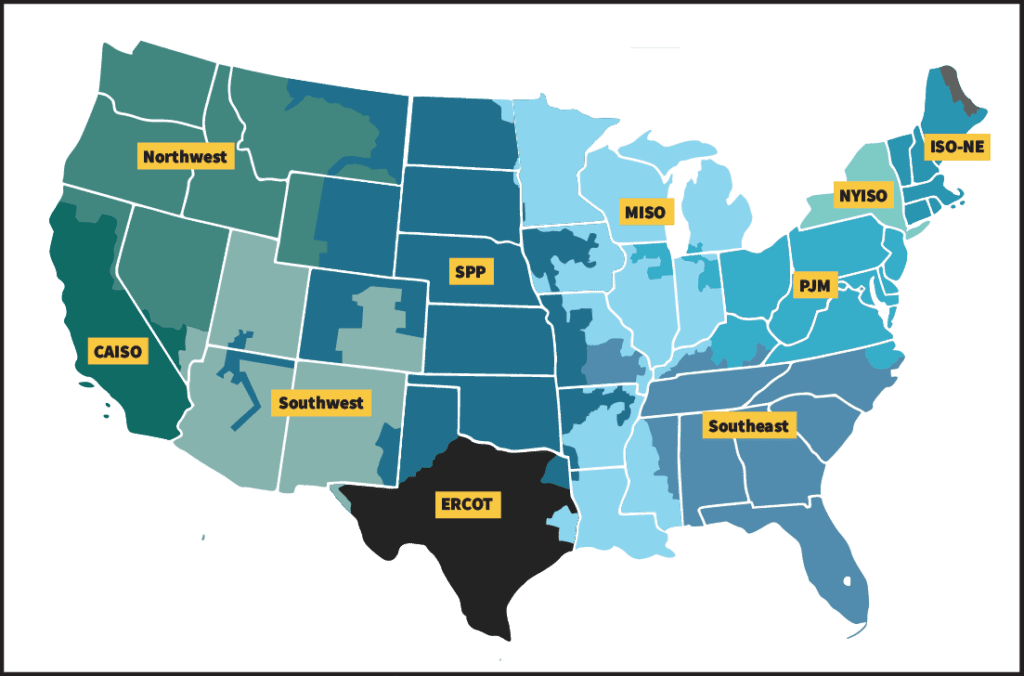

This figure illustrates the estimated volume of new electricity load that could be integrated across major U.S. balancing authorities if new loads are subject to a modest 0.5% curtailment rate. The analysis, covering 22 balancing authorities that serve 95% of the nation’s peak demand, suggests that up to 98 GW of additional load could be accommodated without exceeding grid operators’ existing capabilities. The five regions with the greatest potential for load integration under this model are PJM (18 GW), MISO (15 GW), ERCOT (10 GW), SPP (10 GW), and Southern Company (8 GW). The study finds that most curtailment events last about two hours, with 90% of required reductions affecting less than 50% of the new load at any given time. Source: Tyler Norris, “Rethinking Load Growth: Assessing the Potential for Integration of Large Flexible Loads in U.S. Power Systems,” Testimony before the House Energy Subcommittee, March 5, 2025.

An effort to explore this potential is already underway by the power and data center industries through the Electric Power Research Institute’s (EPRI) DCFlex Initiative, which aims to assess how data centers can adjust their electricity consumption in response to grid conditions. As POWER has reported, the initiative seeks to integrate demand-side flexibility into grid operations, helping utilities better manage peak demand and reduce strain on generation and transmission infrastructure. As a key facet of the initiative, the collaboration—which involves power companies, grid operators, and several tech giants—will seek to establish five to 10 “flexibility hubs” that will demonstrate how data centers can be leveraged as flexible grid resources starting in the first half of 2025.

However, on Wednesday, Norris emphasized that flexibility must be actively incorporated into market structures and utility planning. “Grid operators and policymakers should work with large energy consumers to create incentives that reward demand-side flexibility,” he suggested. He also pointed to ERCOT’s existing price-responsive load programs and industrial demand response mechanisms as examples that could be expanded nationwide. “With the right planning, we can ensure these loads do not exacerbate grid challenges, but rather help smooth variability and provide stability,” he said.

Energy Policy at a Crossroads: Lawmakers Split Over Grid Solutions

Norris’s solution, while promising, will be approached with caution by grid operators and utilities. As PJM’s Haque noted, the real-world flexibility of data centers may be limited. “It is not clear whether or not these data centers can actually express the kind of flexibility that is described in Mr. Norris’s paper,” he said.

One reason is that energy challenges and solutions vary significantly by region. As Southern Co.’s Black testified, “Electricity and energy are highly regional in nature. The weather, resources, state and local political environments, geography, and load profiles greatly impact the physics and finance of making, moving and serving electricity.”

How Congress will responds also remains uncertain. The hearing highlighted a stark partisan divide over how to address surging electricity demand. Republicans largely emphasized the need to bolster baseload power, warning that an overreliance on renewables could jeopardize grid reliability. “We need more baseload generation. We need more coal, more gas, and more nuclear,” one lawmaker asserted. “It doesn’t matter how many gigawatts of wind and solar capacity are built if they are not generating when you need them.” Others framed the issue in terms of geopolitical competition. One lawmaker cautioned: “[W]e are in an arms race for artificial intelligence, … and we don’t have the power capacity to build the data systems that we need in order to win that arms race with China.”

Democrats, on the other hand, pushed for an aggressive expansion of clean energy and grid modernization, arguing that investments in renewables, storage, and transmission will provide the fastest, most cost-effective path to meeting demand. “Clean energy is the only source of new generation capable of meeting electricity demand,” one member argued, warning that rolling back Inflation Reduction Act (IRA) incentives would “increase energy costs for consumers.” Ranking Member Frank Pallone (D-NJ), notably, defended clean energy incentives in the IRA, citing studies suggesting their repeal could increase electricity prices for consumers by up to 20% in some states.

—Sonal Patel is a POWER senior editor (@sonalcpatel, @POWERmagazine).

Correction (March 7, 2025): This article has been updated to correct an error in the reported interconnection capacity. In his testimony, Asim Haque, PJM senior vice president of Governmental and Member Services, stated that PJM interconnected 4,800 MW last year, not 48,000 MW as originally reported. We regret the error.