Ontario Power Generation (OPG) took another step to bolster plans to deploy small modular reactors (SMRs) in Ontario, announcing it is advancing engineering and design work with three major advanced nuclear reactor developers: GE Hitachi Nuclear Energy (GEH), Terrestrial Energy, and X-energy.

The announcement on Oct. 6 stems from a “due diligence” process OPG held in collaboration with other major energy utilities to advance the development of an SMR in Ontario and potentially other provinces. Ontario in December 2019 signed a memorandum of understanding (MOU) with New Brunswick and Saskatchewan that establishes a framework for SMR deployment in those jurisdictions. The three Canadian provinces may soon be joined by Alberta, which signaled an intention to join the MOU this August.

OPG’s announcement, notably, also comes within months of its June 9–formed “Global First Power,” a joint venture with Seattle-based Ultra Safe Nuclear Corp. to build, own, and operate a proposed Micro Modular Reactor (MMR) high-temperature gas-cooled reactor (HTGR) demonstration at the Chalk River Laboratories site in Ontario. That effort made OPG, a Crown corporation wholly owned by Ontario’s provincial government, the first utility to take an ownership stake in an SMR project.

“Our work with these three developers, along with our partnership with Global First Power and its SMR project to support remote energy needs, demonstrates OPG’s unique position to become a world leader in SMRs,” Ken Hartwick, OPG president and CEO, said on Tuesday. “SMRs will play a key role in helping to reinvigorate Ontario’s economy and further support the province and Canada as they work toward meeting their climate change targets of zero-emission electricity.”

A Huge Push for GEH, Terrestrial, X-energy

OPG’s decision to further engineering and design work with the three advanced nuclear reactor vendors—each of which are developing distinct designs—are notable from a utility investment perspective.

In the U.S., near-term prospects for SMR deployments hang on NuScale Power, which has plans to supply 12 modules—each rated at 60 MWe—for the Carbon Free Power Project at an Idaho National Laboratory site for potential customer Utah Associated Municipal Power Systems (UAMPS). Not all 47 UAMPS members are on board with the project, however. Despite decisions made in August by the Utah cities of Logan and Lehi to withdraw, the majority of UAMPS members remain committed to the project, and participants, for now, reportedly have until the end of October to decide whether to continue into the next phase of the project.

While a smaller, 50-MWe module version of NuScale’s design on Aug. 28 became the first SMR to receive a final safety evaluation report (FSER) from the Nuclear Regulatory Commission (NRC), UAMPS is still awaiting a $1.4 billion federal fund influx that could shave project risks and put it on track for first-unit completion by 2029. According to the Post Register, project costs have now soared from $3.6 billion in 2017 to an estimated $6.1 billion.

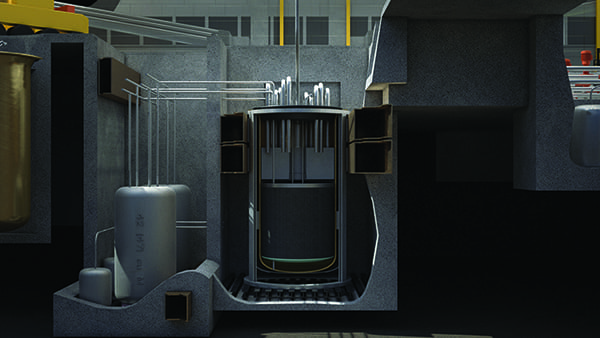

Another Triumph for GEH’s BWRX-300

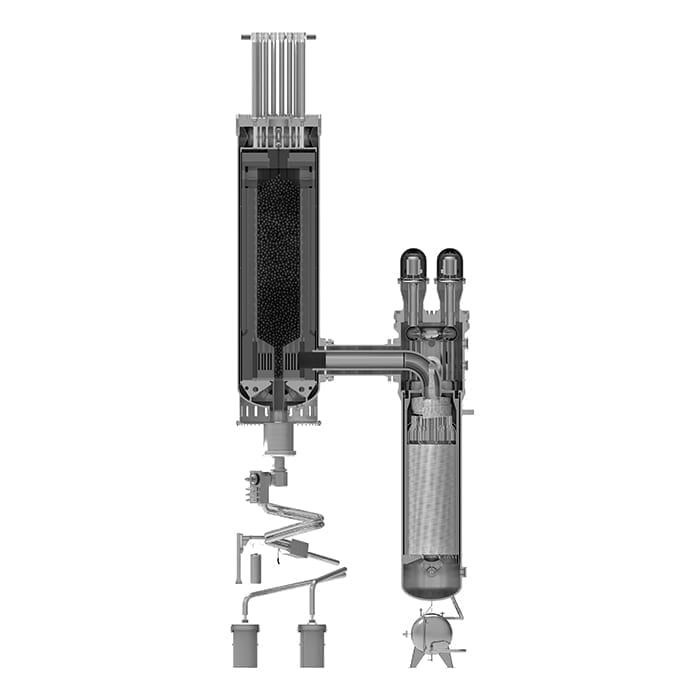

GEH said on Tuesday the selection furthers its vision to build and operate the company’s flagship BWRX-300 SMR, and help “OPG consider options for the future.” GEH has established an aggressive timeline to commercialize the 300-MW boiling water reactor that it claims could be competitive with natural gas power. According to a June status report from the International Atomic Energy Agency’s Advanced Reactors Information System database, GEH expects the first BWRX-300s could begin construction in 2024 and 2025, and enter commercial operation in 2027 and 2028. GEH is also leveraging the BWRX-300’s evolutionary characteristic to speed up licensing, using the NRC’s Part 50 approach to licensing based on the certified ESBWR design.

“Our design-to-cost approach ideally positions the BWRX-300 to help OPG consider options for future deployment of affordable, clean and reliable energy,” said Jay Wileman, GEH president and CEO, on Tuesday.

Under its agreement with OPG, GEH will provide detailed information on the design process, licensing, scheduling, and contracting that will help inform OPG on options for siting an SMR in Ontario. Notably, GEH also intends to develop a Canadian supply chain. On Tuesday, it announced MOUs with five Canadian companies: Aecon Nuclear, BWXT Canada Ltd., Hatch Ltd., Black & Veatch, and Overland Contracting Canada Inc. (a Black & Veatch firm). “Through the MOUs GEH intends to cooperate in areas that include construction, engineering, modularization and manufacture of safety-related components,” GEH said.

Terrestrial Preparing to Secure First Customer for Molten Salt Reactor

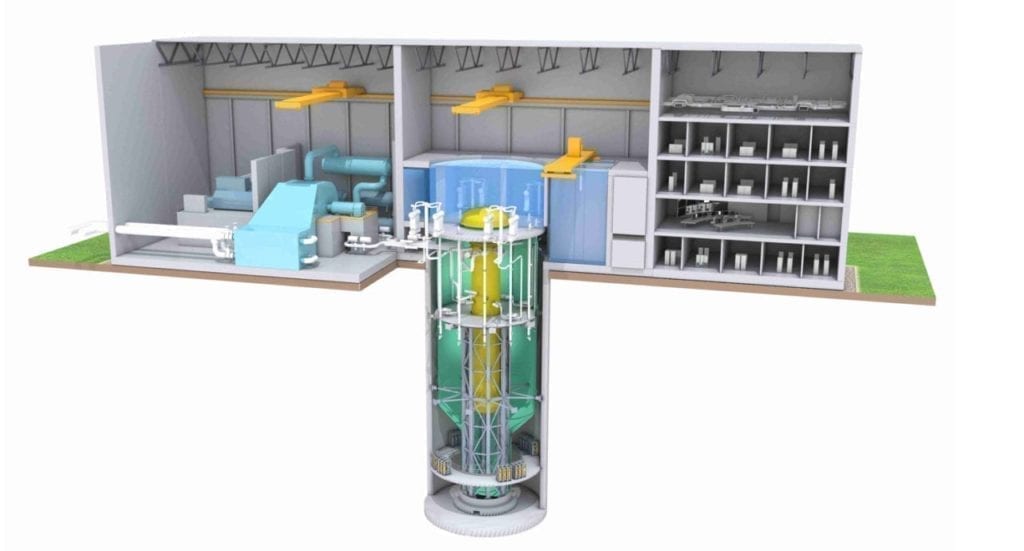

OPG’s selection is also a win for Oakville, Ontario–headquartered Terrestrial Energy, a company that is developing the Integral Molten Salt Reactor (IMSR). The IMSR is a 195-MWe Generation IV nuclear technology that uses a molten fluoride salt—which is a highly stable, inert liquid with robust coolant properties—for its primary fuel salt, as well as in a secondary coolant salt loop (without fuel).

Like other Generation IV systems, the IMSR operates at much higher temperatures—at 700C—to supply steam turbines with superheated steam at 600C, which raises the system’s fuel efficiency to as much as 48%, and raises the prospect of producing cost-competitive, carbon-free power and heat for industry.

“A conventional reactor is stuck in the mid-30s, and if it’s a small conventional reactor, it may not achieve 30% at all,” Simon Irish, CEO of Terrestrial Energy, explained to POWER last year. “If you operate at a much higher temperature, you can make power much more efficiently and you can do many more things with your nuclear reaction. You can provide high-quality industrial heat that can be used in industrial process applications that are very different compared to the steam generated electric power provision—which is pretty much the sole activity of nuclear energy today.”

Irish said on Tuesday the opportunity to work closely with OPG, and its Ontario and Canadian supply chain partners, marks a string of positive developments for the advanced nuclear plant, which is “on track” to secure its first North American industrial customers in the early 2020s and operate first plants in the late 2020s.

On Sept. 30, the company awarded L3Harris Technologies a contract to develop an engineering and operator training simulator for the IMSR. And on Sept. 15, it announced an agreement with the Canadian Nuclear Laboratories to collaborate on a program to evaluate safeguards related to the IMSR’s operation, including work with the 2019–established Canadian Nuclear Research Initiative to establish material accounting methods to track the IMSR’s nuclear fuel salt.

This June, the company updated key details related to costs (estimating a 190-MWe/400-MWth plant could require upfront investments of less than $1 billion), as well as the makeup of its corporate and industrial advisory board—which includes OPG and Bruce Power in Canada, along with several major U.S. nuclear generators.

X-energy’s Canadian Potential

X-energy CEO Clay Sell also lauded OPG’s announcement, suggesting it would help the Greenbelt, Maryland–based private nuclear reactor and fuel design engineering company secure a firmer foothold for its Xe-100 design in the promising Canadian market.

The Xe-100, an 80-MWe/200-MWth pebble-bed HTGR, which can be scaled to 320 MWe (as a four-pack), has already made waves in the U.S. owing to positive developments related to X-energy’s commercialization of its TRISO-X fuel. The company completed the Xe-100’s conceptual design development in 2019, and it plans to submit applications to the NRC in 2021 to meet a schedule to start construction of a potential plant by 2025.

X-energy has promoted the design’s flexibility attributes. “It can integrate into large, regional electricity systems as a base and load-following source of low-carbon power. As such, it can optimize grid use of low-emission, intermittent renewables and other clean power. The reactor is also ideal for mid-size communities, project sites and other power applications, including district heating,” the company explained on Tuesday.

The selection by OPG came after an “extensive and rigorous process,” said Sell. It was “one of the most comprehensive we have been through—addressing technology, licensing, supply chain and corporate matters,” he said. “This Canadian opportunity brought out the best in our team and provided us further insights into our own design process.”

Canada’s SMR Roadmap Gaining Prominence

Canada’s approach to next-generation nuclear is also especially notable in the global context owing to its federally backed “pan-Canadian” approach. In 2017, Natural Resources Canada, the ministry responsible for natural resources and energy minerals, convened a six-month-long dialogue, which led to the “SMR Roadmap Project,” a 10-month-long program that engaged interested provinces, territories, and power utilities, as well as indigenous communities and heavy industry stakeholders.

A November 2018 report stemming from that effort laid out five key findings. The most prominent of these was that successful SMR deployment will likely require a “fleet-based” approach to operations to benefit from standardization and economies of series, for example, to help reduce capital costs as more units are produced. The roadmap envisioned three potential applications for SMRs in Canada: on-grid, heavy industry, and remote communities.

In another finding, the roadmap concluded that Canada’s leadership on SMRs would be crucial to capturing a “first mover advantage.” Risk sharing was also a major concern, and the roadmap found risks related to SMR demonstration and deployment could be shared appropriately among governments, power utilities, and industry. Finally, it concluded that ongoing engagement and knowledge sharing with end-users to address safety, waste management, and overall SMR costs would be pivotal, and that Canada’s regulatory framework and waste management regime are “well-positioned” to respond to an “SMR paradigm shift.”

Canada’s other ongoing initiative to promote SMRs is the Canadian Nuclear Safety Commission (CNSC’s) pre-licensing vendor review, which is an optional three-phase service to assess new reactor designs against CNSC design requirements. As the table below shows, Terrestrial, GEH, and X-energy all have vendor design review service agreements with the CNSC.

| Vendor | Design | Approximate MWe | Applied | Review start | Status |

| Terrestrial Energy Inc. | IMSR Integral Molten Salt Reactor | 200 | Phase 1 | April 2016 | Complete |

| Phase 2 | Dec. 2018 | Assessment in progress | |||

| Ultra Safe Nuclear Corporation | MMR-5 and MMR-10 HTGR | 5-10 | Phase 1 | Dec. 2016 | Complete |

| Phase 2 | Pending | Project start pending | |||

| LeadCold Nuclear Inc. | SEALER Molten Lead | 3 | Phase 1 | Jan. 2017 | On hold at vendor’s request |

| ARC Nuclear Canada | ARC-100 Liquid Sodium | 100 | Phase 1 | Sept. 2017 | Complete |

| Moltex Energy | Stable Salt Reactor Molten Salt | 300 | Series Phase 1 and 2 | Dec. 2017 | Phase 1 assessment in progress |

| Holtec International | SMR-160 PWR | 160 | Phase 1 | July 2018 | Complete |

| NuScale Power | NuScale Integral PWR | 60 | Phase 2* | Jan. 2020 | Assessment in progress |

| U-Battery Canada | U-Battery HTGR | 4 | Phase 1 | Pending end 2019 | Project start pending |

| GE-Hitachi Nuclear Energy | BWRX-300 BWR | 300 | Phase 2* | Jan. 2020 | Assessment in Progress |

| X-energy | Xe-100 HTGR | 75 | Phase 2* | July 2020 | Assessment in Progress |

The Big Vision of OPG’s SMR Leadership

For now, it appears most of Canada’s SMR development will be centered in Ontario. “For decades, Ontario has led Canada’s nuclear industry in safe, carbon free, reliable nuclear generation,” said Bill Walker, associate Minister of Energy on Tuesday. “With over 70,000 jobs supporting this key sector of our economy—the vast majority based here in Ontario—we are poised to lead the world in the development and deployment of small modular reactors.”

And for OPG, Ontario’s largest generator, leading the way in SMR deployment would help position it to “capitalize on the existing nuclear supply chain within the province and could enable other provinces to transition away from coal,” the company said.

What this development will mean for its own future fleet remains to be seen. At the end of 2019, OPG had a 17-GW generation fleet, most of which was hydropower, but it also owns two nuclear generating stations, the four-unit, 3.5-GW Darlington Nuclear Station and the six-unit 3.1-GW Pickering Nuclear Station, which provide nearly half of Ontario’s electricity.

Because nuclear power is “consistent with its business imperatives,” along with goals to mitigate climate change, OPG in 2016 embarked on a renewal plan for its nuclear plants, and despite the pandemic, on June 4, it marked the first major milestone of the refurbishment project to reconnect Darlington 2 ahead of schedule, and extend its operational life by 30 years. And while work will begin to refurbish Darlington 3 later this year (and on Unit 1 in 2022, and Unit 4 in 2023), OPG is also eyeing new nuclear reactors with a maximum output of 4.8 GWe at the Darlington site.

While no decision on technology has yet been made, OPG submitted a license renewal application to the CNSC for the Darlington New Nuclear Project (DNNP) on June 29. “The projected in-service dates for each unit are not yet known but, for planning purposes, the first reactor has been assumed to be in operation by 2028 as described in the DNNP [power reactor site preparation] Renewal Plan,” OPG’s submission says. The indicative schedule assumes that CNSC will issue a license to build by 2024, and a license to operate by 2027.

—Sonal Patel is a POWER senior associate editor (@sonalcpatel, @POWERmagazine).