Generator Maintenance: Preparing for the Bubble

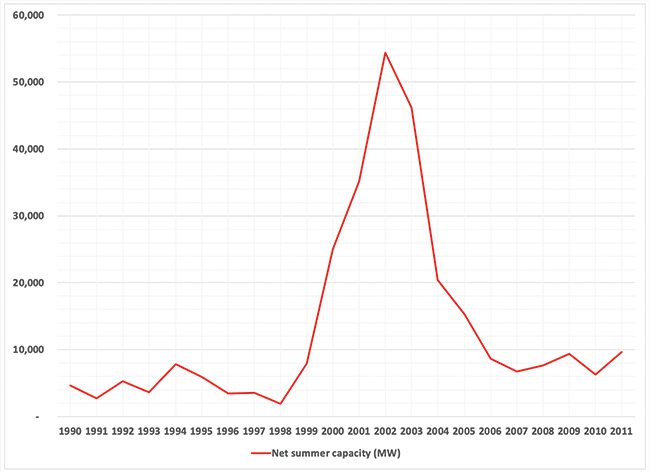

If you were paying attention to the power industry during the early 2000s, you may remember a large spike in the U.S. gas turbine fleet at the time. The Energy Information Administration (EIA) reports that more than 196.5 GW of gas-fired generation entered service in the U.S. from 2000 through 2005 (Figure 1). That was more than six times the capacity added in the six-year period prior to that and more than four times the capacity added in the six-year period after. It was clearly a boom time for the industry.

|

|

1. U.S. natural gas–fired power generation capacity by initial year of operation. Source: U.S. Energy Information Administration |

GE Gas Power, for example, reported adding more than 350 units worldwide to its gas turbine combined cycle fleet in 2002 and more than 300 additional units the following year. Many of the gas turbines were E- and F-class machines. Notably, many of these units are expected to remain viable generation resources for years to come.

During an online presentation, Chris Killian, global sales director for Generators with GE Gas Power, part of GE Vernova, offered a prediction on how F-class units could be operated over the next 10 years to support the North American grid. “The hours that [they] are going to be used will go down as the renewables on the grid increase,” he said. “We also see the number of starts are going to increase on these units. A lot of these units may end up being peakers. They’ll be subject to more cyclic duty operation. So, we’ll see these units viable in this time, but they may be operated differently than we’ve seen in the past.”

Killian said GE found similar trends when studying E-class machines and when looking at grids in Europe and Asia. “Overall, it appears that there’s going to be many units that are still serviceable for years to come,” he said.

Ian Hughes, principal engineer for Generator Reliability with GE Gas Power, covered some generator lifecycle considerations during the presentation. He said while it is common for a stator to operate 25 to 30 years before requiring a rewind, a rotor may need to be rewound after 15 to 20 years of operation. However, increased cycling and load swings will affect lifecycle performance. “The cycling that we’re seeing occurring is affecting shorted turns, movements of insulation, and some other failure modes,” he said.

The most common failure modes include grounds and shorts, mis-operations, failures of main terminal studs, pole-to-pole and coil-to-coil connectors, corona, insulation and bar armor damage and degradation, high vibrations/thermal sensitivity, insulation and amortisseur migration, contamination, collateral damage, pro-active, and other lesser known modes. “The thing to understand is that there are roughly 26 [failure modes] and they affect all of the different fleets—some fleets are more susceptible to certain failure modes, such as the air-cooled fleets are more susceptible to corona than the hydrogen-cooled machines,” Hughes said. “Not all generators will need a rotor or stator rewind. It depends on a lot of different factors, including your own commercial considerations.”

Said Killian, “Really the best thing you can do is understand your fleet risk. You want to know what units you have [that] are at higher risk now, and what’s going to be at higher risk in the future. You’re going to want to use some of the standard predictive tools that we have in our industry—things like flux probe readings, partial discharge analysis for the stators, looking at the results of the standard electrical tests, look at things like excitation current changes, perhaps, do you have vibration issues and are those vibrations sensitive to increases and decreases in output? These are the types of things that you’re going to want to look at and gather that information to help yourself and to help us go through what risk levels that you have on your units.”

Outage planning is also important, and here, owners and operators need to be as proactive as possible. With all the units that entered service in the early 2000s coming due for major maintenance at roughly the same time, you can expect contractor schedules to fill quickly. “We really predict that the demands are going to increase rapidly over the rest of this decade, which means that there’s going to be more demands on field service needs,” said Killian. “So, scheduling this work as soon as you can is paramount. We’re looking at 18 to 24 months as being the time that you really should put solid plans together for your outages.”

Another thing companies should consider is pre-purchasing capital parts. While pre-purchasing is fairly common for gas turbine parts, it’s less common for generator components. Killian suggested pre-purchasing is something that should be done more going forward for things like stator bar kits and replacement rotors, for example.

Killian also suggested rotating exciters could be difficult to source in some cases. “Many of these machines are approaching over 20 years [in operation] and there are some of these assets that are no longer available,” he said. “You’re going to want to either buy the new replacements that we have or explore getting this work done from some of our third-party partners.”

The fact is you can never be “too prepared” for an outage. With so many units potentially hitting the major maintenance window at the same time, advanced planning is more important than ever. Owners and operators can set a course for success by evaluating their machines now and monitoring risks regularly so they aren’t surprised in the future.

—Aaron Larson is POWER’s executive editor.