Cost-Effective Solutions for Boosting Solar Farm Production

It makes sense that solar panels would perform better when positioned to capture more direct sunlight, but the cost of adding tracking systems has not always penciled out. Costs have come down, however, and today even bifacial solutions may be worth considering. A lot of factors are in play, so understanding available options is important.

Despite the imposition of import tariffs and the ups and downs of individual companies, solar power costs continue to fall in the U.S., and the market continues to grow rapidly. The latest low-cost bids for solar include a 300-MW deal with NV Energy for $23.76 per MWh, fixed for 25 years. That contract was announced just after a $24.99 contract for Central Arizona Project, and other aggressive bids for solar plus storage.

And as solar gets cheaper, utilities and other power buyers are going big. The Kit Carson Electric Cooperative in New Mexico expects to get all of its daytime power from solar by 2022. Xcel Energy has committed to going to all zero-carbon electricity by 2050 across its entire eight-state territory. While Xcel is the biggest buyer of wind power among U.S. utilities, it also has 700 MW of solar under contract. Facebook was the biggest corporate buyer of renewables last year, inking contracts for more than 2,500 MW, including 437 MW of solar power in Oregon.

FPL Energy in January announced plans to build and own “30 million solar panels by 2030.” Though the company did not disclose the total capacity or generation, 30 million panels of 300 W each would total 9,000 MW, or about 18% of FPL’s current electricity sales.

Tracking Success

A big part of the solar success story is the growing use of tracking systems. Tracking systems, which move solar panels to follow the sun across the sky, have long been available, but recent breakthroughs have brought down costs, making them more financially attractive. According to Berkeley Lab, solar trackers accounted for 80% of installations in 2017, among projects larger than five megawatts.

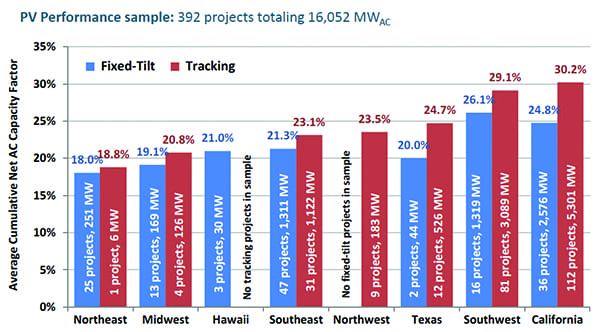

By following the sun, output can be boosted by 20%, increasing capacity factors and lowering the production cost of electricity. Trackers have boosted average capacity factors to around 30% in California and the Southwest, as shown in Figure 1. Fixed-tilt systems have considerably lower performance. Considering that the capital cost premium for trackers has shrunk, with both types averaging about $2.00 per installed watt in 2017, according to Lab figures, trackers have become an easy choice for many projects.

|

|

1. This chart shows capacity factors from a sample of photovoltaic (PV) solar projects in various parts of the U.S. Average cumulative net alternating current (AC) capacity factors can be significantly increased when tracking systems are added. Source: Berkeley Lab |

Fixed-tilt mounting systems have not gone away, but they are more often used in areas with high land costs or limited space, like the East Coast, because more panels can be packed into the same area than is possible when trackers are used. Mounting choice is especially important as solar expands out of the sunny Southwest into more temperate climes. North Carolina, Georgia, and Minnesota have been three of the fastest-growing states for solar. Less sunshine in those areas means higher-cost solar power, but more efficient systems can reduce costs.

Another driver for tracking systems is the decline in the market value of solar power as penetration increases. As solar accounts for a growing share of mid-day demand, it drives down the daily spot market price and creates a glut of capacity, making its own generation and capacity less valuable. To provide more revenues, solar producers are using trackers to increase production in the edge hours, seeking more early morning and late afternoon output.

Duel of the Axes

In the early days of solar power, designers turned to trackers and concentrating systems to get the most out of what were then very expensive solar panels. Trackers were built on a single axis to follow the sun for the day, and on a dual axis, also adjusting for seasonal changes.

But for big utility-scale projects, the single/dual debate has largely been settled. As panel prices have fallen, the balance of system costs has become a more critical factor, and single axis wins in that area handily.

Developers have converged around the “independent row balance tracker,” where rows of panels are built along a north-south axis, and rotate like a spit as the sun moves overhead. Each row can tilt independently. The panels are balanced on a beam, greatly reducing the energy needed to move the panels. Even though double-axis trackers can boost production by 10% over single-axis, they have fallen out of favor.

“Dual-axis tracking is a harder sell than single-axis tracking, as the boost in generation often does not outweigh the incremental capital, and [operations and maintenance] costs (plus risk of malfunction),” according to Joachim Seel of Berkeley Lab.

Dan Shugar, founder and CEO of tracking company NEXTracker, points to a basic engineering problem of dual-axis systems, that of the single-point foundation. Much like a sunflower, a dual-axis tracker is mounted on a pole to get the flexibility of movement needed, with a large number of panels attached to maximize the power output.

“You’ve got a thing the size of a billboard that comes down to a single point, which means you need a massive amount of steel and concrete to deal with the engineering stress from wind,” Shugar said. A horizontal, single-axis tracker has many points of contact with the ground, and much less exposure to wind, greatly reducing the stress and lowering mounting costs.

One exception to the dual-axis consensus has been OCI Solar in Texas. OCI built a 400-MW set of projects for CPS Energy, San Antonio’s municipal utility. All seven of the plants in its “Alamo” series use dual-axis trackers, making them unique in the U.S. They have since been sold to Consolidated Edison and Berkshire Hathaway.

The dual-axis mounts were provided by Sun Action Trackers, also of San Antonio. Pete Lipscomb, director of business development for Sun Action, said CPS chose the dual-axis designs. “They were looking for the most advanced technology that would give them the broadest generation curves, with the most hours of production,” he recalled.

Now, though, Lipscomb said single-axis dominates the utility-scale industry, with as many as 20 companies competing to provide tracking hardware. Sun Action has found that dual-axis systems can provide more value in certain applications, such as places where power prices are high, land is limited or undulating, and power in “shoulder hours” is especially valuable.

“The key is to find the equation that makes sense for dual-axis,” Lipscomb said. “We’ve got that figured out now—places where single-axis is impossible or it makes more economic sense to do dual.”

He points to a project Sun Action is doing in Colusa, California, where a large commercial customer is facing peak prices in the early evening hours. A dual-axis tracker is better able to capture late sunshine to offset the high-priced power.

“Our best market is business-level distributed generation and community solar,” he said. “That’s two megawatts or less usually, but man, there are so many of them.”

Two-Faced Instead

Instead of dual-axis, big developers are now turning to dual-faced panels. So-called bifacial panels have photovoltaic (PV) cells on the front and the back, facing toward and away from the sun (Figure 2). While the front panels do most of the work, the back panels absorb enough reflected light to boost total output with no additional mounting hardware, land use, or electronic controls.

|

2. Bifacial panels, with cells on the front and back, are being considered for many new PV sites. However, the effectiveness of the design hinges on many factors. Source: National Renewable Energy Laboratory, using images from OpSun Systems Inc. |

Because PV cells themselves are now only 35¢ a watt, it can be viable to essentially put them in the shade. While the amount of sun on the backside of the panel can vary due to many factors, a National Renewable Energy Laboratory estimate found one design caught 267 watts per square meter, compared to 1,600 watts per square meter on the front, or 16% as much energy.

The design challenge is to determine how much space to put between the panels to let sunlight through, what the best angle is for both sides, and how reflective different types of ground surface are, among other factors. Developers are claiming gains from as low as 5% to as much as 50% over mono-facial systems. At least one developer, Big Sun Energy Group of Taiwan, is testing a bifacial array floating on water, which they think will increase performance by 50%.

While most panel makers have jumped into the bifacial market, testing is still underway by companies, universities, and national labs to clarify how big the benefits are. Nonetheless, Shugar is optimistic. “This is the breakthrough year for bifacial solar,” he predicted. “I frickin’ love bifacial.”

NEXTracker is involved in more than 750 MW of commercial bifacial projects in U.S., he said. Invenergy completed financing in December for the 160-MWac Southern Oak Solar project in Georgia, with power being sold to Georgia Power under a 30-year contract. The project is under construction now, using NEXTracker’s single-axis trackers.

Smart Trackers

Companies are also looking at digital controls to improve performance. Conventional trackers, going back to the 1980s, are basically timers, set to move the panels in time with the movement of the sun across the sky. While the sun is indeed predictable, clouds are not, and panels can shade each other if they are not on perfectly flat terrain.

Tracker companies are now using sensors and controls that monitor actual sunlight and move each row of panels individually to maximize output. As clouds change direct sunlight into diffuse light, for example, panels are better off pointing straight up to capture a maximum amount of diffuse light, rather than pointing at the blocked sun. And when the sun is low in the sky, the angle of each row of panels can be adjusted to minimize shading on the row behind it, called “backtracking.”

Once a project has committed to tracking hardware, the marginal cost of software monitoring and controls is minimal. Tracker companies are taking advantage of the revolution in microchips and wireless communications, giving each row of panels the intelligence to optimize production.

Speaking at a Bloomberg New Energy Finance event last March, Bryan Martin of DE Shaw Renewable Investments, which owns 2,000 MW of renewables in the U.S., described how NEXTracker’s TruCapture Smart Control System boosted output at the company’s 74-MW solar project in Mississippi. “We’ve been running it for eight months and are getting materially more production, about 3.5%,” he said. “So, we are applying it to a lot of our different sites.”

The combination of horizontal-axis tracking and digital intelligence is a breakthrough, Shugar said. “The move from fixed to single-axis can gain about 20% output, and other features can boost it to 22% to 26%,” he said. “It’s the biggest thing in PV yield gain in the last couple decades.” ■

—Bentham Paulos is a freelance writer and consultant specializing in energy issues.