Chinese Companies Continue to Dominate Global Wind Turbine Market

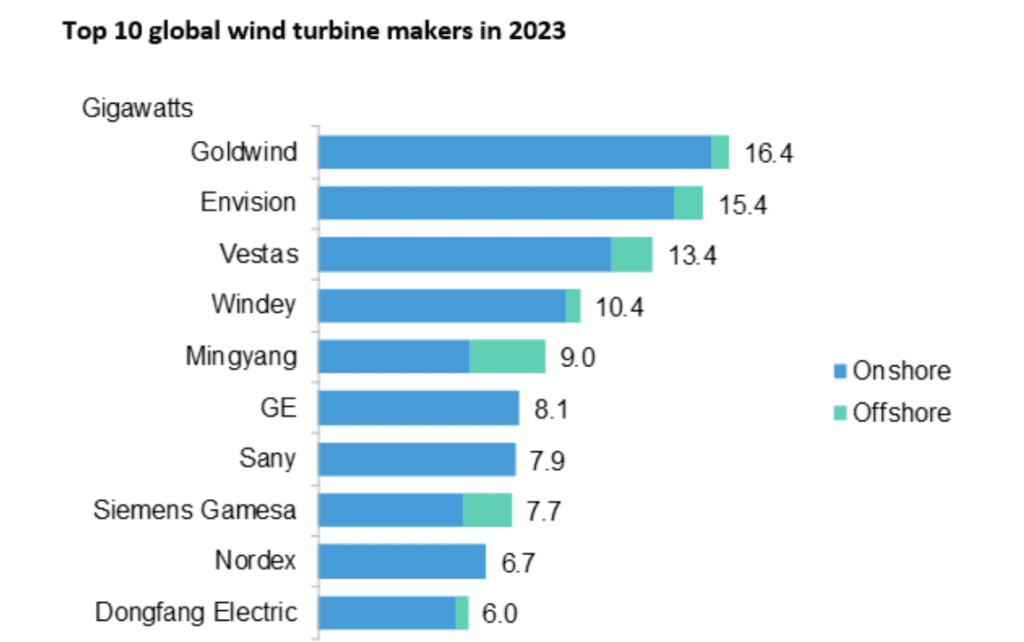

Chinese wind turbine makers continue to pace the global market, taking four of the top five spots in a ranking of the world’s top manufacturers of both onshore and offshore wind power equipment.

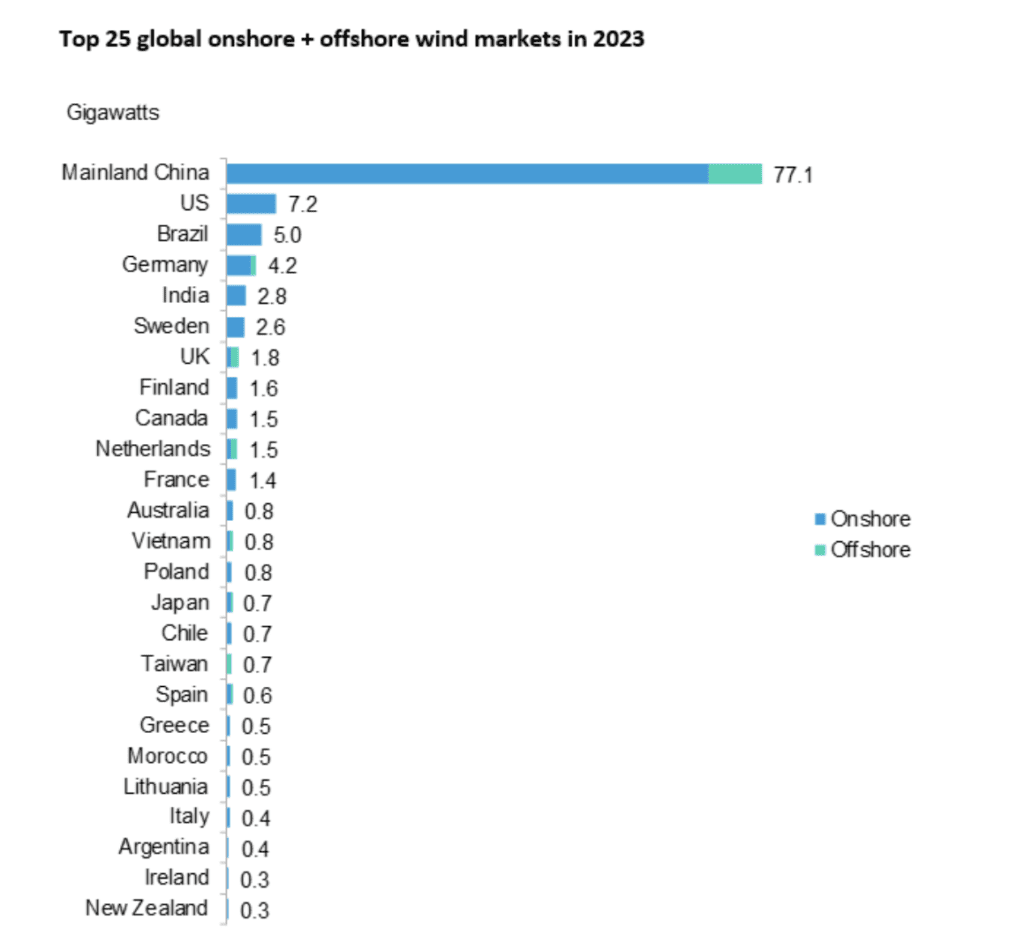

Research from BloombergNEF (BNEF) published March 27 showed global wind power generation capacity additions hit a record 118 GW in 2023. BNEF’s “2023 Global Wind Turbine Market Shares” report said developers commissioned 36% more wind power capacity last year than in 2022, primarily thanks to China, the world’s largest wind power market.

The report said 107 GW of onshore wind power capacity was added in 2023, with 11 GW added offshore.

Goldwind Commissions 16.4 GW of New Capacity

Beijing-based Goldwind commissioned 16.4 GW of new wind projects last year, with 95% of those installations in China. Envision, headquartered in Shanghai, added 15.4 GW of capacity.

Denmark’s Vestas ranked third, with 13.4 GW of new capacity, and was the only Europe-based manufacturer in the top five. Windey, another Beijing manufacturer, was fourth in the rankings, followed by Mingyang, which is headquartered in Zhongshan.

“It’s no surprise that Chinese turbine makers dominate the top five in our ranking, as buildout of gigawatt-scale wind projects and an end to pandemic restrictions sent installations soaring last year,” said Cristian Dinca, wind analyst at BloombergNEF and lead author of the report. Dinca noted that although Chinese manufacturers are exporting their technology, “these players still rely heavily on their home market, with 98% of all their capacity additions coming in China itself.”

GE continues as the top U.S.-based wind turbine maker, though it fell to sixth place in the BNEF rankings for 2023, after placing third in 2022. The BNEF report said GE’s installations last year fell 35% from prior-year levels. The report also noted that U.S. additions of wind power capacity last year totaled 7.2 GW, the lowest level since 2017.

Mainland China accounted for two-thirds of global wind power additions. The EU added 15.3 GW, a record for that group and 16% more than the 13.2 GW installed in 2022. Brazil is the largest Latin American market and added a record 5 GW of new generation last year, twice what it added in 2022.

China’s Foreign Reach

The report said Chinese turbine makers last year commissioned 1.7 GW of wind projects in 20 foreign markets, including in five member states of the European Union. Chinese companies are expanding their presence in part due to offering better prices for turbines compared to other countries. The ability to offer less-expensive equipment also is a reason China continues to pace the market for solar power equipment.

The BNEF report said prices for Chinese-made wind turbines delivered outside mainland China are 20% lower than those of U.S. and European companies.

“The boom in China last year hides a worrying trend, as new additions elsewhere were just 8% higher than in 2022,” said Oliver Metcalfe, head of wind research at BNEF. “There are signs that growth will accelerate, though.” Metcalfe noted orders for new turbines are increasing in the U.S., as well as in other countries.

“A surge in U.S. turbine orders shows the early impact of the new subsidies in the country’s Inflation Reduction Act,” said Metcalfe, “while a boom in project approvals in countries like Germany suggests that Europe’s permitting reform is working.”

Mingyang doubled its installations of offshore wind turbine in 2023, commissioning 3 GW of new capacity and becoming the largest global supplier of offshore turbines for the first time. China remains the largest market for new offshore wind capacity and, as with onshore, accounts for about two-thirds of new worldwide generation. The UK and the Netherlands, respectively, were the second- and third-largest installers of offshore wind capacity last year.

—Darrell Proctor is a senior associate editor for POWER (@POWERmagazine).